The world is getting smaller and more complex. National economies are more integrated globally, but national deficits and the need for tax revenues are driving unilateral measures. The original objective of the base erosion and profit shifting (BEPS) project has been described as ensuring that profits are taxed where economic activities creating those profits are performed or where value is created. Yet there is no widespread consensus as to what value is created, how it should be measured, and how it should be taxed. Here are the key elements of the Organisation for Economic Co-operation and Development’s (OECD’s) policy response:

- BEPS Action 13 – country-by-country reporting;

- Pillar One – new taxing rights for market jurisdictions;

- Pillar Two – agreed per-jurisdiction minimum tax, otherwise subject to a top-up tax in the parent jurisdiction; and

- the multilateral instrument (MLI) – an overlay to bilateral treaties.

Meanwhile, individual jurisdictions are imposing unilateral measures, including digital services taxes.

The US and the End of Deferral—GILTI as the Ultimate Unilateral Measure?

The 2017 Tax Cuts and Jobs Act (TCJA) pursued several overdue policy objectives designed to bring the United States’ international tax system into conformity with its major trading partners, thereby ending a steady stream of corporate tax inversions. These major objectives included:

- lowering the US corporate income tax rate—now twenty-one percent;

- moving toward a territorial system whereby the global intangible low-taxed income provision (GILTI) eclipses Section 245A;

- reducing complexity—though not quite; and

- providing greater tax certainty—hmm, let’s see what happens next!

The TCJA’s primary goal of moving toward a territorial system, where active foreign earnings are not subject to tax when repatriated, was to eliminate the lockout effect. At the time the TCJA went into effect, there were approximately two to three trillion dollars of unrepatriated foreign earnings. A major component of the TCJA was the Section 965 transition tax, which immediately taxed formerly unrepatriated profits as subpart F income at a very low effective tax rate. This transition tax resulted in previously taxed earnings and profits (PTEP) that can be repatriated free of US income tax. The end result of the TCJA’s complex and highly interrelated (and sometimes circular) international tax provisions has created a situation where even the most basic corporate transactions, including repatriation planning (PTEP distributions trump Section 245A), need to be modeled to determine their US tax impact.

Two Essential Modeling Imperatives

Here we describe the whys and wherefores of two essential US international tax modeling scenarios: foreign branch versus controlled foreign corporation (CFC) and the GILTI high-tax exclusion.

Foreign Branch versus CFC and Subpart F versus GILTI

A foreign branch for US tax purposes is generally defined as a qualified business unit operating a trade or business in a foreign country and is generally subject to the income tax laws in the foreign country in which it operates. The income, deductions, losses, and credits of a foreign branch held by a US person are taken into account in calculating tax liability, which may be beneficial if the branch generates losses that can offset its owner’s other income. However, the TCJA introduced two negative aspects to the tax treatment of foreign branches:

- foreign branch income is excluded from the definition of deduction eligible income (DEI) and is therefore denied the 37.5 percent foreign derived intangible income (FDII) deduction; and

- foreign branch income has a separate foreign tax credit (FTC) limitation basket, which has the impact of creating excess foreign tax credits if the blended effective tax rate of all foreign branches exceeds twenty-one percent after accounting for the allocation and apportionment of deductions under the Section 861-8 regulations.

The potentially adverse treatment of foreign branches held directly by US persons has created the need to model various planning scenarios, including converting the foreign branch to a controlled foreign corporation (CFC) or contributing the foreign branch to another CFC held by the taxpayer. In either case, any gain on the outbound transfer of the branch assets would be taxable, and if the foreign branch had previously generated losses in excess of its income, the excess loss amount would be recaptured into taxable income.

One potential upside on the outbound asset transfer is the Section 367(d) treatment of the transferred goodwill and going concern value as well as other intangible property. In effect, this generates annual income to the US person as a contingent sale of the property commensurate with the income generated by the property transferred. This results in foreign source income in the general limitation basket, similar to the treatment of royalty income, which should also qualify as FDII. The regulations also allow the CFC to deduct the deemed payment from its subpart F income and tested income for GILTI purposes. This deemed deduction against potential tested income also has implications for the GILTI high-tax exclusion effective tax rate analysis.

