The many benefits of a diverse and inclusive workplace include increased revenue, improved employee engagement, and more innovation. Despite the great strides that have been made in driving awareness of the importance of diversity, equity, and inclusion (DEI) in the workplace, much work still needs to be done within the corporate tax department, as indicated by the results of the diversity, equity, and inclusion survey that TEI conducted during the first quarter of 2023.

Designed to get the lay of the DEI landscape in the tax profession, the survey received responses from ninety-one TEI in-house tax professionals. The results revealed how increasing DEI efforts could alleviate the number one challenge for tax teams: hiring, recruiting, and retaining top talent.

DEI Awareness at All-Time High

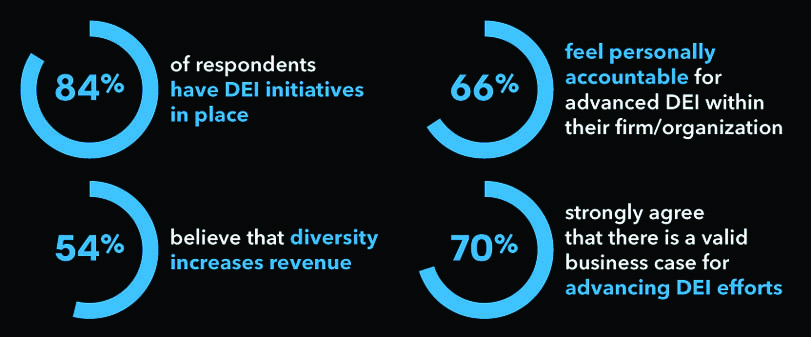

Based on the survey findings, the tax industry is well aware of the need for DEI in the workplace. Over half the respondents (54%) believe that diversity increases revenue, and the majority (70%) agree that there is a valid business case for advancing DEI efforts. DEI is clearly a top priority, with an overwhelming majority of respondents (84%) stating that they have DEI initiatives in place. And 66% even feel personally accountable for advancing DEI within their organizations.

DEI Focus Areas

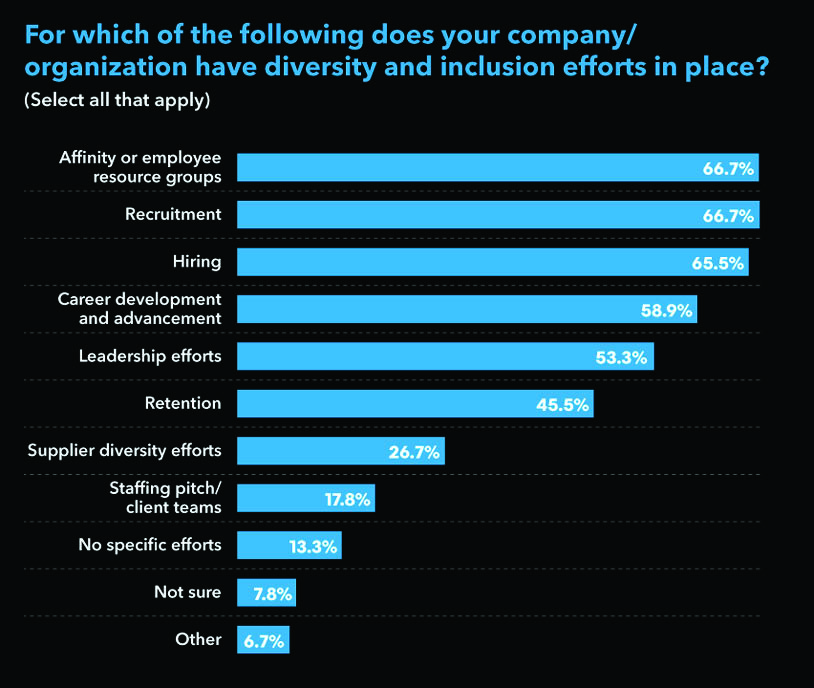

Not surprisingly, DEI initiatives are mostly internal, with most respondents (over 50%) having established efforts in the areas of hiring, recruitment, career development and advancement, leadership, and affinity or employee resource groups. Affinity or employee resource groups are also perceived as the most successful area for DEI efforts, with 71% of respondents ranking them as doing well at advancing DEI.

