Many taxpayers during this 2018 tax season will see differences not only in the amount of their estimated tax but also in the filing process. Family offices will experience changes to once familiar tax rules and a broadened tax base. To top it off, many tax forms have taken on new looks and formats. Certain tax deductions have been suspended until future years, and new tax laws (along with new limitations on deductions) have been enacted. Based on the Tax Act’s colloquial name alone—the Tax Cuts and Jobs Act (TCJA)—one might imagine that taxes would generally be cut. Indeed, the Congressional Budget Office has reported that individuals and pass-through entities (partnerships and S corporations) will receive about $1.125 billion in net benefits over ten years and corporations will receive about $320 billion in benefits. That said, under the TCJA, some high-net-worth taxpayers may actually pay more taxes.

High-net-worth family offices generally positioned within higher tax brackets are experiencing a mix of lower tax rates; limitations on the deductibility of state, local, and real estate taxes, mortgages, and business interest; and the elimination of personal exemptions. This article will focus on certain tax aspects of family office investments in private equity and operating portfolio companies.

Family offices may invest in private equity by acquiring an ongoing business or startup, in which case the family gains control of the business and may hold it through a pass-through structure. The selected acquiring structure may be multi-tiered, depending on nonfamily and family investors and limited partners (LPs). General partners (GPs, management companies) provide management services to the business, family members, related entities, and third-party nonfamily members in return for a management fee and carried interest during profitable times. When performing due diligence prior to the acquisition, the management company may consult with a valuation company to analyze and report on the true enterprise value of the business. The enterprise value sets the purchase price and places a value on intangibles (such as goodwill), enabling the family office to estimate the rate of return on their investment, the tax benefits, and relevant borrowing opportunities. The basic formula for goodwill is: purchase price (fair value) – tangible assets = goodwill.

In previous years, acquisition interest was normally allowable as a business deduction; however, the Act has made some changes from a tax perspective.

Prior to the TCJA, the family office could leverage the purchase of the business through debt in expectation of a real-time tax benefit from flow-through losses for a number of years generated not only from the loan or debt service interest but also from the depreciation and amortization of intangible goodwill and other assets. In previous years, acquisition interest was normally allowable as a business deduction; however, the Act has made some changes from a tax perspective.

Limited Business Interest

The Act has amended Internal Revenue Code Section 163(j), “Limitation on Business Interest,” for tax years beginning after December 31, 2017. Proposed regulations issued November 26, 2018, limit business interest expense deductions to the sum of:

- business interest income (BI);

- thirty percent of adjusted taxable income (ATI);1 and

- the taxpayer’s floor plan financing interest for the tax year.2

This article will focus on the first two limitations; our family office example will not include floor plan financing, which applies only in very limited cases. The family office structure is depicted in Figure 1.

The LPs and the GP acquire their interests in the portfolio companies by contributing cash to the Fund, LP which purchases and holds the investments. The GP usually generates its cash by borrowing from a lender. Both the portfolio companies and the family office are active businesses subject to the proposed interest limitation rules. The borrowed funds of the GP and the portfolio companies are reported on their respective balance sheets.

The portfolio companies conduct their business operations and pay off the acquisition debt along with any working capital debts usually in a consolidated loan. The borrowing sources must be segregated between the investment debt and the working capital (business operations) debt. Any investment debt interest is not subject to the limitations of Section 163(j) but is limited to the limitations of Section 163(d) and is deductible to the extent of the taxpayer’s investment income.

On December 13, 2017, the Tax Court issued a memorandum decision in the case of Lender Management LLC3 that addressed the differentiation between investment activities and business activities as they pertain to a family office. The Tax Court found that Lender Management LLC, a family office providing management services to three separate investment entities owned by various members, was not an investor but was engaged in a trade or business because it received a carried interest as compensation for its management services. The carried interest provided a component of income in excess of an investor’s return on investment. To reach its decision, the Tax Court considered other pertinent factors that are beyond the scope of this article. This distinction between whether this family office was an investor or was engaged in trade or business opened the door for family offices to offer services to their clients similar to the services provided by Lender Management LLC, offering them the possibility of structuring operations to continue to deduct operation expenses and avoid the negative tax implications of the Act’s suspension of two percent miscellaneous itemized deductions.

Prior to the TCJA, all management fees were considered itemized deductions, but for tax year 2018 this practice is no longer permitted and thus is currently suspended. The Lender decision may be considered favorable to family offices, in that they may avoid the disallowance of investment expense deductions under the Tax Act. In our fact pattern, the GP or management company is engaged in a trade or business, and none of the LPs are subject to unrelated taxable business income.

Interest Expense

Generally the interest expense subject to limitations is sourced at the GP level and the portfolio company levels of the organizational chart shown in Figure 1 on the previous page. The interest generated from the GP debt and the portfolio company debt interest is subject to the interest expense deduction limitations. Interest is defined as the following:

- amounts paid or accrued as compensation for the use of money;

- debt issuance costs, loan commitment fees, and guaranteed payments; and

- interest expense, which is defined as any expense or loss incurred in consideration of the time value of money in a transaction or series of transactions in which the taxpayer secures the use of the funds for a given period.