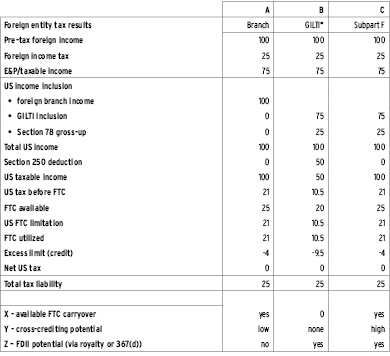

Table 1. Comparison of Foreign Branch Versus CFC & GILTI Versus Subpart F

Table 1 compares the nominal US taxation of a foreign branch with taxation resulting from a controlled foreign corporation (CFC) structure.

- Column A presents the foreign branch.

- Column B presents a CFC with a 100 percent GILTI inclusion.

- Column C presents the same CFC with 100 percent subpart F income.

The foreign income tax results are identical in each of the three structures with 100 units of foreign income and a twenty-five percent foreign effective tax rate. In this simple example, the US tax results seem to be identical as well. The US tax rate is twenty-one percent, with a corresponding foreign tax credit limitation of twenty-one units and excess foreign income tax credits of four units. However, consider the points identified in notes X, Y, and Z at the end of the table:

- subpart F income, especially if it is in the general limitation basket, has the best carryover potential, and excess credits in the GILTI basket cannot be used in any other year;

- subpart F also has the best cross-crediting potential; it is worthwhile to consider forms of low-taxed foreign-source income such as royalty income or Section 367(d) inclusions that may be able to absorb these credits. Similarly, low-taxed passive income could also make use of any excess foreign tax credits in the passive basket; and

- foreign branch income cannot produce FDII, whereas certain types of income such as royalties and deemed Section 367(d) inclusions can produce FDII.

GILTI or Not, and the High-Tax Exclusion Election

What is the cost of being GILTI, anyway? In the last example, it appeared as though the GILTI inclusion did not incur any US income tax. But what is the US tax cost if the foreign effective tax rate is less than the twenty-one percent US tax rate, and what is the break-even rate of foreign income tax such that there is no incremental US income tax—considering the fifty percent Section 250 GILTI deduction? Answers to these questions can be found using Table 1.

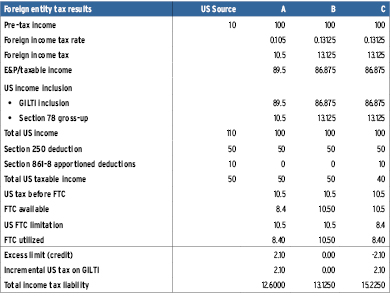

Table 2 presents additional general observations.

- In general, an effective foreign income tax rate of 13.125 percent is the break-even point, as demonstrated in column B of Table 2.

- If the foreign income tax rate is less than 13.125 percent, then there will be insufficient foreign tax credit shelter, and incremental US income tax will result, as column A shows.

- Column C demonstrates the impact of the Section 861-8 allocation and apportionment regulations. In general, every dollar of expense allocated to the GILTI basket results in twenty-one cents of incremental US income tax by reducing the foreign tax limitation, which is generally foreign source taxable income multiplied by the US tax rate.

Table 2. GILTI Break-even Analysis, With and Without Section 861-8

So, under what circumstances should you consider electing the GILTI high-tax exclusion? The simple answer is if the high-tax exclusion reduces your overall US income tax liability. So far, we have considered situations present in columns A, B, and C. We will explore these and other effective tax questions after considering the potential impact of the GILTI inclusion and its associated foreign tax credit on a taxpayer’s potential base erosion minimum tax amount (BEMTA) or base erosion and anti-abuse tax (BEAT) liability.

The BEAT tax liability equals the amount by which the taxpayer’s minimum tax amount (which includes the GILTI inclusion but not the FTC) exceeds its adjusted regular tax liability (which excludes the GILTI FTC). By reducing the GILTI inclusion, the taxpayer’s minimum tax amount decreases, which may result in a lower BEAT tax liability.

Highlights of GILTI High-Tax Exclusion

The final GILTI high-tax exclusion rules were included in the July 23, 2020, regulations. For the income to be excluded from tested income, the foreign effective tax rate of the tested unit must be greater than ninety percent of the highest Section 11 tax rate. Therefore, given the current twenty-one percent Section 11 rate, the potential tested income must have a tax rate higher than 18.9 percent to qualify as high-taxed. The high-tax test is performed independently for each CFC at the level of each tested unit. The CFC itself is a tested unit, as are any passthrough units flowing into the CFC such as disregarded entities and partnership interests. Tested units subject to the same taxing jurisdiction are combined, so the tested unit is generally determined on a country-by-country basis within each CFC. The final regulations retain the all-or-nothing requirement for all high-taxed income of all CFCs controlled by the taxpayer to be covered by the election. Therefore, any low-tax GILTI flowing into the US tax net cannot be sheltered by the high-taxed income left behind. Hint: if the remaining low-taxed GILTI flowing into the United States has a blended effective foreign income tax rate of 13.125 percent, you have a winner!

