In the current business environment, the only constant in the face of major economic and societal shifts is dynamic change. As companies forge ahead, their tax departments increasingly lead the way in sustainably transforming their business models and their digital and strategic footprints.

Tax leaders are remaking their technology infrastructures to free up team capacity, operate more efficiently, and use data more effectively. Meanwhile, all this change is happening during an unprecedented global shift to remote and hybrid working. These trends have profound implications for the future of tax and business models in general.

Tax Work Reimagined

Until recently, manual processes and disparate systems forced tax teams to spend hours classifying, reformatting, and preparing data to meet compliance obligations. That burden is lifting as the tax function embraces robotic process automation (RPA) and new resourcing models. The impetus to automate is both internal—enabling team members to focus on higher-value work—and external, as tax authorities push businesses (in some cases mandating them) to digitize their tax operations.

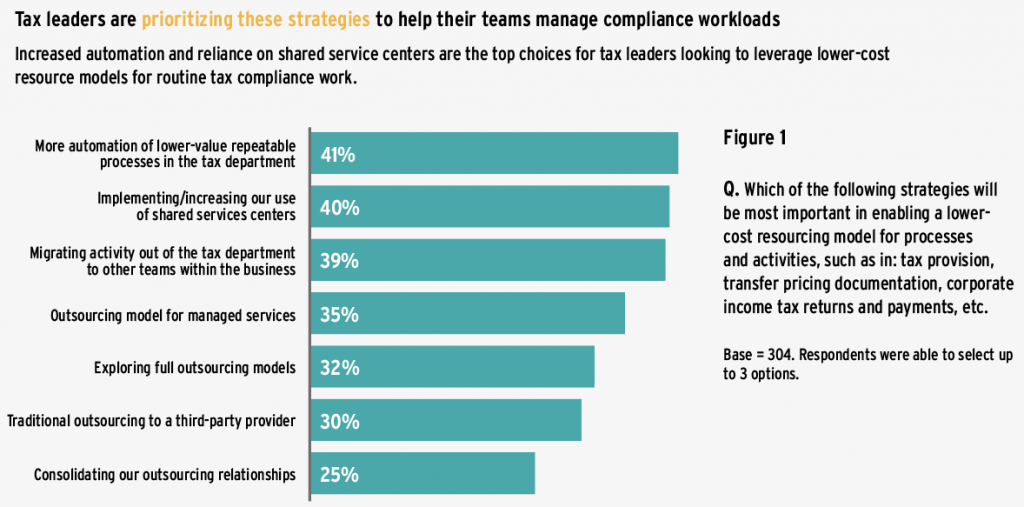

Dramatic shifts are underway in how tax work is done. A recent Deloitte survey of 304 tax professionals found that deeper automation, for instance, is a top priority for forty-one percent of respondents in terms of changing how compliance processes are managed, which will alter the day‑to‑day roles of tax professionals.1 Figure 1 shows the specific strategies that respondents are prioritizing to manage compliance workloads.

Tax leaders are evaluating all areas of their tax function to identify potential opportunities to streamline processes, leverage technology, and bring enhanced value to the organization with their current team. The state and local tax function is often an area where tax leaders turn to achieve early results from their efforts to transform tax. With numerous state and local jurisdictions requiring quarterly and/or annual reporting, based on data that may come from multiple sources in varying degrees of completeness and typically requiring hours of manual manipulation and analysis, the state tax function can consume all of its resources for compliance processes alone—leaving little time for planning and supporting the company’s objectives.

Rethinking the Tax Function

As the realities of managing state tax become more complex and the pressure to do more with less intensifies, state tax leaders are looking to new technologies to help them manage compliance, provisions, and planning. Executives want the state tax function to become a better business partner, to provide more insights, and to create more value—all with the same budget or less. These strategic expectations of C-level executives require a fundamental change in how such work is performed.

Thankfully, the timing is right from a data and technology perspective. The past decade has seen an explosion of enterprise data at increasingly granular levels. At the same time, technology tools have matured to a point where many non-IT professionals can effectively use them to access and work with large data sets in practical and meaningful ways.

