As children, we learned new and difficult concepts, such as our first words, by associating them with pictures. Who could forget the Dr. Seuss classic Hop on Pop? In this article, we take you back to your childhood by offering a series of pictures to simplify the most significant aspects of new Section 163(j),1 enacted as part of the Tax Cuts and Jobs Act (TCJA),2 and the recently proposed regulations thereunder.3 Each section includes a figure and an explanation.

In general, Section 163(j) limits interest deductibility for taxpayers by imposing a thirty percent general cap on net business interest, computed as follows:

Section 163(j) Limitation4 = business interest income + thirty percent of ATI + floor plan financing interest

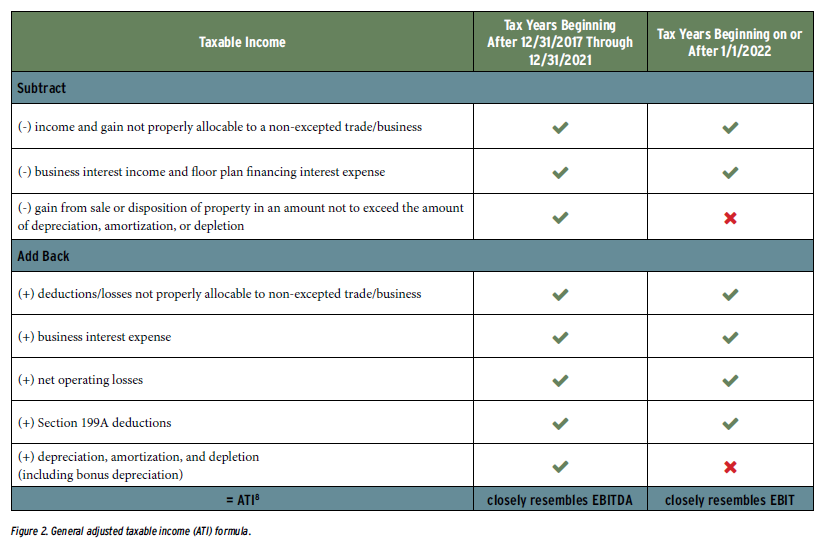

Broad Definition of “Interest”5 (Figure 1)

Taxpayers should be mindful of the broad definition of “interest” under the proposed regulations. In addition to interest on a debt instrument, the following are listed as examples of interest for the purposes of Section 163(j):

- debt issuance costs and, if any amounts have been borrowed, commitment fees;

- original issue discount, accrued market discount, and repurchase premium;

- premium in the case of debt instruments issued or acquired at a premium;

- guaranteed payments by partnerships for the use of capital under Section 707(c);6

- income and deductions as well as gains and losses resulting from certain transactions used to hedge interest-bearing assets or liabilities (regardless of whether such transactions are integrated with the assets or liabilities hedged);

- substitute interest payments on securities lending or sale-repurchase transactions;

- time value components for non-cleared swaps with significant nonperiodic payments; and

- ordinary income or loss arising from contingent payment debt instruments.

Furthermore, an anti-abuse rule provides that any expense or loss “predominantly incurred in consideration of the time value of money” in transactions in which the taxpayer secures the use of funds for certain time periods is considered interest.

As illustrated in Figure 1 and listed previously, amounts like guaranteed payments for the use of capital under Section 707(c) will be subject to Section 163(j) under the proposed regulations. On the other hand, rent paid under a true sale-leaseback and interest expense capitalized into the basis of assets under Sections 263A and 263(g) will not be treated as interest expense. In view of this broad definition of interest, taxpayers now must examine closely all costs associated with borrowing and hedging and any business income that may produce “interest.”

