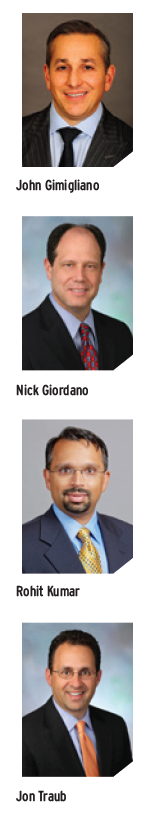

This is not your typical presidential election season. So, as we prepare this issue of the magazine, tax issues are not on the front burner. Who knows what will happen during the debates or as the campaign heads inexorably toward Election Day? For this roundtable, we convened a group of senior tax policy professionals who follow tax matters and politics with a discerning eye: John Gimigliano, principal in charge of federal tax legislative and regulatory services at KPMG LLP; Nick Giordano, principal and director of U.S. tax policy for Ernst and Young LLP; Rohit Kumar, principal at PricewaterhouseCoopers LLP and co-leader of its tax policy services practice; and Jon Traub, managing principal of tax policy for Deloitte Tax LLP. Tax Executive Senior Editor Michael Levin-Epstein moderated the discussion immediately following the Republican and Democratic National Conventions.

This is not your typical presidential election season. So, as we prepare this issue of the magazine, tax issues are not on the front burner. Who knows what will happen during the debates or as the campaign heads inexorably toward Election Day? For this roundtable, we convened a group of senior tax policy professionals who follow tax matters and politics with a discerning eye: John Gimigliano, principal in charge of federal tax legislative and regulatory services at KPMG LLP; Nick Giordano, principal and director of U.S. tax policy for Ernst and Young LLP; Rohit Kumar, principal at PricewaterhouseCoopers LLP and co-leader of its tax policy services practice; and Jon Traub, managing principal of tax policy for Deloitte Tax LLP. Tax Executive Senior Editor Michael Levin-Epstein moderated the discussion immediately following the Republican and Democratic National Conventions.

Michael Levin-Epstein: Let’s start with Trump’s tax plan.

Jon Traub: Donald Trump’s plan is the fairly traditional broaden-the-base, lower-the-rate kind of plan we’ve seen from a number of Republicans in recent years. Although I think it’s fair to say his plan features much more rate reduction than it does base-broadening, such that most nonpartisan estimates expect the plan as currently crafted would lose somewhere between $9 and $12 trillion over a decade, figures that are not likely to be embraced by Congress as we speak today. There are ongoing discussions about whether Mr. Trump might release a new plan, a revised plan, intended to bring down the bottom-line cost of his proposal. I do expect we will see that. When we will see it and what it will look like exactly, of course, remain up in the air.

John Gimigliano: I agree with Jon. I think we are likely to see changes in the Trump plan, maybe significant changes, at some point in the future, possibly reflecting a position closer to the House blueprint. One of the interesting things about the current Trump plan is that it costs trillions of dollars—from $10 to $12 trillion by some estimates—yet it really did not get the dramatic boost from the macroeconomic scoring you might have thought. Compare that with the House tax reform blueprint, where you had a significantly different macroeconomic score than the conventional score. At least, according to the Tax Foundation, you don’t have a terribly significant difference between the conventional and macro-economic revenue estimates, so I think that alone, to me anyway, suggests that we’re likely to see substantial changes before Election Day.

Rohit Kumar: Just picking up on that, I was looking at the Tax Foundation numbers. The Tax Foundation’s conventional estimate of the Trump plan is a $12 trillion revenue loss, and their dynamic estimate is $10 trillion. So it’s a relatively small pickup relative to the order and magnitude of these changes—you’re not getting big bang for your buck. For context, the federal government is anticipated to collect roughly $40 trillion over the next decade, so you’re talking about a ballpark 25 percent reduction in anticipated federal revenues. Despite that, on the international business side, the plan departs from the Republican orthodoxy in that it doesn’t shift to a territorial system but rather, in reducing the corporate rate to 15 percent, would apply it on a worldwide basis with no deferral. That is clearly a departure from where Republicans have been on that issue for any number of years, and even a departure from where Senator [Chuck] Schumer and Senator [Rob] Portman were in an international working group document they produced out of the Finance Committee where they, on a joint bipartisan basis, called for a shift to a territorial system with strong anti–base erosion measures. The cost of shifting to a territorial system is several hundred billion dollars, but in the context of a $10 or $12 trillion tax cut, you would think you ought to be able to find the revenue to shift to a territorial system as a part of the overall change in the system.

