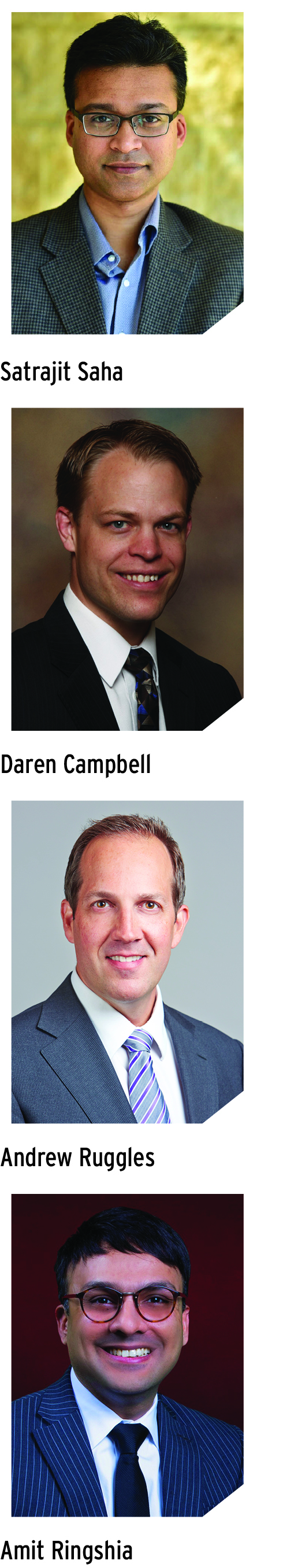

Clearly, the corporate tax function has been transforming dramatically in the last decade as new technology has emerged at an accelerated pace. But we’ve been so busy keeping up with the evolving transformation, do we know exactly how it’s actually been changed? To get a handle on that thorny issue, we convened a roundtable in July that included some of the most knowledgeable practitioners in this space, including Satrajit Saha, senior manager, tax technology, in Deloitte’s Dallas, Texas, office; Daren Campbell, partner at Ernst & Young’s tax technology and transformation practice and EY’s Americas Tax Innovation Leader; Andrew Ruggles, partner with PwC, who works in the company’s automation practice and leads its global alliance with Alteryx; and Amit Ringshia, managing director of KPMG’s ignition practice. Michael Levin-Epstein, Tax Executive’s senior editor, moderated the discussion.

Clearly, the corporate tax function has been transforming dramatically in the last decade as new technology has emerged at an accelerated pace. But we’ve been so busy keeping up with the evolving transformation, do we know exactly how it’s actually been changed? To get a handle on that thorny issue, we convened a roundtable in July that included some of the most knowledgeable practitioners in this space, including Satrajit Saha, senior manager, tax technology, in Deloitte’s Dallas, Texas, office; Daren Campbell, partner at Ernst & Young’s tax technology and transformation practice and EY’s Americas Tax Innovation Leader; Andrew Ruggles, partner with PwC, who works in the company’s automation practice and leads its global alliance with Alteryx; and Amit Ringshia, managing director of KPMG’s ignition practice. Michael Levin-Epstein, Tax Executive’s senior editor, moderated the discussion.

Michael Levin-Epstein: When you look back at the last couple of years, what has surprised you the most about this transformation of the tax function?

Satrajit Saha: One of the things I’ve noticed is just the pace of digitization, both digitization in terms of what the firms have been able to do—whether it’s Deloitte or the other big firms—and the adoption that clients have towards it. If I look back at the last decade and what I’ve seen over the last five to seven years, there is a very rapid adoption of technologies like cloud ERP, AI, robotics, SharePoint platforms, a lot of the big data solutions by both clients [and] federal and state governments. More is needed of our tax departments with lesser resources and tighter filing deadlines. So, what has surprised me is the level of adoption of technology from our clients and the willingness to leverage their internal relationships with IT/finance and technology to accelerate solving for all of these pain areas.

