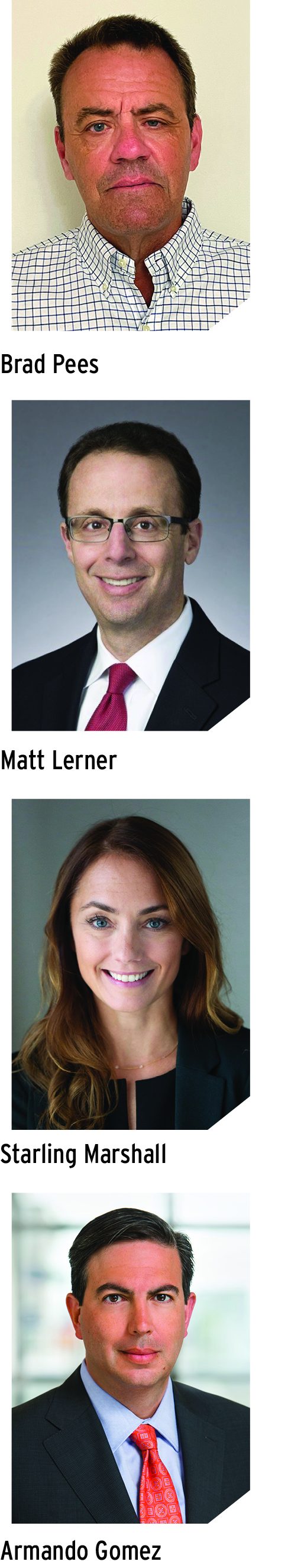

There’s a new sheriff in D.C., but what does that mean for taxpayers in terms of enforcement? That’s a difficult question. As you might expect, we convened a roundtable of some of the most notable forecasters in the tax space to discuss this issue, including Brad Pees, lead tax controversy for Nestlé USA and vice chair of TEI’s IRS Administrative Affairs Committee; Matt Lerner, partner with the law firm Sidley Austin and head of its global tax controversy practice; Starling Marshall, partner at Crowell & Moring in the tax and litigation groups; and Armando Gomez, partner at Skadden, Arps, Slate, Meagher & Flom LLP. Senior editor Michael Levin-Epstein moderated the discussion in April.

There’s a new sheriff in D.C., but what does that mean for taxpayers in terms of enforcement? That’s a difficult question. As you might expect, we convened a roundtable of some of the most notable forecasters in the tax space to discuss this issue, including Brad Pees, lead tax controversy for Nestlé USA and vice chair of TEI’s IRS Administrative Affairs Committee; Matt Lerner, partner with the law firm Sidley Austin and head of its global tax controversy practice; Starling Marshall, partner at Crowell & Moring in the tax and litigation groups; and Armando Gomez, partner at Skadden, Arps, Slate, Meagher & Flom LLP. Senior editor Michael Levin-Epstein moderated the discussion in April.

Michael Levin-Epstein: Do you expect to see changes in enforcement now that the Biden administration is up and running?

Brad Pees: From my experience, the IRS can go around in circles. They start at some point, and they end up back at the same point at some time in the future. Obviously, with a new administration coming in, you would expect that there would be some type of changes, including tax rates and things like that. How that feeds down to the enforcement at the IRS all the way down to the agent level, that’s to be seen and to be heard. At the end of the day, I think we’ll still be back, in my experience, to the same positions we’ve been in for years.

