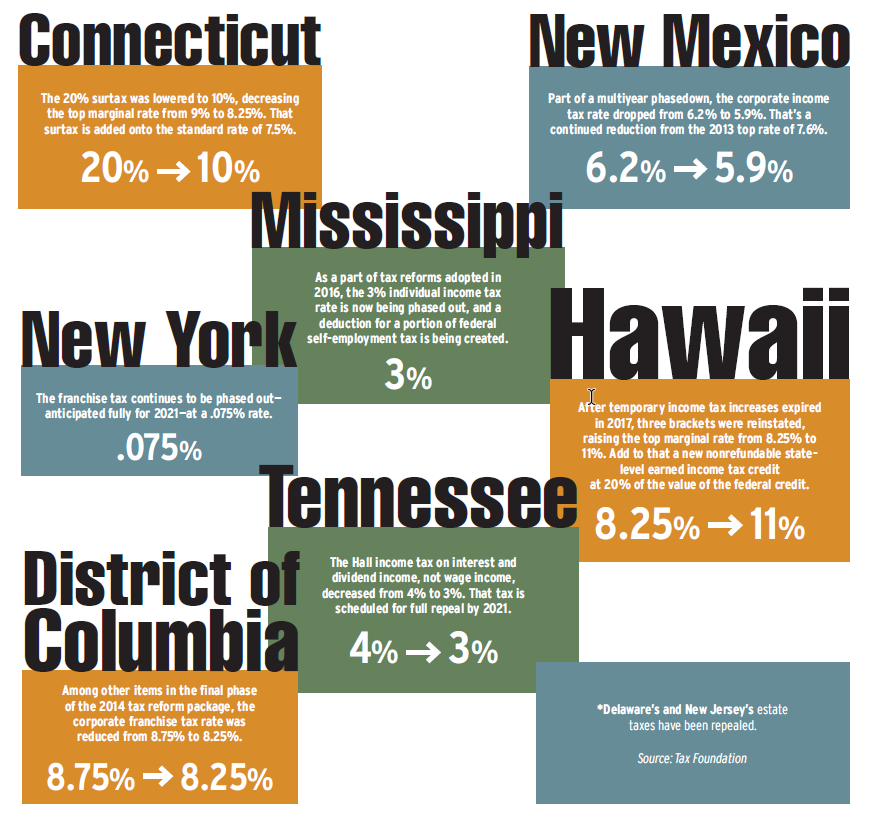

As the world of federal tax was shaken up by the passage of the Tax Cuts and Jobs Act of 2017, U.S. tax departments across the country continue to adjust. One of the main pieces of the new tax bill is the lowered corporate tax rate, which had not been adjusted since the 1980s. On the state level, however, corporate income taxes typically see yearly changes that should be noted. Because the Tax Cuts and Jobs Act affects all states, states have further impetus to evaluate their own tax codes. Below are some important state-level rate adjustments in 2018.

Tax Valuation Considerations for M&A Transactions Public corporations, private equity-backed portfolio companies, and privately held companies…

The Market for Clean Energy Tax Credits Is Booming The Expert: Rob Parker Since Congress passed the Inflation Reduction…

Your Complete Pillar Two Playbook Today’s resource-challenged tax departments often find it necessary to focus…

The SALT Team of the Future To respond to rapidly changing state and local tax (SALT)…

Purchasing Clean Energy Tax Credits The Inflation Reduction Act of 2022 (IRA) greatly expanded energy-related…

Gorka Echevarria When Gorka Echevarria made the move to Lexmark in 2018,…