Every country’s tax code is unique, but how do experts define and rank competitiveness around the globe? Each year, the Tax Foundation pulls together its evaluation of how countries in the Organisation for Economic Co-operation and Development structure their tax systems, titled the International Tax Competitiveness Index (ITCI). The index defines a competitive tax code as “one that keeps marginal tax rates low” and considers more than forty tax policy variables, including corporate taxes, individual income taxes, consumption taxes, property taxes, and the treatment of profits earned overseas, with the purpose of offering important insight into different tax models and how tax policy should be perceived. Other factors unique to 2020—COVID-19’s impact and related temporary changes—were taken into account in the most recent ITCI.

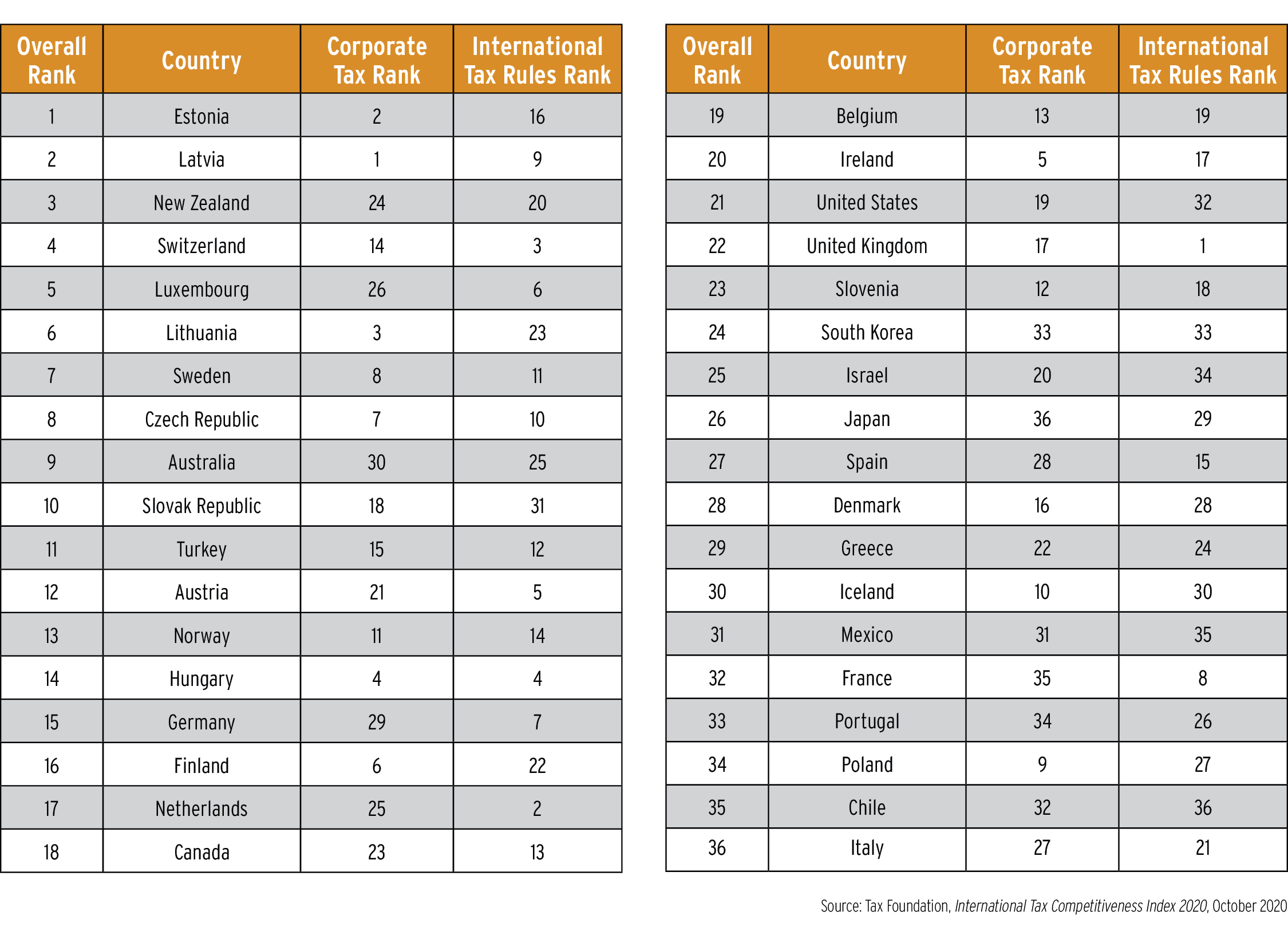

Of course, to the in-house tax professional, some of those above-mentioned factors are more relevant than others, such as corporate tax. Below are the overall ITCI rankings for 2020, as well as the Tax Foundation’s rankings for corporate tax and international tax rules. To dig deeper into the index, visit www.taxfoundation.org/publications/international-tax-competitiveness-index.