Data analytics tools, RPA bots, data-wrangling technologies, and optical character recognition (OCR) tools are creating great value. Companies are adopting artificial intelligence (AI) to help automate certain tax decisions. Additionally, the traditional compliance software suites are evolving rapidly to deliver more functionality, insights, and automation.

Seeing Opportunities

Technology can unlock significant value across the state tax compliance process. In many cases, the value created stems from the automation of resource-intensive manual processes. For example, our work with state tax functions suggests that most teams spend more than half their tax compliance time working with data: collecting it, manipulating it, analyzing it, and readying it for downstream use. Once you factor in the additional time spent producing state tax work paper packages and working within compliance software, very little time is available for other value-generating activities like planning and analysis.

So, where could technology and the automation of data and analytics processes bring improved efficiency, quality, and value to the state tax compliance cycle? Consider the following key areas for high impact:

- Data collection. The collection and management of data is a good place to score a quick win from technology. Many stakeholders (inside and outside the tax department) already leverage high-tech enterprise resource planning (ERP) tools to generate their data. However, state tax functions still commonly rely heavily on other departments to provide data required for tax compliance. Furthermore, data collection is often managed through multiple rounds of email. In some cases, data collected or provided does not represent data that is actually needed for downstream tax computations due to a poor understanding of state tax rules and calculation nuances by those providing the data. In other cases, systems cannot provide required data with the desired level of detail.

- Data preparation. This area is perhaps where tax teams spend the most time and effort and risk the most error. It is also an area where state tax teams may see the greatest impact from technology. Frequently state tax professionals spend hours working with multiple large data sets that often must be validated, combined, reconciled, and enhanced before they are usable in downstream computations or analysis. Data-wrangling tools can dramatically reduce time spent manipulating data, particularly in data-intensive areas with repeatable rules-based processes such as state apportionment, modifications, and work paper preparation. Leading state tax functions use data-wrangling tools to establish repeatable, well-documented data transformation processes, resulting in improved accuracy and speed and substantially reducing the burden, effort, and risk involved in preparing data.

- Tax calculations. Yet another area where state tax teams spend significant time is the underlying complex computations needed to determine state tax liability across all applicable jurisdictions for each entity and filing group. These computations involve a long list of calculations and rule sets—from apportionment and depreciation to state modifications, federal tax reform adjustments, net operating loss (NOL) utilization, and more that must be managed simultaneously. State tax functions could continue to maintain these computations in internal spreadsheets, which often introduce time, cost, and risk. Or they could leverage third-party technology tools to assist with these items. While there is no one-size-fits-all answer, leading tax functions are carefully weighing the value technology could deliver here. Such tax calculation tools not only facilitate computation of state tax liability for tax compliance but also enable the tax function to more easily and rapidly analyze potential alternative filing positions, consider the impact of changes in tax law, and analyze the tax effects of potential M&A transactions.

