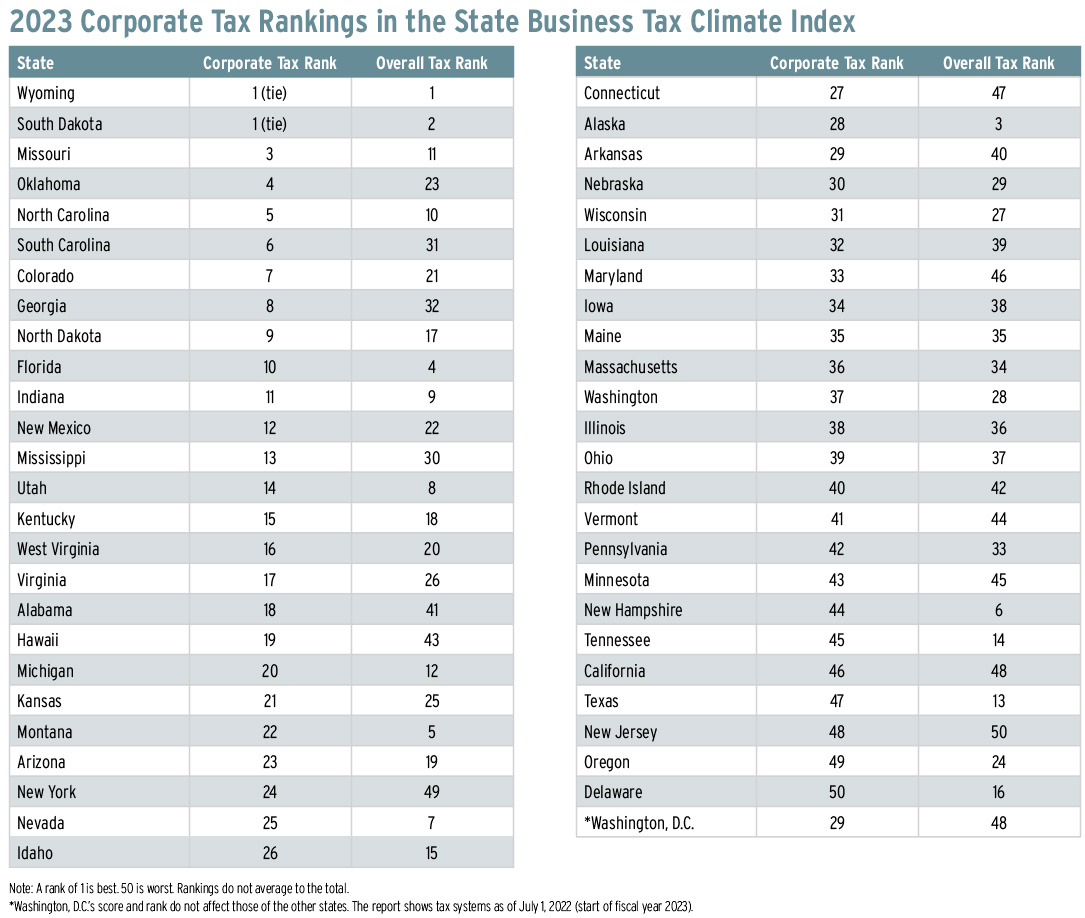

The Tax Foundation’s State Business Tax Climate Index is intended to show how well state tax codes stack up against those of other states, with the goal to provide a road map to improve the system. Each year, the Tax Foundation updates the index and ranks the states. Among the top ten states overall, several stand out for not having one or more of the major taxes, such as corporate income tax, individual income tax, or sales tax. States in the bottom ten tend to have more complex tax systems with higher rates.

The index also ranks each state by component, including individual income tax, sales tax, property tax, unemployment insurance tax, and, of course, corporate tax. The corporate tax rankings, as well as the overall rankings, are highlighted below. To access the State Business Tax Climate Index and read about its methodology and why your state stands where it stands, visit https://taxfoundation.org/2023-state-business-tax-climate-index.

Source: Tax Foundation, State Business Tax Climate Index, https://taxfoundation.org/2023-state-business-tax-climate-index.