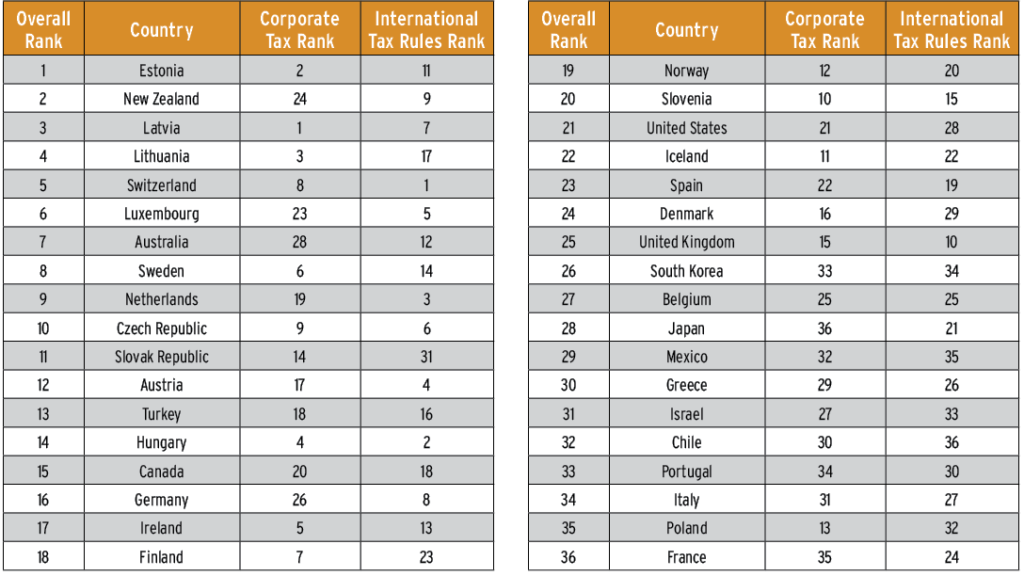

What makes a well-structured tax code? According to the Tax Foundation, it’s one that is easy to comply with and that promotes economic development while raising sufficient revenue for a government’s priorities. In last year’s January/February issue of Tax Executive, we shared the Tax Foundation’s rankings of all tax codes in countries in the Organisation for Economic Co-operation and Development (OECD). As in years past, this year’s report, titled International Tax Competitiveness Index 2019 (ITCI), aims to measure each tax code’s adherence to two overarching policy factors—competitiveness and neutrality.

For the sixth straight year, Estonia and France are at the top and bottom of the rankings, respectively. The report attributes Estonia’s high score to its twenty percent tax rate on corporate income that applies only to distributed profits, its flat twenty percent tax on individual income that doesn’t apply to personal dividend income, and its territorial system that exempts from domestic taxation 100 percent of foreign profits earned by domestic corporations, among other factors. As for why France has the least competitive system among OECD countries, the report points to its high corporate income tax rate, its high property taxes, a net tax on real estate wealth, a financial transaction tax, and an estate tax.

In 2019, a few changes in other countries’ tax systems affected their rankings:

- Belgium fell in the rankings, to twenty-seventh from twenty-second, after a European Union directive forced it to adopt both controlled foreign corporation (CFC) rules and capitalization rules that adversely affect its international tax position.

- Canada adjusted its corporate income tax base by expanding write-offs for machinery and building capital investments, improving its ranking from twentieth to fifteenth.

- Ireland fell to seventeenth from fourteenth because of its new CFC regime, which applies to passive income earned by or attributed to a foreign subsidiary.

- South Korea’s ranking dropped from twenty-four to twenty-six as it continued to reduce businesses’ ability to offset future tax liability with current losses.

- Poland implemented a patent box that offers a five percent reduced corporate rate on qualified intellectual property income, dropping its ranking from thirty-two to thirty-five.

- Slovenia, like other EU countries, adopted new CFC legislation that applies to passive income. This dropped its ranking to twenty from seventeen.

- Turkey improved from sixteenth to thirteenth on the list, a change the report attributes to significant improvement over the last few years in corporate, individual, and consumption tax compliance time.

For a more thorough breakdown, the full 2019 ITCI is available at taxfoundation.org/publications/international-tax-competitiveness-index.

2019 International Tax Competitiveness Index Rankings