Traub: Couldn’t you argue that his plan is more than a 25 percent reduction in revenues, since if you isolate only corporate, income, and estate taxes—the areas that get the most revision under his plan—they don’t add up to $40 trillion, given the magnitude of payroll tax receipts? It’s probably like a 35 or 40 percent reduction in the tax accounts he’s actually moving around.

Kumar: That’s probably true, right, because it doesn’t include payroll. Payroll taxes are roughly 35 percent of what the federal government collects on an annual basis.

Nick Giordano: I just wanted to pick up, Rohit, on your point about the international side and how Trump’s plan is out of step with the normal orthodoxy when you look at the taxation of foreign operations of U.S. companies. He’s set forth a proposal more similar to what Senator Ron Wyden had been proposing, at least in the past, where you simply lower the rate as low as you can and go to a worldwide system where you’re taxing the first dollar. And for TEI member companies, similar to what I’ve seen with clients, there might be a number of companies out there who, if you could get them a rate as low as 15 percent, which is what Trump is proposing, the idea of doing that as opposed to a territorial system with a very strong minimum tax or other anti–base erosion measures might in fact be more attractive to some of them. We’ve talked to a number of companies that have looked at the Trump plan and are thinking that this might actually be something that they could support, but it’s obviously not in step with where Speaker [Paul] Ryan, Chairman [Kevin] Brady, and others have been.

Gimigliano: It creates a potentially interesting dynamic between taxpayers. Really, all companies are going to have to do a math exercise to some extent to determine whether they are better or worse off under this scenario. It also creates this possible distinction between multinationals and domestic companies in terms of how they might shake out, whether they prefer it or not.

Giordano: I agree, and I think that same exercise is one that is going to have to be done with respect to the Republican blueprint that John mentioned at the outset. With the introduction of border adjustability in the context of an income tax, you would think the domestic-only companies would look at this in ways that the multinationals are going to have to look at differently. The concept brings about an issue between those who are significant exporters and those who need to import to a significant extent in order to have raw material or even finished products for resale, for example.

Levin-Epstein: How does this stack up against what’s being proposed in the House and the Senate?

Gimigliano: An important and maybe obvious point here, as we compare presidential tax plans with congressional plans, is a reminder of what the presidential plans mean. In the grand scheme of things they can set the tone, but of course all tax legislation must begin in Congress. We always have this same debate about the president’s budgets, what do they really mean, and are they really more based on aspirations or politics than on policy. But, in the end, tax legislation must begin in the House and ultimately move through the Senate. Again, that’s maybe an extremely obvious point, but it bears keeping in mind as you think about presidential tax plans.

Giordano: To go back to the question you posed regarding the comparison of this plan, I think we’ve had some discussion already of how the Trump plan differs from the House Republican blueprint on tax reform that was released prior to the conventions. We can talk further about that. On the Senate side they don’t have a comparable plan that Republicans have unified around. The chairman of the Senate Finance Committee, Senator [Orrin] Hatch, has talked for months about putting out a plan that would deal with corporate integration, basically integrating the corporate and individual income tax systems, in particular focused on the payment of dividends by U.S. companies, but so far that plan has not been put forward. Otherwise, there has been lots of discussion about tax reform, a lot of hearings about it, and I think there has often been talk about a more conventional proposal that would involve lowering the rates and broadening the base, but at this point there’s really not a unified Senate proposal. Maybe others can comment more on that.

Kumar: Back to Michael’s opening question—we don’t know the makeup of Congress next year. It seems most likely the House will stay in Republican hands, although anything’s possible. The Senate seems like a much closer call, but you will have new leadership in the Senate, no matter what, since the minority leader is leaving, likely to be replaced by Chuck Schumer, who has been quite interested in tax reform, as Nick noted. So, a lot of dynamics there will not reveal themselves until we get closer to November and see who actually controls the levers of power next year.

