The definition of “pro rata share” in Section 951(a)(2) is fundamental to the subpart F regime. That regime, of course, dates to the John F. Kennedy administration.1 Most words in current Section 951(a)(2) do, too. Though Congress amended Section 951(a)(1) on numerous occasions, it has left undisturbed the words of Section 951(a)(2) first enacted in 1962.2 Perhaps, like so many tax practitioners, successive Congresses since then simply found Section 951(a)(2) inscrutable.

Section 951(a)(2) was susceptible to improvement even before the enactment of the Tax Cuts and Jobs Act (TCJA)3 in 2017. But it was in that law that Congress rolled out Section 245A, the keystone of the United States’ pseudo-territorial tax system for domestic subchapter C corporations.4 As this article details, in certain circumstances Sections 245A and 951(a)(2) arguably have permitted amounts of subpart F income, as well as tested income under the new GILTI regime, to escape US federal income taxation altogether. Congress might have avoided this result in the TCJA by limiting Section 245A in these circumstances or by modifying Section 951(a)(2). It did neither. The result has been less than ideal: an extraordinarily complex Treasury regulation5 and costly controversy between taxpayers and the government over the regulation’s validity.6

Enter the Build Back Better (BBB) legislation proposed in late 2021.7 As of this writing, enactment of the BBB legislation is far from assured. Many in Washington believe that a political compromise permitting enactment would not require changes to the revenue provisions in the legislation (including the proposed amendments to Section 951(a)). Draft legislation never dies, however, and even if the BBB legislation were not enacted, we believe that the proposed amendments to Section 951(a) would likely reappear in future tax legislation. As part of the BBB legislation, Congress would modify Section 951(a) substantially.8 The proposed Section 951(a) effectively would rectify (thankfully, only prospectively9) Congress’ failure to coordinate Sections 245A and 951(a) in the TCJA.10 But it would also go further, resolving over a half-century’s worth of ambiguities.11 Unfortunately, proposed Section 951(a) is also chockablock with new and confusing concepts—only partially due to their lengthy, unmemorable names (“pro rata current earnings percentage,” “nontaxed current dividend share”).12 In this article we hope to elucidate these concepts to provide the US-outbound tax practitioner with a basic guide to proposed Section 951(a).

Background

Section 951(a)(1) requires a United States shareholder (hereafter “US shareholder”) of a controlled foreign corporation (CFC) to include certain amounts in gross income on a current basis, thus preventing deferral of US tax on that income. A US shareholder’s “pro rata share of subpart F income” is one of the amounts that Section 951(a) obligates the shareholder to include in income.13 The US shareholder is subject to US taxation on this amount as if the CFC had distributed its subpart F income to the shareholder in the taxable year it earned the income—even if it does not actually make such a distribution.

Current Section 951(a)(2) defines a US shareholder’s “pro rata share” for this purpose. The “pro rata share” concept inheres as to the particular shares of stock of a foreign corporation that the shareholder owns (or is treated as owning).14 As we will describe in more detail, Section 951(a)(2) comprises three basic concepts that together determine a US shareholder’s pro rata share: 1) a hypothetical distribution of the CFC’s earnings and profits (E&P) to its shareholders (what we will call a “hypothetical distribution”), 2) a proration of subpart F income to reflect the portion of the year during which the foreign corporation was a CFC (a “CFC status proration”), and 3) a reduction to the pro rata share for certain dividends to another person (a “dividend to another”).

Similarly, Section 951A requires certain United States persons (hereafter “US persons”) owning stock of a foreign corporation during a taxable year to include currently in their gross incomes their respective global intangible low-taxed income (GILTI) inclusions.15 The amount of a person’s GILTI inclusion results from a formula for which the person’s pro rata shares of certain items from the foreign corporation are the key inputs.16 Section 951A links to Section 951(a)(2) for the definition of “pro rata share.”17 Accordingly, the GILTI regime also relies on the three concepts just identified.

Section 245A serves a different purpose. To the extent it applies, Section 245A effectively exempts from US taxation certain “foreign” E&P18 of qualifying foreign corporations. Specifically, an eligible domestic corporate shareholder of a foreign corporation that receives a dividend attributable to the foreign corporation’s “foreign-source” E&P20 generally is allowed an equal deduction under Section 245A.21 The deduction zeroes out the net income attributable to the dividend. Thus, for the corporate shareholder that derives foreign income through a foreign corporation, the US tax system can be characterized as a territorial regime. Section 245A, however, does not apply to a dividend unless the relevant E&P have somehow slipped, untaxed, through post-TCJA subpart F.22

Not long after the TCJA was enacted, some in the government recognized the consequences of Congress’ failure to coordinate Sections 245A and 951(a)—in particular, its failure to update the dividend-to-another concept in Section 951(a).23 Current Section 951(a)(2), both before and after the TCJA, expresses this concept: an “inclusion” US shareholder’s pro rata share of a foreign corporation’s subpart F income for a taxable year can be reduced where the corporation distributes a dividend in that taxable year to a person other than the inclusion shareholder (at a time during the taxable year when the inclusion shareholder does not own the stock).24 This is true even when the recipient of the dividend is not liable for any US tax whatsoever in respect of the dividend.25 Thereby, a portion of the foreign corporation’s subpart F income (namely, an amount equal to the reduction attributable to the dividend26) can escape US taxation. From this perspective, Section 245A represented more of the same: like a dividend to a foreign person, a dividend allowed a Section 245A deduction is not subject to US taxation but nevertheless can reduce another US person’s pro rata share of subpart F income. After the TCJA was enacted, some in Congress determined this result was inappropriate and proposed legislation to “correct” Section 951(a).27 Congress never passed the legislation.

Ultimately Treasury and the Internal Revenue Service acted to coordinate Sections 245A, 951, and 951A—by promulgating Treasury Regulations Section 1.245A-5(e) and (f), which together form the so-called extraordinary reduction rules.28 According to them, “[S]ection 245A and the subpart F and GILTI regimes . . . form an integrated set of rules to tax post-2017 foreign earnings.”29 Specifically:

[I]t would be inconsistent with the residual definition of [S]ection 245A eligible earnings [i.e., E&P remaining untaxed even after the application of the subpart F and GILTI regimes] and the interaction of [S]ection 245A and [those regimes] . . .

to allow a [S]ection 245A deduction for a dividend paid out of [E&P] attributable to subpart F income or tested income where such dividends[] . . . could result in double non-taxation of such income.30

Taxpayers that interpreted “the text of [S]ection 245A in isolation”31 could reach this inconsistent result. To prevent them from doing so, Treasury and the IRS promulgated the extraordinary reduction rules to address scenarios where they deemed that applying Section 245A would be inappropriate. The rule essentially renders Section 245A inapplicable to the extent that amounts would escape US taxation.32

In the latest proposals for the BBB legislation, a new Congress has proposed technical amendments to Section 951(a).33 This article focuses on the ramifications of these proposed amendments to Section 951(a). One might ask: with Section 1.245A-5 on the books, why would Congress bother to revise Section 951(a)? One possibility is that Section 951(a) is the more appropriate rule to amend; as described below, disallowing a Section 245A deduction in case of a dividend might cause more pain than warranted. Another possibility is that, with the validity of Section 1.245A-5 under attack at this very moment, a statutory fix is needed—one that would solidify Treasury’s authority.34 Finally, some might have determined that it is high time to tackle other irregularities in Section 951(a). Whatever the reasons, we now explore “proposed” Section 951(a), making reference to current Section 951(a), and describing those irregularities as we go.