Daren Campbell: What’s probably surprised me the most is where some of the pressure to transform has come from. And that’s in the digital tax administration. For the early part of my career, we always saw governments as kind of far behind on the technology spectrum and the adoption of technology. The last number of years, we’ve really seen a transition where a lot of the pressure that is on companies to transform and change is actually coming from the taxing authorities as they become much more digital. And in many cases around the world, we see that the tax administration really far outpaces the companies in their use of technology. The other thing that I think has been a bit of a surprise as well is the speed of the expansion of no-code, low-code technologies. That’s a trend that has emerged, and just how rapidly that’s expanded is pretty incredible. It’s come at a good time, because it allows tax to solve some of the challenges that they’ve faced for a long time without having such a heavy dependency on IT. We hope to do a little bit more self-service around that. Those would probably be the two trends that stand out as the biggest surprises over the last several years.

Andrew Ruggles: I think there’s two things. I think the emergence of the low-code, citizen-empowered approach has gained real traction across tax and finance functions over the last few years. It is one of the bigger shifts in the space. The second thing that has surprised me is our clients’ biggest challenge is not necessarily the budget to invest, but it’s the time and capacity to invest. That continues to be the number one barrier that surprises me in terms of companies making the leap and making the commitment to make substantive changes—the availability of time to commit to change, and either the reluctance or pressure to free up time is often a barrier that’s difficult to overcome.

Amit Ringshia: While we’ve seen a lot of smart technology developments come to fruition—and fast—over the last few years, one thing I’ve learned is to not be surprised by much. Why? Because tax has always done well with custom technologies as well as just-in-time “quick-fix” solutions. Historically, tax has not been a key participant in the larger organizational transformations, but that’s all changing. Today, we’re seeing tax make big moves with technology. And the global pandemic certainly supercharged the transformation of tax in which change is a constant, forcing companies to make fast moves to ensure their tax functions and corporate functions at large are resilient and fit for purpose. With new regulations that blur the lines of what it means to be a traditional tax professional, suddenly, tax needs data outside of traditional tax systems to meet regulatory needs like BEPS and digital tax and ESG standards. In light of these changes, tax professionals are reinventing themselves and their functions in a more holistic manner. They have been resilient throughout a time of rapid change, and they continue to get the work done while improving and broadening their skills to better serve clients as the function increasingly participates more closely with what’s going on in finance, IT, HR, and other areas of a business. They have adopted technology into their function in a very impressive way.

Top Challenges

Levin-Epstein: What is the top challenge that your clients have faced in terms of tax data, calculations, and reporting?

Saha: I would say the top challenges would involve data extraction. Most of our clients, a lot of times, are in acquisition mode, so the IT environment, the ERP systems, and other source systems are very heterogeneous. The other aspect of it is the IT landscape is changing. You’re introducing other systems that are newer technologies, like latest cloud ERP upgrades, installation of new cloud procurement, and sales systems. So, now you’ve got a simplification of IT landscape that’s happening, and you’ve also got newer systems that are coming into that landscape, and all of these things affect downstream tax data ingestions, calculations, and reporting. So how does the tax department have a technology roadmap that is dynamic enough to capture these changes to technology and regulations and be able to react to them over time by partnering with the best players in the market?

Campbell: The top challenge is that tax is such a heavy user of data, but we don’t own or control any of the upstream source systems. We’re a downstream consumer of systems whose intended purpose is something other than tax. I see that as the number one challenge that tax faces, just a diversity of data sources and the fact that none of those sources are built with tax in mind. Tax has to deal with the challenge of how they bring together all that data, how do they connect to it, how do they bring in and make sure that they’re retaining the appropriate tax attributes through the life cycle of that data.

Ruggles: I’d say the number one challenge is knowing what is the right data management strategy—and this is similar in theme but it’s sort of industry-wide—we don’t own the data in tax, and there’s a lot of different ways or views out there in how to manage data. The balance is, do you go for stopgap, short-term solutions? Do you go for a more strategic “solve it at the source” issue? I think the challenge is just figuring out what is the best way to approach the data challenge. Because there’s not always a clean solution, and it’s balancing short-term needs with longer-term, more strategic, and I just think it is a core challenge when it comes to data, is knowing what to do.