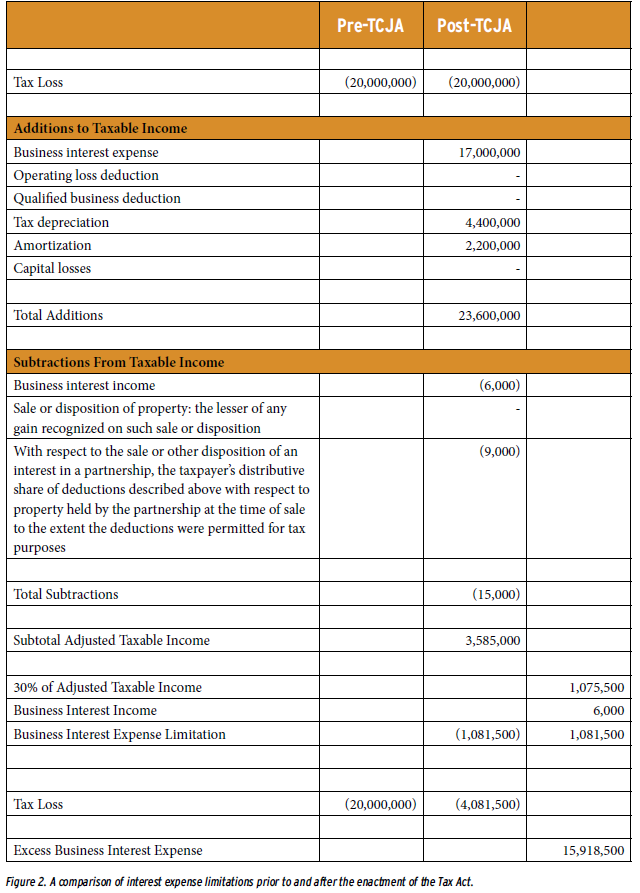

Prior to the thirty percent limitation, the deducting entity must adjust its taxable income to arrive at its adjusted taxable income (ATI). The taxable income of the GP or the portfolio company is adjusted by adding or subtracting the following:4

- add back the following (not a complete list):

- business interest expense;

- operating loss deduction;

- qualified business income deductions under Section 199A;

- any deduction for depreciation, amortization, and depletion (for tax years prior to January 1, 2022); and

- deductions for capital loss carrybacks or carryovers; and

2. subtract the following (not a complete list):

- business interest income;

- in reference to the sale or disposition of property, the lesser of any gain recognized on such sale or disposition and any depreciation, amortization, or depletion deductions (for tax years prior to January 1, 2022); and

- with respect to the sale or other disposition of an interest in a partnership, the taxpayer’s distributive share of deductions described above with respect to property held by the partnership at the time of the sale to the extent the deductions were permitted for tax purposes.

Consider Figure 2 on the previous page, which illustrates the interest expense limitations prior to and after the Tax Act. The pre-Act tax loss is $20 million, which would have been deductible by the limited partners of the family office or fund, assuming sufficient tax basis. In comparison, post-TCJA the adjusted tax loss is $4.08 million. Of the $17 million of interest expended, only $1.081 million is permitted to be deducted on the current-year tax return, and $15.9 million is suspended.

The suspended interest is allocated to each of the partners and is suspended until the partners are allocated taxable income in the future.

What follows is a simplified example of the current and following tax year treatment of the disallowed interest expense. Partner Smith was allocated $1,000 disallowed interest per his 2018 Fund Schedule K-1 footnote. In 2019 Smith was allocated income of $2,000 with no disallowed interest. On Smith’s 2019 tax return, he will deduct the carryover year 2018 $1,000 interest from his fund taxable income of $2,000. If Smith was not allocated any income per the 2019 Schedule K-1, the interest would continue to carry forward until allocated excess taxable income to support the future deduction. The disallowed interest is suspended at the partner level until the partner has sufficient taxable income in the future to offset the disallowed interest and the $1,000 must reduce his basis in fund regardless of not currently receiving a tax benefit.

In conclusion, the Section 163(j) rules are complex and require a radical departure from the way partnerships were previously taxed. The regulations can be unclear and contradictory. Family offices should be cognizant of their investment interest expense versus their business interest expense and should segregate and document the borrowings, sources, and uses for their tax preparer. Family offices are encouraged to keep good loan documentation books and records to maximize their deductions for interest expenditures.

For next year, plan to discuss the loan documentation, the debt issuance costs, commitment fees, guaranteed payments, and payoff plans to prepare for the next tax season.

Lindsey Serrate is managing director of True Partner Consulting LLC.

Endnotes

- ATI is taxable income for the tax year adjusted by adding and subtracting adjustments listed in the tax code. One shortcut is generally to start with EBIDTA (earnings before interest, depreciation, tax, and amortization) and then to subtract business interest income, gains on dispositions of property. Additional adjustments and exclusions may apply.

- Floor-plan financing interest applies only to the acquisition of certain motor vehicles held for lease, which is beyond the scope of this article.

- Lender Management LLC, et al. v. Commissioner (TC Memo 2017-246).

- The listing of additions and subtractions is not complete and is provided for illustration purposes; exceptions apply.