The Expert: Rob Parker

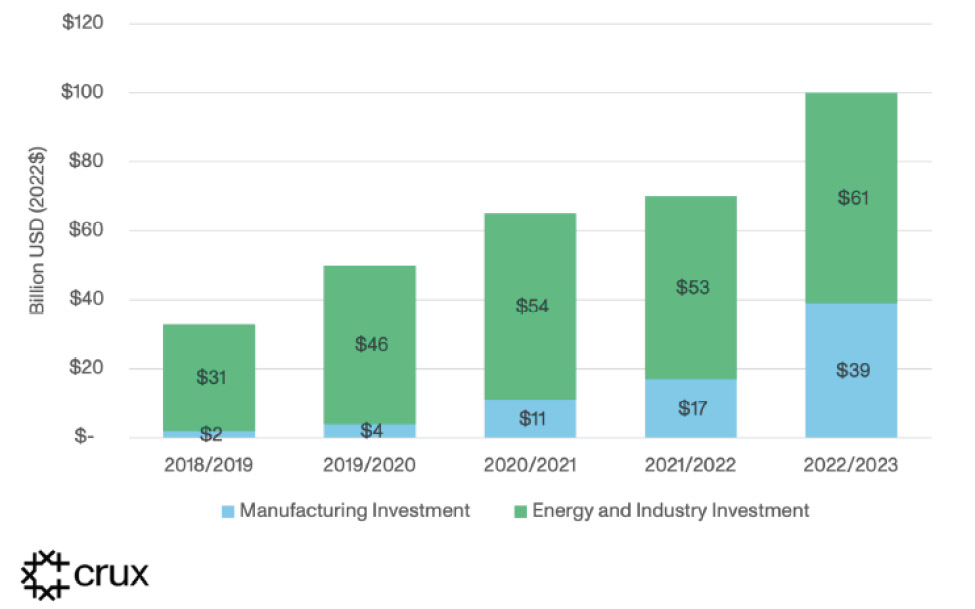

Since Congress passed the Inflation Reduction Act (IRA) in August 2022, private companies have announced over $628 billion in commitments to American industries like clean energy manufacturing, electric vehicles, and clean power. The economic research firm Rhodium Group reports that clean energy investments in the twelve months ending in July 2023 rose fifteen percent year over year to $61 billion, and investments in clean manufacturing more than doubled, to $39 billion.

Tax credit transferability is a key mechanism driving this surge of investment in clean energy and manufacturing. Clean energy project sponsors often cannot use the full value of their tax incentives right away. Selling these credits to companies that can use them offers projects an efficient pathway to realizing the value of these tax credits. Under the IRA, companies can purchase twelve different clean energy tax credits to satisfy their tax liabilities at a discount on their face value.

Purchasing tax credits became legal in 2023. In the wake of regulatory guidance the Internal Revenue Service issued in June, transactions rapidly accelerated, with buyers, sellers, and intermediaries entering the market for the first time. They were motivated by the opportunity to manage tax liabilities, receive essential investments, and scale syndication and advisory businesses, all while supporting sustainability goals and clean energy development.

Crux Climate released its inaugural market intelligence report in January, outlining the market for tax credits in 2023 and laying out market projections for 2024. The company derived the data in the report from a market survey it conducted in November and December 2023, augmented by public announcements and data from the company’s platform. In total, this report reflects information collected from 150 market participants and more than $3.5 billion in 2023 transferable tax credit transactions. Highlights of the report:

- The market for clean energy tax credits in 2023 approached $30 billion, of which newly transferable tax credits totaled $7 billion to $9 billion. Transferable credits are the fastest growing new asset class supporting clean energy development and are likely to be the main driver of tax attribute investment in future years.

- Purchasing clean energy tax credits created hundreds of millions of dollars of value for tax credit buyers and drove billions of dollars of investment into clean energy.

- On average, clean energy tax credits sold for ninety-two to ninety-four cents per dollar of tax credit, subject to a number of factors, including deal size, credit type, and technology type. The return on investment for companies purchasing the credits was typically between six percent and eight percent.

- Transferability is proving to be a powerful mechanism for smaller projects and technologies that qualify for tax credits for the first time. Around eighty percent of deals were for credits worth $50 million or less. Deals of this size generally have limited access to traditional tax equity partnerships—a more complex financial structure that was the primary tool for clean energy developers to monetize tax attributes before the introduction of transferability.

Some tax credit buyers in 2023 described their strategy as “testing the market,” and as 2024 begins, the clear majority of market participants believe this market is about to grow rapidly in both participation and deal size. Sixty-seven percent of Crux survey participants reported that they expect deal sizes in 2024 to increase. In the first weeks of 2024, deal activity accelerated rapidly. Crux has already seen dozens of bids totaling over half a billion dollars—a figure that already exceeds the total value of bids submitted on the company’s platform in 2023.

Tax credit transactions are not without risks, and firms should be well apprised of those risks prior to purchasing. A great many buyers find that, with the right advisors, these risks can be managed. In its research, Crux found that nearly ninety-five percent of transactions carry some form of insurance or guarantee from a project sponsor and that sellers commonly cover costs of legal due diligence. With risk mitigation strategies, companies can get a handle on what this market has to offer: the chance to lead on tax management, sustainability strategy, and good corporate governance.

Companies are driven to pursue tax credit transactions first and foremost because they offer an opportunity to manage tax liabilities. Tax credits are typically purchased at a discount on face value, and the seller usually covers transaction costs and insurance. But the benefits extend beyond that—many companies also see tax credits as a less risky way to support clean energy and sustainability and to demonstrate good governance practices.

For most businesses, it is impractical to invest directly in clean energy. Besides being outside most companies’ expertise, direct investments expose firms to the risk that future policy changes might affect the economics of the investment. However, for investments in transferable tax credits, no money changes hands until the credits are generated, and credit value is not tied to project economics.

Governance is another motivating factor that buyers of tax credits often cite. Most corporations balance a range of stakeholder interests when preparing their tax strategies, including pressures to ensure that corporations do so responsibly. Clean energy tax-preferred investments are typically regarded as being aligned with good governance principles. They represent a way to manage tax liability while leveraging a company’s tax burden to meet corporate sustainability or responsibility goals.

In pursuing a transaction, buyers need to manage transaction due diligence and develop a clear tax, legal, and accounting framework to integrate tax credits into their overall tax strategies. Many tax and legal advisors have experience with other forms of transferable tax credits—such as state tax credits or the low-income housing tax credit—or with traditional tax equity partnerships that can be applicable to transferable tax credit deals.

We are just beginning to see what this new market has to offer, but one thing is clear: investment in clean energy tax credits will finance new infrastructure, create jobs, support communities across the United States, and fuel American innovation. To achieve its full economic potential, driving as much as $3 trillion of private sector investment over the next ten years, the tax credit market needs liquidity, efficiency, transparency, and new participants. Transferable tax credits uniquely enable companies to support clean energy while generating an immediate return on investment.

For more information, download Crux Climate’s 2023 Transferable Tax Credit Market Intelligence Report at www.cruxclimate.com/2023-market-report.

Rob Parker is chief commercial officer at Crux Climate.