The tax reform act enacted in December 2017 (commonly referred to as the Tax Cuts and Jobs Act or TCJA) significantly altered the landscape of U.S. taxation of foreign investments. Historically, U.S. individuals preferred to own foreign investments directly or through entities classified as partnerships for U.S. federal income tax purposes. Partnerships are not subject to entity-level U.S. federal income tax and are often an important part of family office investment structuring. However, the TCJA made sweeping changes to the U.S. international tax rules and reduced the U.S. corporate tax rate to twenty-one percent.

As a result, family offices should reevaluate whether their existing foreign investment holdings continue to be tax-efficient and consider reorganizing those holdings. In certain circumstances, it may be more efficient to structure foreign investment through a U.S. corporation (rather than as a direct investment or through a pass-through entity), notwithstanding the added exposure to a second layer of U.S. taxation. Using a U.S. corporate holding company could reduce the net U.S. tax rate (that the U.S. individual ultimately pays or bears) on the foreign company’s earnings by over twenty percent depending on circumstances, some of which this article discusses. That said, U.S. corporate holding company structures may trigger certain rules against tax avoidance.

Choice of Entity: Form of Ownership

Many of the U.S. international tax changes enacted by the TCJA aim to transition the United States from a worldwide tax system toward a modified territorial tax system. Among these changes, the implementation of a “participation exemption” for U.S. corporations and a new tax on certain high-return foreign assets (the “global intangible low-taxed income” or “GILTI” tax) significantly alters the calculus for U.S. investors in determining the ownership structure of their foreign investments. These changes generally disadvantage direct individual investment in foreign corporations when compared to U.S. corporate investments in foreign corporations.

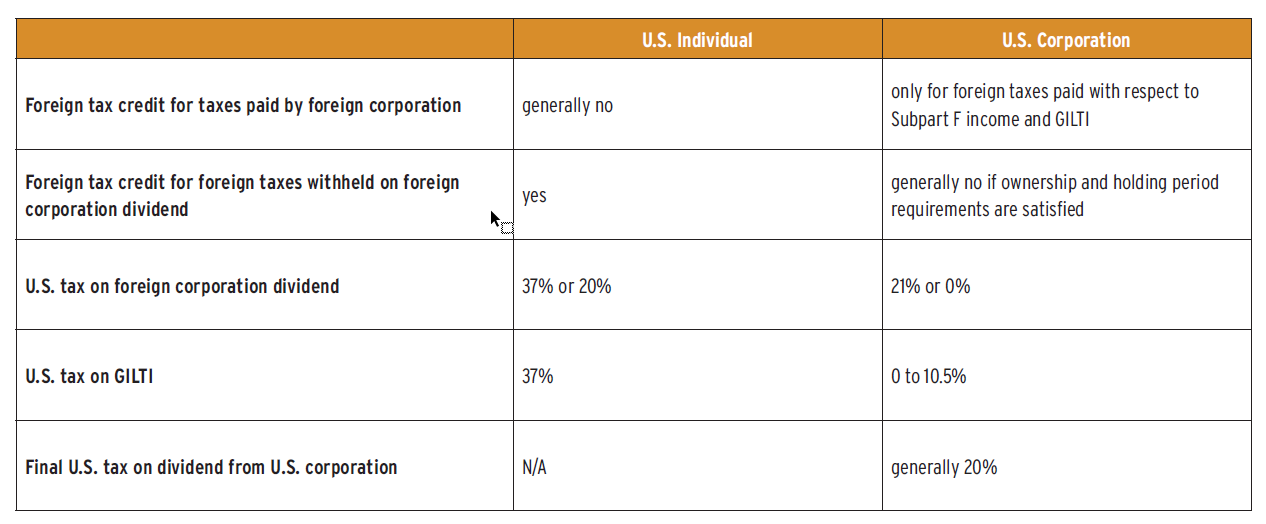

The chart below (Figure 1) provides an overview of certain key considerations for the ownership of an investment in a foreign corporation. For simplicity’s sake, this article assumes that the investment target is a controlled foreign corporation that generates only foreign-source income that is not Subpart F income (generally referred to as a “foreign corporation”). The term “U.S. individual” refers to a U.S. individual shareholder (direct or through a pass-through entity) of a foreign corporation, and the term “U.S. corporation” refers to a U.S. corporate shareholder of a foreign corporation. In each case, this article also assumes that more than ten percent of the foreign corporation’s stock is owned by the relevant U.S. investor.