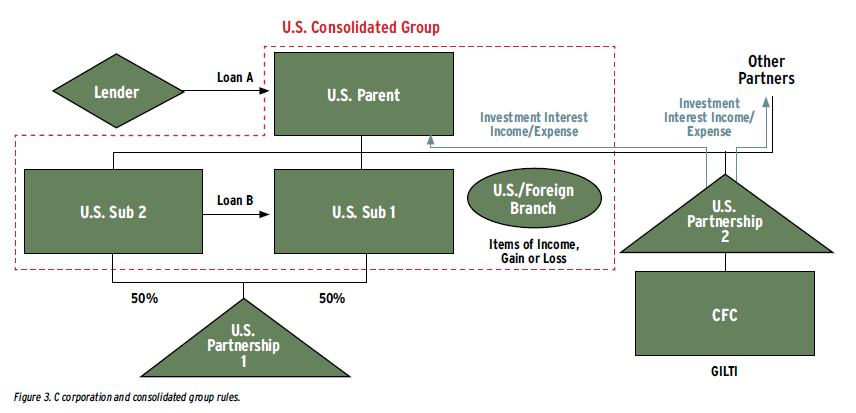

Definition of “Adjusted Taxable Income”7 (Figure 2)

As shown in Figure 2, the adjusted taxable income (ATI) of a C corporation or a consolidated group generally is its taxable income computed without regard to the application of the Section 163(j) limitation and with certain adjustments. Consistent with the theme of Section 163(j), ATI for a partnership and its partners is not as simple. A partnership’s ATI includes Section 734(b) basis adjustments but excludes partner-level adjustments, such as Section 743(b) basis adjustments, built-in loss amounts with respect to partnership property under Section 704(c)(1)(C), and remedial allocations of income, gain, loss, or deduction to a partner pursuant to Section 704(c). Instead, a partner takes into account these partner-level adjustments in determining its own ATI. The partner’s ATI excludes 1) the partner’s distributive share of any items of income, gain, deduction, or loss of the partnership (except for “excess taxable income,” or ETI, once all of the partner’s EBIE (as discussed below in the Partnership Complications section), including any carryforwards, has been treated as paid or accrued); 2) business interest income from the partnership subject to Section 163(j) (except to the extent the amount of business interest income exceeds business interest expense at the partnership level); and 3) the partner’s allocable share of the partnership’s floor plan financing interest.

