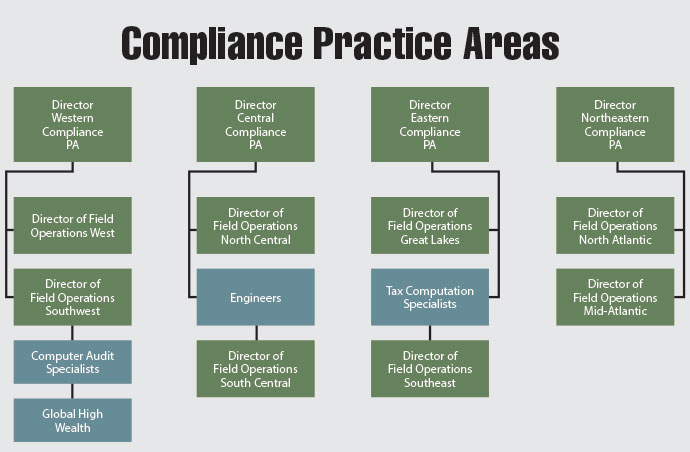

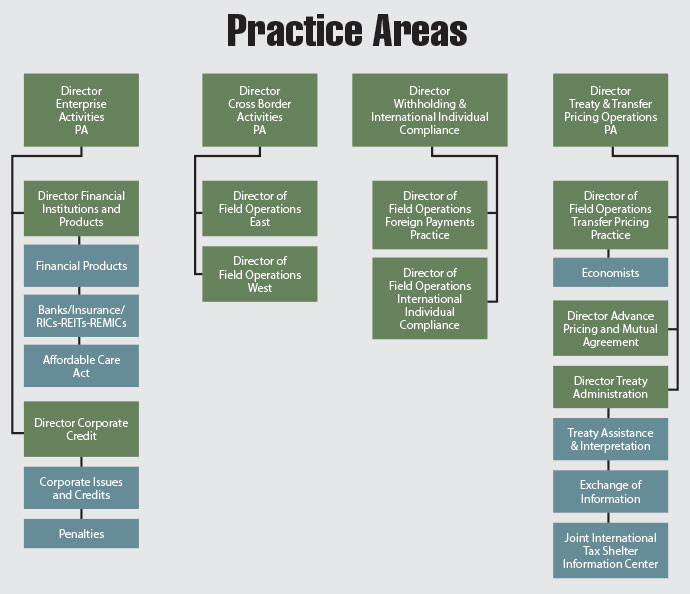

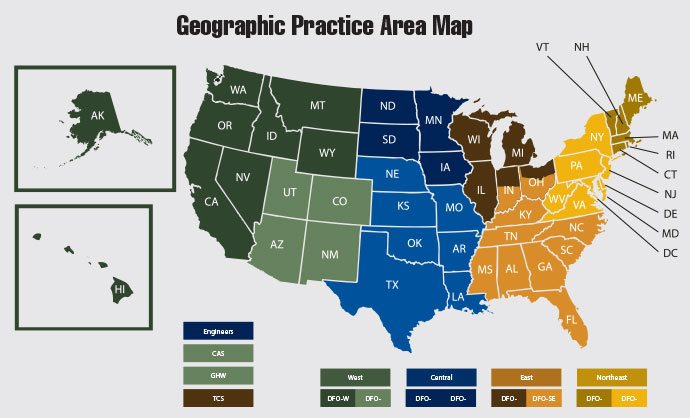

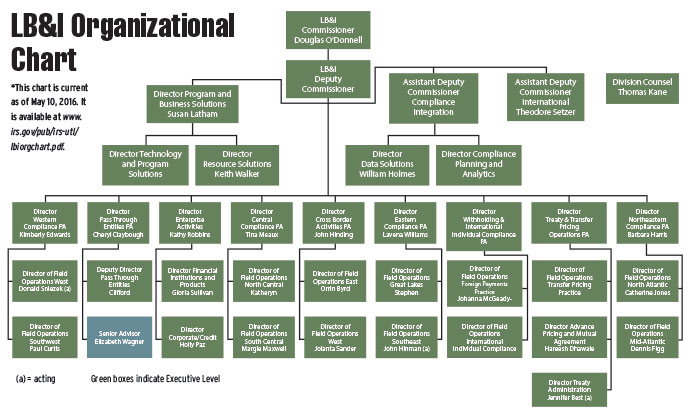

The recent restructuring of the LB&I division of the IRS has many wondering how responsibilities may change. (See the March/April 2016 Tax Executive cover story, “The New LB&I.”) Here we provide an easy-access organizational chart* so you can see who is responsible for which regions and where your LB&I questions or concerns can be directed.