The Internal Revenue Service has issued interim guidance on the process the Advance Pricing and Mutual Agreement Program (APMA) will follow when determining whether to accept taxpayer requests for an advance pricing agreement (APA).1 Existing guidance already states that APMA has discretion to reject an APA request and identifies some circumstances under which APMA may do so.2 The interim guidance formalizes the process APMA follows when exercising this discretion and, for the first time, explicitly provides a role for non-APMA IRS transfer-pricing personnel in that process. The stated goal is not to limit or reduce the number of APA requests that APMA accepts, but rather to provide an “early mechanism for identifying potential roadblocks to successfully concluding a proposed APA and opportunities for other paths to certainty.”3 Despite this seeming reassurance, taxpayers and tax practitioners have been wary about the extent to which this interim guidance will cause APMA to channel requests away from the collaborative APA process and toward the more adversarial IRS examination process. The interim guidance applies to all APA requests filed with APMA after April 24, 2023—whether unilateral, bilateral, or multilateral and whether for a new APA or a renewal APA—and will eventually be incorporated into the Internal Revenue Manual.

Introduction

An APA allows taxpayers to coordinate with one or more tax authorities to resolve transfer-pricing issues voluntarily and prospectively. The United States has had a formal APA program for over thirty years and has executed over 2,200 APAs during that time. In recent years, APMA has seen its inventory of pending APA requests rise and the average time for executing an APA lengthen. Recent APMA statements have also referenced instances where APMA has worked on an APA request for years, only to have a treaty partner ultimately refuse to accept the APA request or otherwise terminate the process, an outcome APMA considers “an utter failure and a waste of everybody’s time and resources.”4

Against this backdrop, the interim guidance observes that there are multiple procedures for obtaining certainty for transfer-pricing issues, and an APA might not always be the most “successful,” a concept the interim guidance asserts is based “not only on reaching agreement but also doing so with an appropriately commensurate commitment of financial and human resources for both the taxpayer and the tax administrations involved.”5 Other procedures the interim guidance calls out specifically are the International Compliance Assurance Program (ICAP), joint audits by multiple tax authorities, and conventional transfer-pricing examinations. Taxpayer views on and experiences with these mechanisms, which are invariably retrospective in nature, have been mixed.

The interim guidance lays out a two-stage review process. In the first stage, APMA provides optional pre-submission review to taxpayers that wish to submit a prefiling memorandum to APMA before submitting a formal APA request. In this pre-submission review, APMA—in consultation with IRS transfer-pricing personnel responsible for risk assessment—gives a preliminary opinion on whether an APA or an alternative mechanism is best suited to achieving the desired certainty. In the second stage, APMA—again, in consultation with other IRS transfer-pricing personnel—formally reviews all APA requests to determine whether to accept the request in full or in part.

Stage 1: Prefiling Memorandum Review

APMA invites—and sometimes requires—taxpayers to submit a prefiling memorandum before filing an APA request.6 For example, a taxpayer must submit a prefiling memorandum to APMA if the taxpayer wishes to file a unilateral APA request to cover an issue that could fall under a bilateral or multilateral APA under the pertinent tax treaties, or if the taxpayer proposes covered issues that will, or could reasonably be expected to, involve the license or other transfer of intangibles in connection with, or the development of intangibles under, an intangible development arrangement.7 A mandatory prefiling memorandum must identify the taxpayer, whereas an optional prefiling memorandum does not.

The interim guidance does not change the foregoing rules or expand the scenarios in which a taxpayer must file a prefiling memorandum on a named basis. Rather, the interim guidance formalizes the review process that APMA will follow upon receiving a prefiling memorandum. This “prefiling memorandum review” is intended to provide a rapid and high-level process through which taxpayers are informed about the likely acceptance of an APA request, as well as other potential avenues to achieving transfer-pricing certainty. APMA aims to complete the prefiling memorandum review within four weeks of receiving a taxpayer’s prefiling memorandum.