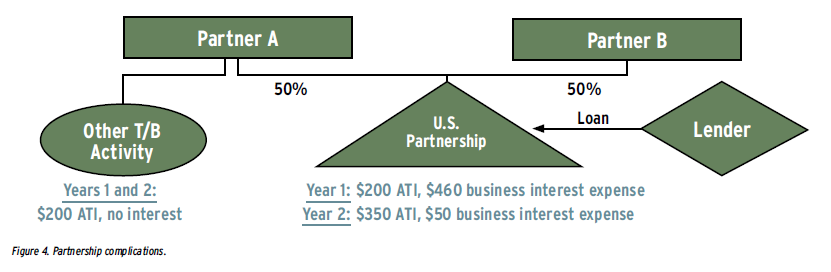

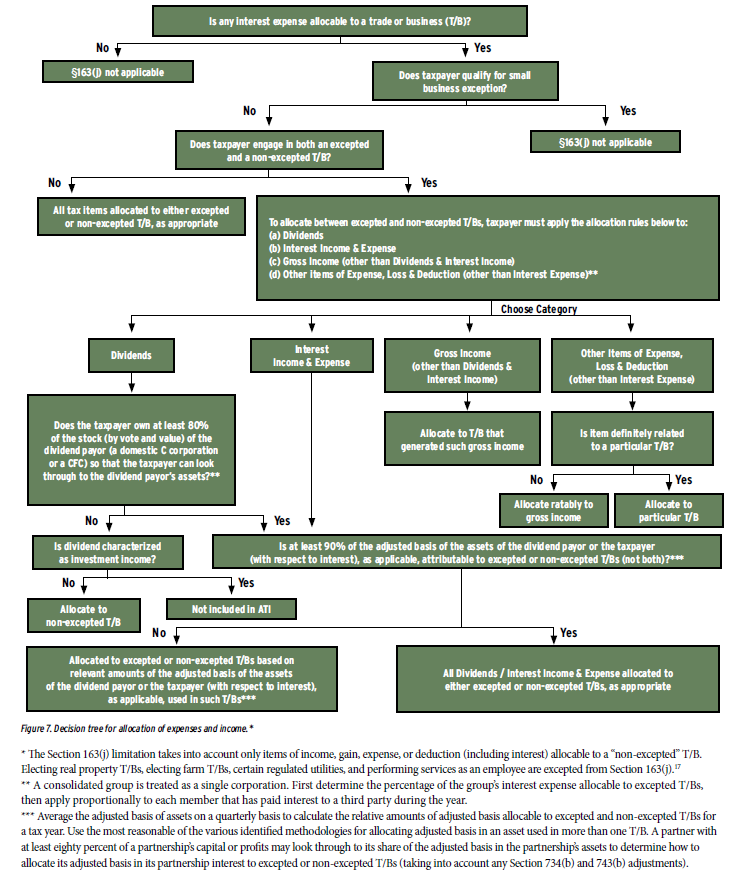

C Corporations and Consolidated Groups—“Simple” Rules9 (Figure 3)

In comparison to partnerships and non-U.S. entities, the Section 163(j) rules applicable to C corporations and consolidated groups are relatively straightforward. All interest paid or received by a C corporation will be treated as business interest expense or interest income for the purposes of Section 163(j), even if attributable to investment activities. Thus, in Figure 3, all of U.S. Parent’s interest expense on Loan A will be subject to Section 163(j), and all of its interest income, just like other items of income, gain, deduction, or loss (including such items earned or incurred through a U.S./Foreign Branch), will be taken into account in determining its ATI, except to the extent that such items are properly allocable to an excepted trade or business (discussed in more detail in the Allocating Between Excepted and Non-Excepted Trades or Businesses section and Figure 7, both on page 29). With all of a C corporation’s interest paid or received treated as attributable to a trade or business, a C corporation (like U.S. Parent) should evaluate whether financing activities related to investments are adversely affecting its Section 163(j) limitation.

A partnership, such as U.S. Partnership 1 or U.S. Partnership 2, may have investment interest income or expense that is allocated to its partners, including C corporation partners like U.S. Sub 1, U.S. Sub 2, or U.S. Parent. This investment interest income or expense will be recharacterized as business interest income or expense to a C corporation partner and be taken into account in determining the C corporation’s Section 163(j) limitation. Thus, U.S. Partnership 2’s allocation of investment interest income and expense would be converted into business interest income and expense for U.S. Parent. This recharacterization rule does not apply to any Subpart F income or global intangible low-taxed income (GILTI) inclusion that is treated as investment income at the partnership level, which remains excluded from the calculation of the Section 163(j) limitation, even for C corporation partners. U.S. Parent’s GILTI inclusion from U.S. Partnership 2 may be properly allocable to a non-excepted trade or business but nevertheless is not included in U.S. Consolidated Group’s ATI.

As clarified by the proposed regulations, a consolidated group (like U.S. Consolidated Group) has a single Section 163(j) limitation. Under these rules, Loan B and any other intercompany obligations would be disregarded for purposes of determining current-year business interest income and expense (as well as U.S. Consolidated Group’s ATI). Intercompany items, such as gain or loss, are also disregarded for purposes of determining U.S. Consolidated Group’s ATI to the extent such items offset in amount. U.S. Partnership 1 and other captive partnerships are not aggregated with U.S. Consolidated Group but remain subject to the rules specifically applicable to partnerships (discussed in more detail in the Partnership Complications section, as well as Figure 4 on the next page).

If, for any tax year, a C corporation or a consolidated group (like U.S. Parent or U.S. Consolidated Group) has business interest expense not allowed as a deduction as a result of the Section 163(j) limitation (a DBIC), such DBICs will be carried forward indefinitely for possible use in subsequent tax years. As with all carryforwards, taxpayers must keep close track of their DBICs.10 The future value of these DBICs, however, is speculative at best, because they and all other carryforwards share the same problem—a taxpayer must enjoy an economic change or a shift in a capital structure before the carryforward can be used. Because many taxpayers’ business interest expenses remain relatively constant from year to year, absent a change in taxable income, it is possible that DBICs may never be utilized.

In the context of mergers and acquisitions, a seller may consider its subsidiary’s DBICs as “tax attributes” for which the seller should be paid. A buyer, on the other hand, should model whether its group can utilize such DBICs in the first few post-closing tax years before agreeing to pay anything for the DBICs.11

Partnership Complications12 (Figure 4)

As alluded to above, Congress and the Treasury abandoned simplicity in crafting the Section 163(j) rules for partnerships, although they begin simply enough. Generally speaking, the Section 163(j) limitation applies at the partnership level. Any business interest expense allowed as a deduction by a partnership under Section 163(j) (deductible business interest expense) will not be subject to further limitations at the partner level for the purposes of Section 163(j).

