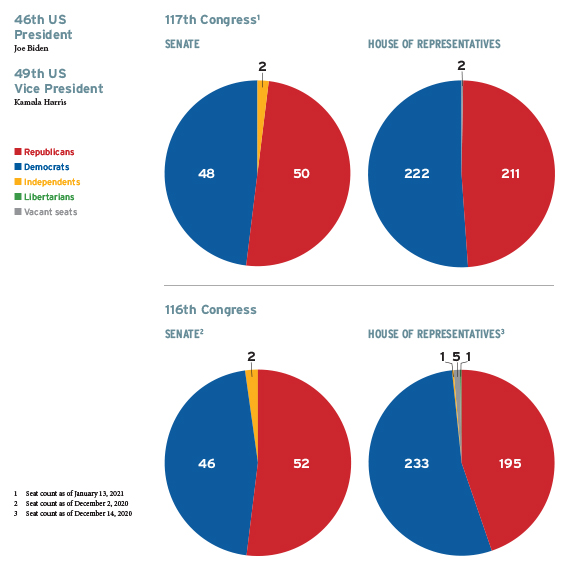

As we look ahead to the swearing-in of new US President Joe Biden, Congress has undergone its own changes—more than 60 new members as of this writing. Although the new presidential administration promises overhauls of the business and tax landscapes, it will be largely up to the 117th Congress to take regulatory and legislative action in either direction. The figures below help to illustrate where the balance of that power lies.