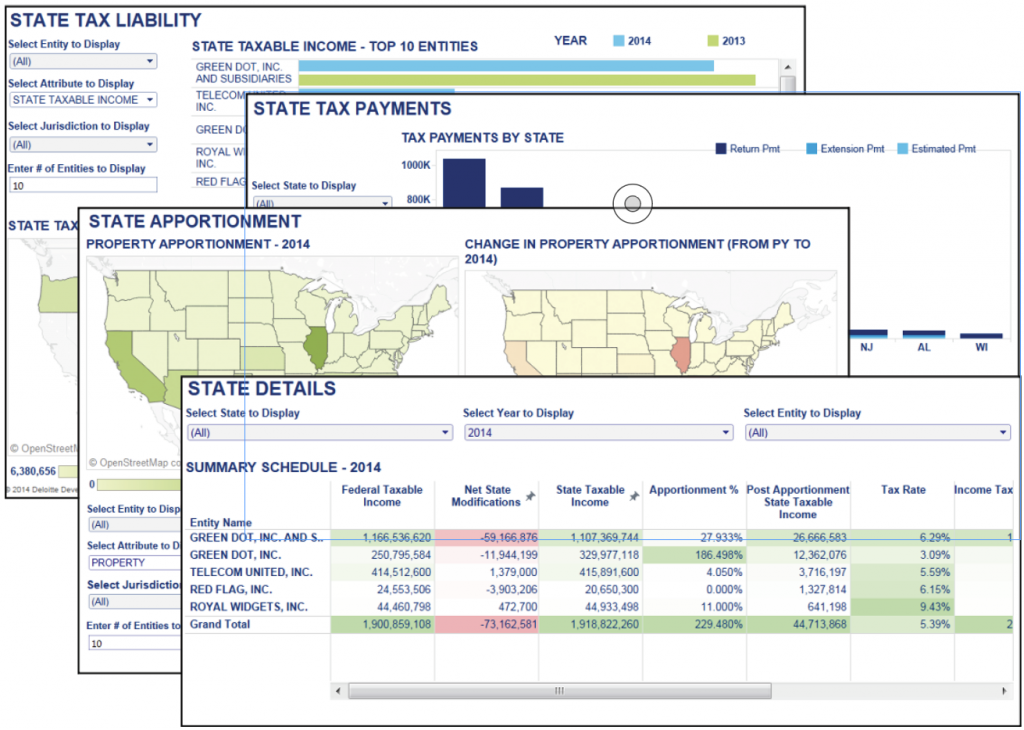

- Return review process. Technologies are also being adopted to make the return review process faster, better, and more effective. What has historically been a very manual process—comparing amounts on each page of the tax return with expected values from the finalized tax return work papers—is now becoming highly automated, enabling tax professionals to focus their attention on the exceptions revealed through technology-powered analytics. Process automation tools paired with OCR technology can be applied to compare work papers with the final draft of tax returns (often in PDF format) to identify differences or leveraged to ensure that e-filing XML packages align with the returns. Visual data analytics software also helps tax professionals review large data sets through interactive dashboards, allowing them to quickly compare prior-year and current-year results to uncover anomalies, trends, and other insights. Leading state tax functions are using technologies to reduce the risk, complexity, and resource requirements of reviewing returns.

Reimagining Technology-Enabled Compliance

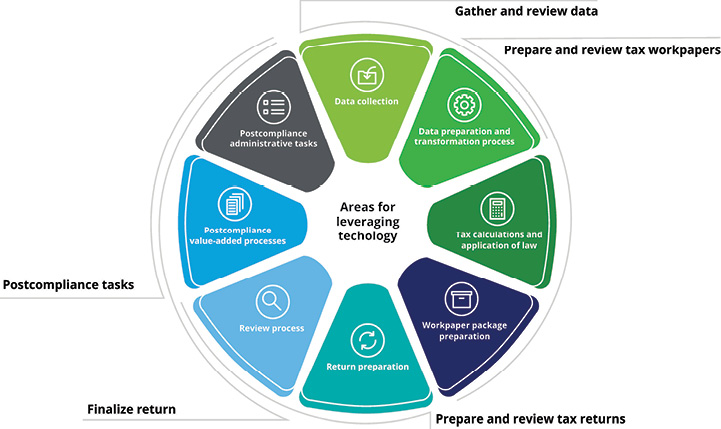

At Deloitte, we have spent significant time, resources, and intellectual capacity reimagining each step of the state tax compliance process and inserting technology tools to supplement the human effort, replacing manual input with automation and allowing tax professionals to spend their time on high-value areas of the compliance process. Figure 2 shows many of the areas where technology can improve each step of the compliance process.

It starts with ensuring that data requirements have been thoroughly documented and understood and analyzing what data is readily available from the company’s ERP system and subsystems. Where possible, the process proceeds with data flowing directly into the state tax function through feeds from the ERP system’s supplemental reporting engines across the enterprise. Process automation tools instantaneously pull or push data, in the format needed, when needed. Data wrangling technologies speed up the data manipulation and transformation process.

Tax calculations and analysis are conducted, leveraging new or enhanced features within the existing tax compliance software, augmented by tools that integrate rules, calculation, and reporting functions to speed up the analysis around areas such as apportionment, NOL tracking, state modifications, and tax reform calculations.

Rather than manually building the documentation and work papers required to support returns, process automation tools assemble work papers in real time by state and entity.