Matt Lerner: I think that we were already seeing, even before the new administration came in, a somewhat heightened enforcement effort from the IRS. For a number of years the IRS had been constrained in its ability to bring on new agents by budgetary limitations. Those constraints have been easing so that the IRS is able to hire additional revenue agents, which presumably will increase enforcement activity still more. We have heard the IRS making threats about going after ultra-high-net-worth individuals whom the IRS perceived as perhaps secreting their assets offshore, and also messages about using penalties more with corporations, launching criminal investigations of corporations, and employing outside investigators with experience in high-profile investigations to augment the IRS’ capabilities with respect to the audits of corporations. There seems to be a growing sense at the IRS, or at least among some folks there, that there are many corporate bad actors out there who need to be brought to heel. When you add to that an administration that, at least from the outside looking in, makes lots of noises about having a less favorable view of big business and being more willing to seek funds from the corporate taxpayer community, and the statements about a $1 trillion tax gap that were recently made by Commissioner [Charles] Rettig, I think the only conclusion that one can draw is that there will be heightened enforcement and, unfortunately, enforcement that starts with more of an anti-taxpayer bent. I’ve been representing large corporate taxpayers for more than thirty-five years; my experience has been that they are among the most responsible taxpayers in our system. Certainly they take advantage of tax incentives in the Internal Revenue Code, but they seek to be compliant. Having a tax administration that has a view that they’re trying not to comply or maybe to play fast and loose with the rules is unfortunate and not consistent with conduct I’ve observed.

Starling Marshall: I agree with Matt that there will be noises made about increasing enforcement and a focus on what Biden phrased in his campaign as “paying fair share,” which has been largely interpreted as focusing on large corporations and high-net-worth individuals. But I also agree with what Brad said, that the noises made at the top announced through policies and legislative initiatives are interesting and will definitely have an effect on tax policy, but in terms of the trickle down to enforcement, it remains to be seen if they will really make a difference. I think that the answer is yes if this administration is successful in obtaining the additional funding that they have requested. In the past, we’ve seen lots of enforcement—I’ll call them “trends”—campaigns and operations. But where the IRS did not have the staff or the resources to really pursue those in any kind of concerted and consistent way, they haven’t made a big change in enforcement. Here, we see an administration and a commissioner who seem very focused on getting a large increase in funding for the IRS, and that could enable things like this new promoter office that was just announced to have real teeth behind it, because it won’t be just words. There will be staff and money behind the enforcement priorities.

Armando Gomez: I agree with Matt and Starling. The Biden-Harris administration is asking Congress for $80 billion over the next decade to help the IRS increase its enforcement efforts. Just making that budget request is a clear signal to the career employees at the IRS that the administration wants them to crack down. In some ways, this will make audits difficult for compliant taxpayers, but unfortunately that is something that all of us will need to deal with. However, the administration is clearly focused on using technology to bolster their enforcement efforts, including by expanding the use of information reporting to identify potential gaps in the system. This makes good sense, and we should commend them for that. Also, the administration wants to make sure that the IRS is devoting sufficient resources to auditing partnerships, high-net-worth individuals, and persons using cryptocurrency. That’s probably not welcome news for those groups, but understandable in light of recent studies suggesting that these may be likely areas of noncompliance.

New Promoter Office

Levin-Epstein: Picking up on that last point that Starling made, what is the goal of the new promoter office?

Marshall: The promoter office, in my understanding, is really going to be focused on shelters and other tax-planning strategies that the IRS has listed and will just be a further coordinated effort on those. I believe that this is somewhat a reaction to [the fact] that some of these shelters are spanning different parts of the IRS; in other words, it doesn’t neatly fit within [the Small Business/Self-Employed Division] or [the Large Business & International Division], or there just might be more intersectionality, and this office would hope to coordinate those efforts across the Service and possibly even coordinate between civil and criminal enforcement. But I haven’t heard too many details, so I’m eager to hear if Matt and Brad know anything further.