The final rules are more favorable than the earlier proposed rules, in two very important ways:

- The election may be made retroactive to 2018—but the amended return must be filed within twenty-four months of the original due date (April 15, 2021, for a 2018 calendar-year taxpayer); and

- The election may be made independently on an annual basis, whereas the proposed regulations had required a five-year binding election.

This list shows those situations most likely to succeed under the GILTI high-tax exclusion:

- NOL companies:

- GILTI inclusion otherwise taxed at 10.5 percent (after the Section 250 deduction) offsetting NOL deduction worth at least twenty-one percent; and

- CARES Act carryback to pre-TCJA years is worth thirty-five percent, and excluding GILTI can help to maximize the carryback potential.

- Other companies otherwise unable to claim FTCs

- Companies with excess foreign tax credits in the GILTI basket:

- remember the 13.125 percent FTC target; and

- expenses allocated to GILTI cost as much as twenty-one percent in FTC limitation, but may be somewhat less than twenty-one percent considering partially exempt treatment for foreign tax credit purposes.

- BEAT taxpayers:

- as noted above, modified taxable income does not benefit from FTCs.

This list includes potential downsides to the GILTI high-tax exclusion:

- loss of sufficient FTC cover for GILTI inclusions having an effective tax rate of less than 13.125 percent;

- loss of the GILTI inclusion for Section 163(j) limitation purposes, applicable when the CFC 163(j) group election is in effect;

- loss of FTCs on high-taxed tested income; and

- loss of qualified business asset investment (QBAI) on high-taxed income.

Taking a Global Perspective—MLI or Bust?

As noted above, the environment for multinational companies is more global than ever. Although many tax executives at US companies have rightfully focused on digesting the significant changes shepherded in by US tax reform, the rest of the world has only accelerated what can truly be described as global tax reform. The OECD has continued to refine elements of its original BEPS project while moving forward with sweeping proposals designed to fundamentally alter longstanding international tax concepts, that is, Pillars One and Two. At the same time, many countries have moved forward with unilateral measures focused on capturing their perceived “fair share” of global profits typically associated with the digitization of the overall economy. This has been exacerbated by the global COVID-19 pandemic, which has left many countries scrambling to generate additional tax revenue in the wake of stimulus spending.

Seize the Data (and Model!)—and Seize the Day

During ongoing efforts to understand the impact of US tax reform and to transition to affirmative planning and risk-mitigation strategies, there is a real opportunity to leverage the underlying data and information collected as part of this process to inform a more global perspective. Some specific examples include:

- Country-by-country reporting (CbCR). Information gathered by complying with CbCR requirements provides a unique snapshot of global operations. This data can be leveraged to better understand relative performance among group members as well as third-party benchmarks. It is worth noting that the OECD has already suggested that global tax auditors take a similar approach in its handbook for interpreting CbCR information.

- The multilateral instrument (MLI). Fundamental building blocks of modeling the impact of US tax reform include a thorough understanding of legal entity structure coupled with intercompany transaction flows among group members. From its broadest perspective, the MLI was introduced as part of the BEPS project to modify bilateral income tax treaties aimed at curbing perceived treaty abuses by denying treaty benefits for certain tax-motivated transactions or where treaty participants lack requisite business purpose. Augmenting legal entity structure and intercompany transaction data with information available in the CbCR is a foundation for understanding risks and opportunities associated with the ever-broadening adoption of the MLI. Moreover, an updated perspective on global withholding taxes is critical to modeling results under the TCJA such as GILTI, subpart F, and the associated foreign tax credits.

- Unilateral measures (also known as digital service taxes). The information noted above can also be used to better understand potential liabilities associated with individual countries moving forward with unilateral taxes while waiting for global consensus under Pillars One and Two. The list of countries either enacting or proposing such measures has lengthened in recent months. As of February 5, 2021, the number of countries moving forward on their own stands at twenty-one and includes many countries of significance to US-based multinational companies, including France, Hungary, India, Italy, Poland, Malaysia, Mexico, and Brazil.

Mark Gasbarra is the national managing director for Forte International Tax.