Diagnostic tools, OCR technologies, and process automation tools are combined in the review process to pinpoint discrepancies or differences in the data between a company’s tax returns and specific work papers. Where the controls allow it, process automation tools can even correct the differences. Similar tools can be used to quickly and efficiently review e-filing packages against the finalized return and flag areas for review.

Throughout the process, sophisticated data analytics create visualizations that allow the reviewer to look at the data, identify anomalies, and uncover new insights more efficiently and effectively. (Some examples appear in Figure 3.) These visualizations may be used to better understand the data (for instance, by comparing year-over-year values or by focusing on materiality) or to drive valuable conversations with executives through heat maps, interactive charts, and dynamic tables.

This is not a vision of the future. It is here, now. Companies of all sizes and across all industries are implementing a technology road map that pushes their state tax functions along this journey. For many companies, it is becoming a reality and a significant value driver for the state tax function and the business itself.

Getting Started

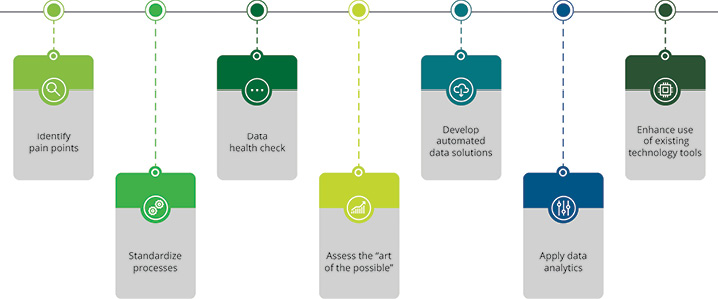

So, what’s the starting point? Certainly not the technology; this is about creating a technology-enabled transformation, not a technology-led one. As shown in Figure 4, the transformation must start with the business pain points in mind. For some companies, that will be in the tax provision process or in addressing the tax return process. Others will look at automating their more data-intensive processes, such as state apportionment or indirect tax. Still others will be in the middle of a merger or corporate reorganization, where disparate systems must be aligned without increasing headcount.

Before any technology purchase, companies should consider how value can be created through improvements to current data feeds, processes, and software. Processes should be evaluated for the potential for standardization. Businesses should perform a data “health check” to identify ways to enhance and cleanse the data before applying automation solutions. Next, they should explore the full functions of existing tax compliance software to see where enhancements can be achieved.

When developing a technology transformation road map, companies should consider the “art of the possible.” Talking to peers, technology leaders, and advisors can reveal how others are leveraging technology across their businesses. And as technologies and systems are being built, companies should pay attention to information that could be used to improve future processes.

Make It Part of a Larger Transformation

The state tax compliance process is full of opportunities to derive meaningful value through technology, but businesses can create the greatest value when they connect these projects within a larger transformation. This gives companies the potential to increase their returns on technology investments and to take advantage of change management efforts already underway as part of the transformation.

Ultimately, adopting new technologies can release experienced tax professionals from their manual tasks to focus instead on more strategic, technical, or valuable areas. State tax leaders have the opportunity to consider how they reallocate activities, retrain teams to develop new capabilities, and engage tax professionals as they improve and transform the operating model.