Giordano: One of the comments that Rohit and others have made referred to Senator Schumer; I think another issue that we may not be able to separate totally from whether or not there’s going to be tax reform, particularly in a split-government context where you have some levers of power controlled by Democrats and others by Republicans, and that is whether or not there’s going to be a willingness on the Republican side to spend some money from tax reform on infrastructure or other matters. Democrats, particularly Senate Democrats, have been very active on this. Senator Schumer has often talked about the idea of doing tax reform, particularly international tax reform, and using some of the money from that to fund a significant amount of additional infrastructure spending. It may not be easy to separate those two topics in the next Congress, obviously depending on the outcome of the election.

“The Tax Foundation’s conventional estimate of

the Trump plan is a $12 trillion revenue loss, and

their dynamic estimate is $10 trillion.”

—Rohit Kumar

Kumar: As Nick points out, there is now this linkage between international tax reform, and specifically the revenue raised from a deemed repatriation of the accumulated earnings and profits of U.S. multinationals, and using it to fund infrastructure improvements—roads, bridges, rail, mass transit, bike paths, and the like. Although the president’s budget and the campaign plans are sort of “opening-bid” documents, this is an area where you see the influence of presidential budget on the tax policy conversation. Because I think the original impetus for using the money from a deemed repatriation to fund infrastructure comes from one of President Obama’s budgets, but then gets picked up by Chairman [Dave] Camp in 2014 as a part of his HR 1 legislation, and now, I don’t say it’s quite the received wisdom, but certainly almost every conversation you have about tax reform and international tax reform involves some element of using the money from the deemed repatriation to fund infrastructure. So it is evidence that, although these budgets are not adopted, it’s not a parliamentary system, where the president or the prime minister proposes and the legislature just passes it. These documents do influence the trajectory of the tax policy conversation. This sort of deemed repatriation infrastructure linkage is one example of that.

Traub: I completely agree with that, although I think it’s interesting, as Rohit says, it is just part of the received wisdom. I think it ignores, in some sense, a fundamental question for Republicans: will they support what looks like higher taxes for more spending? That has always been a formulation that runs counter to Republican orthodoxy. They generally insist that government should not raise taxes to spend more money. But it may be that’s the price of getting tax reform done. It will be interesting to see how Republicans approach that in an effort to do tax reform in 2017 or beyond.

Gimigliano: That’s exactly right. I think there’s a real challenge there, the perception of raising taxes to pay for spending. On the other hand, you could view that as the price that Republicans have to pay to get tax reform done. Just to flip it around, you could argue that the price Democrats have to pay to get infrastructure spending is to produce a revenue-negative tax package, which Republicans I guess could still tout as a net tax cut even though revenue somehow went into infrastructure spending.

“One of the interesting things about the

current Trump plan is that it costs trillions

of dollars—from $10 to $12 trillion by some

estimates—yet it really did not get the

dramatic boost from the macroeconomic

scoring you might have thought.”

—John Gimigliano

Kumar: Part of the genesis of allocating the money from the deemed repatriation to infrastructure was the president’s posture that one-time revenue—and deemed repatriation would clearly be a classic example of one-time revenue—not be used to finance permanent tax relief, whether that’s rate reduction or otherwise. Which is a little bit of a different perspective than your traditional definition of revenue neutrality. Traditionally, revenue neutrality is measured over the ten-year budget window, and all the revenue inside the window counts, all the revenue loss inside the window counts, and, as long as that nets to zero, the bill is revenue-neutral. The president and the Obama administration tried to move the goalpost a little bit on that calculation by saying that they will not count towards the revenue neutrality principle anything that we determine to be “one-time revenue” and that money should instead be used to fund other priorities that would improve the economy or otherwise deal with political priorities. So that was a little bit of a shift in the calculations, but Republicans, too, have been pushing on a change in the way the budget window is measured by the use of these macroeconomic scores. In counting the additional revenue that’s created by a faster-growing economy, you could see a potential trade here between the two political parties around revenue neutrality—do you count the macroeconomic effects of the policy?—in exchange for not counting whatever is deemed to be one-time revenue and using that one-time revenue to fund other priorities. So, both sides have something they want that’s a little bit different than the way we do it now or the way that it’s been done traditionally, and there may be some room for negotiation there so that both sides can claim they adhered to their core principles while still finding a way to do the deal in the middle.

