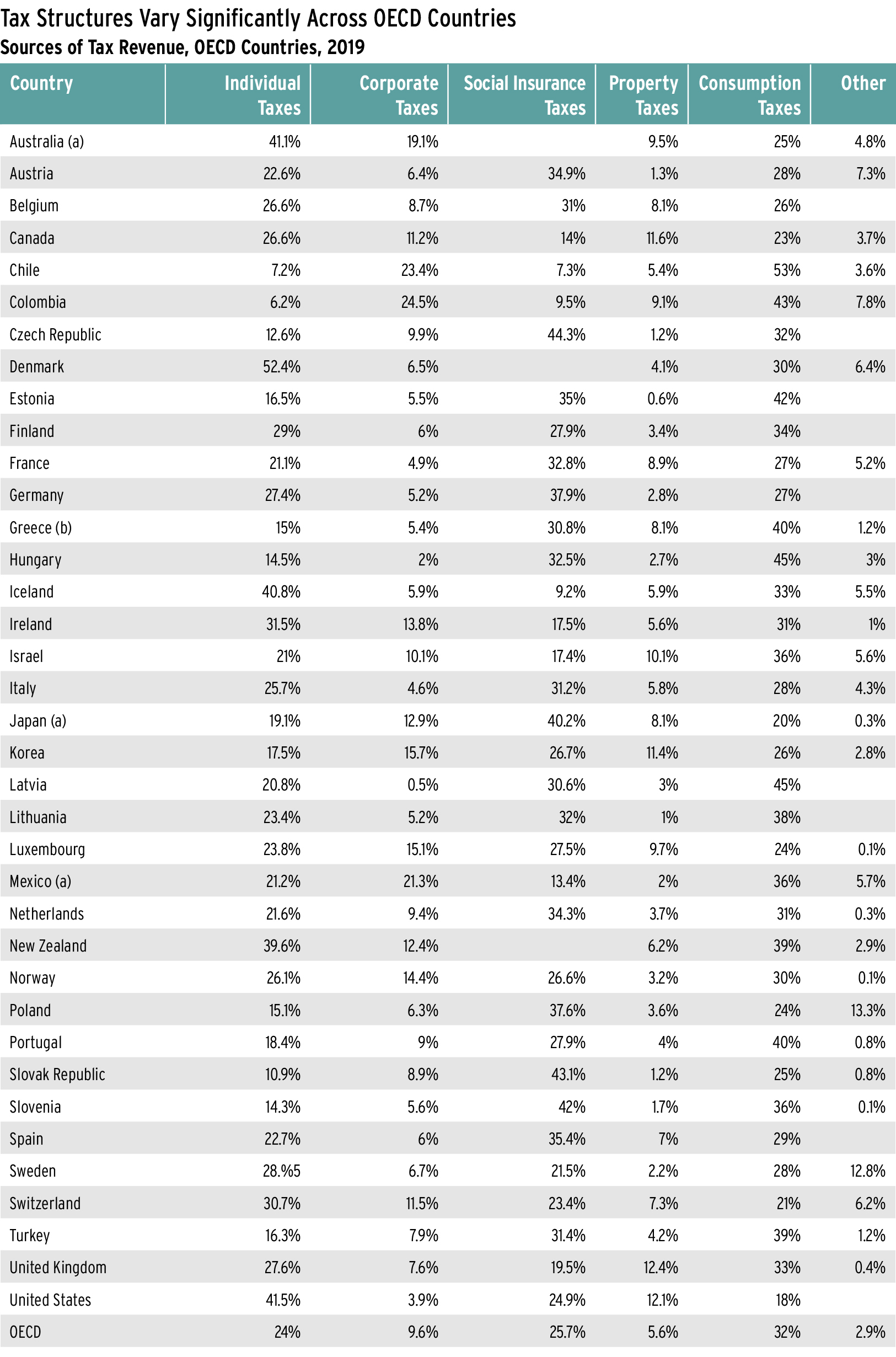

Countries in the Organisation for Economic Co-operation and Development (OECD) vary greatly in how tax revenue is generated. For example, although all OECD countries levy a corporate income tax, it typically raises far less revenue than other tax sources.

Using the 2019 OECD average of 9.6 percent as a benchmark for the share of tax revenue from corporate income taxes, according to the Tax Foundation’s Sources of Government Revenue in the OECD, countries such as Colombia and Chile rely more heavily on such revenue. Others such as Latvia and Hungary rely very little on corporate income tax for revenue.

Below, see how OECD countries’ tax structures, and thus sources of tax revenue, differ. To learn more about the Tax Foundation’s analysis of this data, visit taxfoundation.org/oecd-tax-revenue-2021.

Data for Australia, Japan, and Mexico is from 2018, because 2019 data was not available yet.

For Greece, only the aggregate Taxes on Income, Profits, and Capital Gains was available for the year 2019. To split this aggregate into the three subcategories of individual income taxes, corporate income taxes, and other income taxes, each subcategory’s average share of the three years prior (2016–2018) was used to weigh it.

Source: Tax Foundation, Sources of Government Revenue in the OECD, taxfoundation.org/oecd-tax-revenue-2021; OECD, “Revenue Statistic – OECD countries: Comparative tables,” https://stats.oecd.org/Index.aspx?DataSetCode=Rev.