As recently as five years ago, technologies such as robotic process automation (RPA), distributed ledger technology (DLT), machine learning (ML), and artificial intelligence (AI) were mere technology buzzwords for most tax professionals. Now, rarely do you see an organization that is not incorporating these technologies into its strategic plan for the new decade. This past fall, Gartner released its highly anticipated list of 2020 technology trends, which details what is really happening in this space as we enter a new year.1

Question: How are new technologies such as RPA, DLT, MI, and AI changing the tax function?

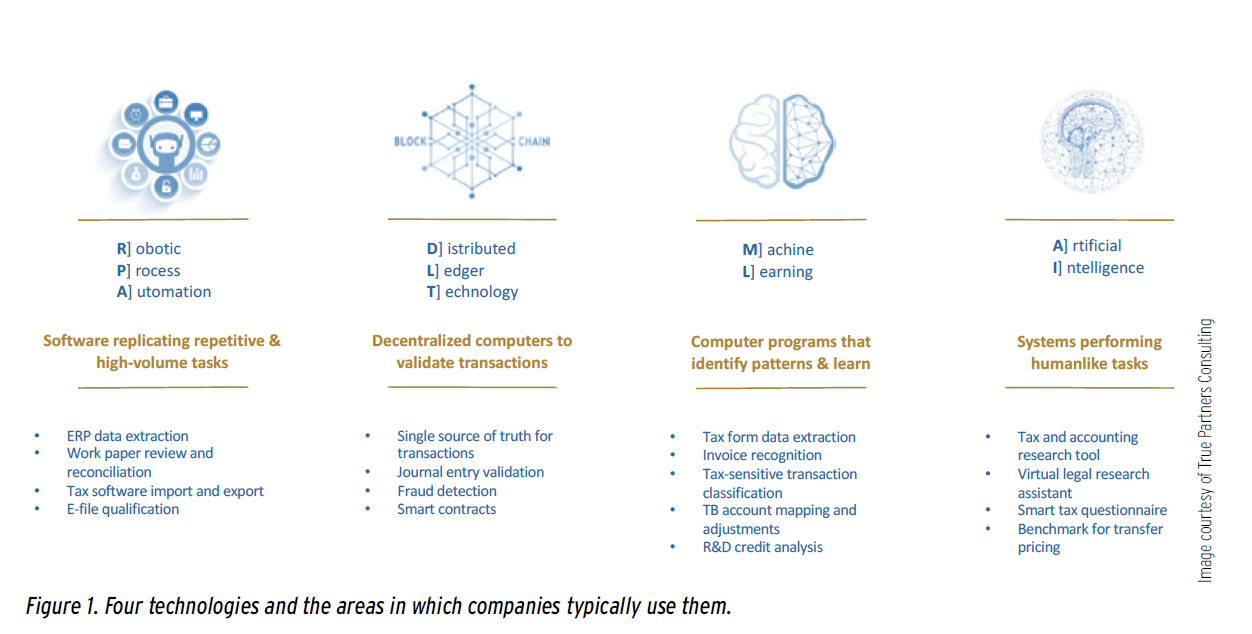

Thanks to the fast maturity and commercialization of these technologies and wide-sweeping success stories in tax, these technologies are becoming the new norm for tax functions. Figure 1 spells out the tasks for which each of these technologies is typically used.

Strategic Decisions

There are a few instrumental considerations before tax departments embark on a journey of technology implementation:

Infrastructure. As a number one foundation, the organization will define a scalable tax technology environment that collaborates with solutions such as ETL (extract, transform, and load) applications, RPA, ML, and the IoT (internet of things). Whether it’s a firm-wide strategy or a tax-centric initiative, we see the most successful programs starting when tax and information technology leaders proactively define technical infrastructure and its supporting models, including security, resilience, scalability, governance, and risk management.

Process. This is the task of creating the overall vision for tax processes and establishing enterprise process governance, control, and ownership. Before selecting particular tech vendors or creating any solution, it’s crucial to spend time analyzing the repeatable, manual, and high-risk tax functions in order to create a shared vision of the end-to-end future state. This analysis phase is also the best time to establish process performance measurements as barometers of improvement and future success.

Data. Creating a modern data architecture that enables tax data accessibility and analytical insights is essential. This is fundamental to breaking tax function silos and implementing true tax process integration. Different parts of an organization often adopt different content management systems (CMS). Data accessibility, in this context, means the ability to integrate those various platforms, systems, and data sources and to generate tax-significant inputs with ease. We also see that the more granularly an organization articulates its data sources and provides guidelines for data quality control, the higher the likelihood that the technologies will have maximum impact across the organization.

People. It is crucial to create an organizational structure with clear tax process ownership and a roadmap for upskilling. The new technologies are fundamentally changing the roles and responsibilities of tax professionals. As these technologies create an integrated data structure for the staff, for instance, employees will spend much less time sourcing and chasing the data but much more on analyzing and reviewing the tax implications and strategic recommendations using business intelligence (BI) tools. As a result, tax leaders must create a plan to upskill and realign existing staff as well as a vision for mentoring new tax professionals to learn about technologies they may have not anticipated before entering the tax industry.

Key Functions and Critical Opportunities

With the fundamental aspects in place, we are ready to look across all tax functions and regulatory requirements and to seek opportunities to improve them. Unlike traditional tax technology implementation projects, these emerging tech initiatives can be small, agile, incremental, and additive; in other words, they don’t need to be complex. Tax departments commonly focus on four key areas when implementing these technologies:

- Data collection. How does information come into the tax department, and how can that data transfer be streamlined? An ETL tool combined with RPA solutions, for example, can be implemented to automate data extraction, blending, aggregating, and reformatting for tax purposes.

- Data readiness. Once you have the information, how can you quickly review, connect, and enrich the data into a workable format? Machine learning tools and algorithms can be created to help tax professionals allocate trial balance accounts for permanent and temporary adjustments, based on account descriptions and historic mapping.

- Information integration. How do you seamlessly integrate calculations, analyses, and reconciliation with your work papers and, eventually, your tax software? RPA or application programming interface (API) solutions are usually put in place to integrate tax software with manual calculation or analyses. Depending on the system requirements and tax technology ecosystem of an organization, the manual intervention between these two key steps can be reduced. Most important, minimizing mundane and voluminous reviews will optimize the effectiveness of reconciliation and review, too.

- Derived insights. What insights can you derive to improve tax department deliverables, and what additional intelligence can you provide to other areas of the business? Combined with RPA, ETL, and data visualization tools, tax data analytics is a powerful tool not only for tax planning and provision but also for understanding what business actions may affect tax outcomes and on what scale.

It’s an exciting time for tax professionals—we’re barely two years out from the Tax Cuts and Jobs Act and we’re having groundbreaking conversations about how technology can support critical business functions. Best of luck to those embarking on technology transformation initiatives—I can’t wait to see the results.

Anli Chen is a director and technology transformation lead at True Partners Consulting.

Endnotes

- Kasey Panetta, “Gartner Top 10 Strategic Technology Trends for 2020,” Gartner, October 21, 2019, www.gartner.com/smarterwithgartner/gartner-top-10-strategic-technology-trends-for-2020/.