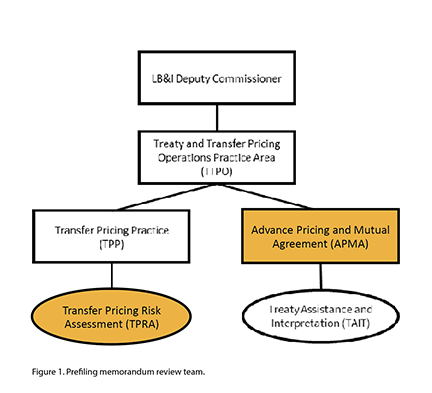

A “prefiling memorandum review team”—consisting of an APMA team leader or economist and a member of the transfer pricing risk assessment (TPRA) team—conducts the prefiling memorandum review. The TRPA team is part of the transfer pricing practice (TPP) within the IRS’ treaty and transfer pricing operations (TTPO) practice area and participates in the prefiling memorandum review to provide early consideration of ICAP, a joint audit, or another work stream as an alternative to an APA.8 The yellow highlights in Figure 1 show where the prefiling memorandum review team members reside within the IRS’ Large Business & International (LB&I) Division’s transfer-pricing structure.

The prefiling memorandum review team evaluates the prefiling memorandum to determine whether the case is suitable for the APA program or for an alternative work stream based on the facts and circumstances. The interim guidance provides a nonexclusive list of facts and circumstances relevant for this purpose. For example:

- suitability for resolution through an APA could consider whether the proposed covered transactions rise to a level of “significance” that justifies using resources necessary to engage in and complete an APA and whether there is a potential for the proposed APA to impact prior tax year or period compliance;

- suitability for resolution through ICAP could consider the scope, materiality, and complexity of the multinational enterprise group’s covered transactions in the United States and the jurisdictions participating in ICAP and the multinational enterprise group’s history of transparent and cooperative engagement with the IRS; and

- suitability for resolution through an IRS examination or joint audit could consider whether there are taxpayers (including non-US affiliates) with common tax years or periods under examination in the jurisdictions of the relevant tax administrations and transactions that pose significant compliance risk to one or more tax administrations relative to the resources employed.

After completing the required review, the prefiling memorandum review team recommends one of three taxpayer actions to the APMA frontline manager: 1) proceed with submitting an APA request; 2) consider an alternative as a more effective route to tax certainty, because APMA is unlikely to accept the APA request; or 3) provide additional information to APMA about the proposed APA. The APMA frontline manager decides whether to accept or reject the prefiling memorandum review team’s recommendation and then orally communicates a decision about recommendations to the taxpayer. The interim guidance does not explicitly require the APMA frontline manager’s oral communication to include an explanation of the rationale behind the recommended taxpayer action. Nevertheless, if the recommendation is to consider an alternative work stream, a taxpayer should seek as much explanation as possible from the APMA frontline manager, including whether modifications to the prefiling memorandum might produce a different recommendation.

Notably, the APMA frontline manager’s decision is merely a recommendation. For example, the second option is for the taxpayer to “consider” an alternative to an APA. The taxpayer need not do so. If the IRS chooses to begin an audit, however, or to include the transfer-pricing issue identified in the prefiling memorandum in an ongoing or future audit, the taxpayer will have no choice but to engage on that basis.

Stage 2: APA Submission Review

Revenue Procedure 2015-41 identifies the information a taxpayer must include in an APA request filed with APMA. Upon receiving a complete APA request, APMA reviews the submission to determine whether the APA work stream is best suited to achieve certainty for the proposed covered transactions. APMA aims to complete this “APA submission review” within eight weeks of receiving a complete APA request submission.

