The New LB&I

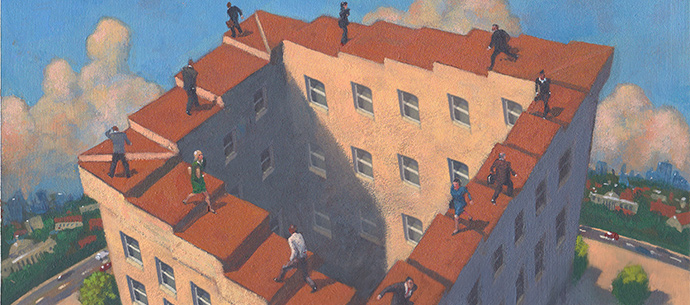

Recent IRS reorganization raises panoply of significant issues

For a large majority of business taxpayers and their in-house tax professionals worldwide, the Large Business & International Division (LB&I) of the Internal Revenue Service (IRS) represents the principal point of regular interface with the U.S. taxing agency. Thus, any changes, whether large or small, in scope, focus, or operation…

AI in the Tax Department: Getting Tax a Seat at the Table Artificial intelligence (AI) is reshaping business functions rapidly, yet many…

TEI Roundtable No. 51: The Future Corporate Tax Department As tax moves into the future, in-house professionals are experiencing…

The Impact of AI in R&D Tax Credits For the last several years we’ve heard that artificial intelligence…

Making Sense of CAMT Complexity The corporate alternative minimum tax (CAMT) under Section 55 of…

Question: What Are the Key Updates in the FASB Income Tax Disclosure Requirements? In 2023, the Financial Accounting Standards Board (FASB) issued Accounting Standards…

Breaking Down Real-Time Controls in Global Tax As governments implement digital approaches to tax filing, reporting, operations,…