A tsunami of change has roiled the normally calm waters of state conformity to the Internal Revenue Code (IRC) as a result of federal tax reform. Passed in December 2017, shortly before state legislatures went into session in 2018, the Tax Cuts and Jobs Act of 2017 (PL 115-97), hereafter the TCJA, significantly altered many domestic and international tax provisions of the IRC. In 2018, the Internal Revenue Service (IRS) and the U.S. Department of the Treasury issued numerous notices, hundreds of pages of proposed regulations, and other forms of guidance to help taxpayers interpret the revised IRC. Keeping pace with developing federal rules has challenged even the most sophisticated corporate tax departments. Because state corporate tax systems heavily rely on conformity to the IRC in calculating state taxable income, these federal-level changes also have significant derivative effects on states and taxpayers alike. This article reviews responses to select provisions of the TCJA generally and in certain key states for multistate corporate taxpayers.

Incorporating the IRC into determinations of state taxable income provides efficiency, because doing so creates an established base from which states can layer in their own modifications to achieve certain policy goals and avoid constitutional pitfalls. (Both the federal constitution and state constitutions impose some restrictions on state taxing powers.) States generally conform to the IRC in one of two ways: through either “static” or “rolling” conformity. Static conformity states conform to the IRC as of a particular date and must take legislative action to update that conformity to include subsequent amendments to the IRC. States with static conformity generally update their conformity date annually. This process allows those states to review amendments made to the IRC during the previous year and make policy choices about what changes they may not want to sign on to. For example, over the years many states have legislatively decoupled from federal bonus depreciation in this manner to avoid the temporary revenue loss associated with accelerated depreciation deductions. In contrast, rolling conformity states automatically conform to the IRC, including amendments to it. These states generally review any amendments made to the IRC and respond legislatively to decouple from, or otherwise modify their conformity to, the IRC where their state legislatures deem appropriate.

The magnitude of the recent changes to the IRC has put state governors, legislatures, and departments of revenue in a precarious position as they consider whether to adopt some or all of the changes it contains. In addition to policy considerations, states must consider the fiscal impact of conforming to the amended IRC and must do so in the context of limitations and restrictions that do not exist at the federal level. For example, states generally must operate on a balanced budget and have limited or no ability to run a deficit. Also, not all state governments have the resources to crunch all the numbers needed to accurately model the budgetary effects of how the numerous complicated amendments to the TCJA would alter state tax collections in a very short timeframe. This job has been further complicated as the IRS and Treasury continually roll out guidance on the new law. Still, many state departments of revenue produced revenue estimates of conformity to certain provisions of the amended IRC. State legislatures relied, in part, on these reports in deciding how to conform to, or decouple from, the changes, and states continue to evaluate their responses to the TCJA and issue guidance of their own.

