The Inflation Reduction Act of 2022 (IRA) greatly expanded energy-related federal income tax credits and created Internal Revenue Code Section 6418, which allows eligible taxpayers to transfer, or sell, certain clean energy tax credits to unrelated parties for cash.

One key area of due diligence when purchasing a tax credit is to ensure that the project complies with prevailing wage and apprenticeship requirements (PWA), which the IRA introduced to encourage a robust market for well-paying clean energy jobs. Clean energy projects that comply with PWA requirements receive a five-times multiplier on the value of tax credits. If a tax credit buyer purchases a credit that later is found not to comply with PWA requirements, the buyer will face a recapture of the increased tax credit amount.

Buyers of tax credits should understand PWA requirements and the documentation required to ensure compliance. Buyers should also mitigate the risk of recapture due to PWA noncompliance with careful due diligence, contractual protections (including provisions requiring the tax credit seller to compensate the buyer for PWA noncompliance), and tax credit insurance.

How the PWA Applies to Each Credit Type

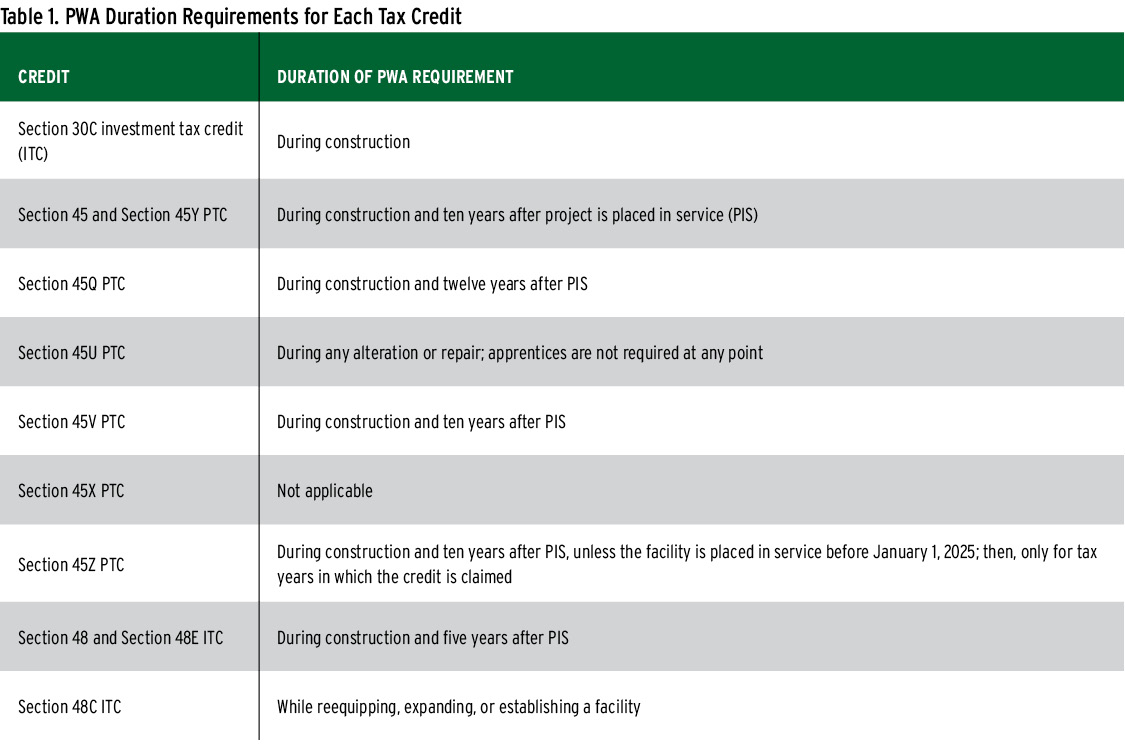

All but one of the IRA’s eleven transferable tax credits are subject to PWA requirements; the exception is the Section 45X advanced manufacturing production tax credit (PTC). Table 1 shows how long PWA compliance is required for each credit.