Gimigliano: The ideal scenario there—am I correct, Rohit, in what you’re saying?—is that you would have revenue-negative or -neutral on a macroeconomic basis but potentially revenue-positive on a conventional scoring basis, thereby splitting the difference between the two parties. Now, I don’t know whether that would ever actually work in the real world, where it usually goes the opposite way, that is, where a macroeconomic score is neutral, and a conventional score is negative, not positive.

Kumar: I think if you were to take the bill that I’m envisioning, it would be a revenue loser on a statically scored basis, but revenue-positive on a dynamically scored basis, and that positive revenue from the dynamic score is what ends up being spent on other policy priorities so that Democrats can say it’s a revenue-neutral bill, but we still funded key priorities for the infrastructure or Head Start or whatever, and Republicans can say it’s a revenue-neutral bill, and maybe in some quarters will actually say it’s a tax cut, but at a minimum it’s revenue-neutral, and because we have a policy that makes the economy grow more quickly, creates jobs, and improves the welfare of all Americans, there’s more revenue we can use to spend on priorities that we agree on a bipartisan basis ought to be funded. I think about infrastructure as one of the prime examples of an area where both Democrats and Republicans are interested and willing to spend more money than we are currently spending.

Traub: I was going to say, if you could make the argument that the tax revenues have dynamic implications, so too does the infrastructure spending. Part of the sweetener for all parties might be that if you score infrastructure spending as creating growth, you can potentially pay for, say, $600 billion worth of infrastructure with only $500 billion, if you will.

Kumar: I think the Congressional Budget Office has not traditionally given infrastructure spending much of a dynamic effect. I don’t know if that’s subject to revision in the model or if it’s that there’s just a lot of lead time on big infrastructure projects. One thing we learned from the stimulus bill in 2009 is “shovel-ready” is not as shovel-ready as we might all like it to be, and infrastructure in particular, especially big infrastructure projects, has a long lead time between when you authorize the project to begin and when you actually start—when construction begins and wages start getting paid and improvements start being experienced in terms of people’s daily lives.

Giordano: But there are a couple of issues in here. So, there’s lead time necessary to recognize economic growth, on both sides, and you’re right, maybe on the spending, a) do they recognize any dynamic scoring at all? and b) how much do you get out of it and when? What I think we’re all talking about here is a classic Washington compromise, where different parties to the agreement highlight and de-emphasize different aspects of it. In the past, that’s when some of these deals have been able to come together where, depending on what side of the issue you are on, you can talk about revenue raised and, holding firm on the fact that there was not any one-time revenue counted, you can emphasize the inclusion of the spending piece, etc. It would be a classic compromise in the split-government environment.

Levin-Epstein: What about Hillary Clinton’s tax plan?

Giordano: Maybe I’ll start and others can chime in. I think, first of all, Clinton doesn’t really in my view have a plan per se. She has a series of proposals, mostly to raise taxes on the individual side, on high-income and wealthy taxpayers. So she has some of the things left over from the Obama administration such as that she’d like to impose a minimum 30 percent income tax rate on taxpayers, phased in between $1 and $2 million per year, and then apply to all taxpayers above that. In addition, she’s proposed a 4 percent surcharge on taxpayers with incomes above $5 million and she’s also picked up the proposal from the Obama administration to limit the benefit of itemized deductions and certain other tax preferences in the code to, I think, 28 cents on the dollar, or a 28 percent benefit rate. On the corporate side, I know there are some specific proposals that involve childcare and some other things, but she really doesn’t have, in my view, a comprehensive corporate tax reform plan. She certainly has spoken out against the idea of lowering the corporate income tax rate, and in fact one of her former senior advisors who’s now in charge of the Center for American Progress just the other day at the Democratic Convention said on behalf of the campaign that they don’t see a need to alter the corporate tax rate, that multinationals and U.S. companies are doing just fine. I think there’s more to come here. There’s also some talk that possibly Secretary Clinton would put forward a middle-class tax cut to separate middle- and lower-income taxpayers from higher-income taxpayers. But I think there’s more to come in terms of what a Clinton tax plan would look like.

