Jurisdictions around the world are increasingly using indirect tax legislation to drive tax revenue. For tax professionals in multinational organizations, it’s a dizzying task staying abreast of these changes and their implications for business. However, to effectively manage and minimize your company’s audit risk, it’s crucial to understand and adapt to evolving tax regimes.

Today, many governments are in the midst of one of three scenarios: transitioning from one tax regime to another; updating existing tax laws to increase transparency and reduce fraud; and introducing a brand-new system of taxation where one has never existed. Here, we look at an example of each scenario and provide best practices for companies operating in each arena.

Transition to a New Tax Regime

Example: Goods and services tax (GST) in India

India has implemented a new tax regime effective July 1, 2017. The new tax replaces India’s historically complex tax system with a centralized, singular GST tax. The goal is to simplify the tax system while maximizing revenue and reducing fraud.

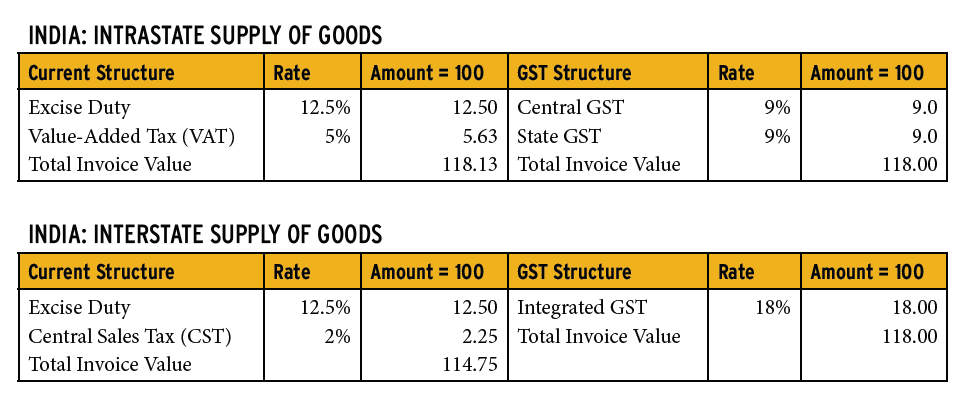

At the top of the next page is a comparison example of tax calculation before India’s GST and after for a business-to-business sale transaction of “software” product manufactured in India (see tables, page 71).

The GST calculations assume a GST of eighteen percent and that Centre and States share equally.

Transitioning toward a centralized system is complex and requires planning. Although the result is simplification, major challenges lie ahead for businesses operating in India. It’s a huge undertaking to prepare for such a radical change—and political and logistical challenges add to the complexity.

How to Prepare

- Educate yourself on the GST legislation and its impact on your business

- Seek advice from tax and technical advisors

- Attend GST training

- Prepare common scenarios for your business comparing the current tax calculation with the new GST calculation

- Prepare for the switchover

- Ensure your calculation and compliance systems are ready for GST by running tests for scenarios you commonly encounter

- Identify any issues and determine a strategy to resolve them.

Updates of Existing Tax Laws

Example: Possible tax reform in Brazil

Brazil seeks to simplify its historically complex tax system, according to finance minister Henrique Meirelles. Companies operating in Brazil spend on average 2,038 hours to complete their taxes, or about twelve times the average in the wealthy OECD group of nations, according to the World Bank’s “Doing Business” index.1 The hope is that reducing tax complexity will ease the burden on companies that see the country’s complicated tax laws as a barrier to long-term growth.

How to Prepare

- Monitor legislative activity for potential changes and updates

- Seek advice from tax advisors

- Use tax subscriptions that keep you up-to-date

- Document and evaluate your business transactions in the region and how tax is imposed today

- Track and monitor potential tax changes

- Evaluate your systems for compliance with current rules and potential rules.

Introducing a New System of Taxation Where None Existed

Example: Gulf Cooperation Council (GCC) value-added tax (VAT)

The GCC countries, which include Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates, are resource-rich but had no system of taxation in the past. Together, they are working to introduce a common taxation framework. Currently, all countries have signed on and agree to move forward with a single VAT rate applicable to all of them, effective January 1, 2018, with each working through its own legislative process. For businesses operating in this region, it’s a whole new ballgame.

How to Prepare

- Document and evaluate your business transactions in the region

- Review your existing systems and determine the impact VAT would have on your systems

- Consider a trusted advisor for legislative updates and related guidance.

Conclusion

Depending on the complexity of your organization and its volume of business transactions, it could take your tax department a significant amount of time to evaluate and formulate a strategy to address each of these scenarios and remember that this isn’t everything going on within indirect tax. Therefore, it is critical to start early to properly manage your risk and increase your agility in response to rapidly changing legislation.

Many taxpayers seek tax and technical guidance to assist with getting and staying in compliance with indirect taxes. Using tax automation is a best practice to assist with the tax calculation and compliance burden, as software can automatically track and respond to changes in policy and tax rates.

Governmental bodies continue to evolve and become more sophisticated in driving revenue via indirect taxes. Given the constant change, make sure your tax department is taking the necessary steps to ensure compliance, minimize risk, and inform business decisions.

Carla Yrjanson is vice president, tax research and content, tax and accounting, at Thomson Reuters.

Endnotes

- Silvio Cascione, “Brazil Plans to Vote on Tax Reform This Year—Finance Minister,” Reuters (April 18, 2017), www.reuters.com/article/brazil-economy-tax-idUSE4N1F700N.