Current vs. Proposed Section 951(a)

Section 951(a) as a Whole

Were the BBB legislation enacted, subsection (a) of Section 951 would remain titled “Amounts included.” US persons that constitute US shareholders with respect to the applicable foreign corporation would continue to do the including. The BBB legislation would not change the definition of “United States shareholder.” That term would continue to mean, as to a particular foreign corporation, a US person that owns (within the meaning of Section 958(a)), or is treated as owning pursuant to Section 958(b), at least ten percent of the stock of the foreign corporation, as measured by voting power or value.35 Determining whether a US person is a US shareholder, then, would still take into account stock ownership under both the rules of subsection (a) of Section 958 as well as those of subsection (b).36

Under both current Section 951 and proposed Section 951, a US shareholder of a foreign corporation (during an applicable taxable year of the corporation) would not be required to include any amount in income with respect to the corporation unless the US shareholder owned—within the meaning of Section 958(a)—shares of stock of the foreign corporation during the applicable year.37 Such shares of “Section 958(a) stock”38 of a US person encompass 1) the particular shares of stock that the person owns “directly”39 and 2) a proportionate amount of the particular shares of stock owned by a foreign corporation, partnership, or a trust or estate of which the US person is a shareholder, partner, or beneficiary, respectively (sometimes referred to as “indirect” ownership).40 Ownership pursuant to the rules of Section 958(b)—frequently called “constructive” ownership—does not affect the amount of a US shareholder’s pro rata share of subpart F income.41

Section 951(a)(1)

Similarities Between Current and Proposed Paragraph (1)

If revised as proposed, paragraph (1) would still serve as the operative rule of inclusion.42 The rule would still require that a foreign corporation constitute a CFC43 at some point during the corporation’s relevant taxable year—otherwise no inclusion to any shareholder would result.44 A US shareholder’s Section 951 inclusion (if any) for a taxable year of a foreign corporation would continue to comprise two components: the shareholder’s pro rata share of the corporation’s subpart F income for the taxable year (hereafter a “subpart F income inclusion”) and the shareholder’s Section 956 amount for the year (a “Section 956 inclusion”).45 As under current paragraph (1), a US shareholder would have a Section 956 inclusion with respect to a taxable year of a foreign corporation only if the shareholder owned Section 958(a) stock of the corporation as of the close46 of the last day during the taxable year on which day it constituted a CFC (its “last relevant day”47).48 Where a US shareholder had a Section 951 inclusion with respect to a taxable year of a foreign corporation, the rule would remain that the inclusion is taken into account in the shareholder’s taxable year in or with which the corporation’s taxable year ends.49

Because the rules governing a US person’s Section 956 inclusion would not change if Section 951(a) were revised as proposed, this article mainly focuses on the rules pertaining to subpart F income inclusions.

Differences Between Current and Proposed Paragraph (1)

Under current paragraph (1), a US shareholder of a foreign corporation can have a subpart F income inclusion with respect to a taxable year of the corporation (that is, for purposes of this article and with reference to current Section 951(a), the shareholder can be a current inclusion shareholder) only if the shareholder owned Section 958(a) stock of the corporation on the last relevant day of that year. This is one of two factors that combine to make current paragraph (1) a “hot potato” rule.50 As we describe below, proposed paragraph (1) generally would retain this hot potato rule. For reasons that will become clearer, however, it would also eliminate one of the necessary conditions for a subpart F income inclusion—namely, that a US person own Section 958(a) stock of a foreign corporation on the corporation’s last relevant day. Instead—again, as we explain below—a US person could have a subpart F income inclusion merely if the person 1) had been a US shareholder of the foreign corporation at any time during the relevant taxable year of the corporation and 2) owned Section 958(a) stock of the corporation on any day on which the corporation constituted a CFC.51

Section 951(a)(2)

Similarities Between Current and Proposed Paragraph (2)

Proposed paragraph (2) would continue to house the definition of the “pro rata share” term of art.53 Accordingly, paragraph (2) remains a critical provision for determining the amount of a US person’s subpart F income inclusion.

Differences Between Current and Proposed Paragraph (2)

Current paragraph (2) contains, in effect, the formula by which a US person’s subpart F income inclusion is calculated. The components of this formula are described in the sections of this article following this one—because in proposed subsection (a) of Section 951, those components would migrate from current paragraph (2) elsewhere.

Proposed paragraph (2) would become a mere waypoint—it would remain the site at which pro rata share is defined, but only insofar as it introduces two new terms of art, defined in subsequent paragraphs of Section 951(a): “general pro rata share” and “nontaxed current dividend share.”54 Under proposed paragraph (2), these constituent amounts of a US person’s pro rata share of subpart F income would depend on an initial distinction: whether the US person owns Section 958(a) stock of the CFC as of the close of that CFC’s last relevant day.

To the extent that a US person owns Section 958(a) stock of the CFC as of the close of the last relevant day of that CFC’s taxable year, the US person’s pro rata share of subpart F income with respect to those shares of stock would be its “general pro rata share,” defined in proposed paragraph (3). If a US person’s general pro rata share would be positive under proposed Section 951(a), in this article we refer to that person as a “general inclusion shareholder” (our term). A general inclusion shareholder is analogous to a current inclusion shareholder under current Section 951(a). We use the term “hot potato inclusion shareholder” to encompass both concepts simultaneously.

Conversely, if a US person owned Section 958(a) stock of a foreign corporation during its taxable year but did not own that stock as of the close of the corporation’s last relevant day, the US person’s pro rata share of subpart F income would be its “nontaxed current dividend share,” defined in proposed paragraph (4). We refer to a US person with a positive nontaxed current dividend share as a “dividend inclusion shareholder” (again, not in the legislative text).

Proposed paragraph (2) would provide that a US person’s pro rata share is the sum of its general pro rata share and its nontaxed current dividend share. Presumably, this is because a single US person, during a particular taxable year of a foreign corporation, could own certain shares of Section 958(a) stock of the corporation on its last relevant day and other shares of Section 958(a) stock of the corporation on other days, but not at the close of the last relevant day. The US person would constitute a general inclusion shareholder as to the former shares and a dividend inclusion shareholder as to the latter.

Proposed Section 951(a)(3)

Proposed paragraph (3) would define “general pro rata share” as a new term. The definition effectively would absorb the three concepts embedded in the pro rata share formula in current paragraph (2)—the “hypothetical distribution,” “CFC status proration,” and “dividend to another” concepts. But it would tweak them a bit and introduce some new, unfamiliar names. As a reminder, only a US person that owned Section 958(a) stock of a foreign corporation as of the close of the corporation’s last relevant day in a taxable year could have a general pro rata share as to that taxable year. Where (presumably) it was intended that a US person’s general pro rata share would closely resemble today’s pro rata share, it’s unsurprising that the new term would incorporate these three concepts.

Similarities Between Current Section 951(a) and Proposed Paragraph (3)

In the big picture, a US person’s general pro rata share under proposed paragraph (3) would be the amount it would receive in a hypothetical distribution of the foreign corporation’s E&P, prorated based on the foreign corporation’s CFC period, then reduced by the amount of certain dividends to another person. Sound familiar? The general pro rata share formula is fundamentally the same as the current pro rata share formula; despite all the fresh ink, the changes would have an impact only in limited circumstances.

Most of the time, computing a US person’s general pro rata share of a foreign corporation’s subpart F income for a particular taxable year could be distilled into these steps:

- Take the corporation’s total subpart F income for the taxable year.

- Reduce total subpart F income by aggregate “nontaxed current dividend shares,” a new concept with no analogue under current Section 951(a). Let’s skip this term for now; we’ll come back to it when we cover proposed paragraph (4), which defines it.

- Subject the resulting amount to CFC status proration: If the foreign corporation was a CFC on each day during the taxable year, do nothing to the amount. Otherwise, multiply the amount by a fraction, the numerator of which is the number of days on which the foreign corporation was a CFC and the denominator of which is the total days in the corporation’s taxable year.

- Determine the US person’s “pro rata current earnings percentage,” another new term that stands for a (more) familiar concept. Under current law (albeit in a Treasury regulation), to determine a US person’s pro rata share, one must simulate a hypothetical distribution on its last relevant day of the foreign corporation’s “allocable” E&P, unreduced by any actual distributions.55 In effect, a fraction is derived from the combination of 1) the amount that the US person would receive, with respect to its Section 958(a) stock, in that hypothetical distribution (the numerator) and 2) total, unreduced allocable E&P (the denominator).56 A US person’s pro rata current earnings percentage would essentially be the same fraction—except, instead of allocable E&P, “ordinary” E&P generated in the applicable taxable year (that is, current-year E&P) would be used.57

- Whatever the (US person’s) pro rata current earnings percentage is (for example, twenty-

three percent), apply that percentage to the result in step 3.

These five steps would generate the US person’s general pro rata share—in most circumstances.58 It might be challenging to discern, but those steps are effectively identical to the steps implied in current Section 951(a) and the corresponding regulations.