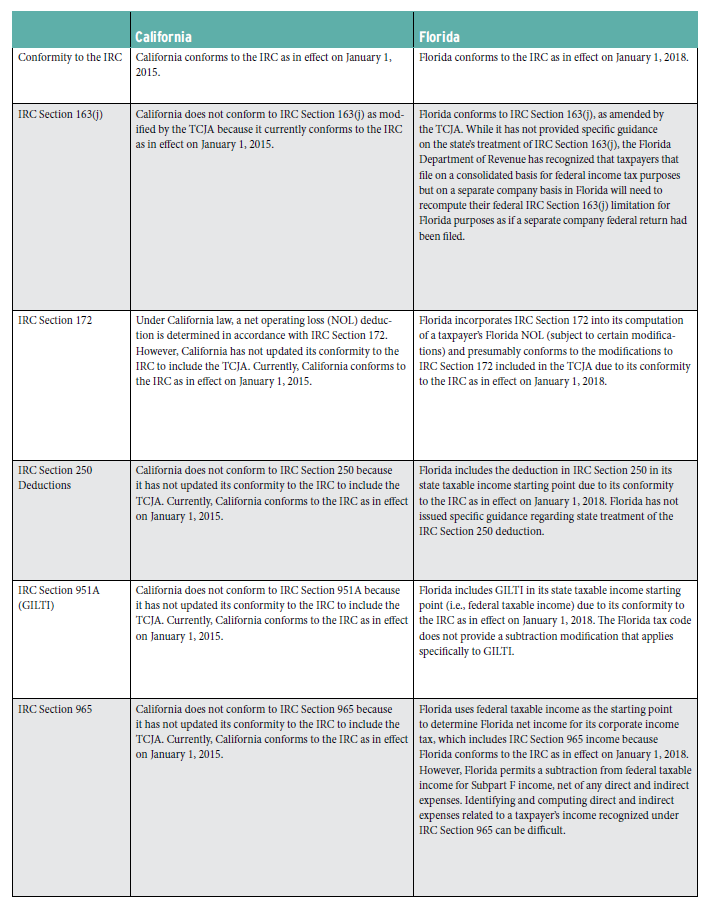

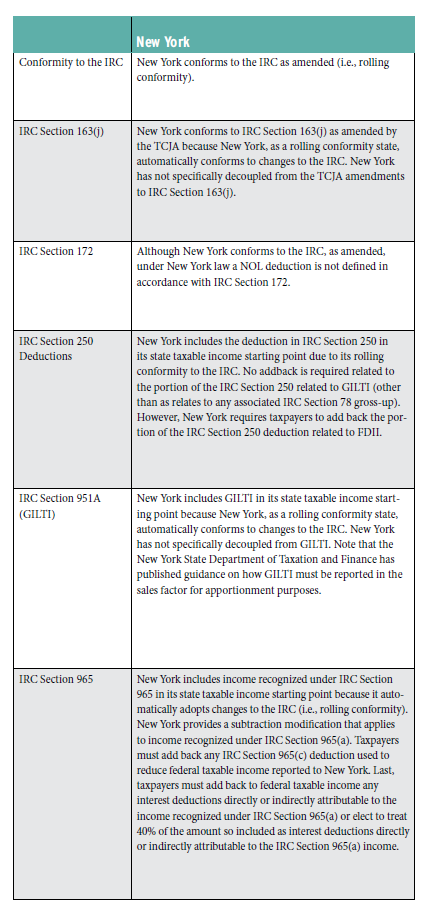

Although the TCJA has affected numerous existing provisions and created many new concepts, this article and the accompanying matrix summarizing state responses (or lack thereof) focus on the following areas of the new law that have proven especially challenging to states and taxpayers: 1) the interest deduction limitation in IRC Section 163(j); 2) the limitation on the use of net operating losses (NOLs) in IRC Section 172; 3) the deemed repatriation of deferred earnings and profits in IRC Section 965; 4) global intangible low-taxed income (GILTI) in IRC Section 951A; and 5) the deduction in IRC Section 250 related to GILTI and foreign-derived intangible income (FDII).

Limitation on Interest Deductions: IRC Section 163(j)

IRC Section 163(j) generally limits taxpayers’ ability to deduct interest expenses above a specified threshold. If interest expense exceeds that threshold, taxpayers may carry forward that disallowed interest and treat it as paid or accrued in the succeeding year. The TCJA repealed the preexisting limitation and replaced it with a new limitation based on a percentage of a taxpayer’s adjusted taxable income (ATI), which is a new concept in the tax law. Under the amended IRC Section 163(j), a taxpayer’s interest deduction for a tax year (excluding floor plan financing) is generally capped at thirty percent of ATI for taxpayers with an average of more than $25 million in gross receipts over the three prior years. Taxpayers in certain real property businesses, farming businesses, regulated public utilities, and electric cooperatives may elect out of these rules. A taxpayer’s ATI is roughly its taxable income before interest and taxes, for taxable years beginning before January 1, 2022. Thereafter, ATI will include depreciation and amortization (which will reduce ATI and the associated IRC Section 163(j) threshold).

State conformity to the interest limitation as amended in the TCJA is often not straightforward due to differences in filing methods at the state and federal levels. Proposed regulations published by the IRS and Treasury would calculate a single IRC Section 163(j) limitation for a federal consolidated group. For state purposes, however, a member of the federal consolidated group may be required to file a separate return with taxable income calculated as if the corporation had filed a separate company federal income tax return. Even some states that require groups of affiliated corporations to file a single combined report require each member of the combined report to begin the calculation of state taxable income with its separate company federal taxable income as if the corporation had filed a separate company federal return. Significant differences can result from applying the IRC Section 163(j) rules on a consolidated versus a separate company basis, resulting in significant differences in applicable IRC Section 163(j) interest limitations and carryforward amounts. In addition, over twenty states currently have rules that disallow the deduction of interest or intangible-related interest paid to related parties. Most conforming states have not addressed the potential overlap between these rules and the IRC Section 163(j) limitation. Because the federal limit applies to all interest, and money is fungible, it may not be clear whether the character of the interest that is allowed to be deducted is “related-party” interest for state purposes. Because disallowed interest deductions under IRC Section 163(j) may be carried forward to subsequent years, these differences between state and federal calculations can affect more than just the current tax year.

Limitation on Use of NOLs: IRC Section 172

IRC Section 172, as amended by the TCJA, restricts the use of net operating losses (NOLs) by taxpayers (other than property and casualty insurance companies), effective for losses arising in tax years beginning after December 31, 2017. The amendments to IRC Section 172 eliminate the preexisting carryback provisions in most cases and allow NOLs to be carried forward indefinitely. Also, for NOLs generated in tax years beginning after December 31, 2017, the NOL deduction is limited to eighty percent of the taxpayer’s taxable income determined without regard to the deduction.

Most states require the federal NOL to be added back in the calculation of state taxable income but provide their own state-specific NOL (typically calculated after apportionment). Even though those states provide a state-specific NOL, many reference IRC Section 172 in their NOL statutes. For example, some states have rules that generally provide that the state NOL should be treated in the same manner as for federal purposes, or, more specifically, that the state NOL carryforward period should be aligned with that permitted for federal purposes. It is unclear how the limitations on NOL usage included in the TCJA interact with state NOL provisions that reference generally IRC Section 172.