From here, however, the partnership rules descend into complexity. To the extent a partnership has business interest expense in excess of its Section 163(j) limitation (excess business interest expense, or EBIE), the EBIE, unlike a DBIC of a C corporation, is not carried forward by the partnership. Rather, the EBIE is allocated to the partners, which reduces (but not below zero) their outside bases in their partnership interests. A partner’s ability to deduct EBIE in subsequent years is limited by future allocations of ETI and “excess business interest income” from the same partnership that produced the EBIE. ETI is essentially the portion of the partnership’s ATI for a given tax year that is not used to support the partnership’s deductions of business interest in that year (see below for the formula). Excess business interest income is the amount by which a partnership’s business interest income exceeds its business interest expense in a tax year. Absent a change in the relevant partnership’s taxable income, EBIE generally will not be freed up by ETI or excess business interest income until the relevant partnership repays its debt and stops making yearly interest payments.13

Figure 4 offers an example of the impact (and complications) of these Section 163(j) rules for partnerships and is further discussed here.

U.S. Partnership

In Year 1, U.S. Partnership’s Section 163(j) limitation is $60 ($200 of ATI multiplied by thirty percent). U.S. Partnership has $60 of deductible business interest expense, which is reflected in U.S. Partnership’s non-separately stated income or loss and is not subject to further Section 163(j) limitation at the Partner A or B level.14 U.S. Partnership allocates $200 of EBIE to each of Partners A and B ($460 of business interest expense minus $60 of deductible business interest expense multiplied by 50 percent).

In Year 2, U.S. Partnership’s Section 163(j) limitation is $105 ($350 of ATI multiplied by thirty percent). U.S. Partnership has $50 of deductible business interest expense. A partnership’s ETI is computed as follows:

ETI = Partnership’s ATI x [(thirty percent of Partnership’s ATI – business interest expense – floor plan financing interest – business interest income) / (thirty percent of Partnership’s ATI)]

U.S. Partnership allocates $91.67 of ETI to each of Partners A and B = $350 of ATI multiplied by [($350 of ATI multiplied by thirty percent, or $105, minus $50 net business interest) divided by $105], multiplied by each partner’s 50 percent share.

Partner A

In Year 1, U.S. Partnership allocates $30 of deductible business interest expense and $200 of EBIE to each of Partners A and B. Partner A’s Section 163(j) limitation is $60 ($200 of ATI from its other trade or business activity multiplied by thirty percent). However, Partner A is not allowed to use its $200 of ATI from its other trade or business activity to free up the EBIE.

In Year 2, U.S. Partnership allocates $25 of deductible business interest expense and $91.67 of ETI to each of Partners A and B. When a partner receives an allocation of ETI or excess business interest income, any EBIE that was carried forward from a prior tax year will be treated as business interest expense paid or accrued by the partner in that tax year up to the amount of the ETI and excess business interest income, and that amount will be deductible subject to the partner-level Section 163(j) limitation. If any of the partner’s EBIE exceeds the partner’s share of the partnership’s ETI or excess business interest income, the EBIE remains outstanding and is carried forward to the next applicable tax year. Consequently, Partner A increases its ATI by $91.67 of ETI and treats $91.67 of its $200 Year 1 EBIE as business interest paid or accrued in Year 2, and $108.33 of Partner A’s EBIE from U.S. Partnership ($200 from Year 1 minus $91.67 treated as paid or accrued in Year 2) remains outstanding and is carried forward.

Partner A’s Section 163(j) limitation is $87.50 ($200 of ATI from its other trade or business activity plus $91.67 of ETI multiplied by thirty percent). Thus, of Partner A’s $91.67 business interest expense, $87.50 is deductible in Year 2, and $4.17 is treated as business interest expense paid or accrued by Partner A in Year 3 (the deductibility of which will be subject to Partner A’s Section 163(j) limitation).