Now for those less frequent circumstances. Our summary above covers proposed Section 951(a)(3)(A)(i), which would encompass the hypothetical distribution and the CFC status proration concepts. The third familiar concept (“dividend to another”) would find a home in proposed Section 951(a)(3)(A)(ii).

Under both current and proposed Section 951(a), the dividend-to-another concept would operate when, during a particular taxable year of a foreign corporation and with respect to particular shares of Section 958(a) stock of the corporation that the hot potato inclusion shareholder owns on the last relevant day, the corporation distributes a dividend on the shares to a person other than that shareholder.59 In those circumstances, the hot potato inclusion shareholder’s pro rata share of subpart F income is reduced. The amount of the reduction is the lesser of two amounts. The first amount is the amount of the dividend received by the other person(s). The second amount acts as a limitation on the dividend-to-another concept: this is the amount that the inclusion shareholder would receive on its Section 958(a) stock in a hypothetical distribution but that bears the same ratio to the foreign corporation’s subpart F income for the particular taxable year as the number of days on which the inclusion shareholder did not own the stock (within the meaning of Section 958(a)) bears to the total number of days in the taxable year.60 Proposed Section 951(a)(3)(A)(ii), however, would add bells and whistles, discussed in the following section.

Differences Between Current Section 951(a) and Proposed Paragraph (3)

Two principal differences distinguish current Section 951(a) and proposed paragraph (3): the concepts of “nontaxed current dividend share” and “pre-holding period dividend.”

We encountered the term “nontaxed current dividend share” in step 2 above, where it would have the effect of reducing a general inclusion shareholder’s general pro rata share. As for unpacking what it means, earlier we had kicked that can down the road. And we do it again here—we take it up in earnest below when describing proposed paragraph (4), which would define nontaxed current dividend share. Suffice it for now to confirm that, as the term indicates, a (positive) nontaxed current dividend share could arise when a portion of a dividend is not subject to US taxation due to one or more specified provisions. We also note that, despite the term, proposed Section 951(a) effectively would subject a (positive) nontaxed current dividend share to US taxation.

The concept of the pre-holding period dividend comprises the “bells and whistles” with which proposed paragraph (3) would augment the dividend-to-another concept. The only restriction that current Section 951(a)(2)(B) places on a dividend for that subparagraph to affect a pro rata share is that it be received by “any other person” (of course, with respect to the same shares of Section 958(a) stock). There is no condition that the dividend be sourced out of current-year E&P (the E&P attributable to the subpart F income or tested income at issue). There is no condition that the recipient be, for example, a US person or an entity not exempt from US taxation.61 In informal administrative guidance, the IRS even concluded that a dividend distribution to a foreign person after the last relevant day of a taxable year, but before the end of that year, could reduce the hot potato inclusion shareholders’ pro rata shares.62

In contrast, proposed paragraph (3) would add further conditions that must be satisfied if a dividend that is received by “any other person” were to reduce the general pro rata share of a general inclusion shareholder. The term that proposed paragraph (3) would use to denote a dividend that satisfied those conditions is “pre-holding period dividend.” With it would come some new conditions. To constitute a pre-holding period dividend, an otherwise qualifying dividend with respect to particular shares of Section 958(a) stock of a foreign corporation would need to:

- be sourced out of the corporation’s current-year E&P;63

- not constitute a “nontaxed current dividend” (if not self-evident, hang tight for proposed paragraph (4) below);64 and

- be received:

- by any United States person other than the general inclusion shareholder;65

- before the general inclusion shareholder owned (within the meaning of Section 958(a)) the particular shares;66 and

- at a time when the corporation was a CFC.67

To constitute a pre-holding period dividend, then, the dividend must (among other conditions) be received by a US person but not be a nontaxed current dividend.68 As will become clear when we explore that latter term, a dividend that did not fail at least one of the various conditions for a Section 245A deduction could not constitute a pre-holding period dividend.69

Proposed Section 951(a)(4)

Similarities Between Current Section 951(a) and Proposed Paragraph (4)

Unlike current Section 951(a), proposed Section 951(a) would have a paragraph (4). Paragraph (4) would define the term “nontaxed current dividend share.” As noted above, per proposed paragraph (2), the pro rata share of each dividend inclusion shareholder with respect to a foreign corporation for a taxable year would be the shareholder’s respective nontaxed current dividend share. A US person would be a dividend inclusion shareholder as to the corporation for that taxable year if (and only if):

- on at least one day during that taxable year, provided it was not the last relevant day,

- the corporation was a CFC;

- the US person was a US shareholder of the corporation; and

- the US person owned particular shares of Section 958(a) stock of the corporation;70

and

- also on a day during that taxable year (which could, but apparently need not, be a different day than the day in (1)):

- the corporation was a CFC; and

- a “nontaxed current dividend” was distributed with respect to shares of stock then owned (within the meaning of Section 958(a)) by the US person.71

A nontaxed current dividend with respect to shares of stock would be an amount distributed with respect to those shares that:

- “would result”72 in a dividend out of current-year E&P,73 and

- either

- “would give rise”74 to a Section 245A deduction,75 or

- if received directly or indirectly by a foreign corporation, “would not result”76 in subpart F income to that recipient by reason of Sections 954(b)(4) (the subpart F “high tax” exception), (c)(3) (the “same country” exception to foreign personal holding company income), or (c)(6) (the “look-through” exception to foreign person holding company income [FPHCI] for related CFCs).77

As described below, a nontaxed current dividend share would be the portion78 of the total nontaxed current dividends, attributable to a dividend inclusion shareholder’s stock, that the shareholder would be required to include in gross income pursuant to proposed Section 951(a). Recall above that in step 2 of the formula for computing a general inclusion shareholder’s general pro rata share, the applicable corporation’s total subpart F income for a taxable year would be reduced by the aggregate amount of nontaxed current dividend shares. At a high level, the concept of nontaxed current dividend share would operate with respect to a dividend that would reduce a general pro rata share (by reason of the dividend-to-another concept)—but without a corresponding amount being included in gross income to another person.

Proposed paragraph (4) seemingly has no similarities with current Section 951(a)—which is technically accurate. But the concept of nontaxed current dividend share bears more than a passing resemblance to the extraordinary reduction rules in Treasury Regulations Section 1.245A-5(e) and (f). Proposed paragraph (4) would require a subpart F income inclusion with respect to a portion of a dividend that is effectively excluded from US taxation due to one of the provisions specified (including Sections 245A and 954(c)(6)). The extraordinary reduction rules presently operate similarly, at least concerning those two provisions. Rather than a “nontaxed” dividend’s prompting a subpart F income inclusion, however, the extraordinary reduction rules deny the recipient a Section 245A deduction or a Section 954(c)(6) exclusion to FPHCI (as applicable).80

Differences Between Current Section 951(a) and Proposed Paragraph (4)

Despite similarities between Treasury Regulations Section 1.245A-5(e) and (f) and the concept of a nontaxed current dividend, no analogue exists under current law for a dividend inclusion shareholder’s nontaxed current dividend share in proposed Section 951(a). By definition, that share would be the shareholder’s “nontaxed current dividend percentage” of the applicable foreign corporation’s total subpart F income for the relevant taxable year. A nontaxed current dividend is the portion of a dividend81 that is received with respect to stock of the foreign corporation and sourced from the foreign corporation’s current year E&P82 and that either: 1) would give rise to a deduction under Section 245A(a),83 or 2) because of a specified exclusion would not result in subpart F income of an upper-tier CFC, in the case of a dividend that is paid, directly or indirectly, with respect to stock of the lower-tier CFC that the dividend inclusion shareholder owns within the meaning of Section 958(a)(2).84 The specified exclusions are familiar: they are Section 954(b)(4), the high tax exception to subpart F income; Section 954(c)(3), the same country exception to FPHCI; and Section 954(c)(6), the related CFC look-through rule, respectively. Under current law, the extraordinary reduction rules apply only to deny the exclusion under Section 954(c)(6); a dividend denied under Section 954(c)(6) may nevertheless qualify under Section 954(b)(4) or (c)(3).

