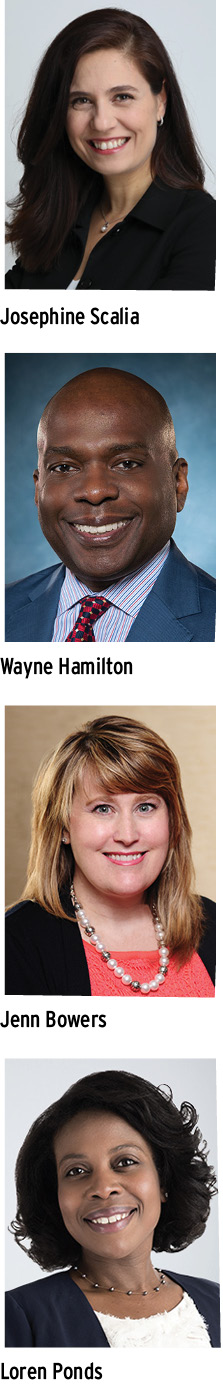

No two journeys toward a career in tax are the same. Just ask the panelists from TEI’s My Tax Journey session at the Annual Conference last fall. For this issue’s Roundtable, we reconvened the panelists to gather more of their perspectives. They are Josephine Scalia, head of tax at Nestlé Health Science and senior vice president of TEI; Wayne Hamilton, vice president of global indirect tax at Walmart and incoming TEI secretary; Jenn Bowers, vice president of tax for Fortive Corporation; and Loren Ponds, member and practice co-lead of the tax policy practice at Miller & Chevalier and moderator of the original conference session. Sam Hoffmeister, Tax Executive’s managing editor, moderated this discussion. See the upcoming May/June issue for more from these insightful tax experts.

Sam Hoffmeister: Could each of you describe your journey to professional tax? Feel free to include some of the biggest challenges you’ve had to overcome to get where you are today.

Josephine Scalia: I originally started off my career in audit, where I worked for a Big Four accounting firm. In terms of my journey into tax, I’ve actually stated in a previous [Tax Executive] article that I ended up doing a personal tax season. From that experience I ended up just really loving it. At a later point, after spending about four years in consulting and audit, I found my way back into tax. I love the comment I think somebody had made—sometimes people end up in tax by accident, but nobody stays in tax by accident. Loren, I think you had said that at one point. I would say that was my case. Once I went into it, I realized how much I love tax and our ability to see the product from the beginning to the very end of the life cycle. For example, at the beginning of a product life you would have the [research and development], the R&D tax credits that tax would be involved in, all the way through the transfer pricing and everything else, and then finally at the end maybe the sales tax and related and everything else in between.

Wayne Hamilton: My journey into tax actually started in law school. I was taking one or two tax classes, and I fell in love with this area because of the business interaction that it required to get to the tax answers. From there, I spent some time with District Counsel–IRS, then on to General Motors, and then was tax counsel for Southeast Toyota Distributors, JM Family [Enterprises], in South Florida. I like what Josie said. I didn’t go into law school thinking it, but I fell into it.

Jenn Bowers: In my town where I grew up, our middle school had a tax class we were required to take—or I guess it was a section in math. So, we learned how to prepare an individual tax return, and I thought it was a great life skill to teach children, but also I thought, “Well, this is easy; I could do this. My uncle is a CPA. I bet I could be like my uncle.” And of course, I knew nothing about what my uncle did at that age really at all. He was on the audit side. But I just thought CPA meant “tax” at the time. That was really what sparked my interest in tax, that experience. And of course, we all know it’s not just easy. But it does have a lot of rules-based information that you can build from and then learn on top of, and then because our rules are embedded so much in law, it actually is very different than accounting, because there’s just more complexity about different jurisdictions and how the courts rule on things. It’s super interesting, because you have to find how your path of interpretation of the rule matches to the facts that you’re presented with. I was in public accounting for five years, and I’ve been in industry for about twenty-two years. You asked about challenges; I would say the biggest challenge professionally was there was a point in time where I wanted to live in a different city. Trying to, like, move my career into a different city at that time felt really challenging. I don’t know if it’s that same way today, but I would say that was a big challenge for me, to move to a different city where I didn’t have a reputation in the industry.

Loren Ponds: My journey to tax is similar to Wayne’s. I was a French major in undergrad and I wanted to do something international of sorts but really didn’t know what. I thought I would do international trade. I was really focused on that until I took a tax class and really just liked it. I liked the interaction between tax and our social policy goals so you can really see what we care about, what we prioritize. And also the complexity—it was like a puzzle, similar to learning a different language. When I figured out you could be an international tax specialist like you could be an international trade specialist, that kind of sealed the deal for me. So, that was my pivot. At the beginning of my career, I was focused on becoming a law professor and ultimately decided I probably needed to work a little bit before I tried to teach people. I started at EY, stayed there for about a decade in the national practice here in D.C. Then I went to Ways and Means and worked on the Tax Cuts and Jobs Act, which was a lot of fun, and just really a challenging, fulfilling, exciting time to be practicing tax. In terms of challenges, I think was just hard to break into tax at the beginning of my career. It was still very much a male-dominated practice, and I found it difficult to be heard. At the beginning you’re just trying to learn as much as possible, differentiate yourself as much as possible, and really be recognized as somebody who’s seriously committed to the profession.