Ringshia: I’m going to riff off of what Andrew said because I agree that it’s a lot about the right data management strategy. It’s also about thinking critically and outside the box. Tax needs two things: skills and thought leaders. And both of these need to work and move together to help solve the data conundrum. The truth is . . . what we do as tax professionals is tax data work; tax is data and data is tax. New regulations that are leading us beyond simply getting information on tax forms to higher-level considerations like tax morality (think “S” in ESG) are causing tax professionals to look more and more at the bigger business picture. This requires the kind of skills and thinkers who can cut across organizational silos. And those are the two most important success factors for a tax department—the right skills and the right thinkers—that will position tax as a tool that helps set the overall business strategy for greater competitiveness.

Citizen-Led Issues

Levin-Epstein: I want to move on to citizen-led issues, where citizens are starting to lead the automation. Do you think that has become a legitimate approach for organizations?

Saha: I think it’s a blend of citizen-led automation versus enterprise technology that tax departments will need in the future. When we look at the features that tax departments need some of them could be quick fixes and could be done through citizen-led automations leading to faster ROI for tax while others that are more data intensive in nature need enterprise technology and a longer duration to fix core data and process issues within a client. What I think is happening is more and more enterprise technology is being architected in a way to give it a more user experience feel in order to allow for citizen-led developer mindsets to understand how can tax departments use this conglomerate of technology available to them.

Campbell: I definitely think it’s a legitimate approach. It’s not an all-in solution, so there still is a place for enterprise technology and enterprise approaches, but citizen developer is a growing trend and clearly has its place. We look at some of the benefits—a lot of benefits of automation that we’re seeing in tax is coming from the emergence of these technologies that allow for citizen developers. I look at things like Microsoft Excel—I think I said this in the conference—but I view spreadsheets as the first low-code, no-code environment. Prior to spreadsheets people had to have an IT degree, maybe use punch cards to be able to program computers, and with the advent of the spreadsheet, it turned a host of people, essentially, into computer programmers. And you can see that by the stronghold spreadsheets have had in the tax function and larger accounting finance functions within companies over the years and even today, because it allows people to solve some of their immediate problems without having to go through an enterprise technology development life cycle. So, the tools that individuals are able to use to solve challenges are expanding at a very rapid pace, and I think that will continue to be a growing area. But I do see that there still has to be alignment with the broader enterprise IT strategy.

Ruggles: Yes, citizen-led automation is legitimate. I think that was actually really well put, what Daren just said. In other words, it’s not a new approach; it’s been around for a long time. What is new is an institutional strategic decision to invest in a citizen approach. I think that organizations are recognizing that this is an important component of how we work, and they’re recognizing that they do need to step back and evaluate tool choices. It’s not about the tool at the end of the day; it’s about a strategic choice. And so, yes, it’s legitimate. And I think that the recognition that it’s a strategic choice for organizations to complement the enterprise is one that is signaling what’s new, and just doing that a little bit more intentionally.

Ringshia: The citizen developer movement is not something tax initiated. It started in the larger organization primarily driven by IT to empower and enable business technologists. But tax is well positioned to take advantage of it, because tax has always acted in this capacity.

The role of the citizen developer has expanded with the advent of new technologies. For example, cloud-based technologies now provide tax professionals access to data management capabilities traditionally reserved for professionals with advanced domain knowledge. This is an awesome mix. We’re seeing new operating structures emerge and a new class of data-driven tax professionals. Today they may be spread out across different parts of tax—be it compliance, provision, or planning—but in the long run, we expect that to change. In most cases, automations will drive the traditional compliance and provision and, instead, a renewed focused on data-driven modeling and analytics will rise to answer business needs and questions. We’re going to see tax reimagine itself along data lines, which will be very interesting. Personally, I can’t wait to see how tax transforms.

The Future

Levin-Epstein: Looking ahead now to the next couple of years, what technologies are your firms investing in, and what do you see as the next big unlock in tax? What’s coming down the pike that maybe people only know a little bit about but is going to be a bigger thing two, three, four years from now?