The nontaxed current dividend percentage would be a fraction, expressed as a percentage, of 1) the aggregate amount of nontaxed current dividends from the corporation attributable to the dividend inclusion shareholder’s Section 958(a) stock (the numerator) over 2) the corporation’s E&P for the taxable year, unreduced by any dividends (the denominator).

What is the upshot of all of these “nontaxed” definitions? Let’s take a step back. Where certain conditions were satisfied, a dividend inclusion shareholder would have a subpart F income inclusion. Among those conditions would be the distribution of a nontaxed current dividend on the shareholder’s Section 958(a) stock. The amount of the inclusion (the shareholder’s nontaxed current dividend share) would not necessarily be equal to the total amount of any such dividends. Instead, it would bear the same proportion to that total as the applicable corporation’s subpart F income bore to its E&P for the taxable year. Thus, if the amount of the corporation’s subpart F income equaled half its E&P, the dividend inclusion shareholder’s nontaxed current dividend share would be only half the total amount of the shareholder’s nontaxed current dividends.

We noted above that the concept of nontaxed current dividend share would operate similarly to the extraordinary reduction rules. There would be at least two important differences, however—both of which would favor taxpayers.

First, when the extraordinary reduction rules apply today, Section 960 (which deems an inclusion shareholder to have paid certain foreign income taxes actually paid by the applicable foreign corporation) does not apply to taxes paid by the distributing foreign corporation.86 In the same circumstances, in contrast, proposed Section 951(a) would generate a subpart F income (or GILTI) inclusion to which Section 960 could apply. Accordingly, the inclusion might result in a (greater) foreign tax credit with which the dividend inclusion shareholder could offset its US tax liability for the inclusion.

Second, the extraordinary reduction rules can convert an amount that would have been taxable to a corporate current inclusion shareholder at an effective rate of 10.5 percent (given the Section 250 deduction with respect to GILTI inclusions) into gross income taxable to the recipient of the dividend at the full US tax rate for corporations (currently twenty-one percent).87 It seems likely that proposed Section 951(a), as applied to GILTI inclusions, would allow a dividend inclusion shareholder to treat the increased GILTI inclusion attributable to its nontaxed current dividend share as eligible for a Section 250 deduction (like the rest of its GILTI inclusion).

Proposed Section 951(a)(5)

Current Section 951 has no paragraph (5); in contrast, proposed Section 951(a) would include a paragraph (5) to define “last relevant day.” As explained earlier, the “last relevant day” would be the last day of a foreign corporation’s taxable year on which the foreign corporation is a CFC. Thus, the last relevant day of a CFC’s taxable year would be the last day of its taxable year, unless a transaction or two caused the CFC to “de-CFC” during the taxable year without the year’s having closed.

Proposed Section 951(a)(6)

We noted above that current Section 951 contains no specific delegation of authority to Treasury to promulgate regulations that deviate from the statutory text. This has been especially problematic after the enactment of the TCJA. Proposed Section 951(a) would add paragraph (6) to address this ostensible shortfall in authority. Proposed paragraph (6) would not only empower Treasury to promulgate regulations under proposed Section 951(a) “as may be necessary or appropriate to carry out the purposes” of that subsection but would also direct Treasury to do so (“shall prescribe”). In addition to this general instruction, proposed paragraph (6) would identify three explicit regulatory objectives for Treasury. Treasury would be enlisted to issue regulations or other guidance: to treat a partnership as an aggregate of its partners,88 to provide rules allowing a foreign corporation to close its taxable year upon a change in ownership,89 and to treat a distribution followed by an issuance of stock to a shareholder not subject to tax under this chapter in the same manner as an acquisition of stock.90

If Congress enacts the BBB legislation, it would be interesting to see how Treasury uses its new regulatory authority.

Conclusion

The operation of Section 951(a), as the BBB legislation proposes to modify it, is more familiar than one might expect at first glance. Proposed Section 951(a) would retain the major concepts underlying current Section 951(a), albeit with a number of important modifications, not to mention additional layers of complexity. The differences between current and proposed Section 951(a) uniformly relate to new provisions in the latter that, conceptually, would serve one cause: ensuring that the “correct” amount of subpart F income (and tested income) is included in the gross income of some US person. More specifically, with respect to subpart F income (and tested income) allocable91 to a general inclusion shareholder’s Section 958(a) stock, proposed Section 951(a) would permit the general inclusion shareholder’s general pro rata share to be less than that allocable amount if, and only if, other US persons would be expected to be obligated to include the difference in their gross income (currently, by reason of a subpart F income inclusion or other provision). Some taxpayers, however, would be likely to experience proposed Section 951(a) as a welcome change: for example, when it would mitigate unexpected results under the extraordinary reduction rules in Treasury Regulations Section 1.245A-5. In that respect, if the BBB legislation, as currently proposed, were passed, it would be interesting to see how Treasury and the IRS address the extraordinary reduction rules. Proposed Section 951(a) would provide Treasury and the IRS greater flexibility to promulgate regulations anew for the appropriate application of the pro rata share rule.

Adam Becker, senior manager; Seth Gray, manager; and Allen Stenger, principal, are all members of EY’s National Tax Department (International Tax and Transaction Services) based in Washington, D.C.

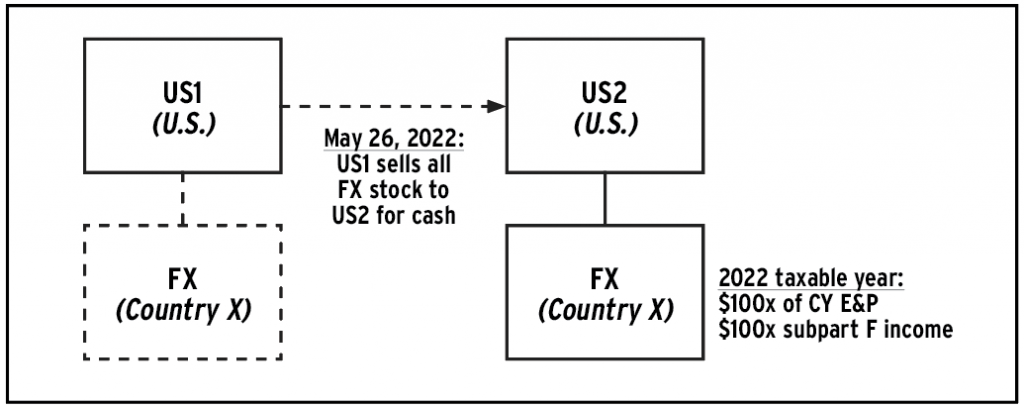

Sidebar: Example 1

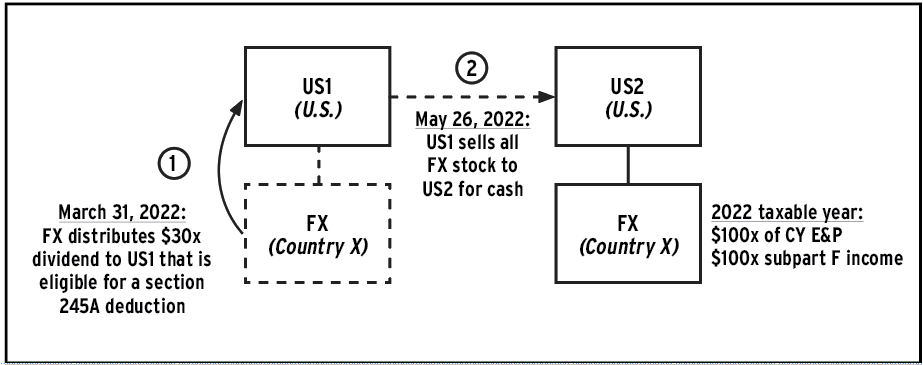

Example 1 illustrates the “hot potato” effect of determining pro rata share on the last relevant day of a CFC’s taxable year.

Facts. FX is a foreign corporation whose US taxable year is the calendar year. At the beginning of 2022, US1 (a domestic corporation) owns all of the outstanding FX stock. On May 26, 2022 (that is, two-fifths of the way through FX’s twelve-month taxable year), US1 sells all the FX stock to US2, an unrelated domestic corporation. No amount is characterized as a dividend to US1 under Section 1248 (because, for example, US1 recognizes no gain on any of the shares of FX stock). US2 owns the FX stock for the remaining three-fifths of 2022. During its 2022 taxable year, FY earns $100x of taxable income, resulting in $100x of current-year E&P, all of which is subpart F income. FX makes no distributions with respect to its stock, and holds no United States property,52 in 2022.