Deemed Repatriation of Deferred Foreign E&P: IRC Section 965

The TCJA includes a provision (IRC Section 965) requiring a deemed repatriation of post-1986 earnings and profits (E&P) of certain foreign corporations and subjecting those amounts to reduced federal tax rates depending on whether the E&P is related to cash and cash equivalents or other assets. This is accomplished by adding the post-1986 E&P to certain U.S. shareholders’ Subpart F income and then allowing a partial deduction of those included amounts to effectively arrive at preferential tax rates. The effective preferential rates on repatriated earnings in IRC Section 965 are 15.5 percent for cash and cash equivalents and eight percent for other amounts.

To address repatriation income recognized by U.S. shareholders, most states have either amended their laws or issued guidance for applying existing laws. Those rules often treat income recognized under IRC Section 965 as eligible for Subpart F income subtraction or a state dividends-received deduction (DRD) but may require taxpayers to add back related expenses. In those states with static conformity that have not updated their IRC conformity to include the TCJA, no repatriation income under IRC Section 965 has occurred. However, any actual distributions of cash from foreign subsidiaries would need to be analyzed under the rules of those states that apply to actual dividends (California, for example).

To address repatriation income recognized by U.S. shareholders, most states have either amended their laws or issued guidance for applying existing laws.

GILTI: IRC Section 951A

To address perceived base erosion through the movement of intangible assets offshore, the TCJA added IRC Section 951A. Under that provision, certain U.S. shareholders of foreign corporations must include in gross income what is referred to as the global intangible low-taxed income (GILTI) of the foreign subsidiary. The calculation of this income inclusion is complicated and is made based on certain enumerated attributes of the U.S. shareholder’s foreign subsidiaries.

Although IRC Section 951A requires GILTI to be treated as Subpart F income for a number of purposes, it is not included in the definition of “Subpart F income” under IRC Section 952. Because the state exclusions from income (or qualifications for a DRD) often refer to Subpart F income or to a specific definition of Subpart F income (e.g., IRC Section 952), the exclusion or DRD provisions may not encompass this new income inclusion. Fewer states have addressed the treatment of GILTI than have addressed repatriation income. In those states that have amended their laws or published guidance for GILTI, the approach has varied significantly, from including GILTI as part of an existing Subpart F subtraction or DRD to taxing the entire amount of GILTI. Even the small minority of states that have chosen to tax GILTI have also varied in their decisions about whether and how to apportion GILTI to the state. This remains an evolving area that states continue to analyze and with which taxpayers continue to struggle.

Deduction for GILTI and FDII: IRC Section 250

The TCJA provides a deduction in IRC Section 250 equal to fifty percent (37.5 percent for years beginning after December 31, 2025) of the taxpayer’s GILTI (subject to limitations when GILTI exceeds taxable income). IRC Section 250 also provides a deduction to corporations for 37.5 percent of a corporation’s foreign-derived intangible income, or FDII (21.875 percent beginning after December 31, 2025). A corporation’s FDII is a portion of certain types of income (typically related to services and intangibles) attributable to sales to customers outside the United States. Although the intent behind taxing GILTI may have been to discourage taxpayers from moving certain operations offshore, the FDII deduction may provide an incentive to taxpayers to move similar operations back to the United States.

State responses to the deductions for GILTI and FDII in IRC Section 250 have not been uniform. In states that have decided to exclude GILTI from the tax base, most have required taxpayers to add back the portion of the IRC Section 250 that relates to GILTI. For states that do include GILTI in the state tax base, many permit the related IRC Section 250 deduction. Similarly, states have reacted in different ways (or not at all) to the deduction in IRC Section 250 for FDII. A small number of states have decided to require that taxpayers add back the FDII deduction, while most other states have decided not to modify it at all.

State responses to the deductions for GILTI and FDII in IRC Section 250 have not been uniform.

Responses to Select TCJA Provisions in Key States

The changes brought about by the TCJA are new and complex. The delay in states issuing guidance or responding legislatively to some of the new tax provisions highlights the difficulty of understanding the ways these new provisions flow through and affect the calculation of state taxable income and the tough policy states must consider.

The matrix spread across the next three pages describes in general terms how certain key states have responded (or not) to the TCJA provisions described in this article. Please note, however, that the state treatment of each of these provisions can be affected by other aspects of a state’s corporate tax system that could alter the application of these rules significantly. For example, many states require corporations to file a separate corporate return for each member of an affiliated group that does business in the state, regardless of whether that group files a consolidated return at the federal level. In situations where applying the TCJA provisions in a federal consolidated return would differ from applying those rules to a corporation that files on a separate basis, the resulting taxable income of the corporation could be different for federal and state purposes—even before the application of state modifications to the federal taxable income starting point for computing state taxable income. Furthermore, the application of certain state modifications, such as a DRD, can vary depending on the taxpayer’s ownership percentage in a subsidiary. Thus, the matrix below should be used only as a starting point for understanding how each state treats these provisions.

Also, state legislatures will continue to introduce legislation to address conformity to the IRC in their 2019 legislative sessions and beyond. The matrix below is current as of March 17, 2019.

Dan De Jong is a senior manager and Raj Lapsiwala is a manager in KPMG LLP’s Washington, D.C., national tax office.