Lerner: I think an important point to be made about the new promoter office—and it’s a point that I know TEI members have heard many times before—is that in the IRS’ view, one treads on more dangerous ground when third-party professionals bring ideas for tax savings to companies. There is a sense within the IRS, and we’ve seen previous promoter investigations that demonstrate the existence of that view, that there is a difference between a company’s embarking on business-driven steps in the most tax-advantaged way possible—which the courts have almost unanimously said is appropriate and permissible—and having someone not affiliated with the business bring a tax-saving idea to the corporation and then go in search of a business purpose for it. I think the new promoter office is aiming in part at that latter type of transaction. A large corporation is still free, for example, to engage an outside advisor to assist it in looking at its transfer pricing structures globally and try to determine if it is doing things in the right way and identify potential areas for savings. That’s OK, because it’s driven by the specific characteristics of the business. But what companies should be careful to avoid is signing on to something that is being prepackaged and presented to lots of people. Further, I do agree with Starling that one of the things that the IRS has tried to address is the absence of information-sharing across different parts of the IRS. In the past, LB&I might identify a corporate tax shelter and get the word out to agents in the LB&I community. SB/SE may identify something that it views as a tax shelter that’s being done by high-net-worth individuals and partners. Sometimes there was an intersection with those, but very little knowledge-sharing across divisional lines. One of the goals of this new promoter office is to share the information more widely to be sure that trends that may well not be appropriate tax planning are shared with the entire workforce of the IRS and dealt with consistently.

Pees: The only additional thing that I will add is, in my experience looking into my different bosses’ offices over the years, every week there would be somebody that would come in to try to promote something. So, I wholeheartedly agree with Matt’s thought. You think about what’s going on today with the type of programs and things that the Biden administration is promoting, like [the] Green New Deal and things like that, there are certainly out there already—I’ve seen them, and there will be—people promoting shelter-type activities to save taxes. To emphasize Matt’s point, we’ve just got to be careful from a corporate standpoint, from a TEI standpoint, our taxpayers, that we are doing the right thing, that there’s a business reason for the deal and there’s not a package program.

Gomez: I think there are two important drivers behind the new promoter office. First, as Starling and Matt observed, the IRS needs to have a more coordinated approach to promoter investigations, particularly for investigations that cut across different taxpayer groups. For example, there are ongoing investigations today that involve issues for LB&I, SB/SE, and [Tax-Exempt & Government Entities Division] taxpayers. Having a way to ensure that the promoter investigations have access to the relevant information and subject matter experts is critical to the success of the program. Second, there is a long history of prolonged promoter investigations. It is rare for promoter investigations to be resolved in less than a few years, and I am aware of at least one pending case today that involves transactions from almost twenty years ago. The new promoter office will hopefully help the IRS to better prioritize these investigations and find a way to bring them to completion faster, which in the long run is in the best interests of tax administration.

Areas of Increased Enforcement

Levin-Epstein: Let’s presume that the funding is there for additional staff and resources. What are the substantive areas that taxpayers should be aware of regarding increased IRS enforcement?

Lerner: I think we can look first, obviously, at the ever-broadening list of campaigns. That gives you an idea of things that the IRS is particularly interested in. Being a bit more surgical about it, we see the IRS’ conclusion that transfer pricing needs more attention because it believes taxpayers’ intercompany transactions need to be brought under control. The IRS seems to believe that it needs more resources, such as economists and trained agents, who are able to look at companies’ global structures and make sure that profits are residing where value is contributed. The second thing that’s almost so obvious that it doesn’t need to be mentioned, but I’ll say it anyway, is that we have a broad range of new tax provisions, particularly international ones: FDII, GILTI, BEAT, etc. Each of those has a complex set of rules where the IRS needs to learn the law . . . business taxpayers do as well . . . needs to understand its nuances and then needs to deal with taxpayers who have been making valiant efforts to comply with what is as of yet a not very well developed body of law. So, I think we can expect to see a lot of compliance activity with the new international tax provisions. On the domestic side, there are two things that I would highlight. One is the ever-increasing activity surrounding the research credit. Those examinations are extremely fact-intensive, because one has to understand companies’ projects and their satisfaction of the four-part or seven-part test, which requires a high degree of knowledge and fact development. And then the other thing, if there is a change in rates, is timing issues. Each time we see a change in rates, there is a permanent aspect to what was previously just a timing issue. For example, whether I get five-year depreciation or seven-year depreciation is typically not much more than a question of whether cost recovery gets spread over five or seven years, but if one or more of those years is a year with a higher tax rate, the timing becomes important. We saw in 2017, with the change of rates into 2018, the IRS coming back and looking more at timing issues because it was important to know whether something in fact happened in [2017] or [2018]. So, assuming the IRS gets additional funding, those are some of the areas that I think are likely to get attention. One last point I would make is that I hope the IRS uses a significant portion of any budget for training. I believe that most revenue agents are trying very hard to do their jobs, they’re hard-working folks that would like to get things right. But sometimes they’re out there in the field, in my view, without adequate tools. They haven’t had the chance to really learn and understand these new tax provisions, they haven’t been taught those new tax provisions as well as we would like by experts. They’d like to understand them better, they’d like to get it right, and I think the IRS would benefit itself, its relationship with taxpayers, and overall enforcement to make sure that its cadre of highly qualified agents are well trained in the specific technical areas that are its current focus.