Result under current Section 951(a). Only US2 owns Section 958(a) stock of FX on its last relevant day in 2022 (December 31). US2, that is, holds the hot potato. US2 includes in income $100x, its pro rata share of FX’s subpart F income. US1 has no subpart F income inclusion.

Result under proposed Section 951(a). Again, only US2 owns Section 958(a) stock of FX on its last relevant day in 2022 (December 31). Whereas only US2 could have a subpart F income inclusion under current law, it would be possible for US1 to have a subpart F income inclusion under proposed Section 951(a). The relevant conditions, however, would not be satisfied here. US2 would have a subpart F income inclusion with respect to FX of $100x. US1 would have no inclusion.

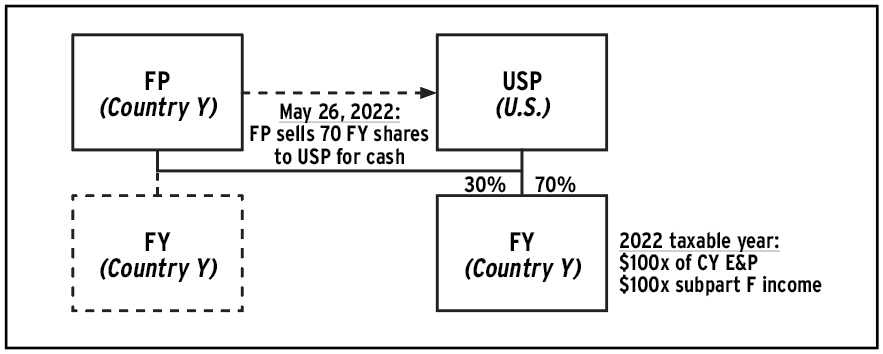

Sidebar: Example 2

Example 2 illustrates the CFC status proration and hypothetical distribution concepts.

Facts. FY is a foreign corporation whose US taxable year is the calendar year. FP, a foreign corporation, owns all 100 outstanding shares of the sole class of FY stock. On May 26, 2022 (that is, two-fifths of the way through FY’s twelve-month taxable year), FP sells seventy of the 100 shares of FY stock to USP, an unrelated domestic corporation. No amount is characterized as a dividend to FP under Section 1248 (because FP is not a US person). FY was not a CFC prior to the sale but becomes one once USP acquires seventy of the 100 shares of FY stock. During its 2022 taxable year, FY earns $100x of taxable income, resulting in $100x of current-year E&P, all of which is subpart F income. FY makes no distributions with respect to its stock, and holds no US property, in 2022.

Result under current Section 951(a). USP includes in income $42x, its pro rata share of FY’s subpart F income. This computation begins with FY’s $100x of subpart F income, which is first reduced by $40x because of the CFC status-proration rule (that is, $100x multiplied by 146/365, reflecting the two-fifths of FY’s 2022 taxable year during which it was not a CFC). The remaining $60x is treated as if it were distributed with respect to the 100 shares of FY. Because USP owns seventy out of 100 shares, USP would receive seventy percent of the hypothetical distribution, or $42x (that is, seventy percent of $60x).

Result under proposed Section 951(a). USP would include in income $42x, its general pro rata share of FY’s subpart F income. This computation begins with FY’s $100x of subpart F income, reduced by any nontaxed current dividend shares, of which there would be none because FY did not distribute a dividend in its 2022 taxable year. Next, this amount would be reduced by $40x to reflect the two-fifths of FY’s 2022 taxable year during which FY was not a CFC. Finally, the remaining $60x would be multiplied by a pro rata current earnings percentage of seventy percent, or $42x, which is USP’s proportionate right to the hypothetical distribution of FY’s $60x subpart F income.

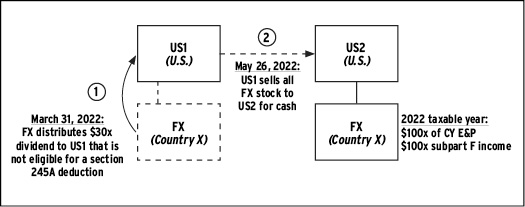

Sidebar: Example 3

Example 3 illustrates a pre-holding period dividend.

Facts. The facts are the same as in Example 1, except that FX distributes a $30x dividend out of current-year E&P to US1 on March 31, 2022. The dividend is ineligible for a Section 245A deduction (because, for example, the one-year holding period requirement in Section 246(c)(5) is not met).

Result under current Section 951(a). US1 has no subpart F income inclusion because it does not own any FX stock on the last relevant day of FX’s taxable year. The $30x dividend US1 receives from FX, however, results in net taxable income of $30x to US1 because there is no offsetting Section 245A deduction. US2 includes in income $70x, its pro rata share of FX’s subpart F income, calculated as FX’s $100x of subpart F income reduced by the $30x dividend paid to US1. The reduction equals the amount of the dividend, because $30x is less than the limitation of $40x (that is, $100x subpart F income multiplied by two-fifths, or 146/365 days during which US2 did not own the stock upon which the dividend was paid).

Result under proposed Section 951(a). US1 would have no general pro rata share because it would not own any FX stock on the last relevant day of FX’s taxable year. Further, US1 would not have a nontaxed current dividend share, because the $30x dividend would not give rise to a Section 245A deduction and thus would be taxable to US1. Again, the $30x dividend would result in net taxable income of $30x to US1. US2 would include in income $70x, its general pro rata share of FX’s subpart F income, calculated as FX’s $100x of subpart F income, reduced by a pre-holding period dividend of $30x. The $30x dividend would be a pre-holding period dividend because it 1) is received by a US person while FX was a CFC and before US2 owned the shares upon which the dividend was paid and 2) is not a nontaxed current dividend. As under current law, the limitation in proposed Section 951(a)(3)(A)(ii)(II) would not apply, because $30x of pre-holding period dividends is less than the limitation of $40x.

Sidebar: Example 4

Example 4 illustrates a nontaxed current dividend share.

Facts. The facts are the same as in Example 3, except that FX generates $200x of CY E&P and US1 is eligible for a Section 245A deduction for the full amount of the dividend.

Result under current Section 951(a). US1 has no subpart F income inclusion because it does not own any FX stock on the last relevant day of FX’s 2022 taxable year. But the $30x dividend US1 receives from FX results in net taxable income of $30x to US1 because there is no offsetting Section 245A deduction: the dividend gives rise to an extraordinary reduction amount of $30x under Treasury Regulations Section 1.245A-5(e) (that is, the extraordinary reduction rules). US2 includes in income $70x, its pro rata share of FX’s subpart F income, calculated as FX’s $100x of subpart F income reduced by the $30x dividend paid to US1. The reduction equals the amount of the dividend because $30x is less than the limitation of $40x, or $100x of subpart F income multiplied by two-fifths for the 146/365 days during which US2 did not own the stock upon which the dividend was paid.

Result under proposed Section 951(a)79 US1 would include in income $15x, its pro rata share of FX’s subpart F income. Its pro rata share would be its nontaxed current dividend share of $15x. US1’s nontaxed current dividend percentage would be US1’s nontaxed current dividend of $30x over FX’s $200x of E&P for its 2022 taxable year, expressed as a percentage (fifteen percent). Fifteen percent of FX’s $100x of subpart F income would be $15x. US1’s nontaxed current dividend share would not affect the application of Section 245A. US1 would be eligible for a Section 245A deduction equal to the $30x dividend. Accordingly, the entire $30x dividend would be a nontaxed current dividend. US2 would include in income $85x, its general pro rata share of FX’s subpart F income. That amount is computed by reducing FX’s subpart F income ($100x) by US1’s nontaxed current dividend share ($15x) and multiplying the result by a pro rata current earnings percentage of 100 percent.