Interestingly, externally driven efforts, such as attempts to diversify suppliers and staffing pitch/client teams, were at the bottom of the rankings, indicating that much of today’s DEI work still focuses on areas within company walls.

DEI Goals, Key Metrics, and Accountability

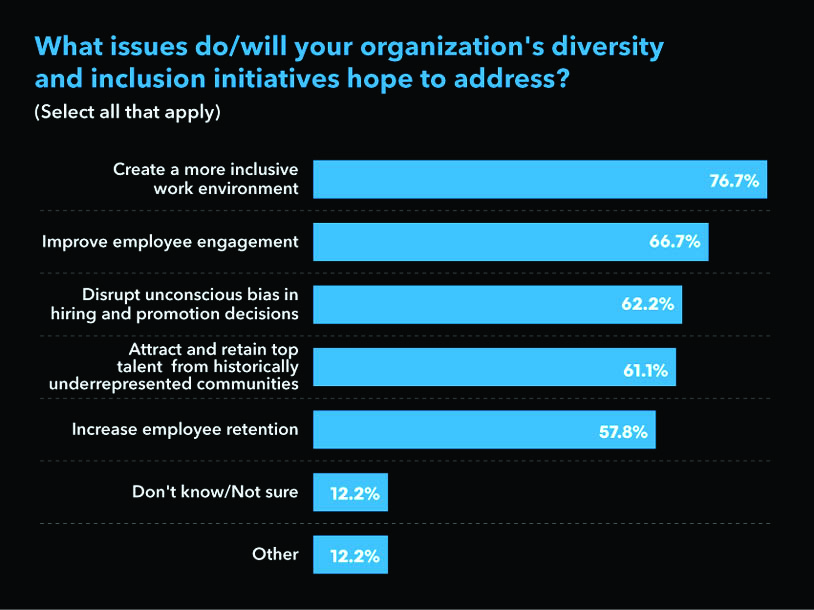

As for DEI objectives, the top issue survey respondents hope to address is creating a more inclusive work environment, followed by improving employee engagement.

Generally, respondents support workplace DEI as evidenced by widespread established DEI-specific initiatives. However, voicing support for diversity, equity, and inclusion is not enough. The real power comes from getting employees’ input on the measures that resonate with them, putting a plan in place, and tracking the impact of any initiatives.

As experienced tax executives know, you can’t fix what you can’t measure. To that end, aligning DEI strategy and the success of execution with key metrics is imperative to making progress in DEI. Unfortunately, the tax industry is behind the curve in measuring its DEI efforts.