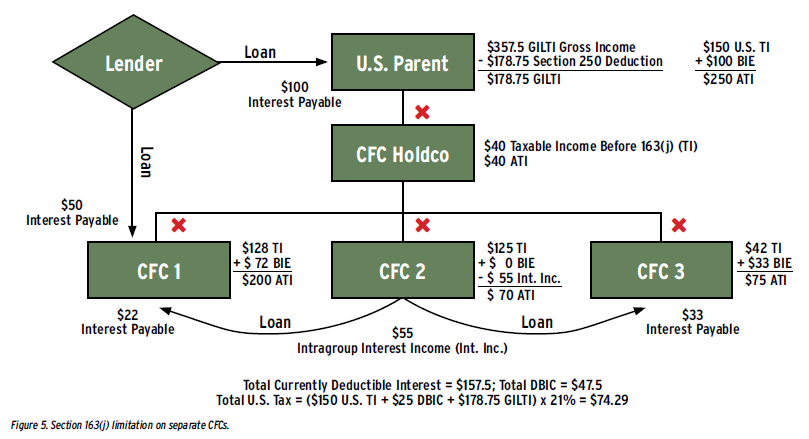

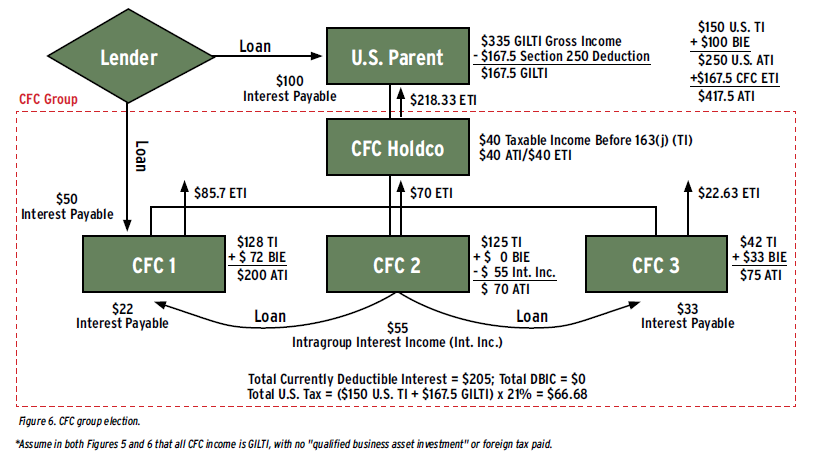

Controlled Foreign Corporations and Effectively Connected Income15 (Figures 5 and 6)*

General Rules Concerning CFCs

The Section 163(j) limitation will apply to any CFC that has at least one U.S. shareholder that owns 10 percent of the CFC’s stock by vote or value. If a CFC is a partner in a foreign partnership, the Section 163(j) limitation would apply to that foreign partnership as if the CFC partner were a domestic corporation.

Figure 5 below depicts the general rule. Both CFC 1 and CFC 3 apply the Section 163(j) limitation to business interest expense (BIE) as if they were standalone U.S. corporations, without netting for related party interest income. CFC 1’s Section 163(j) limitation is $60 ($200 of ATI multiplied by thirty percent), creating a $12 DBIC, and CFC 3’s Section 163(j) limitation is $22.50, creating a $10.50 DBIC. Each CFC must allocate the allowed interest expense among Subpart F income, GILTI, and “effectively connected income” (ECI), but the proposed regulations do not provide guidance. The DBICs increase the tested income of CFC 1 and CFC 3, thus increasing U.S. Parent’s GILTI inclusion. The Section 163(j) limitation applies at the U.S. Parent level to its business interest expense. In computing a U.S. shareholder’s ATI, taxable income is reduced by Section 78 gross-ups, Subpart F income, and GILTI inclusions (reduced by any Section 250 deduction). Consequently, U.S. Parent’s ATI does not include the $178.75 GILTI inclusion, even though CFC 2 and CFC Holdco generated GILTI tested income and had no business interest expense. U.S. Parent’s Section 163(j) limitation is $75 ($250 of ATI multiplied by thirty percent), creating a $25 DBIC.