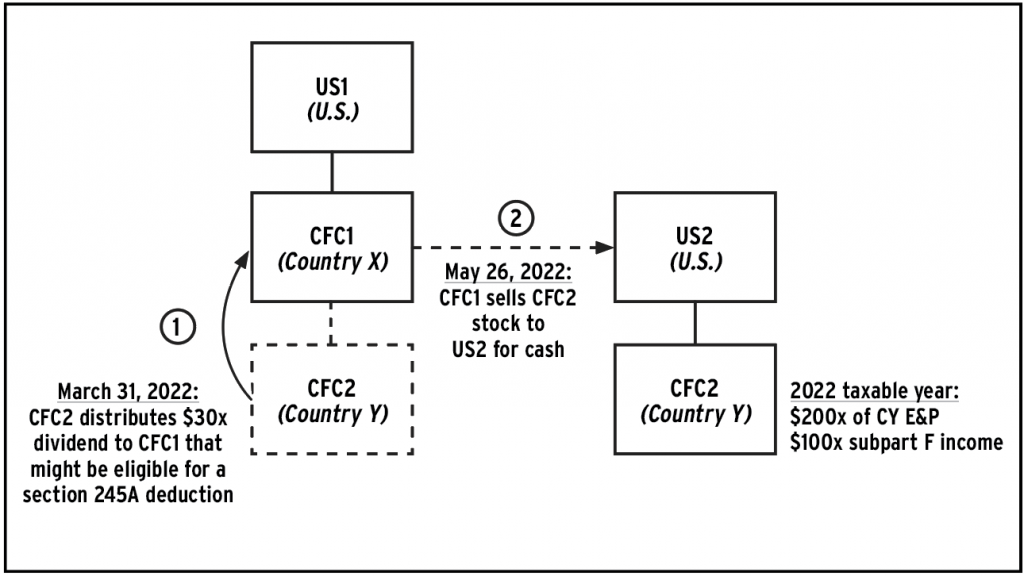

Sidebar 5: Example 5

Example 5 illustrates a nontaxed current dividend share in the context of a CFC-to-CFC dividend.

Facts. The facts are the same as in Example 4, except that US1 owns the stock of CFC2 indirectly through CFC1 prior to the sale. Thus, the $30x dividend is received by CFC1, not US1, and CFC1, not US1, sells the CFC2 stock to US2. It is assumed that, but for the extraordinary reduction rules, Section 954(c)(6) would apply to prevent the $30x dividend from constituting FPHCI to CFC1. No amount of US1’s gain on the sale is treated as a dividend for purposes of Section 964(e) (because, for example, CFC1 recognizes no gain in any of the shares of CFC2 stock).

Result under current Section 951(a). US1 has no subpart F income inclusion from CFC2. However, US1 has a subpart F income inclusion from CFC1 attributable to the $30x dividend. Section 954(c)(6) does not prevent this result, because the dividend gives rise to a tiered extraordinary reduction amount of $30x under the extraordinary reduction rules. US2 includes $70x in income, its pro rata share of FX’s subpart F income, calculated as FX’s $100x of subpart F income, reduced by the $30x dividend CFC2 distributes to CFC1.

Result under proposed Section 951(a).85 Similar to the result in Example 4, US1 would have a nontaxed current dividend share of $15x of CFC2’s subpart F income. The $30x dividend distributed by CFC2 to CFC1 would be a nontaxed current dividend because, by reason of Section 954(c)(6), the dividend would not result in subpart F income to CFC1. Separately, US2 would have a general pro rata share of $85x of CFC2’s subpart F income.

Endnotes

- P.L. 87-834, Section 12(a).

- In 1997, Congress added words to Section 951(a)(2), namely, the final sentence of Section 951(a)(2) (“For purposes of subparagraph (B), any gain included in the gross income of any person as a dividend under section 1248 shall be treated as a distribution received by such person with respect to the stock involved”). P.L. 105-34, Section 112(a)(1).

- P.L. 115-97.

- P.L. 115-97, Section 14101(a). Many tax practitioners had come to expect that Congress, as part of substantial tax legislation such as the TCJA, would adopt a territorial tax system (like the rest of the world). As we know, those practitioners were disappointed. Congress left the existing provisions in subpart F more or less untouched. But see, for example, Section 14212(b)(1)(A) (amending Section 951(a)(1)(A) to remove deadwood) and 14214(a) (adding a disjunctive “value” test to the definition of “United States shareholder” in Section 951(b)). Yet in the TCJA Congress added Section 951A (the GILTI regime), as shown in Section 14201(a) of the TCJA. Only CFC income that has not been included in a US shareholder’s gross income after running the gauntlet of the “upgraded” subpart F could give rise to a deduction under Section 245A.

- See Treasury Regulations Section 1.245A-5 (preceded by Temporary Treasury Regulations Section 1.245A-5T). In this article, a reference to Treasury Regulations Section 1.245A-5 is intended to encompass Temporary Treasury Regulations Section 1.245A-5T as well. In general, Treasury Regulations Section 1.245A-5 can deny a deduction under Section 245A to an otherwise eligible recipient of a dividend. See generally Treasury Regulations Section 1.245A-5(b)(1). Certain provisions, relevant here, operate when there has been a reduction (according to the criteria in those provisions) to the pro rata share of subpart F income or tested income corresponding to the shares of stock on which the dividend had been distributed. See Treasury Regulations Section 1.245A-5(e) and (f), setting out the so-called extraordinary reduction rules.

- See, e.g., Liberty Global, Inc., v. U.S., U.S.D.C. Colo., No. 1:20-cv-03501 (filed 2020).

- See, e.g., Build Back Better Act, H.R. 5376, 117th Congress (2021), updated by Staff of Senate Finance Committee, 117th Congress, Rep. on Build Back Better Act, H.R. 5376.

- In this article we focus on the Senate Finance Committee’s proposed changes to Section 951(a) (BBB Section 951(a), as amended). Build Back Better Act, H.R. 5376, 117th Congress (2021), updated by Staff of Senate Finance Committee, 117th Congress, Rep. on Build Back Better Act, H.R. 5376, Section 128129(c)(2)(A).

- The legislative proposal released by House Ways and Means Chairman Richard Neal (D-MA) on September 13, 2021, purported to apply retroactively. H.R. 5376, Section 138129(e)(2)(A) (effective as to “distributions made after December 31, 2017”).

- Id.

- Id.

- Id.

- Section 951(a)(1)(A).

- See Section 951(a)(2)(A) (“… distributed with respect to the stock which such shareholder owns (within the meaning of [S]ection 958(a)) …”) and (B) (“… received by any other person during such year as a dividend with respect to such stock …”) (emphasis added).

- Section 951A(a); Treasury Regulations Section 1.951A-1(b).

- Section 951A(b), (c), and (d); Treasury Regulations Section 1.951A-1(c) and (d).

- Section 951A(e)(1) (“The pro rata shares [referred to in Section 951A] … shall be determined under the rules of Section 951(a)(2) in the same manner as such Section applies to subpart F income”). The provisions containing the GILTI pro rata share rules sit in Treasury Regulations Section 1.951A-1(d). We observe that, far from applying in the “same manner” as Section 951(a)(2) applies to subpart F income, those rules apply very differently. See, e.g., Treasury Regulations Section 1.951A-1(d)(4)(i)(D) (“In lieu of applying [S]ection 951(a)(2)(B) and [S]ection 1.951-1(b)(1)(ii), the United States shareholder’s pro rata share of the tested loss . . . is reduced by an amount that bears the same ratio to the amount of the tested loss as the part of such year during which such shareholder did not own (within the meaning of [S]ection 958(a)) such stock bears to the entire taxable year”).

- See note 20 below.

- See Section 245A(a) (requiring that the corporation constitute a US shareholder with respect to the distributing foreign corporation).

- The portion of a dividend that is eligible for a Section 245A deduction is the “foreign-source portion.” Section 245A(a). In general, that portion is derived from E&P that are attributable to neither 1) income effectively connected with the conduct of a trade or business within the United States nor 2) a dividend distributed by a domestic corporation meeting certain requirements. Section 245A(c)(1), (2), and (3).

- Section 245A(a).

- Otherwise it would constitute previously taxed earnings and profits excludible under Section 959(a), and Section 245A would be irrelevant.

- See note 27 below.

- Section 951(a)(2)(B). The distribution must be with respect to the same shares of stock that the US shareholder owns (within the meaning of Section 958(a)) on the last day during the taxable year on which the foreign corporation is a CFC. See note 14 above and corresponding text.

