The European Union (EU) passed a sixth version of its Directive on Administrative Cooperation in the Field of Taxation, known as DAC 6 (EU Council Directive 2018/822), on May 25, 2018. DAC 6 introduces reporting requirements for professional intermediaries (and, under certain circumstances, taxpayers) relating to their involvement in a wide range of cross-border arrangements and transactions featuring “hallmarks” of tax planning that concern one or more EU member states or the United Kingdom. DAC 6 refers to these as “reportable cross-border arrangements.” Because the law’s effect is limited to cross-border arrangements involving member states and the United Kingdom, its scope excludes wholly domestic matters. Failure to comply with DAC 6 could lead to significant penalties under the domestic legislations of the EU member states as well as reputational risks. This applies not only to intermediaries (law firms, accounting firms, banks, etc.) but also, in some circumstances, to taxpayers.

Why Has DAC 6 Been Introduced?

The new rules aim to provide member states’ and the United Kingdom’s tax authorities with information on arrangements made and structures used that may reduce or eliminate tax liability. The information reported to national tax authorities will be shared automatically among the tax authorities (and to some extent with the EU). Information shared will be used to coordinate tax policy to address what is perceived to be unacceptable tax planning and reduce the erosion of national tax bases and the shifting of taxable profits into lower-tax regimes. As discussed below, reportable arrangements under DAC 6 are widely drafted—and will catch some transactions that most tax professionals would not previously have thought of as “unacceptable” tax planning.

When Did It Take Effect?

DAC 6 came into force on July 1, 2020, for reportable arrangements. However, as a result of COVID-19, on June 24, 2020, the Council of the EU adopted an amendment allowing EU member states to defer the time limits for filing and exchanging reportable arrangements by up to six months. Many member states (but not all) and the United Kingdom have deferred the initial reporting dates. In the United Kingdom, France, and Belgium, for example, the first reports will be due by January 31, 2021, in relation to reportable arrangements made available or where the first step took place between July 1, 2020, and December 31, 2020. For all later arrangements, there is a thirty-day reporting deadline. Germany chose not to defer the initial reporting dates, so the first reports were due by August 1, 2020 (with regard to reportable arrangements where the first step occurred on July 1, 2020).

Is There a Retroactive Element?

One practical difficulty of DAC 6 is its retroactivity. Even though it came into force only recently, on July 1, 2020, any reportable cross-border arrangement whose first step was implemented between June 25, 2018, and June 30, 2020, inclusive, must also be reported. In the United Kingdom, France, and Belgium, such arrangements must be reported by February 29, 2021, which is an extended deadline. In Germany, such arrangements had to be reported by August 31, 2020. This retroactivity means that intermediaries and taxpayers involved should (if they have not already) conduct exercises to identify and report on relevant matters initiated in that period.

Given Brexit, Why Is the UK Involved?

Under its transitional agreement with the EU, the United Kingdom is treated for most purposes as if it were still an EU member state until December 31, 2020. Therefore, the United Kingdom has still had to implement DAC 6 and has done so. Intermediaries subject to UK jurisdiction will therefore continue to be subject to the reporting requirements. In any event, many jurisdictions around the world are looking at DAC 6 and are considering introducing similar reporting regimes. An example is Mexico, where mandatory disclosure rules are being introduced starting from January 1, 2021.

Who Needs to Report?

Primarily, DAC 6 is aimed at what it calls intermediaries, and it is those intermediaries who must report in the first instance. An intermediary, in this situation, is defined as 1) anyone who designs, markets, organizes, makes available for implementation, or manages the implementation of a reportable cross-border arrangement; or 2) anyone who knows or could reasonably be expected to know that they have undertaken to provide (directly or indirectly) aid, assistance, or advice with respect to designing, marketing, organizing, making available for implementation, or managing the implementation of a reportable cross-border arrangement. Most obviously this catches lawyers and accountants, but it could also catch banks, consultants, and other advisors. Note that the provision of tax advice is not a condition, so the scope of DAC 6 is potentially very broad. However, the intermediary must have an EU-taxable presence or be registered with an EU legal, tax, or consultancy services professional body to be within the scope of DAC 6.