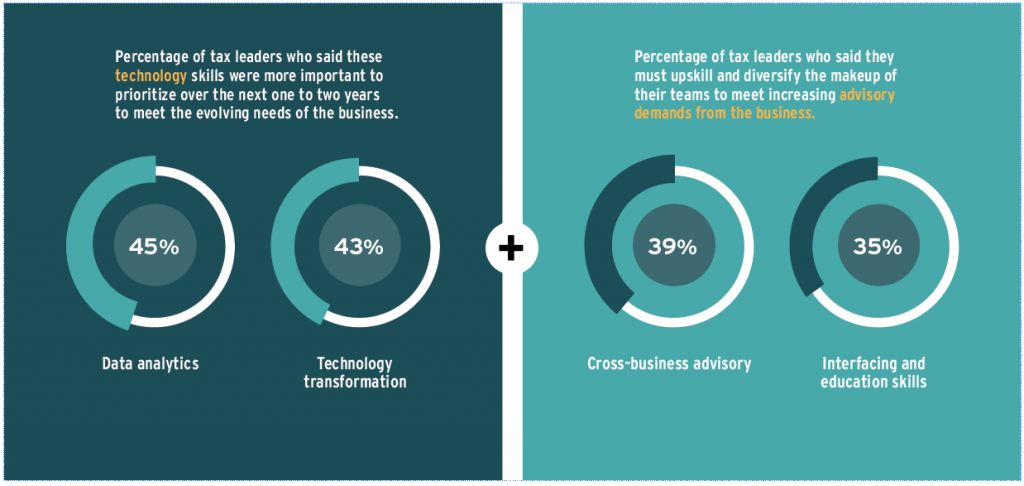

The need to reimagine the skill set and role of the tax professional is key to transforming the tax function. As shown in Figure 5, the tax leaders in the Deloitte survey recognized that their teams need to develop new technical skills, with data analytics (forty-five percent) and technology transformation (forty-three percent) at the top of their wish lists. However, these team members also need to flex their cross-business advisory skills (thirty-nine percent) and their interfacing skills and education (thirty-five percent). This may indicate the need to upskill and diversify the roles on state tax teams to meet increasing business advisory demands.

Additionally, technology investments made in the state tax function can bring similar value to other areas within the broader tax function, thereby deriving the potential to increase the overall ROI from these investments. Consider, for example:

- data extraction tools and the ability to automate data collection to support federal and international tax computations;

- data wrangling tools to enhance fixed asset data for depreciation computations or to manipulate large data sets to automate aspects of transfer pricing analysis; and

- a common visual data analytics tool or platform that provides the tax leader immediate ability to see into the company’s global tax posture with the ability to reveal insights and anomalies in a few clicks.

As tax professionals’ experience with technology tools grows, so too may the potential use and value realized from these technology investments.

Our view is that there has never been a better time for state tax functions to consider modernization. And our experience helping organizations across the country to design, deliver, and operate the reimagined state tax compliance function tells us that value is achievable, whether by taking small steps or by engaging in a larger transformation.

It’s time to disrupt the norm in state tax compliance.

Bridget Foster, a partner with Deloitte’s Multistate Tax Services, is the technology and transformation leader for the practice, working closely with clients to explore alternative delivery models and the use of technology to extract, transform, and load data as well as to drive process efficiencies. Andy Gold, a partner with Deloitte’s Multistate Tax Services, is responsible for steering multistate tax technology and data analytics strategy and transforming the ways in which Deloitte Tax and its clients address state and local tax needs through data, technology, and analytics. Anita Sims is a managing director at Deloitte Tax LLP and, as the corporate competency leader for Multistate Tax Services, is responsible for marketplace strategy, business and technology transformation, business strategy, and training vision for corporate professionals, as well as driving process and technology improvements across the practice. Steven Cohen, a senior manager with Deloitte’s Multistate Tax Services, is a member of the data and technology team and focuses on project management, identifying tax process improvements, system assessments, tax compliance software redesign and implementation, and research and analysis of new legislation

Editor’s note: This article contains general information only and Deloitte is not, by means of this article, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This article is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this article. As used in this document, “Deloitte” means Deloitte Tax LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of Deloitte’s legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting.

Copyright © 2022 Deloitte Development LLC. All rights reserved.

Endnotes

- Deloitte surveyed 304 senior tax and finance professionals in ten countries and conducted in-depth interviews with more than twenty tax leaders and academics to understand how these leaders are reimagining their talent models. Some of the survey findings are shown in Figures 1 and 5. The survey respondents came from Australia, Belgium, Canada, China, Germany, Japan, the Netherlands, Switzerland, the United Kingdom, and the United States. The main sectors represented were financial services; technology, media, and telecommunications (TMT); manufacturing; consumer goods; and health care and life sciences. The respondents worked exclusively in large firms with annual revenue of US $750 million or more. The survey and its results are available at “Tax Transformation Trends Survey – Talent Reimagined,” Deloitte, October 2021, www2.deloitte.com/us/en/pages/tax/articles/tax-transformation-talent.html.