- See, e.g., Treasury Regulations Section 1.951-1(b)(2)(iv) (Example 3) (inclusion shareholder A’s pro rata share of the subpart F income of foreign corporation M is reduced to reflect a dividend distributed by M to B, a nonresident alien individual, with respect to the shares of M stock that A subsequently acquired from B); see also IRS Technical Advice Memorandum 9538002 (similar).

- The amount of the reduction can be an amount that is less than the dividend amount. See Section 951(a)(2)(B).

- See Tax Technical and Clerical Corrections Act Discussion Draft (2019), https://waysandmeansforms.house.gov/uploadedfiles/tax_technical_and_clerical_corrections_act_discussion_draft.pdf.

- T.D. 9865, 84 FR 28398 (June 18, 2019) (promulgating Temporary Treasury Regulations Section 1.245A-5T); T.D. 9909, 85 FR 53068 (August 27, 2020) (promulgating Treasury Regulations Section 1.245A-5).

- T.D. 9865, 84 FR 28398 (June 18, 2019) at 28402.

- Id.

- Id. at 28399.

- See note 5 above.

- See note 7 above.

- See note 6 above and corresponding text.

- Section 951(b).

- See Section 958(b) (Section 318(a) shall apply, inter alia, to the extent that the effect is to treat any US person as a US shareholder).

- Under current Section 951, the US shareholder must own the stock (within the meaning of Section 958(a)) on the last day during the particular taxable year of the foreign corporation in which it is a CFC. Section 951(a)(1) (discussed in greater detail below). Under BBB Section 951, it would not be necessary for a US shareholder to own stock (within the meaning of Section 958(a)) on that last CFC day, but at a minimum at some time during the particular taxable year of the foreign corporation. BBB Section 951(a)(1) (also discussed below).

- Cf. Treasury Regulations Sections 1.951A-1(f)(4) and 1.965-1(f)(32) (defining Section 958(a) stock for purposes of Sections 951A and 965, respectively, but generally capturing our intended meaning here).

- Section 958(a)(1)(A).

- Section 958(a)(1)(B) and (2); see also Treasury Regulations Section 1.958-1. Stock may be owned within the meaning of Section 958(a)(2) through multiple foreign entities. See Section 958(a)(2) (“Stock considered to be owned by a person by reason of the application of the preceding sentence shall, for purposes of applying such sentence, be treated as actually owned by such person”). It cannot apply, however, through a domestic entity. Id.

- OK, with one exception: Section 958(b)(1) does not apply for purposes of Section 956(c)(2) to prevent a US shareholder from being treated as owning stock of a domestic corporation for purposes of Section 956(c)(2). Section 958(b) (flush language after repealed paragraph (4)).

- Paragraph would continue to be titled “In general” in BBB Section 951(a). Section 951(a)(1); BBB Section 951(a)(1).

- For completeness: A “controlled foreign corporation” (CFC) is a foreign corporation, more than 50 percent (when measured by voting power or value) of the stock of which is owned (directly, indirectly, or constructively) by one or more US shareholders “on any day” during the foreign corporation’s taxable year. Section 957(a).

- A subtle change is proposed, the significance of which (if any) is unclear: The condition of current paragraph (1) is that the foreign corporation constitute a CFC “at any time” during the taxable year; in BBB paragraph (1), those words would be replaced with “on any day.” Section 951(a)(1); BBB Section 951(a)(1).

- Section 951(a)(1)(A) and (B).

- Current Section 951(a)(1) requires a US shareholder to own the Section 958(a) stock “on” that last day. Again, the significance of this change is elusive. Pursuant to Treasury Regulations Section 1.951-1(f), a person holding stock of a foreign corporation at any time during a day is treated as holding the stock for the full day (and thus as of the “close” of that day). If stock changed hands twice on the last day on which the corporation were a CFC during its taxable year, theoretically, there could be two inclusion US shareholders. See Treasury Regulations Section 1.951-1(f). If Section 951(a)(1) were revised as proposed, and Treasury Regulations Section 1.951-1(f) were withdrawn, the revisions to Section 951(a)(1) would seem to eliminate this possibility.

- This is the term that would be introduced by BBB Section 951(a), and we adopt it in this article. See BBB Section 951(a)(5) (discussed below).

- Under current law it is less than clear whether a US person must be a US shareholder on that last day to have a Section 951 inclusion. On the one hand, Treasury Regulations Section 1.951-1(a)(1) and (2) appear to indicate that a US person need not be a US shareholder on that last day to have a Section 951 inclusion. On the other hand, current Section 951(a)(1) could be construed to apply only to US shareholders on that last day, and Treasury Regulations Section 1.951-1(b)(1) describes “a United States shareholder’s pro rata share.”

- Section 951(a)(1); BBB Section 951(a)(1).

- “Hot potato” in the sense, of course, that a US shareholder could acquire a share of stock of a foreign corporation on the day before the corporation’s last relevant day, and the shareholder would likely be the only current inclusion shareholder with respect to that share. Section 951(a)(1). The other factor is the absence in the definition of pro rata share (discussed below) of a provision that limits a US shareholder’s pro rata share of subpart F income based on the number of days during an applicable taxable year that the shareholder owned the share of stock (within the meaning of Section 958(a)). Section 951(a)(2) (instead, ownership of the share (within the meaning of 958(a)) on only the last relevant day can mean a pro rata share based on 365 days’ worth of subpart F income).

- BBB Section 951(a)(1)—which would contain the operative rule of inclusion and set forth necessary conditions for an inclusion—would read: “If a foreign corporation is a [CFC] on any day during a taxable year, every person who is a United States shareholder of such corporation, and who owns (within the meaning of [S]ection 958(a)) stock in such corporation on any such day, shall include …” (emphasis added). It seems to us that any “such” day ought to be interpreted as a day on which a foreign corporation is a CFC. BBB Section 951(a)(1).

- See Section 956(a)(1)(A) (“United States property” held by a foreign corporation is one of the critical inputs that determines a US shareholder’s Section 956 amount with respect to the corporation); Section 951(a)(1)(B) (requiring a Section 956 inclusion).

- It also would retain the title of current paragraph (2) (“Pro rata share of subpart F income”). Section 951(a)(2); BBB Section 951(a)(2).

- BBB Section 951(a)(2)(A) and (B).

- See Treasury Regulations Section 1.951-1(e)(1)(i). A foreign corporation’s allocable E&P for a taxable year is, in general, the amount that is the greater of 1) the E&P that the corporation generated in that year and 2) the sum of the corporation’s subpart F income and tested income in that year. Treasury Regulations Section 1.951-1(e)(1)(ii). The regulations adopt this convention because the amount of tested income in a taxable year can exceed E&P. See Notice of proposed rulemaking, 83 FR 51072, 51082 (denoted “current” E&P in the proposed Treasury regulation).

- Treasury Regulations Section 1.951-1(e)(1)(i).

- Why the switch? We are not certain, but here’s a guess: The concept of “allocable E&P” was created to allow Treasury Regulations Section 1.951-1 to accommodate its central role in determining a US person’s subpart F income inclusion and GILTI inclusion. See note 55 above. The BBB legislation proposes to make certain revisions to Section 951A (in addition to Section 951(a))—suggesting that they might permit the two types of inclusions to be computed more harmoniously. See Build Back Better Act, H.R. 5376, 117th Congress (2021), updated by Staff of Senate Finance Committee, 117th Congress, Rep. on Build Back Better Act, H.R. 5376, Section 128129(c)(2)(C) (modifying Section 951A(e) to provide that “pro

rata shares” of tested items under Section 951A

are “determined under rules similar to the rules of

[S]ection 951(a)(2)” [emphasis added]). - We consider those other circumstances after the examples immediately below.

- Essentially: the shares of Section 958(a) stock in question need to change hands during the particular taxable year; and during the period that the hot potato inclusion shareholder does not own the shares, another person must receive a dividend from the corporation with respect to those shares.

- Cf. Treasury Regulations Section 1.951-1(b)(1)(ii) and BBB Section 951(a)(3)(A)(ii). The dividend-to-another concept in current paragraph (2) can result in a reduction to the hot potato inclusion shareholder’s pro rata share in an amount that is less than the amount of the dividend to the other person. Section 951(a)(2)(B); Treasury Regulations Section 1.951-1(b)(1)(ii). In such a case, if the other person is a US person or otherwise subject to US tax in respect of the dividend, the excess of the dividend over the reduction is subject to US tax twice. BBB Section 951(a) would not eliminate this result.