That said, in some circumstances obligations apply to “relevant taxpayers.” This may occur where there is no intermediary at all (for example, an in-house arrangement), or where there is no intermediary with the relevant EU connection, or where the only intermediary or intermediaries are covered by legal professional privilege. In such cases, the relevant taxpayer must comply with the reporting obligations. In cases with multiple intermediaries or multiple relevant taxpayers, reporting is typically required only once (but all other intermediaries/taxpayers must satisfy themselves that reporting has been done correctly by another party).

Note that certain jurisdictions also have annual reporting requirements for taxpayers, who must report all reportable cross-border arrangements they have been involved in that year. France, for example, requires taxpayers to report annually the use made, in the previous year, of the cross-border arrangements they have been involved in. The reporting deadlines for annual reporting vary widely among countries. In the United Kingdom, for example, annual reports are generally due when corporate income tax returns are due. In contrast, in Germany, no such additional specific reporting obligations regarding cross-border arrangements exist.

Does DAC 6 Reporting Override Legal Professional Privilege?

Information that is subject to legal professional privilege is excluded from reporting. In such circumstances, some of the information reporting (or, if all of it is covered by legal professional privilege, all of the information reporting) switches to other intermediaries or the relevant taxpayer. The intermediary subject to privilege must notify in writing the other intermediary/taxpayer of the same.

In the United Kingdom, HMRC has stated in a published consultation document that frequently some of the information to be reported will not be subject to legal professional privilege. But one of the United Kingdom’s professional bodies that regulates lawyers—the Law Society—has made it clear that in most cases it expects that legal professional privilege will prevent a lawyer from making any report (partial or full) where the lawyer has advised on a reportable cross-border arrangement (unless the client waives privilege).

In Belgium, the professional secrecy rules are governed by criminal law, and the professional secrecy rules apply to lawyers, public notaries, chartered accountants, and statutory auditors (although banks are not covered). The position is similar in France (albeit that in France, banks and other credit institutions are subject to professional secrecy rules). When an intermediary is subject to professional secrecy, no reporting can be done without the client’s agreement. In the absence of such agreement, the intermediary must notify any other intermediary (or, if there is no such other intermediary, the taxpayer) of the reporting obligation.

In contrast, in Germany legal professional privilege (relevant in particular for lawyers, tax consultants, and notaries) does not exempt the intermediary from the reporting obligation. The intermediary still must fully disclose the reportable cross-border arrangement. Only to the extent that a report contains personal data that enables the identification of the user of a cross-border arrangement does that specific information not have to be disclosed.

Taxpayers should carefully consider the wider consequences of waiving legal professional privilege, since that waiver might extend to third parties (including other authorities, tax or otherwise) and not just the tax authority to which reporting will be made.

What Are Cross-Border Arrangements?

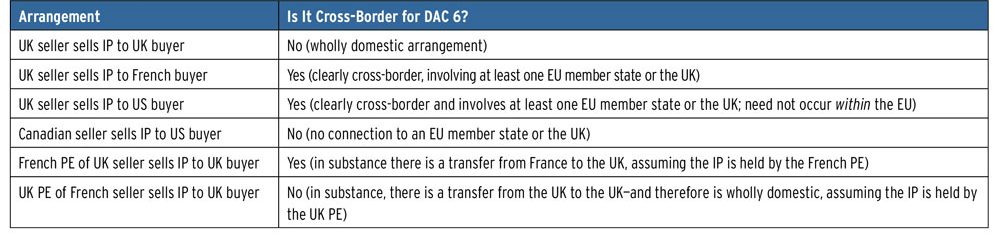

Cross-border arrangements for DAC 6 purposes do not require arrangements to be cross-border within the EU—they need involve only one EU member state or the United Kingdom, plus one other state (anywhere in the world). In most cases, for example where entities or operations involved are in different jurisdictions, it will be straightforward to identify whether something is cross-border. Other cases, for example those involving entities with multiple tax residences or operating through a branch or permanent establishment, may be harder. See Table 1 for examples of arrangements that are cross-border and others that are not. However, to be a reportable cross-border arrangement, the cross-border arrangement must contain at least one hallmark, to be discussed in the next section.