Foreign Taxes

As with U.S. corporations, a foreign corporation’s earnings may be subject to multiple layers of foreign tax. The foreign corporation may pay tax in the jurisdiction in which it is organized and/or the ones in which it does business. Except for foreign taxes paid with respect to Subpart F income and GILTI, U.S. investors (whether individual or corporate) are generally no longer entitled to a foreign tax credit for foreign taxes paid by the foreign corporation.

Another level of foreign tax may apply when the foreign corporation distributes earnings to its shareholders. The jurisdiction from which the dividends are paid may impose a withholding tax on those dividends, and any such withholding tax may be reduced by an income tax treaty between the United States and the country imposing the tax. A U.S. individual is generally allowed a foreign tax credit for this withholding tax, whereas a U.S. corporation generally is not.

U.S. Federal Income Taxes on Dividends

The U.S. federal income tax consequences with respect to dividend income vary greatly. A foreign dividend received by a U.S. individual is subject to tax at ordinary income tax rates, with a highest marginal rate of thirty-seven percent. In some circumstances, a foreign dividend may qualify for the lower rate of twenty percent for “qualified dividends.” This lower rate is generally available when the foreign corporation is eligible for benefits under an income tax treaty with the United States or if the stock of this foreign corporation is readily tradable on an established securities market in the United States. On the other hand, a U.S. corporation, as a ten percent shareholder, generally is allowed a 100 percent dividends-received deduction or DRD (and therefore is not subject to U.S. federal income tax) with respect to dividends from a foreign corporation. However, the subsequent distribution by the U.S. corporation of the foreign corporation’s earnings to its ultimate shareholders (presumably U.S. individuals) also will be subject to U.S. federal income tax at a twenty percent rate.

If there is no foreign withholding tax imposed on the dividend, and the foreign dividend is a “qualified dividend,” the overall net U.S. federal income tax will be the same whether the foreign investment is held by a U.S. individual directly (or through a pass-through entity) or indirectly through a U.S. corporation. That is, either way, the only U.S. federal income tax imposed on the foreign corporation’s earnings that are distributed would be the twenty percent tax at the individual level. If the foreign dividend is not a “qualified dividend” (for example, because the foreign corporation is not located in a jurisdiction with a double taxation treaty with the United States), then the U.S. individual would be taxed at up to thirty-seven percent upon receipt of the foreign dividend. In that case, holding the foreign investment through a U.S. corporation may result in less tax. On the other hand, if the foreign jurisdiction imposes a high withholding rate on dividends, it may be preferable for a U.S. individual to hold the foreign investment.

GILTI and Subpart F Income

Determining a U.S. investor’s form of ownership of foreign corporation stock may be impacted the most significantly by the amount of GILTI, and to a lesser degree by Subpart F income, the foreign corporation is anticipated to earn. The GILTI tax seeks to prevent outbound profit-shifting by imposing a minimum tax on a foreign corporation’s earnings to the extent the earnings exceed a ten percent return on the foreign corporation’s tangible asset base. Although the GILTI tax is sometimes considered a tax on significant returns on intangibles, it applies more broadly and is in fact a tax on a foreign corporation’s residual earnings over a permitted minimum return on tangible assets. A U.S. individual is subject to ordinary income tax (thirty-seven percent) on any GILTI of the foreign corporation. On the other hand, a U.S. corporate owner effectively qualifies for a 10.5 percent tax rate on GILTI by virtue of a fifty percent GILTI deduction. Further exacerbating the disparity, a U.S. corporation, but not a U.S. individual, is entitled to foreign tax credits for foreign taxes paid with respect to Subpart F income and GILTI. As a result of the foreign tax credit, generally U.S. corporations will not be subject to tax on GILTI as long as such income is subject to a foreign income tax rate of at least 13.125 percent.

Thus, to the extent that a foreign corporation is expected to have significant GILTI, a U.S. corporation may be a preferable holding structure.

Determining the appropriate, tax-efficient ownership structure for foreign investments is an inherently fact-intensive exercise that depends on a number of variables.

Exiting Foreign Investments

To exit a foreign investment, a U.S. individual will generally sell his or her shares of foreign corporation stock. A U.S. individual’s gain from the sale of foreign corporation stock will generally be subject to capital gains tax of twenty percent. In certain circumstances, such gain may be recharacterized as a dividend to the extent of the accumulated earnings and profits of the foreign corporation attributable to such stock. In such an event, such dividend income may be taxable at ordinary income rates (thirty-seven percent) or preferential rates for “qualified dividends.”

