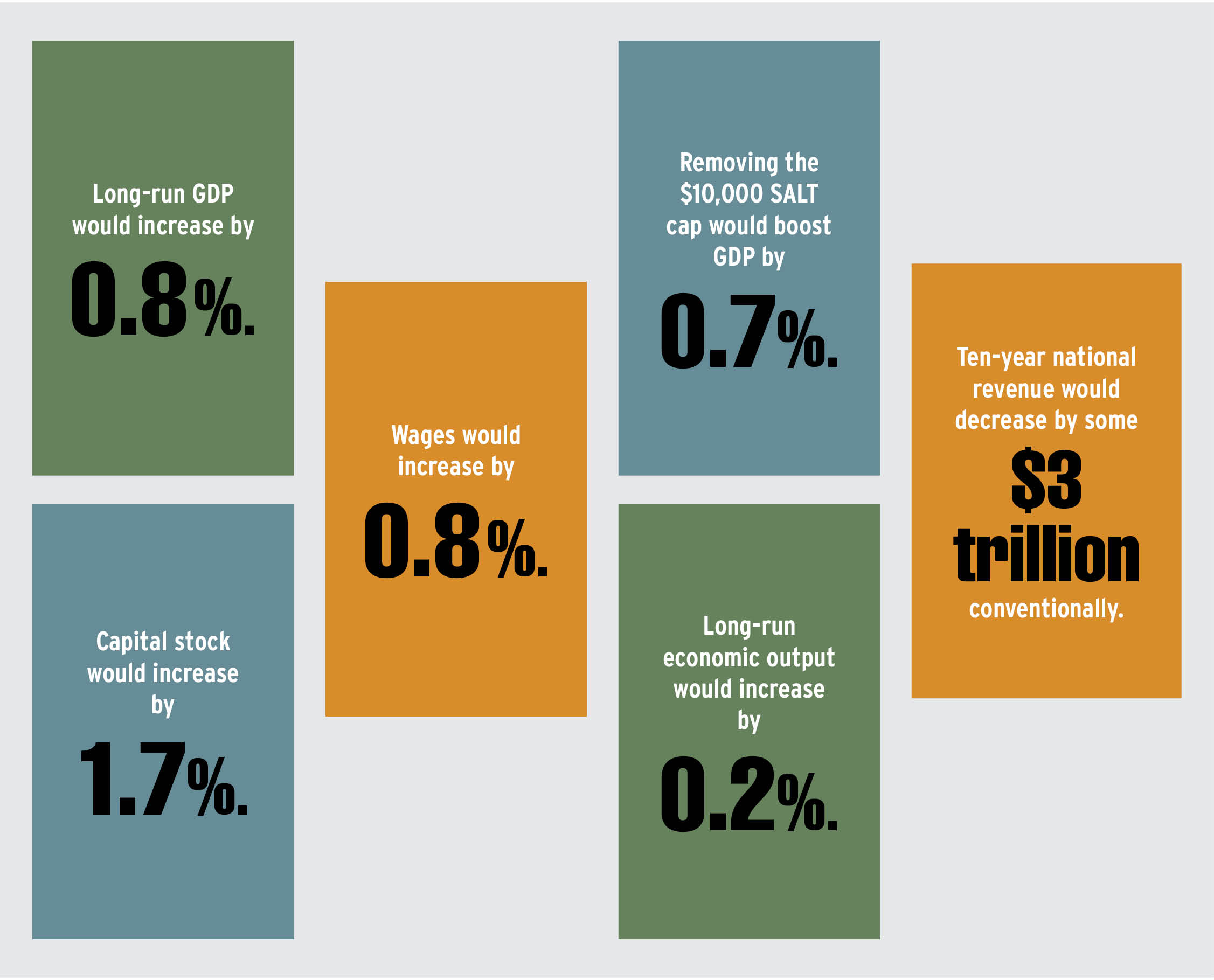

As anticipated, the new US presidential administration, under President Donald Trump, will aim to set in motion a set of policies—some familiar, some not as much—that could greatly affect in-house tax departments. Ahead of the US presidential election, the Tax Foundation broke down Trump’s tax proposals to evaluate the impact they’ll have on the US economy. Those include extending the expiring provisions of the Tax Cuts and Jobs Act, reenacting the deduction for state and local taxes, and repealing green energy tax credits, to name just a few.

This second Trump administration, with the support of a Republican-majority Congress, may very well have its way. With that in mind, below are what the Tax Foundation, through its General Equilibrium Model, estimates as effects of this next tax policy overhaul. For the full analysis, visit

www.taxfoundation.org/research/all/federal/donald-trump-tax-plan-2024.