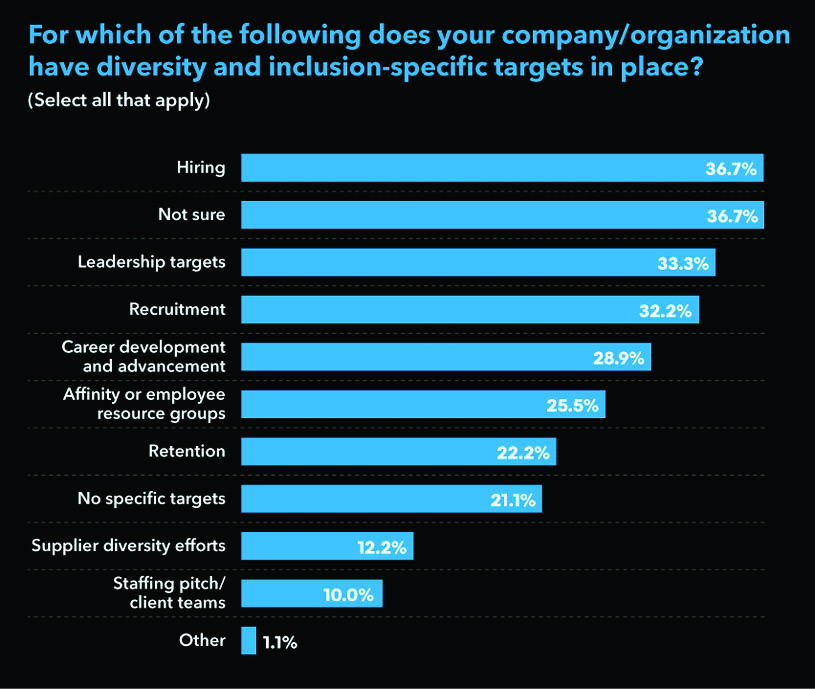

Among survey respondents, only an estimated one third apiece have DEI targets specific to hiring (37%), recruitment (32%), and leadership (33%). Only 12% have targets related to suppliers.

To reach the next level of DEI success, the same rigor and effort used to increase DEI awareness needs to be applied to creating and using meaningful metrics. At Bloomberg Tax & Accounting, for example, we have culture champions who engage staff and collect feedback to inform discussion groups and activities. We have an annual culture survey where we ask our employees anonymously for feedback on how they rank the inclusiveness of our company culture, within their immediate teams, within our tax and accounting business, and within the overall company. It’s crucial that we consistently measure this inclusiveness annually so we can not only measure our progress but also inform areas of focus for our DEI initiatives.

Shrinking Talent Pool Remains Top Barrier

Recruiting and retaining tax talent continues to be the number one challenge for 76% of tax teams, according to Bloomberg Tax’s 2022 Corporate Tax Department Benchmark Survey.1 In the TEI survey, respondents cite creating more inclusive workplaces and increasing employee engagement as key tools in the competition for talent. The thinness of the talent pool is not surprising, since accounting school enrollment remains at all-time lows. This area is, however, where we have an opportunity to really improve tax and accounting as a career brand and reposition it for the dynamic, evolving, and multifaceted profession it is today. Few professions offer the variety of roles and skills that tax does to navigate constant changes in tax laws, regulations, and reporting requirements in the United States and across the globe, the increased complexity of business activities and locations, and the demands of wrangling colossal amounts of data. In particular, the need to use technology to move away from manual workflows has never been greater and is a challenge that translates into opportunities for a wider variety of roles for current and future generations of tax professionals.

This shift in focus will empower tax and accounting professionals to spend less time on repetitive compliance activities and more time delivering better results for their clients and businesses, which will ultimately make accounting a more attractive career option for students.

To turn around the downward trend in college and university students majoring in accounting, large-scale efforts need to be made to drive awareness of the accounting profession well before potential colleagues enter college. More high school curriculums need to offer accounting. But improvement goes beyond increasing the talent pool and recruiting qualified candidates. The industry needs to do a better job of retaining diverse talent by investing in their professional development and making use of their new ideas and approaches so they can lead the tax profession across this new frontier.

Another consideration is that the US Census estimates that, by 2045, fewer than half of Americans will be white, which makes it clear that the industry needs to do a better job of attracting people of color to the profession. In addition, addressing the needs of Generation Z professionals, those just entering the workforce or who have recently entered it, is imperative to the future success of tax and accounting. According to a 2022 Forbes study, Gen Z needs to feel empowered, valued, and included.2 They are interested in gaining new skill sets, and they care whether their managers are invested in their professional development.

The poor talent pool by far is the greatest pain point for the tax profession; however, the TEI survey did reveal a few other top DEI challenges including:

- lack of staff resources to support DEI initiatives (28.74%); and

- senior leaders with insufficiently diverse backgrounds (26.44%).

Beyond the scope of this survey, at the most recent TEI Midyear Conference, members identified as top challenges within their departments and companies the need to create an inclusive culture and increase employee engagement.