Gimigliano: I agree with Nick, and I was just thinking the same thing in reviewing Secretary Clinton’s plan. It doesn’t really feel like a comprehensive plan yet. It’s got some very specific ideas. Perhaps it’s a question of whether strategically this election will come down to tax issues as a central theme. It has in prior elections; I think of 2000 and even 2012 to a certain extent. But perhaps this year tax policy won’t be critical, one of the issues that she’s going to feel like she needs to run on. You wonder if strategically there seems to be an advantage to not putting together a comprehensive tax plan, at least not yet, and leaving all options open by not outlining what her plan is in specific detail. That would give her the most flexibility, should she win in November.

“On the Senate side they don’t have a

comparable plan that Republicans have

unified around.”

—Nick Giordano

Levin-Epstein: If you were an advisor to Trump, what points would you make on the Clinton plan, and vice versa?

Kumar: I’ll take the first crack at this. If I’m Secretary Clinton, I think the attacks on the Trump plan are twofold: one is, at least the plan as currently constructed, she would argue a disproportionate amount of the benefit goes to upper-income taxpayers and that it will blow a hole in the deficit and substantially increase our national debt and make it difficult if not impossible to invest, either to make critical investments in the economy, and she would then list off a whole litany of political popular programs. You could think of NIH or Head Start, education or job training, for example. She would say, by contrast, “My tax policies are focused on bolstering the middle class, making sure the wealthy pay their fair share”; she would talk about the Buffett tax in particular, being fiscally responsible in order to facilitate the investments in the list of projects that she would have previously identified. I think if you’re Donald Trump, you say, “My plan cuts taxes for everybody.” You would ignore the deficit argument except to say, “I’ll deal with that in some other form,” but he may judge perhaps correctly that the deficit, as much as people talk about it, has never been a key voting issue for most of the American public. For Secretary Clinton’s plan, he’ll say it’s not as generous as his and may argue that, although she talks a big game about all these things, that at the end of the day one of his points of attack is that she’s the candidate of special interests and somehow the special interests will contort her plan to their benefit, and he’s more likely to do the right thing, however you define that.

“Will [Republicans] support what looks like

higher taxes for more spending? That has

always been a formulation that runs counter

to Republican orthodoxy.”

—Jon Traub

Gimigliano: Adding to that, the point that Nick made earlier, which is that Secretary Clinton has not committed to cutting the corporate rate yet, so I think Mr. Trump would make the point that U.S. multinationals are finding it increasingly difficult to compete against their foreign rivals, and that it’s critical to cut the U.S. corporate rate to help U.S.-based companies. President Obama has proposed to cut the rates to 28 percent, and Mr. Trump has proposed to decrease the rate even further. I think that would likely be one of the points he would make.

Giordano: A couple of other points. One, I think if I’m on the Trump side I would talk about my plan to try to unlock all of the cash from U.S. compa¬nies that is sitting offshore, and you have to have some way to get that money back to the U.S. and get it deployed in the United States, and we want it invested in the United States, in jobs and to grow the economy, rather than having it sitting offshore. Even President Obama, albeit at a high rate, had a policy that at least considered a way to get that money back into the U.S., both the current amount accumulated as well as on an ongoing basis. So, I’d kind of attack her on that front. Second, he might emphasize the fact—although I’m not sure this would be wise—that he too is interested in making sure carried interest is taxed as ordinary income, go after Wall Street, maybe challenging whether she would really do it, given the support Secretary Clinton has received from the Wall Street firms. I think that’s something he would assert. On her side, I would agree with the points that have been made and that she would probably emphasize the statistics of how the top 1 percent has got 90 percent of the wealth over some period of time; even though they’ve paid a lot of taxes they’re doing just fine, but she would say we need to find a way to help the middle class, and she may bring forward at that point the idea of some sort of a middle-class tax cut. Certainly if I was advising her I would look to have that as part of the discussion. And it would help if she outlined a jobs package or an economic package. It was interesting last week in her speech at the convention she did indicate that in the first hundred days she’d like to come forward with an economic package. I would think that’s going to be a combination of tax and other items that would have to be included there.

Traub: I would add only one thing to what the other three have said, which is I think Secretary Clinton might also point out that Donald Trump’s plan is likely to be very beneficial to high-income individuals, including presumably to Donald Trump himself, and if he released his tax returns publicly, then it could be determined whether his proposed tax plans would be beneficial to him.