What Are the Hallmarks?

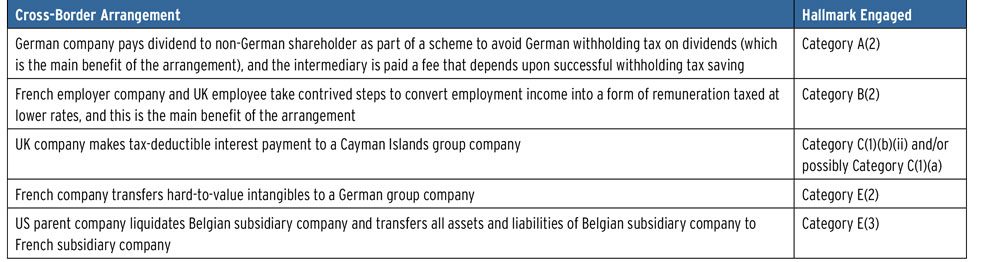

DAC 6 groups hallmarks into five categories, labeled A through E. Whereas some hallmarks apply in all cases, certain hallmarks apply only where a main benefit of the arrangement can reasonably be expected to be a tax advantage (the “main benefit test”).

Categories A and B both depend on the main benefit test. Category A hallmarks cover nondisclosure obligations imposed on clients relating to the arrangement’s tax elements, standardized documentation and structures, and professional fees linked to or contingent on gaining tax advantages. Category B looks at specific tactics including acquiring tax shelters, transaction steps without a primary commercial function, and transformation of revenue into more tax-efficient forms.

The main benefit test applies only to certain elements of Category C, which is the category most, although not exclusively, focused on arrangements between associated enterprises. This category looks mostly at making tax-deductible payments to places where they will be subject either to no tax, to a near-zero rate of tax, or to a preferential tax regime. Deductible payments to “noncooperative” jurisdictions, double deductions, double reliefs, and asymmetrical tax valuation of assets transferred under an arrangement are also covered here.

Categories D and E are reportable whenever they appear, regardless of the main benefit test. Category D concerns disguising beneficial ownership and undermining anti-money laundering and automatic exchange of information arrangements. Category E targets potential abuses of transfer pricing through the use of unilateral safe harbors, transferring hard-to-value intangibles and large-scale (defined as reducing the transferor’s projected three-year earnings before interest and taxes by more than fifty percent) assets, function, or risk transfers.

A full list of current hallmarks appears at Annex IV at https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2018.139.01.0001.01.ENG&toc=OJ:L:2018:139:TOC. Note that DAC 6 provides for biennial reports and legislative proposals on the hallmarks, so this list may develop over time. See Table 2 for examples of arrangements that may trigger certain hallmarks.

How Does the Main Benefit Test Work?

Some hallmarks apply only where one of the main benefits of the arrangement can reasonably be expected to be a tax advantage. This is an objective test—it is not a subjective, or purpose-based, test.

In the United Kingdom and most member states, tax benefits can be ignored if they relate to value-added tax (VAT), customs and excise duties or national insurance, or taxes in third countries (such as the United States). However, in some member states such as Belgium, local guidance makes it clear that tax benefits should take into account third-country taxes. Under UK and French implementation of DAC 6 (Germany and Belgium differ somewhat), they can also be ignored if they conform to the principles and policy intent of legislation—that is, if governments intend for them to be available to taxpayers in the circumstances in question.