Marshall: I wholeheartedly agree with looking at the campaigns as clear indications of places that the IRS already has publicly said they want to spend more time. I think I would doubly and triply emphasize that with respect to R&D credits, as well as Section 199 although no longer with us in the Code but still with us in that there are still open claims out there, as those claims seem to draw a lot of scrutiny from the Service. But beyond the areas, I would just add one thing to Matt’s comment about the international provisions. I think a lot of Section 965 payments are in current audit cycles, and it is yet to be seen really what the issues there will be, but certainly the IRS will have to address calculation methods, etc. as they work through those audits. I think that’s an area to watch. Outside of the things that Matt talked about, I also think there’s going to be an emphasis on partnerships. I know there’s an effort underway on a large partnership compliance program. I think that the use of partnerships and the proliferation of partnerships even between large corporate taxpayers is something that, again, sort of spans different areas of the IRS and could necessitate increased coordination and focus on those. I think, as Brad astutely pointed out, there are lots of credits being discussed in the new infrastructure bill and Made in America tax plans that have been announced recently—renewable energy credits, etc. Drawing from the experience of Section 1603 grants, I think we could see an enforcement focus monitoring how taxpayers are taking advantage of the grants, credits, or deductions, however they will be included in the legislation. I also think that there is a real emphasis, as Matt alluded to earlier, on coordination between criminal and civil, and possibly a more aggressive use of criminal enforcement even in the corporate realm. So, I do think that is a tool that, at least [according to] the perception by some in the administration, has been underutilized and that could be an area of really increased focus. Finally, sort of building off the criminal, I know there is a current Operation Hidden Treasure on cryptocurrencies. I think the IRS is really coming around to a greater understanding of digital assets and their use, and I think that that will result in an evolution of both a policy and enforcement regarding digital assets and an effort to have all taxpayers come into compliance with regard to their digital assets.

Pees: I would follow up on that just a little bit. I agree with both Starling and Matt. On the issues that I would expect the IRS to increase enforcement on, assuming that they get the resources that they need—because as we all know, without the appropriate resources, without the training, it’s not going to make a difference what the people at the top say because it’s not going to get down to the bottom level. The research credit, transfer pricing, those are relevant on almost every single large corporate audit. The partnership items—again, I agree with that as well. One of the things we’re doing at TEI is we have some subgroups in both research credit and transfer pricing working with the executives at the IRS. One of the things we’ve recommended in the transfer pricing working group is to actually offer training to the IRS agents about certain industries or areas. I think that would be a highly productive thing if somebody from, say, oil and gas or from an IT company would be able to train an IRS agent on the certain business policies and procedures of that particular industry. We’d be able to save an immense amount of resources either on an R&D credit or a transfer pricing audit.

Gomez: Not sure there is much to add beyond what Matt, Starling, and Brad have covered. As I mentioned earlier, I do expect the IRS will use some of its enhanced funding to focus on using technology to be smarter about who they audit and how they perform their work. Part of this will involve more information reporting and better matching of information returns to income tax returns. In terms of substantive areas, I agree that areas to watch include cross-border planning, transition tax, tax credits, and timing issues that become permanent due to tax rate changes. I’ve already seen the IRS pushing deductions from 2017 into 2018 and later years.