Alternative Method: CFC Group Election

To mitigate the impact of the Section 163(j) limitation on intra-CFC loans, a group of qualifying CFCs may make an “alternative method” election, the CFC group election. The CFC group election is available only if a group of two or more CFCs is eighty percent or more owned by value (vote is irrelevant) by the same U.S. shareholder or by multiple related U.S. shareholders in the same proportion (the CFC group). Partnerships that are wholly owned by CFCs in the same CFC group are also treated as CFCs for that purpose. Any CFC that has any ECI cannot be a CFC group member.

Making a CFC group election has two principal effects:

- Aggregate business interest income is netted against aggregate business interest expense of all CFCs in the CFC group. Such net business interest expense is allocated proportionately to each CFC with net business interest expense in calculating each CFC’s Section 163(j) limitation.

- The CFC group election would permit a “roll-up” of a lower-tier CFC’s excess taxable income (CFC ETI) to a higher-tier CFC, and ultimately to the U.S. shareholder, in a manner similar to the application of Section 163(j) to partnerships. A U.S. corporation that is a U.S. shareholder (or holds its interest through a domestic partnership that is a U.S. shareholder) of a CFC group can increase its ATI by its share of the CFC ETI of the highest tier member of the CFC group (capped at the amount of the U.S. shareholder’s Subpart F and GILTI (less Section 250 deduction) from the CFC group). Dividends received by CFCs from related parties, however, would be subtracted from the CFCs’ taxable income in computing their ATI.

A CFC group election is irrevocable and must be consistently applied to all CFCs, including any subsequently acquired CFCs. The CFC group election appears to be generally beneficial for U.S.-parented multinationals that rely on intercompany lending between CFCs and charge intercompany interest with a markup and/or if borrowing is concentrated either at higher-tier CFCs or at the U.S. shareholder level.

Figure 6 on the previous page illustrates the CFC group election. The CFC group has $50 of net business interest expense ($105 total business interest expense offset by $55 of business interest income). CFC 1’s share is $50 multiplied by CFC 1’s $72 interest expense divided by the CFC group’s interest expense of $105, or $34.29. Only CFC 1’s allocable share of the CFC group’s net business interest expense is subject to CFC 1’s Section 163(j) limitation of $60 ($200 of ATI multiplied by thirty percent), so the $34.29 is currently deductible, as is $37.71 of CFC 1’s business interest expense not subject to its Section 163(j) limitation. For CFC 3, its allocable share of CFC net business interest expense is $15.71, which is less than CFC 3’s Section 163(j) limitation of $22.50 and thus is currently deductible, as is CFC 3’s remaining $17.29 of interest expense.

In calculating CFC ETI, amounts roll up from the lowest tier to highest tier. Because all CFCs have separate company CFC ETI, all such CFC ETI is included in the calculation of the roll-up. CFC 1’s ETI is $85.70 = $200 of ATI multiplied by [($200 of ATI multiplied by thirty percent, or $60, minus $34.29 of allocable net interest expense) divided by $60]. CFC 3’s ETI is $22.63 = $75 of ATI multiplied by [($22.50 minus $15.71) divided by $22.50]. Because neither CFC 2 nor CFC Holdco has interest expense, all of their ATI constitutes CFC ETI. CFC Holdco must apply the “specified ETI ratio” to the total CFC group members’ CFC ETI. Because the GILTI inclusions equal taxable income of the CFC group members, the ratio is 100 percent.

CFC Holdco’s rolled-up CFC ETI is $218.33 ($85.70 of CFC 1’s ETI plus $70 of CFC 2’s ETI plus $22.63 of CFC 3’s ETI plus $40 of CFC Holdco’s ETI). U.S. Parent’s CFC ETI inclusion is limited to the $167.50 of GILTI inclusion, so U.S. Parent’s ATI is $417.50 ($250 of U.S. Parent’s ATI plus $167.50 of the CFC Holdco’s rolled-up CFC ETI). U.S. Parent has a Section 163(j) limitation of $125.25 ($417.50 of ATI multiplied by thirty percent), so all of U.S. Parent’s $100 of interest expense is currently deductible.

Allocating Between Excepted and Non-Excepted Trades or Businesses16

Diana S. Doyle and Samuel R. Weiner are partners and Christopher J. Ohlgart is an associate at Latham & Watkins.