Skills Beyond Tax

Hoffmeister: What are some of the soft skills that helped you develop your careers and advance?

Hamilton: A few things come to mind. The first one is being a good listener. That is critical as you are working with your business partners or with controllership or other finance teams in making sure you understand what the real issues are. The second one is being a good storyteller. The third one is how you take complex regulations and rules and simplify them so that the business can immediately appreciate or understand the financial impact. I think all good tax practitioners need to exercise all three of those if they’re going to be successful. The last one, the fourth one, is a thick skin. Oftentimes, for many of us, tax is the holdout or the reason that something can or cannot happen. It’s being able to take that, but still navigate to get your business or your company—or even if you work for the Ways and Means—how do you get them to sign off on something that you believe inherently is right?

Bowers: I wrote answers ahead of time, and I have two that matched with Wayne. I did talk about listening, and the way I talked about talking with the business, I said having the ability to translate tax into the language that the business leader can understand. It’s a real superpower that not everybody is given that many opportunities to learn and practice. In that area, I remember as a new staff, if I were able to go on a sales pitch presentation—you’re often in small companies or startups. We weren’t talking to tax people. So, really listening to how others presented ideas was helpful. It kind of ties in with the listening. You learn a lot from listening. And also just the ability to make sure you gather in all facts. That is an area where actually I have to be diligent, because I’m just, like, eager to help. But listening I do know is important. The other two things I put down were—and they’re a little bit the same—being a leader of people and developing others. There’s some real soft skills in there. And one of those things is finding ways to enable other people to shine. Sometimes that’s on a handoff; you have some piece of information or perspective that’s important for the analysis, but really handing that off to the person so that they can be the one to share and show it. It doesn’t take a lot of effort, but it really enables them to take ownership and takes it off your plate, so it kind of has a side benefit when you’re trying to get more done. I think the other thing is also around development. It’s giving people challenges and not always saying, “This is what the answer is going to be.” You might give some hints, but really seeing what they can do with it. That will really help you identify people who can take ambiguity. You have to have a whole different kind of team, but having people who can deal with ambiguity, and resolve that issue, and think creatively around not just the first answer that appears, but maybe there’s more to dig into. Not everybody has that skill set, and not everyone must have that skill set, but it’s really important to have on your team versus people who are super good at process and making sure that things get done on time, and it improves every year and the quality of data is good. There’s a lot of skills that we need in our team, but really enabling people to figure out where they shine, and then helping them move forward.

Ponds: I think certainly the mentoring piece and letting people shine is important. As I get further along in my career, I’m less concerned about myself and more about who’s coming behind me. How can I make more Lorens to unleash upon the world? I certainly agree with that. I think in terms of day-to-day work, I find that taking ego out of what I’m doing and really focusing on service is important. Helping my clients get to the right answer, not presenting myself as the only source of knowledge or the only person who might know what’s best, but really approaching the work as a team is really important. I don’t want to set up the dynamic where we’re coming to our clients with solutions or answers or this new idea; it’s more, “Let’s think about these things together.” I’m not going to give you a prepackaged plan or concept. Really being about teamwork and trying to keep the service portion of my work front of mind.

Scalia: I agree with what everybody has said. Actually, I loved listening to all those answers. I guess the things that I want to mention is really about having a growth mindset. We’re just constantly learning. Tax is so interesting because it’s always changing. It’s very dynamic that way. So, if you approach it by embracing change and just being OK with the fact that things are changing all the time—and actually enjoying it—I think that’s one of the skills that you develop. I love this quote: It doesn’t get easier; you get better at it. I don’t know that it ever gets easier; we’re constantly looking at change and dealing with it. It’s just that we’ve gotten to the point where we’ve just gotten much better at it as time goes by, as you grow as a person, as you learn to regulate yourself so that if somebody comes to you and they’re a bit overwhelmed, as long as you’re strong with yourself then you can help. And that brings me to my next point: just being helpful. Being that person that’s viewed as willing to help others. We talk a lot about networking. There’s also networking within your company. There’s a lot of cross-functional work that we do where we’re dealing with all different parts of the business—certainly legal, the accounting side, but also maybe regulatory and different groups. From that perspective, whenever somebody reaches out, if you’re genuinely willing to help, then it goes back to the growth mindset, because you’re curious, because you want to understand. You want to understand the business, because if you understand the business first and foremost, then you’ll be able to give the right answers.