Projects that comply with PWA requirements receive a tax credit five times greater than non-PWA-compliant projects. For example, a solar project with a $100 million cost basis qualifies for a base tax credit amount of $6 million (assuming a Section 48 ITC). If the project meets PWA compliance, the tax credit amount increases to $30 million.

If a tax credit buyer purchases a credit that later is determined not to comply with PWA requirements, then the Internal Revenue Service will recapture the PWA multiplier portion of the credits, which is equivalent to eighty percent of the tax credit value—for example, $24 million of a $30 million credit. For Section 48 ITCs, the recapture is applied to the unvested portion of the credit (the ITC vests twenty percent annually over a five-year period).

As a result, buyers of tax credits must perform proper diligence on projects to ensure that the project will not later be found to fail to comply with PWA requirements.

Summary of Prevailing Wage and Apprenticeship Requirements

Prevailing Wage Requirements

Prevailing wage rules require that certain workers be paid a minimum prevailing wage specified by the US Department of Labor (DOL). The DOL publishes a list of prevailing wages on www.sam.gov according to geographic location, labor classification, and type of construction. It is also important to use the correct wage determination based on timing of work, which is primarily driven by when construction begins. If no applicable published wage rate is available, the taxpayer or project developer must request a supplemental wage determination from the DOL.

Apprenticeship Requirements

The apprenticeship rules require that a certain percentage of labor hours during construction, alteration, or repair for a project be performed by a qualified apprentice. The minimum percentage of hours that must be performed by qualified apprentices is:

- 12.5% for projects that began construction in 2023; and

- 15.0% for projects that begin construction in 2024 or later.

Two Exceptions to PWA Compliance

The IRA includes two general exceptions to PWA requirements—the “beginning of construction” exception and the “one megawatt” exception. Projects that meet one of these exceptions receive the five-times credit multiplier without necessarily paying prevailing wages and employing qualified apprentices. Specifically:

- Beginning of construction. Projects that began construction before January 29, 2023, are generally exempt from the wage and apprenticeship rules, except for credits under Sections 48C and 45Z; and

- One megawatt. Projects under Sections 45 and 48 (and their replacements under Sections 45Y and 48E) are exempt from PWA if the maximum net output is less than one megawatt or the capacity of electrical or equivalent thermal storage is less than one megawatt.

PWA Information Developers Should Collect and Maintain

In its August 2023 guidance, the Treasury provided a list of required and recommended documentation for PWA compliance. All documentation should cover every person working on the project, including contractors and subcontractors. Subcontractors may be several companies removed from the actual sponsor of the project.

Required PWA Information

According to the IRS guidance from August 2023, PWA documentation must include “payroll records for each laborer and mechanic (including each qualified apprentice) employed by the taxpayer, contractor, or subcontractor employed.”

Recommended PWA Information

The IRS also recommends collecting additional documentation. Nine of the recommended items relate to wages—including the name, Social Security number, address, and email address for each laborer and mechanic—and five items relate to apprentices. Buyers should require this optional documentation, which can be found in Proposed Regulations Section 1.45-12(b) and (c).

Additionally, the PWA’s proposed labor requirements have significant overlap with the Davis-Bacon Act—a nearly century-old federal law. Some project developers document certified payroll, a practice required for federal projects subject to Davis-Bacon rules, although not required under the IRA. Each employee on the certified payroll must receive weekly payment for work performed and must have their legal name, address, correct job classification, rate of prevailing wage pay, daily hours worked, weekly hours worked, and amount paid clearly recorded on the required certified payroll report. Other project developers use the certified payroll form, WH-347, when compiling and maintaining payroll records.

Opportunity to Cure If a Project Fails to Comply

If a clean energy project claims an increased PWA credit value and the IRS later determines the project did not meet PWA requirements, the tax credit is not automatically reduced to the base rate. A deficiency can be cured within 180 days after the IRS identifies a failure.