Legislative Efforts

Levin-Epstein: Are there legislative efforts you think that could affect enforcement?

Marshall: I definitely think the big legislative package that’s being proposed, everybody is watching with real interest because that would have significant impact. In terms of legislative initiatives regarding enforcement, I guess one thing that I left out of my previous comments were the COVID relief measures. There’s been four or five depending on how you count them, and some of those did include some tax provisions. I think that now, with the restrictions easing and businesses opening back up and the economy at least seemingly rebounding, there will probably be some enforcement activity surrounding any perceived abuses or misuse of the COVID relief provisions that were passed during the thick of the pandemic. I think there have been, for example, efforts around or talk around repealing the NOL carryback provision provided for in the CARES Act. I think there will be legislative effort or at least political attention paid to any perceived misuse of the provisions that were meant to bridge suffering during the pandemic. We must remind the IRS that taxpayers were implementing these provisions without any guidance, and the guidance that was issued was mostly through notices, etc. rather than regulatory. Aside from enforcement measures, the big issue will be the huge infrastructure bill, budget, and tax overhaul. It will be interesting if FDII is repealed, and if BEAT is repealed as is being proposed. As Matt mentioned, the law in those areas is somewhat underdeveloped. If those statutes are then ripped from the books, they will remain somewhat underdeveloped, so it will be very interesting to see how enforcement of those provisions for the years in which they applied, if they are now repealed, how that really goes when there won’t be developing law on a go-forward basis.

Lerner: While it is not unique to new legislation, I also think one of the things corporations need to be aware of is that with any number of these provisions—whether we’re talking about provisions from TCJA or the provisions that Starling has just referred to that came into force during the height of the COVID crisis—there are specific interpretational issues. There are issues surrounding alternative minimum tax carrybacks and how they work the new carryback rules. There are issues for fiscal year taxpayers about the first year in which they are subject to TCJA and the interplay of provisions like Section 245A, the foreign tax credit rules, and Section 78. In many of those areas, the IRS has put out through notices—not through regulations that are subject to notice and comment rulemaking—interpretations that taxpayers disagree with. In some instances, those interpretations have found their way into regulations, and I expect that we will see challenges to them. Corporations need to keep their finger on the pulse of such challenges. If I were in a large corporation, and I thought one of those provisions was interpreted incorrectly by the IRS but I didn’t want to be the person out in front leading the charge, I’d make sure that I have a very good calendar tracker and know when I must file protective claims for refund for each of those. Corporations must preserve their right to get the more beneficial treatment should it turn out the IRS interpretation is rejected by the courts. Indeed, corporations have an important choice to make. Do they want to be the ones out in front on the issue? When the answer is no, they need to ask if they have taken all the steps that they need to take so that if the issue comes out the way we in the taxpayer community believe it will, their right to a refund remains available.

Pees: I agree with everything that everybody said. To me, being in the corporate world, the tax law changes and the tax rate changes are the most important thing, because you might have things that have carried back to 2017, and that’s a different tax rate than 2018, and we might have a future tax rate that’s more than the tax rate now. All those things have an interplay on [net operating losses] and capital losses and everything like that that are under consideration when we’re planning our tax returns and when we handle the audits after that. It’s all very important concepts that we need to have a perspective on when we’re planning.

Gomez: Matt put his finger on it. What we have seen in the past several years is a heightened focus on the process by which regulations and other guidance are developed by Treasury and the IRS. As the law in that area continues to develop, it is critical for TEI members to understand how and when they might have opportunities to challenge rules that may not be consistent with the statutory text and purpose. Of course, TEI has a long history of actively commenting on proposed rules and regulations, and I expect that will continue. But with this renewed focus on administrative law in the tax arena, sorting through how and when to take positions that may be contrary to guidance is something that tax executives should examine. We have already seen numerous challenges to rules issued under the 2017 legislation, and with another round of major tax legislation under discussion now—particularly legislation that might result in significantly higher tax rates—these are things that are sure to be high on the list for the foreseeable future.

Levin-Epstein: Thank you.