Saha: We have been heavily investing in the cloud technology space as it relates to core ERPs or enabling technologies around the digital core to help the tax departments out. We think we will see bigger investments in this space for the next couple of years as more ERPs migrate and that forces an unlock on tax departments to take advantage of the shifts in data, process, and technology that will help them with automation and risk management. We would like to stay focused on AI-infused technologies in the future and focus on how we could use a combination of enterprise cloud technology and point solutions, e.g., AI, etc., to ensure that the right tool kit is being used for the right functionalities within a tax department. Ultimately the cost of hardware on many of these technologies is falling, so a lot of this will come to where can tax get the funding from and what technology platforms would that funding cover that can help tax departments in various ways. I would encourage tax departments to partner really well with their IT/finance counterparts to understand [how] the finance or IT road maps within their companies engage with us in a broader tax technology road map conversation around what tools or initiatives within their companies and outside can help them with automation and efficiency gains along with manage risks.

Campbell: There’s a lot in that question, so I’ll try to hit a few things from it. One of the things that I see both companies and our firm investing in is platforms that help with the use and reuse of data. Automation on the front end, bringing data into platforms, and then transforming it once and being able to use it multiple times throughout an organization. Again, something that we’re doing internally, and I see our clients moving the same way. If I look at some of the technologies that are coming that I think will be more commonplace as we go forward, I think there’s a couple I’d put on that list. We’re seeing a lot more around process-mining tools. As we look to automate today, a lot of the general approach is we go out and talk to people about their processes and then we try to make determinations as to which areas should be automated. There’s a rising number of tools that you can plug into the processes that actually begin to identify where there’s some of those pain points and where there’s potential for automation. So, process mining would be one area. Another one that most people know about but we haven’t reached the full impact [of] is in artificial intelligence; in the business world we have a ways to go. We see in our personal lives we’re using AI all over the place. When you pull up your phone, you’re not opening up an “AI app.” You’re opening up an app to help you navigate from point A to point B, and it’s AI-enabled. We will see a much greater infusion of AI through the tools that we’re just using as part of the way that we operate. Gartner had a quote that said, “AI also stands for ‘applied’ and ‘invisible.’” I think that’s well said. In tax, it won’t be such an obvious thing in the future that we’re utilizing AI, it’s just going to be table stakes. It’s going to be embedded in the tools that our tax professionals are using. The third that I would list in that is around data fabrics, where we deal more with the virtualization of data more real time/near time. I think that one’s probably a little bit further out as far as a widely adopted trend [is concerned]. But as we see the move with governments trying to push and get closer to near-time/real-time tax collection, tax assessment, that that’s going to force a need and trend for companies also to adopt those technologies that allow them to have more near-time/real-time visibility of their data for tax purposes.

Ruggles: I think there’s two parts to the question. Where is our firm investing? I think anything and everything cloud-related, our strategy is to be off the desktop, and I think that’s not an uncommon strategy, but I think in the near term that’s going to continue to be an overarching priority of focus for everything we do as a firm and everything we do as a tax practice for our clients. I think that machine learning, specifically, has not seen its day in tax. I think in spots it’s used, but I don’t believe it’s really seen its day, and I believe that’s the most logical area to see the greatest emergence in any transaction-type processing that tax may do. I think it’s sort of here in the market today, but it’s not really in tax functions at scale. I would expect that it will emerge in the near term as the most pragmatic, practical thing that’s going to be new and different from the way people operate today.

Ringshia: A lot of tax departments are saying, “Compliance is no longer the big focus and I want to explore alternative models to deal with it.” Similarly, tax departments are automating the basics, or the business as usual, to target and focus on “value-added” activities and massive changes or disruptions. Let’s use the automotive industry as an example, which is moving from the combustion engine to the electric engine. This means significant changes in supply chains, operating models, IP, sourcing, etc. And with tax as a component of each of these changes, a tax professional in this situation now has to deal with a whole new world and face a whole new way of doing business. Also consider other industries like big tech, which is adding grocery chains and movie studios to its traditional offerings; or insurance, which is adding in-house fund operations. So, you’re seeing a lot of disruptions and changes in business models. And these have all forced tax professionals to rethink their business and data needs. Given the rise of new digital and other transactional-level taxes, the data problem is only getting more complex. So, when we look to the future, it’s difficult to predict a specific outcome, but the trend is certain. The future will be less about optimizing, which is what we’ve been doing with technology in tax for a long time, using technology to put out the fires in traditional tax departments’ operations. The future will be more focused on addressing business issues that will jolt us to act on new external forces of change, like ESG, BEPS, and global regulations.