- See note 25 above.

- IRS Technical Advice Memorandum 9538002 reached this conclusion peremptorily, apparently based on the absence of any restriction against a reduction in this scenario.

- BBB Section 951(a)(3)(C)(i).

- Id.

- BBB Section 951(a)(3)(C)(ii)(I).

- BBB Section 951(a)(3)(C)(ii)(II).

- Id.

- BBB Section 951(a)(3)(C)(i) and (ii)(I).

- See BBB Section 951(a)(4)(C)(ii)(I) and (II) (discussed below). There are numerous statutory and regulatory requirements for a Section 245A deduction. For example, a dividend is not eligible for a Section 245A deduction if it is received by 1) a US person that is not a domestic corporation (such as a US citizen or resident individual) or 2) a domestic corporation that is not a US shareholder with respect to the distributing foreign corporation. See Section 245A(a). The “US-source portion” of a dividend is not eligible for a Section 245A deduction. See 245A(a) and (c). And no Section 245A deduction is permitted in respect of a “hybrid dividend.” See Section 245A(e); Treasury Regulations Section 1.245A(e)-1.

- BBB Section 951(a)(1).

- See BBB Section 951(a)(4)(B)(i). It is unclear whether the shares of Section 958(a) stock on which a nontaxed current dividend was distributed must be the same as those shares held on the day described in BBB Section 951(a)(1). Compare BBB Section 951(a)(1) and (4)(B)(i).

- The use of the conditional mood of the verb here is curious. It might indicate that Congress would not permit an exception to eligibility for a Section 245A deduction (e.g., Section 245A(e)) to prevent a dividend’s constituting a nontaxed current dividend.

- Including an amount characterized as a dividend under Section 1248. BBB Section 951(a)(4)(C)(i).

- See note 72 above.

- BBB Section 951(a)(4)(C)(ii)(I).

- See note 72 above.

- BBB Section 951(a)(4)(C)(ii)(II).

- We assume for purposes of these examples that, were Congress to enact BBB Section 951(a), Treasury would withdraw Treasury Regulations Section 1.245A-5(e) and (f).

- Treasury Regulations Section 1.245A-5(e) (Section 245A) and (f) (Section 954(c)(6)). Treasury Regulations Section 1.245A-5(f) can render Section 954(c)(6) inapplicable to a dividend, but it cannot affect the availability of Section 954(b)(4) or (c)(3).

- The relevant portion would need not be the entire amount of a dividend. See BBB Section 951(a)(4)(C) (“. . . the portion . . .”).

- See BBB Section 951(a)(4)(C)(i) (including an amount characterized as a dividend under Section 1248, if attributable to current-year E&P).

- See BBB Section 951(a)(4)(C)(ii)(I).

- See BBB section 951(a)(4)(C)(ii)(II).

- See note 84 above. Forgoing that assumption, Example 5 illustrates the need for Treasury to withdraw or otherwise modify Treasury Regulations Section 1.245A-5(e) and (f) if BBB Section 951(a) became law. Specifically, if Treasury Regulations Section 1.245A-5(f) continued to apply, US1 would include its general pro rata share of CFC1’s subpart F income, including the $30x dividend, which would be denied Section 954(c)(6) treatment because it is a tiered extraordinary reduction amount. However, US2 would not reduce its general pro rata share by the $30x dividend (or any portion thereof) to the extent it is received by CFC1, which is not a US person, such that the $30x dividend is not a pre-holding period dividend. The result would be double US taxation of CFC2’s E&P that gives rise both to US1’s inclusion of CFC1’s subpart F income from the dividend (denied Section 954(c)(6)) and to US2’s inclusion of CFC2’s subpart F income (unreduced by the dividend-to-another concept).

- Pursuant to Section 960, an inclusion shareholder is deemed to have paid foreign income taxes actually paid by the foreign corporation from which the inclusion arises. Sections 960(a) and (d). As explained above, the extraordinary reduction rules deny the recipient a Section 245A deduction or a Section 954(c)(6) exclusion to FPHCI (as applicable). See note 80 above. The recipient has (more) net taxable income, but that is not the same as a subpart F income or GILTI inclusion. Without a subpart F income or GILTI inclusion, Section 960 does not operate.

- Where the extraordinary reduction rules render Section 245A or Section 954(c)(6) inapplicable to a dividend, a corporate US shareholder generally can be expected to have (more) net taxable income subject to US tax at a rate of twenty-one percent. Suppose a scenario in which the rules apply because a corporate inclusion shareholder’s pro rata share of tested income is being reduced due to the dividend-to-another concept in Section 951(a)(2)(B). See Treasury Regulations Section 1.951A-1(d)(2). If there were no reduction, the inclusion shareholder generally would be liable for US tax on the corresponding amount at an effective rate of 10.5 percent. See Section 250(a)(1)(B) (allowing a deduction equal to fifty percent of a corporate US shareholder’s GILTI inclusion).

- Where the extraordinary reduction rules render Section 245A or Section 954(c)(6) inapplicable to a dividend, a corporate US shareholder generally can be expected to have (more) net taxable income subject to US tax at a rate of twenty-one percent. Suppose a scenario in which the rules apply because a corporate inclusion shareholder’s pro rata share of tested income is being reduced due to the dividend-to-another concept in Section 951(a)(2)(B). See Treasury Regulations Section 1.951A-1(d)(2). If there were no reduction, the inclusion shareholder generally would be liable for US tax on the corresponding amount at an effective rate of 10.5 percent. See Section 250(a)(1)(B) (allowing a deduction equal to fifty percent of a corporate US shareholder’s GILTI inclusion).

- This evokes Treasury Regulations Section 1.958-1(d). This provision was originally proposed in June 2019, and finalized in January 2022. See Notice of proposed rulemaking, 84 FR 29114; T.D. 9960, 87 FR 3648. This provision treats a domestic partnership as an aggregate of its partners for purposes of Section 951(a). Thus, where a domestic partnership constitutes a US shareholder of a foreign corporation, but a US person that is a partner in the partnership does not constitute a US shareholder of that partnership, the partner neither has a Section 951 inclusion with respect to the foreign corporation nor a distributive share of such an inclusion to the partnership. The provision aligns Section 951 with Section 951A, which “ignores” domestic partnerships to this extent. See Treasury Regulations Section 1.951A-1(e).

- This instruction appears to correspond to Treasury Regulations Section 1.245A-5(e)(3), which allows a “controlling [S]ection 245A shareholder” to elect to cause a foreign corporation’s taxable year to close upon an extraordinary reduction. A similar rule under BBB Section 951(a) could provide taxpayers with the ability to opt into general inclusion shareholder status.

- Treasury Regulations Section 1.245A-5(e) seems to encompass this directive. The “identity” of a particular share of Section 958(a) stock is relevant to a US person’s pro rata share under both current and BBB Section 951(a). For example, a dividend to another with respect to a share of Section 958(a) stock owned by one hot potato inclusion shareholder does not reduce the pro rata share of a different hot potato inclusion shareholder that does not own that share of stock (within the meaning of Section 958(a)). The directive in BBB Section 951(a)(6)(C) is targeting a scenario in which shares of Section 958(a) stock that are different in form are the same in substance; Congress would be charging Treasury to draft a rule disregarding this formality. In Treasury Regulations Section 1.245A-5(e), Treasury defined an extraordinary reduction to include a scenario in which a shareholder might not have transferred the particular shares of Section 958(a) stock that it owned, but its pro rata share of subpart F income or tested income decreased nevertheless. See Treasury Regulations Section 1.245A-5(e)(2)(i)(A)(2). In addition, Treasury Regulations Section 1.245A-5(e) addresses the “not subject to tax” condition in the directive, by effectively reducing an extraordinary reduction amount to the extent that a US person’s pro rata share of subpart F income or tested income increased. See Treasury Regulations Section 1.245A-5(e)(2)(ii)(B).

- After accounting for CFC status proration. See BBB Section 951(a)(3)(A)(i).