The test requires a (frankly artificial) comparison between any expected tax advantage and the nontax advantages of any particular arrangements. In most cases, we would expect genuine, commercially driven third-party transactions not to meet the tax main benefit test, since any tax advantage, even one that is economically material, will be incidental to the wider nontax advantages of the transaction. An example would be where a gain that arises on the sale of a target business qualifies for a participation exemption—the tax advantage (being the exemption of the gain) is incidental to the sale of the target business. On the other hand, the main benefit test may be satisfied where arrangements would not have been entered into absent the tax benefits, or where the arrangements were designed to exploit a particular tax treatment.

What Must Be Included in Reports?

Reports generally include the following:

- the identities of the parties and intermediaries involved*;

- hallmark(s) involved;

- a summary of the scheme*;

- the legal basis for the scheme;

- the date the first step was taken in the scheme;

- the value of the arrangement being reported;

- which member states are likely to be concerned; and

- any other persons in the EU likely to be affected, and their state of residence.*

* denotes report items that will be shared with the EU

When Must Reports Be Made?

Subject to the commencement provisions and the delays for implementation as a result of COVID-19 described above, for arrangements not caught within the retroactive period mentioned above, reports must be made within thirty days following the earliest of a) the day after the reportable arrangement was made available for implementation, b) the day after the reportable arrangement is ready for implementation, or c) when the first step of implementation is taken. Where an intermediary’s involvement extends only to providing advice, aid, or assistance and not to implementation, the report is due thirty days from the date of that provision.

How Will Compliance Be Enforced?

DAC 6 leaves compliance to member states but requires a penalty regime for noncompliance. In the United Kingdom, the penalties for failure to comply start at £5,000, but could be as high as £1,000,000 (the latter only with the agreement of the First-Tier Tribunal, the United Kingdom’s lowest-level tax court). In all cases the defense of reasonable excuse applies, and whether reasonable procedures are in place to secure compliance will be taken into account in determining whether there is a reasonable excuse.

In Belgium, fines for reporting failure start at €1,250 and can reach €100,000 in cases involving fraudulent intent. In Germany, violations of the reporting obligation can be punished with a fine of up to €25,000. The fines apply per reportable cross-border arrangement. In France, failure to report is punishable by a maximum fine of €10,000, which is reduced to €5,000 for the first failure in a given year and the three previous years (but the amount of the fines imposed on the same intermediary or taxpayer may not exceed €100,000 per calendar year).

Is Tax Authority Guidance Available?

Official guidance on DAC 6 implementation varies widely among jurisdictions:

- In the United Kingdom, HMRC has issued very useful guidance, which appears at www.gov.uk/hmrc-internal-manuals/international-exchange-of-information/ieim600000.

- Belgium published guidance on June 15, 2020, available at https://eservices.minfin.fgov.be/myminfin-web/pages/fisconet?_ga=2.58524458.1286625458.1599037718-1167737901.1598350707-!/document/f1d1bb0c-89ef-4424-8740-50ca2.

- On July 14, 2020, the German tax administration published detailed draft guidelines, available at www.bzst.de/SharedDocs/Kurzmeldungen/DE/2020_Kurzmeldungen/20200806_dac6_entwurf_bmf_schreiben.html.

- In France, the tax authorities have issued administrative guidelines that are available at https://bofip.impots.gouv.fr/bofip/12272-PGP.html/identifiant=BOI-CF-CPF-30-40-20200429.

What Should I Do Now?

If you are responsible for any international tax affairs in your business, you should be discussing with your advisors now as to whether any arrangements that your business has been involved in since June 2018 potentially fall under DAC 6. DAC 6 must also be considered going forward for any new transactions or arrangements. It is also advisable to ensure consistency with country-by-country reporting (BEPS 13).

James Hill and Astrid Pieron are partners at Mayer Brown Europe-Brussels LLP.

Editor’s note: This article provides information and commentary on legal issues and developments. The article is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek legal advice before taking any action with respect to the matters discussed herein. The authors would like to acknowledge the assistance of David Wormley, Volker Junge, Susan Günther, Benjamin Homo, and Nicolas Vergnet in the preparation of this article.