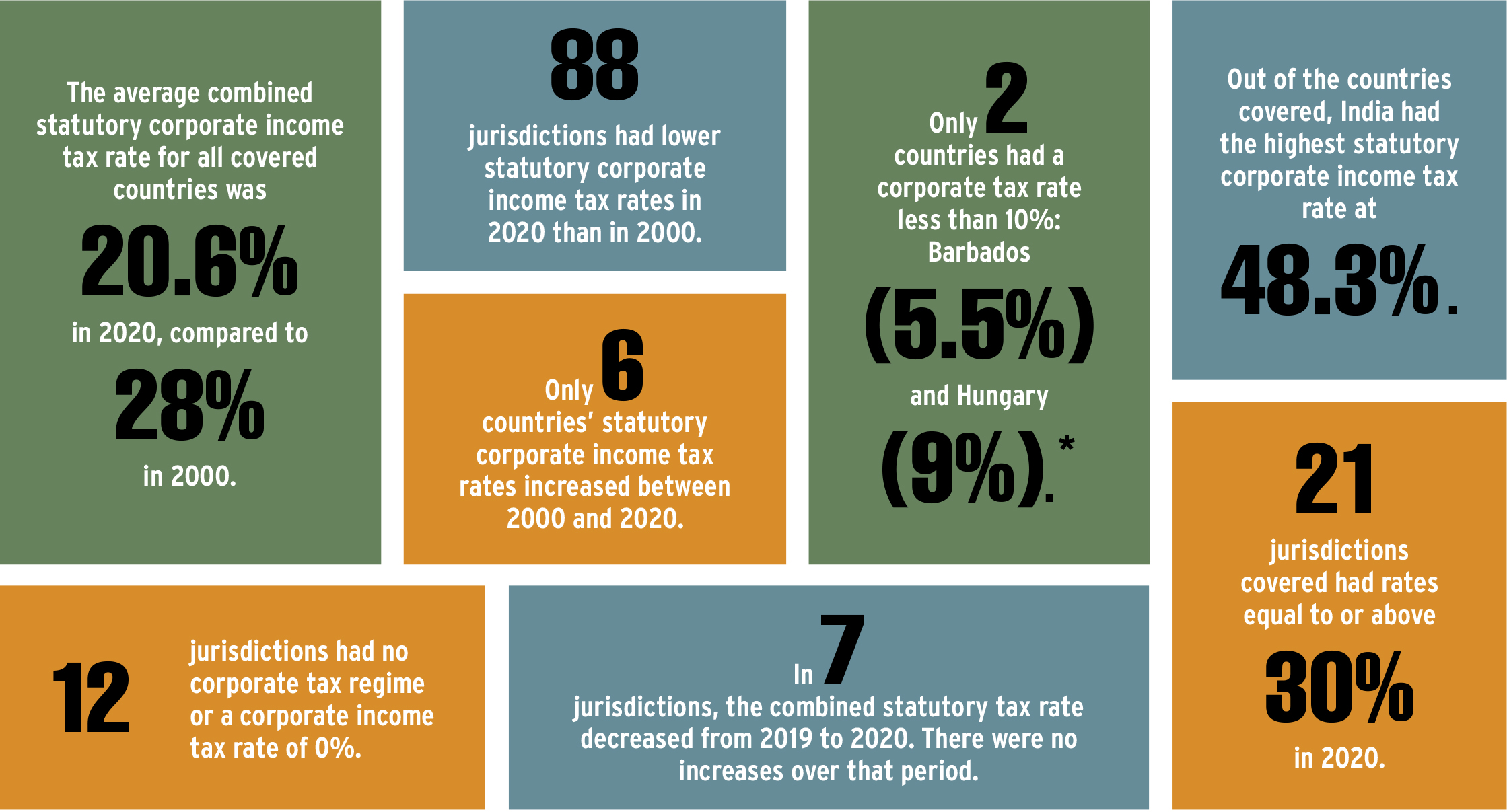

In its Corporate Tax Statistics: Second Edition, the Organization for Economic Co-operation and Development (OECD) recently looked at the tax landscape beyond its own member countries, evaluating adjustments in statutory corporate income tax since 2000. Generally, the OECD found that statutory corporate income tax rates have generally decreased on average since the turn of the century. The average combined statutory rate for all 109 jurisdictions the OECD covered was down by just over twenty-five percent in 2020 when compared with 2000.

Although these findings may not be surprising, the OECD’s report offers some global context while shedding light on some smaller countries with corporate income tax regimes that have evolved greatly over the years. Below are some of the more significant changes highlighted in the OECD’s report. To read the full report, visit www.oecd.org/tax/tax-policy/corporate-tax-statistics-second-edition.pdf.