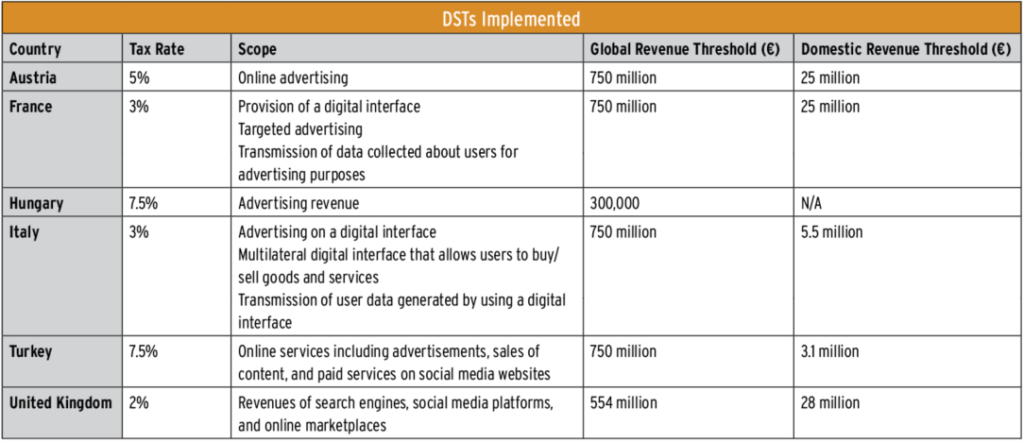

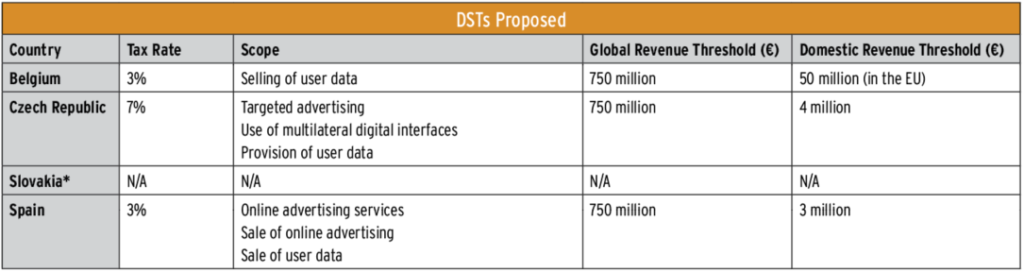

As of March, several European countries in the Organisation for Economic Co-operation and Development (OECD) have implemented, published proposals to enact, or announced intentions to implement a digital services tax (DST). Although each country’s DST differs slightly, all DSTs have revenue thresholds, both domestic and global, below which companies are not subject to paying the tax. Furthermore, the OECD, through its two-pillar approach (see analysis in this issue starting on page 19), is working to bring countries together to create one unilateral set of DST policies and is set to publish a guiding report by the end of this year.

Until then, look below at how each European country’s DST policy, whether implemented or proposed, differs. To dive deeper into what separates these policies and how they vary in scope, and to see which countries are considering DSTs, visit taxfoundation.org/digital-tax-europe-2020.

Source: The Tax Foundation, Digital Services Taxes in Europe