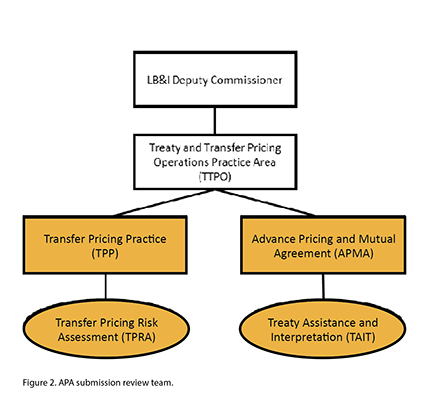

An “APA submission review team” conducts the APA submission review. Led by an APMA frontline manager, the team includes an APMA team leader or economist, a TPRA manager (or designee), a TPP reviewer, and a treaty assistance and interpretation team (TAIT) analyst for any non-transfer-pricing treaty issues that the taxpayer’s APA request raises. The yellow highlights in Figure 2 show where these APA submission review team members reside within the LB&I Division’s transfer-pricing structure.

The APMA frontline manager, APMA team leader or economist, and TPRA manager (or designee) will likely be the same personnel involved in the prefiling memorandum review, if one occurred. But the TPP reviewer and TAIT analyst will be new to the process. Whereas the TPRA manager (or designee) will provide a risk assessment for the APA submission review team’s consideration, the TPP reviewer will summarize the taxpayer’s transfer-pricing examination history, if any. To the extent an issue within TAIT’s jurisdiction is present, it is unclear why a TAIT analyst is not involved as part of the prefiling memorandum review.

The APA submission review team will evaluate the taxpayer’s APA request for suitability for the APA program or for an alternative work stream based on the facts and circumstances. The interim guidance provides a nonexclusive list of facts and circumstances relevant for this purpose. These factors include the following:

- whether, based on APMA’s experience, there is an actual or potential transfer-pricing dispute that would be most efficiently resolved through an APA, considering factors including the taxpayer’s proposed transfer-pricing method and the taxpayer’s examination history in the United States or applicable foreign jurisdiction;

- whether the APA process likely will result in prospective APA years based on APMA’s experience with the treaty partner, the type of covered transaction, and the taxpayer’s industry; whether there is arbitration with the treaty partner and other country-specific strategic considerations;

- whether, in the opinion of the TPRA submission review team member, the proposed transactions are suitable for ICAP based on factors including the scope, materiality, and complexity of the multinational enterprise group’s covered transactions in the United States and the jurisdictions participating in ICAP; and

- whether the IRS has an interest in examining the covered transactions based on TPP’s workload selection process.

If a taxpayer requests a unilateral APA, the APA submission review team may consider factors such as whether a unilateral APA is the most efficient (or only) option to provide necessary certainty and whether the taxpayer’s transaction structure is such that the IRS needs to price the transaction under the unilateral APA to address related bilateral APAs for the same taxpayer. For taxpayer requests for a bilateral or multilateral APA, the APA submission review team may solicit and consider treaty partners’ views on whether an APA or an alternative work stream is most appropriate. The interim guidance also lists factors the APA submission review team may consider for APA renewal requests and APA requests seeking rollback years.

The APMA frontline manager will aim to develop a consensus recommendation from the APA submission review team and then send a recommendation to the relevant APMA assistant director (which will depend on the non-US jurisdictions the taxpayer’s APA request implicates). The recommendation will be either to accept the taxpayer’s APA request into the APA program or to decline to initiate the APA process with the taxpayer. A recommendation to accept the APA request may be conditioned on communicating to the taxpayer challenges that increase the likelihood the process could result in a failure to conclude an APA and any specific expectations regarding the taxpayer’s provision of information and engagement in the process. A recommendation to decline to initiate the APA process should identify any alternatives the APA submission review team believes would likely be more successful.

If the APMA assistant director agrees with the APMA frontline manager’s recommendation to accept the APA request into the APA program, then the frontline manager will begin the APA process per existing procedures (e.g., contacting the taxpayer and scheduling an opening conference). In contrast, if the APMA assistant director agrees with the APMA frontline manager’s recommendation to decline to initiate the APA process with the taxpayer, then the next steps depend on the APA submission review team’s views on potential alternative processes.