The Silver Lining: What’s Done Well, Potential Areas for Improvement

When asked how well organizations are advancing DEI in targeted areas, 71% of TEI survey respondents perceive affinity or employee resource groups (for women, minorities, LGBT+ persons, people with disabilities, etc.) as their companies’ top strength, followed by hiring (59%) and recruitment (59%). DEI efforts related to external suppliers rank among the lowest perceived areas of strength, at 33%.

When asked what could be done to make DEI efforts more effective, respondents made these top recommendations:

- leadership transparency to improve employee trust;

- mentorship programs to support relationships with decision makers;

- more diverse representation on the management committee; and

- sponsorship programs to enhance exposure to decision makers.

Based on these findings, the good news is that substantial improvements could be achieved by focusing within the company. In other words, these changes are completely within the control of an organization. As an example, as part of the Bloomberg Tax & Accounting DEI plan, we encourage engagement through transparent processes that seek feedback, employ self-reflection, and demand accountability for DEI with discussion-based programming about race. Based on employee feedback, we have added a greater variety of discussion groups and formats, ranging from “lunch and learns” (which focus on gaining new skills like project management) to “coffee 1:1s” (where colleagues get to meet and to know colleagues from other teams). We also have team-building events where staff members volunteer to help local nonprofits and give back to our community. These activities can be tailored for small groups.

Bloomberg also has dedicated leadership and activism training to ensure that all employees are aware of DEI best practices and are on track to meet companywide goals. Specific training modules of this program include:

- Being a 21st-Century Leader;

- Recruitment Best Practices;

- Unconscious Bias & Performance Reviews;

- Transitioning Staff Back From Parental Leave; and

- Engaging With HR to Solve Problems.

- Externally Driven DEI Efforts at Bottom of Priority List

Most respondents have engaged accounting and law firms (95% and 94%, respectively), and only one third (31%) of respondents don’t consider diversity, equity, and inclusion in their decision-making process. Ironically, 54.45% strongly agree that there is a need to advance DEI in accounting firms. Over half (53%) have discussed or would like to discuss DEI-related goals or concerns with the relationship partners at their advisory firms.

In-house DEI efforts are obviously a first priority in cultivating an inclusive culture. At Bloomberg Tax & Accounting, we bring external tax leaders of color into our office to speak with staff and share their experiences and perspectives. We’ve gotten consistently positive feedback. Externally focused DEI initiatives also offer great value for staff. At Bloomberg Tax & Accounting, we are working with a local Alexandria, Virginia, high school where most students are of color. We bring in speakers to share their varied experiences and host interactive events at the school, such as a hackathon, to get students engaged and interested in accounting as an attractive and dynamic profession.

Tax professionals widely support the desire to implement DEI initiatives. However, much work still needs to be done to create more inclusive workplaces and to increase employee engagement. Tax leaders should look beyond their immediate team, too, for opportunities to partner and learn. Whether it’s other departments within their company or pairing up with one of their fellow corporate tax leaders to engage in a meaningful activity, the possibilities are great. At this stage of greater awareness of DEI and growing momentum for initiatives, it’s now all about refinement and driving impact that helps tax leaders and their teams thrive. We’ve seen success in establishing a baseline for DEI metrics and measuring the impact of initiatives and then sharing those results in team-wide meetings. It’s helped to foster engagement and better relations between staff and management. Leveraging metrics and increasing transparency are just two ideas that could result in big change and bring us closer to the vision of a truly diverse and inclusive workplace environment.

Lisa Fitzpatrick is president of Bloomberg Tax.

Endnotes

- 2022 Corporate Tax Department Benchmark Survey: The Trends Shaping Tomorrow’s Tax Function, Bloomberg Tax, 2022, https://pro.bloombergtax.com/reports/2022-corporate-tax-survey/.

- Edward Segal, “How and Why Managing Gen Z Employees Can Be Challenging for Companies,” Forbes, March 25, 2022, www.forbes.com/sites/edwardsegal/2022/03/25/how-and-why-managing-gen-z-employees-can-be-challenging-for-companies/?sh=18ea79f44d26.