On the other hand, a U.S. corporation that sells its shares of foreign corporation stock will generally be subject to corporate tax of twenty-one percent on the gain from such sale. Such gain may also be recharacterized as a dividend to the extent of accumulated earnings and profits of the foreign corporation attributable to the sold stock, and in certain circumstances, the U.S. corporation may be entitled to a 100 percent DRD. The subsequent distribution of the sales proceeds by the U.S. corporation to its ultimate shareholders will generally be subject to an additional twenty percent tax. Depending on the particulars, there may be flexibility to mitigate the additional U.S. federal income tax exposure. For example, if the foreign corporation were a holding company that held multiple different businesses, it may be possible for the foreign corporation to sell an unwanted business and dividend the proceeds (or liquidate) tax-free to the U.S. corporation, which could then distribute the proceeds subject to a twenty percent tax to the ultimate U.S. investors.

To summarize, determining the appropriate, tax-efficient ownership structure for foreign investments is an inherently fact-intensive exercise that depends on a number of variables, including whether distributions are expected to be made by the foreign corporation, the type of assets held by the foreign corporation, the expected return on those assets, the type of income earned by the foreign corporation, and the tax rate in the applicable foreign jurisdiction. Ownership through a U.S. corporation will likely be most tax-favorable when significant GILTI is anticipated. This benefit generally increases as the foreign tax rate increases. On the other hand, exiting an investment held by a U.S. corporation may expose the ultimate U.S. investors to an additional level of U.S. tax on the foreign corporation’s earnings. There may be opportunities to mitigate the cost of the corporate-level tax if the U.S. corporation owns a significant percentage of the foreign corporation and can structure its exit other than through a sale of the foreign corporation stock.

Accumulated Earnings Tax and Personal Holding Company Tax

The TCJA has also breathed new life into the tax-avoidance rules under Internal Revenue Code Section 531 (the accumulated earnings tax, or AET) and Section 541 (the undistributed personal holding company tax, or PHCT), which had limited applicability in recent years due to high U.S. corporate tax rates. Now, these tax-avoidance rules will be implicated more frequently as taxpayers attempt to take advantage of the lower corporate tax rates and changes to the international tax regime discussed above. Internal Revenue Service and Department of Treasury officials have noted that additional guidance may be necessary to implement these provisions in light of the TCJA.

Accumulated Earnings Tax

The AET applies to the extent a corporation is “availed of” for purposes of avoiding tax on dividends at the shareholder level. If applicable, there is a twenty percent tax imposed on the corporation’s taxable income (as adjusted) in a particular year. This tax is in addition to any eventual tax on dividends distributed to the shareholders. The fact that any company is a mere holding or investment group is prima facie evidence of a purpose to avoid the income tax with respect to the group’s shareholders. For this purpose, a holding company is defined as a corporation having practically no activities except holding property and collecting the income therefrom or investing therein. Facts and circumstances determine whether there is a purpose to avoid tax.

Personal Holding Company Tax

The PHCT applies to certain closely held C corporations with more than sixty percent of their adjusted ordinary gross income consisting of passive-type income, such as dividends, interest, and rents. If applicable, a twenty-percent tax is imposed on the corporation’s undistributed personal holding company income.

Summary

Each provision imposes additional taxes on certain C corporations that are deemed to inappropriately retain—rather than distribute—earnings to avoid shareholder-level dividend income tax. Taxpayers will need to monitor accumulated, undistributed earnings of their U.S. corporation holding companies. As a result, a U.S. holding company structure may not be appropriate for holding investments in foreign entities treated as partnerships for U.S. federal income tax purposes, because such a structure may result in the U.S. corporation having taxable income and earnings and profits, but no cash to distribute. The IRS recently took the position in a nonprecedential ruling that such a structure resulted in AET liability.

Conclusion

Family offices should consider the impact of the TCJA on their foreign investments. As discussed above, it may now be more efficient to hold foreign investments through a U.S. corporation. Any analysis depends on a number of facts. Assuming it is more efficient to use a U.S. corporation for this purpose, family offices should also carefully consider the AET and PHCT and ensure that neither tax will apply.

Jennifer Ray is a partner and Andrew Park is an associate in the tax group in the Washington, D.C., offices of Crowell & Moring LLP.