Endnotes

- All references to “Section” are to sections of the Internal Revenue Code of 1986, as amended (Code).

- Public Law No. 115-97 (December 22, 2017). Shortly before final Congressional approval of the Act, the Senate parliamentarian ruled that the previously attached short title, the “Tax Cuts and Jobs Act,” violated procedural rules governing the Senate’s consideration of the legislation. Accordingly, the Act does not bear a short title, although commentators generally have continued to refer to it as the Tax Cuts and Jobs Act.

- On November 26, 2018, the Treasury and the Internal Revenue Service (IRS) released the proposed regulations (REG-106089-18). References to “Prop. Treas. Reg.” are to the proposed regulations.

- The Section 163(j) limitation generally does not apply to any small-business taxpayer whose average annual gross receipts for the three-year period ending with the tax year that precedes the current tax year does not exceed $25 million. The Section 163(j) limitation applies to interest expense that would otherwise be deductible, generally after other statutory limitations (including deferrals) applicable to interest expense, and before general loss limitations.

- See generally Prop. Treas. Reg. 1.163(j)-1(b)(20).

- The inclusion of guaranteed payments for the use of capital is an unexpected expansion of the definition of interest that can have an adverse impact on partnership preferred equity structures that rely on guaranteed payments. Further, this expansion puts additional pressure on the appropriate tax treatment of accrued preferred return in partnership preferred equity structures in which the treatment of the return as a guaranteed payment or partnership allocation is unclear.

- See generally Prop. Treas. Reg. 1.163(j)-1(b)(1).

- Any amount of depreciation, amortization, or depletion capitalized under Section 263A and included in cost of goods sold is not a deduction for purposes of calculating ATI. Furthermore, as discussed in Controlled Foreign Corporations and Effectively Connected Income, “global intangible low-taxed income” (GILTI) inclusions are also subtracted in the calculation of ATI.

- See generally Prop. Treas. Regs. 1.163(j)-4 & 1.163(j)-5.

- Current-year business interest expense will be deducted in the current tax year before DBICs will be applied. Thereafter, if the C corporation has any remaining Section 163(j) limitation, DBICs are deducted in the order of the tax years in which the DBICs arose, beginning with the earliest tax year (i.e., using a first-in, first-out method), subject to certain limitations, including Section 382. Any disqualified interest expense under “old” Section 163(j) (the so-called “earnings stripping” rules) is generally carried forward to the taxpayer’s first tax year beginning after December 31, 2017, and becomes subject to the new Section 163(j) rules. But any excess limitation under old Section 163(j) may not be carried forward.

- In the case of certain tax-free asset acquisitions, the TCJA added DBICs to the list of tax attributes to which Section 381(a) applies. Also, the TCJA added DBICs to “pre-change losses” for purposes of Section 382, which generally will be absorbed before NOLs but after pre-change capital losses and all recognized built-in losses.

- See generally Prop. Treas. Reg. 1.163(j)-6.

- In the event a partnership becomes exempt from the requirements of Section 163(j) in a tax year, any outstanding EBIE will be treated as paid or accrued by the partner in that tax year.

- Section 163(j) provides that EBIE, excess business interest income and ETI (collectively, Section 163(j) Excess Items) and deductible business interest expense are allocated to partners in the same manner as “non-separately stated taxable income or loss of the partnership.” However, the phrase “non-separately stated taxable income or loss of the partnership” has not previously been defined by statute or regulation, and the proposed regulations provide that such Section 163(j) Excess Items and deductible business interest expense will be allocated to partners using a complex eleven-step method. See generally Prop. Treas. Reg. 1.163(j)-6(f).

- See generally Prop. Treas. Regs. 1.163(j)-7 & 1.163(j)-8.

- See generally Prop. Treas. Reg. 1.163(j)-10.

- There are numerous special allocation rules, such as direct allocation for interest expenses for qualified nonrecourse debt and provisions for taxpayers who are engaged in banking, insurance, or finance. For noncorporate taxpayers, the rules for determining whether interest is allocable to a trade or business (versus, for example, investment interest or personal interest) generally are found in Sections 163(d) and (h).