According to Thomson Reuters’ 2020 Corporate Tax Departments Survey: New Technology Demands New Skills & New Attitudes, the role of the tax technologist is increasingly important, and tax departments need to decide whether to teach technology to tax professionals or hire technologists who can be taught about tax. On top of that, although new technology projects have likely been put on hold, getting existing technology fully operational remains a high priority for corporate tax departments in general. Still, thirty percent of survey respondents said new technology/automation was the biggest key challenge, following only tax reform/law changes/compliance.

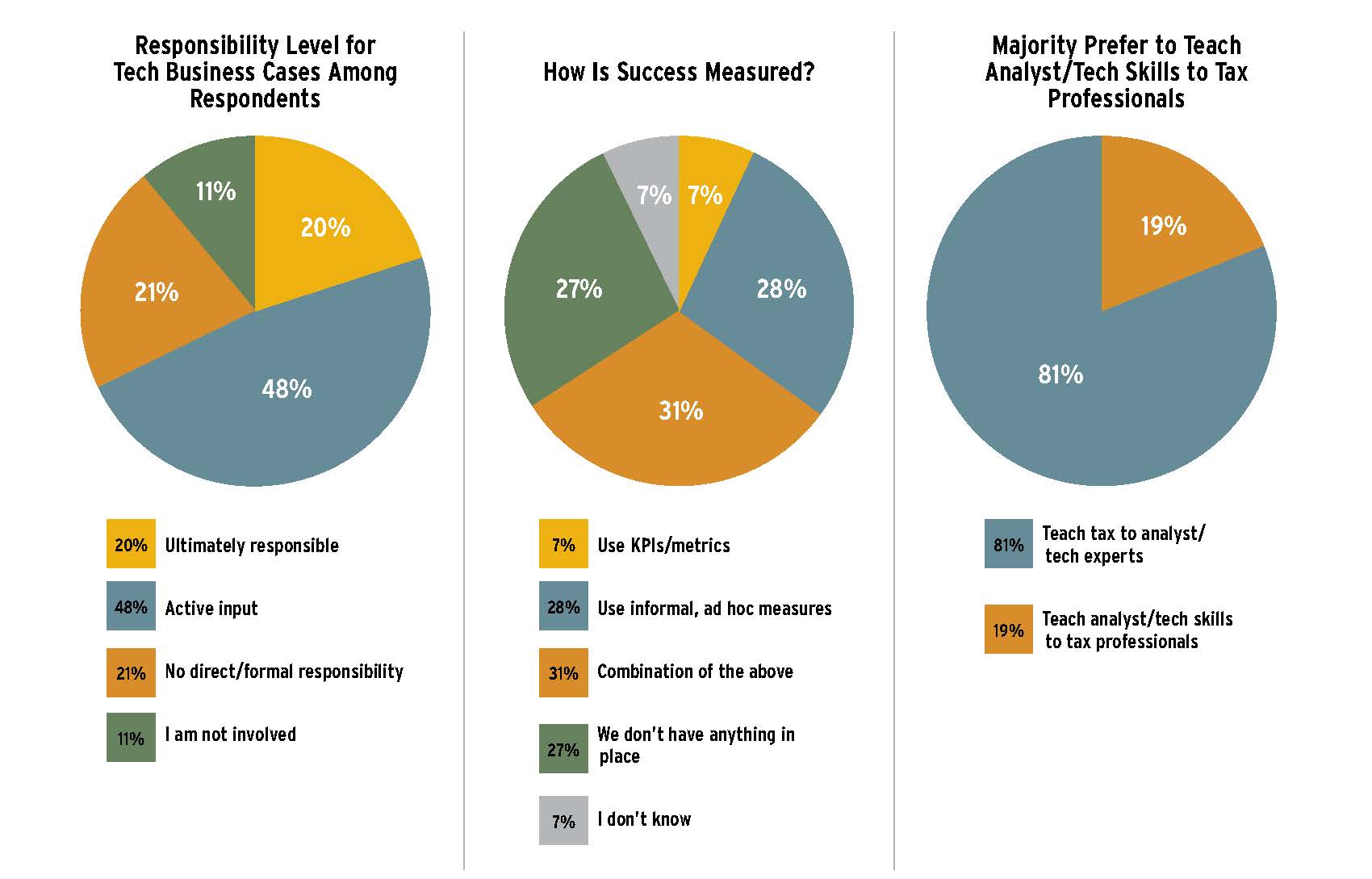

The following charts outline some of the survey’s findings related to tax technology responsibility, measurement, and training, all key factors that help to paint a picture of the corporate tax technology landscape. To gain access to the full report and dig deeper into Thomson Reuters’ findings, fill out the form on the right-hand side of the following page: tax.thomsonreuters.com/en/corporation-solutions/c/state-of-corporate-tax-2020-report.