Hamilton: What Josie was saying brings to mind something. I believe, ultimately, if the business is calling you just for advice—and not only for tax advice—I think that’s where it becomes powerful. A lot of times tax is the one function that has to knit together a few other areas. It’s the controllership, it’s the accounting, it’s legal. We are sometimes the center, and I’m finding that if you do that well, when they’re doing M&A or they’re doing transactions, they want you at the table because you’re able to help guide that. I think that’s not tax, it’s just business acumen.

The TEI Difference

Hoffmeister: What role does a professional organization such as TEI play in helping you grow your careers?

Bowers: My foray into TEI was at the chapter level, which I think is common for most of us. But I went into leadership at the chapter level. When it was presented as something I should consider, my boss at the time, the company I worked for, was supportive of that and really actually encouraged us to participate in TEI. When he suggested that I might find some value in going to the leadership roles at the chapter level, my first response was like, “What can I offer this group?”—I might have been a senior manager at the time—“I’m just a senior manager here at this company.” And he said, “Oh, it’s what you can bring to there. You know me, you know the partners of the law firms we work with, you know the other people in the company. You can bring the input of others to the chapter.” It was just a way to make it feel really welcoming to participate. And so that was my first foray. It does create this area where you connect. “I’m really super interested in learning more about international or transfer pricing, whatever it is. I think we can have a boot camp on transfer pricing for the chapter,” right? And so you can kind of do things that are a little self-serving to you, but it does help others. It’s another way for you to have a gateway to learning. And then, in the international organization, I’ve just had many opportunities. I wrote down a lot around the fact that it’s just access to subject matter experts, whether it’s the staff of TEI or someone I meet at a session and I learn that they work in international, or they work in state for some company, and I can ask them a question. Also advisors—you have access to advisors who come to present. So, when you have a challenging question, you might be like, “I could talk to the partner I usually talk to, but I saw this person presenting.” It just gives you an avenue to learn a network of resources. Those are the things I would call out.

Ponds: We partner with TEI significantly. I find it valuable because it’s fun and a good opportunity to meet people who I don’t necessarily work with in my day-to-day. It expands my own network and exposes me to other professionals and their perspectives, so that’s always good. And it affords me a platform, which, as someone who’s constantly in the marketplace, is also helpful, and I really appreciate it.

Scalia: TEI has been really, really instrumental in many ways for numerous people in-house. I think back to when I was working in the Big Four and you could just go down the hall and you had all these senior managers, partners—everyone there together, all doing tax, all focused. Then suddenly you end up in-house—and especially if you’re head of the tax department—you’re sort of it. The rest of your team is looking at you for all the answers. And TEI was part of the answer. It’s been really wonderful from the networking side that you can just bounce ideas off of others that are also in-house that have very similar experiences to what you’re going through. I’m going to use the word “benchmarks”—being able to compare and say, “Oh, OK; this is what’s going on, and this is how others in-house are dealing with it.” I remember early on when I had left the firms and I was head of tax. One of the publications that TEI had published was a survey of how in-house groups set up their tax departments, for me, having read that publication and then also speaking with others at TEI was incredibly helpful—being able to understand “OK, this is what others are doing.” And it was super detailed: How many countries do you operate in? How many legal entities do you have? What is your revenue? Everything was there. So as an accountant, as a tax professional, I thought, “This is great intel!” Having a network of other in-house tax professionals, being able to bounce off ideas: “Hey, we’re expanding in this market; what do you recommend? How did you guys structure it?” And they’re able to say what advisors they’re using. And then being able to speak to many people. And then after the fact at different steps, where they’ve gone through an audit afterward and said, “Oh, you know, if I would do it again, this is how I would do it.” I just think that that’s excellent. TEI is not just about the networking; the three pillars include education and advocacy as well. On the education side, it’s both, of course the technical, but also on the executive skills. And finally on the advocacy side, being able to be on some of those committees has been incredible for me, because you have a pool of talented people that are also going through the types of things that you are in-house, a lot of the same questions—or maybe they’re raising questions that you’re supposed to be raising. You’re thinking, “Oh, that’s a really good point.” Then you add to it and ask, “What are your thoughts on that?” and then you’re able to further chase it down. What I’m finding by being part of those groups, by being part of the board, is that you end up creating certain relationships with those people where it’s understood. They call you, you always help. And then it’s the same—it’s reciprocated. We help each other. We’re a special community, we tax people. I had an intern that said, “You’re a very passionate group, you tax people.” It is a very exceptional group, and I think that we recognize that in this community.

Hamilton: I must admit this is hard to follow. I would describe it this way. What TEI offers is an investment firm, and there are different types of investments that you can make. You can do a low-interest bank account or you can invest in stocks. Whichever way you choose to invest, that’s the reward you’re going to get. Josie and Jenn have done a good job in explaining all the benefits. You can go all the way from an observer to a participant, and you can pick your level of engagement. Using my investment, if you simply want a short return on your investment, you come and invest, you get your [continuing legal education]. If you really want to grow, you hit your stocks and your money market funds, and that allows you to get a whole different experience. That’s the great thing about this organization. It allows you to enter at one point and grow to whatever you want to.