Where APMA’s experience with the proposed treaty party in the context of mutual agreement procedure negotiations over foreign-initiated adjustments is better than APMA’s corresponding APA experience, or if favorable support exists for considering the proposed covered transaction under ICAP, the APMA assistant director will elevate the recommendation to decline to initiate the APA process to the APMA director. If the APMA director agrees with the recommendation, the APMA assistant director will then tell the taxpayer of the decision, provide a summary of the basis for the decision, and if applicable, make a recommendation to consider applying to ICAP. APMA will also send a formal decision letter to the taxpayer.

Where the APA submission review team concludes that a joint audit might be better than an APA, the APMA assistant director will consult with the TPP territory manager about resource allocation and coordinate with the relevant LB&I geographic practice area. If LB&I proposes a joint audit, APMA will inform the taxpayer that it will not accept the APA request. TPP then will contact the taxpayer to discuss any timing and administrative issues relating to the joint audit process. If LB&I does not propose a joint audit, then the APMA assistant director elevates the recommendation to the APMA director, who then decides whether to accept the APA request. If the APMA director decides to apply APMA resources and proceed with the APA process, APMA will follow its procedures for accepting the APA request. In contrast, if the APMA director declines to initiate the APA process, APMA will send the taxpayer a formal decision letter.

Conclusion

APMA review of prefiling memoranda and APA requests—and discussions between taxpayers and APMA regarding the prospects for achieving a successful APA—are not new. Revenue Procedure 2015-41 currently contemplates both. What are new, however, are the requirements that APMA conduct that review in consultation with IRS transfer-pricing personnel responsible for risk assessment and discuss the outcome of that review with the taxpayer. The new procedures also formalize the risk that a taxpayer submitting a prefiling memorandum or APA request may be met with the IRS’ decision to commence an adversarial transfer-pricing examination, rather than to engage in the more collaborative APA process.

Evaluating these developments against the backdrop of limited APMA resources, APMA’s growing APA request inventory and processing time, and references to alternative treatments like ICAP, joint audits, and conventional transfer-pricing examinations has led to taxpayer and tax practitioner concern over the extent to which the interim guidance is a wolf in sheep’s clothing that will restrict taxpayers’ access to the APA program. APMA leadership has resoundingly rejected this characterization, asserting that the interim guidance formalizes existing processes and procedures and caters to what should be a mutual desire by taxpayers and the IRS to obtain transfer-pricing certainty efficiently and effectively. Time and experience operating under the interim guidance are needed to determine its practical effect. In the meantime, taxpayers may glean additional insights to the extent APMA incorporates the formalized review process in the pending revision to Revenue Procedure 2015-41, which has been on the IRS’ Priority Guidance Plan since September 2021.

_______________________________________________________________________________________________________________

Jim Gadwood and Rocco Femia are members at Miller & Chevalier Chartered.

Endnotes

- Internal Revenue Service, Treasury Department, Memorandum for Treaty and Transfer Pricing Operations Employees, “Interim Guidance on Review and Acceptance of Advance Pricing Agreement (APA) Submissions,” LB&I-04-0423-0006 (April 25, 2023) [hereinafter “Interim Guidance” in endnotes].

- See Revenue Procedure 2015-41, 2015-35 IRB 263, Section 4.02(1).

- See Interim Guidance at 2.

- Andrew Velarde, “APA Prefiling Memo Reflects Administrative, Transparency Concerns,” 179 Tax Notes Federal 1411 (May 22, 2023).

- See Interim Guidance at 1.

- See Revenue Procedure 2015-41, Section 3.02.

- See Revenue Procedure 2015-41, Section 3.04.

- “The TPRA team performs high-level risk assessment using data analytic techniques to identify and evaluate transfer pricing risks” and “supports TTPO through project-focused risk assessment activities” (Transfer Pricing Risk Assessment, Internal Revenue Manual 1.1.24.3.5.2.1.2, September 24, 2020).