Disruption has been the name of the corporate tax game of late. The upcoming 2025 tax cliff, ongoing implementation of the Organisation for Economic Co-operation and Development’s global tax plans, and ceaseless regulatory change—the “tax trifecta,” as KMPG calls it in its recent report, Tax Reimagined 2024: Perspective From the C-suite—persist in the minds of in-house tax professionals, all while conversations continue surrounding generative artificial intelligence, data-driven decision-making, and other potentially transformative technologies.

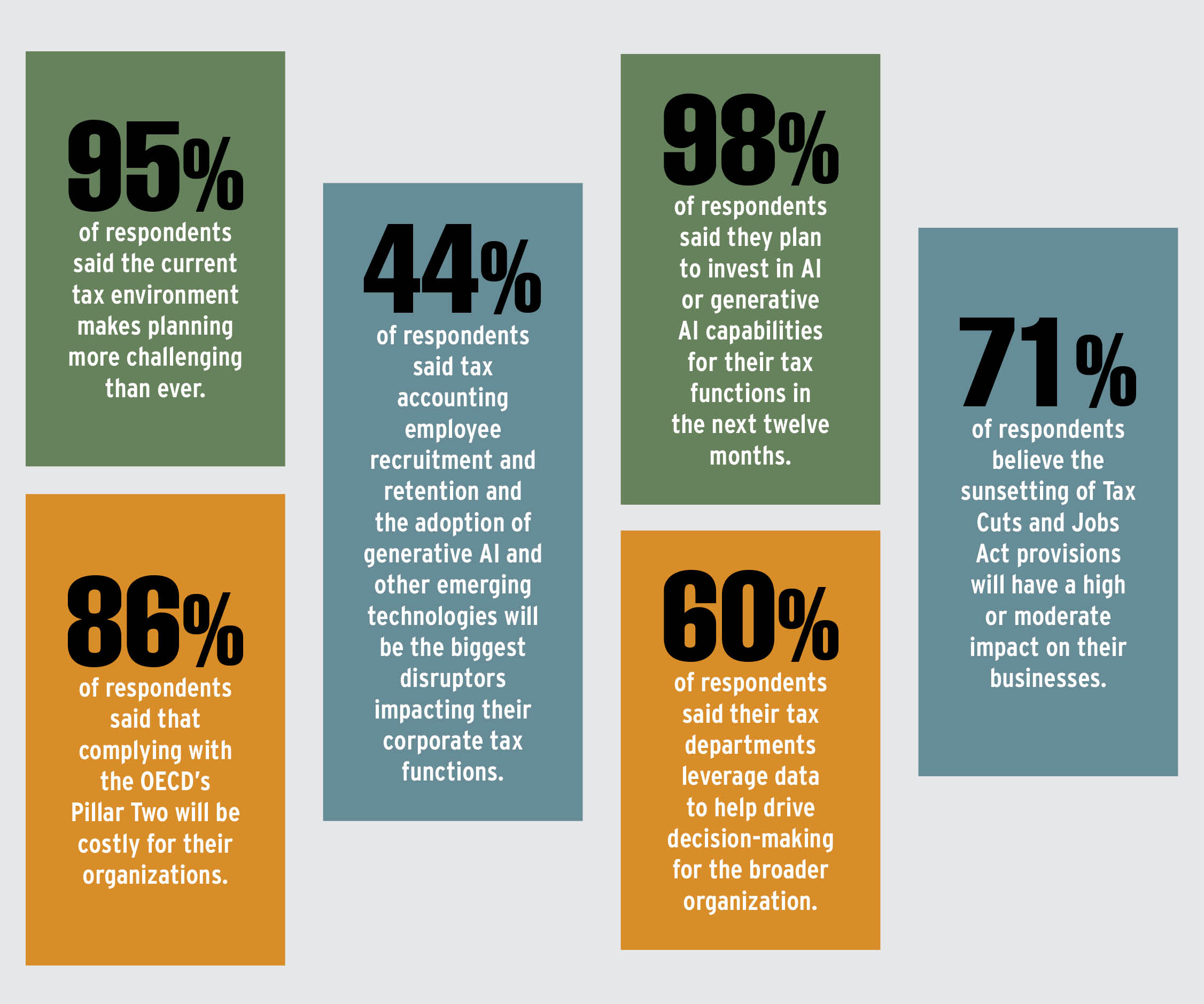

The KPMG report notes that its findings “reveal how tax departments are grappling with new complexities while also expanding their value proposition.” Below are a handful of those findings, which came from a survey of 500 C-suite executives at companies with annual revenues of $1 billion or more.

To explore KPMG’s Tax Reimagined 2024: Perspective From the C-suite further, visit kpmg.com/us/en/articles/2024/tax-reimagined-report-2024.html.

Source: KPMG, Tax Reimagined 2024: Perspective From the C-suite, kpmg.com/us/en/articles/2024/tax-reimagined-report-2024.html.