The seller of the tax credit has a strong incentive to cure any PWA issues, as it typically signs an indemnity to compensate the buyer in the event of a recapture of tax credits. The seller is also closer to the underlying compliance issue. That said, the buyer should require the seller to provide notification of any failure to meet PWA requirements; the buyer may want to step in and make penalty payments on behalf of the seller if there is substantial doubt as to whether the seller will make the cure.

Requirements for Curing Prevailing Wage Deficiencies

To cure prevailing wage defects, the taxpayer or project developer must:

- pay the affected laborers or mechanics the difference between what they were paid and the amount they were required to have been paid (multiplied by three for intentional disregard), plus interest at the federal short-term rate (as defined in IRC Section 6621) plus six percent; and

- pay a penalty to the IRS of $5,000 ($10,000 for intentional disregard) for each laborer or mechanic who was not paid at the prevailing wage rate during the year.

Requirements for Curing Apprenticeship Deficiencies

To cure a failure to meet the apprenticeship requirements, project developers must pay a penalty of $50 multiplied by the total labor hours for which the apprenticeship requirements were not met. The amount of the penalty with respect to the apprenticeship requirements is also increased to $500 per labor hour if the IRS determines the failure was due to intentional disregard.

Buyers Have Several Tools to Mitigate the Risk of PWA Noncompliance

Buyers should proactively manage risk concerning PWA compliance. Buyers have three primary risk management tools at their disposal:

- comprehensive due diligence;

- properly structured tax credit transfer agreement (TCTA); and

- tax credit insurance.

Comprehensive Due Diligence

Proper and comprehensive due diligence is critical for tax credit purchasers.

Project developers currently document PWA in a variety of ways, from manual capture in spreadsheets to certified payroll systems to the use of third-party consultants.

Buyers should understand the process by which PWA information is tracked so they can reconstruct payment records in the event of an IRS challenge. Each contractor and subcontractor should have a system in place to document payroll. In addition, proper records should be kept so workers who were underpaid can be located and compensated to cure any failure to meet PWA requirements.

In the case of the Section 48 ITC, the seller should also provide any information or compliance reports the IRS requires during the five-year recapture period.

Properly Structured TCTA

Buyers bear the risk of any reduction in tax credit amount due to noncompliance with PWA. Buyers should ensure that the TCTA includes sufficient indemnity from the seller in the event of PWA noncompliance. The indemnity should make the buyer economically whole, including the cost of any penalties.

In addition, the TCTA should include several other clauses that protect tax credit buyers:

- Representations and warranties. The seller has complied with or is exempt from all recordkeeping requirements relating to the PWA requirements;

- Indemnification. The seller’s indemnification obligations include any interest or penalties the IRS may impose because of PWA noncompliance;

- Conditions precedent to closing. The seller must furnish evidence the project has complied with PWA requirements; and

- Post-closing obligations. The seller will comply with all laws and regulations required to qualify for and receive the PWA multiplier, including making the necessary filings, registrations, and elections with the IRS.

For a more in-depth discussion of TCTAs, please see the article “Common Terms and Negotiating Points for Tax Credit Transfer Agreements,” available at www.reunioninfra.com/insights/tax-credit-transfer-agreement.

Purchase Tax Credit Insurance

Finally, tax credit insurance is available to mitigate the risk of noncompliance with PWA requirements. Tax credit insurance is recommended if the buyer has doubts about the ability of the seller to fulfill its indemnity obligation in the event of an IRS challenge. Tax credit insurance can be sized to make the buyer whole in the event that the IRA imposes a penalty.

Conclusion

For corporate taxpayers, transferable tax credits represent a new opportunity to reduce federal tax liabilities and achieve a strong risk-adjusted return while providing much-needed capital to clean energy projects. However, buyers are responsible for financial penalties imposed by the IRS due to noncompliance with PWA requirements. Tax credit buyers should proactively mitigate the risk of penalties with careful due diligence, contractual protections, and tax credit insurance, ensuring that they preserve the full financial benefit of their tax credit purchase.

Andy Moon is co-founder and CEO, Billy Lee is co-founder and president, and Denis Cook leads enterprise marketing, all at Reunion.