When the United States adopted the book minimum tax in July 2022 as part of the Inflation Reduction Act, it became clear that the country was not racing to implement Pillar Two issued by the Organisation for Economic Co-operation and Development in March 2022. But the enactment of the minimum tax on book income nonetheless showed that Congress was not prepared to let US multinationals feast on the benefits of tax deferral either.

As an overview, we use “Pillar Two” to refer to the OECD/G20 document titled Tax Challenges Arising from the Digitalisation of the Economy—Global Anti-Base Erosion Model Rules (Pillar Two) and a second document containing examples of those rules. In the executive summary, the OECD describes the first document as:

a co-ordinated system of taxation intended to ensure large multinational enterprise (MNE) groups pay a minimum level of tax on the income arising in each of the jurisdictions where they operate. It does so by imposing a top-up tax on profits arising in the jurisdiction whenever the effective tax rate, determined on a jurisdictional basis, is below the minimum rate.1

The minimum rate is defined as fifteen percent. OECD member states are expected to enact their own rules to meet Pillar Two requirements. OECD member states that meet these criteria are obligated to enforce the minimum tax, unless a higher-tier entity operating in that particular jurisdiction itself meets these criteria. As noted above, the US Congress could have enacted qualifying rules in July 2022 as part of the Inflation Reduction Act. But it did not do so, and instead enacted the comparatively simple rules of the so-called book minimum tax (which is generally acknowledged not to qualify under the Pillar Two rules).

While progress on implementing the global anti-base erosion rules (GloBE) by other OECD member states has not been particularly rapid, there is consensus that GloBE will eventually be implemented and that, once major countries have acted, there will be a domino effect of implementation. Although we do not rule out the possibility that the United States will be one of those dominoes, we are preparing ourselves for the contrary result, with the United States standing as an outlier while other nations plow ahead in a multilateral hunt for insufficient effective tax rates (ETRs) on a country-by-country basis.

In summary, Pillar Two requires the highest-tier compliant country to apply a specified process of five sequential steps:

- jurisdictional ETR = covered taxes/GloBE income

- top-up % = 15% minimum tax rate – jurisdictional ETR

- jurisdictional excess profit = GloBE income – substance-based income exclusion consisting of (5% x payroll) + (5% x tangible assets)

- jurisdictional top-up tax = (top-up % x jurisdictional excess profit) – qualified domestic minimum top-up tax (QDMTT); and

- allocation of top-up tax between low-taxed constituent entities within each jurisdiction.

This article primarily focuses on Step 1, specifically how laws governing controlled foreign corporations (CFCs), such as global intangible low-taxed income (GILTI), will affect these calculations. In particular, we address how taxes imposed on the ultimate parent entity of a CFC are allocated to the correct countries (for purposes of Step 1) whose ETRs are being tested under the five steps above. The definition of adjusted covered taxes does not specifically list “taxes imposed under a CFC regime” as a component of covered taxes. However, as Article 4.3.2(c) of Pillar Two makes clear, these taxes do apply:

in the case of a Constituent Entity whose Constituent Entity-owners are subject to a Controlled Foreign Company Tax Regime, the amount of any Covered Taxes included in the financial accounts of its direct or indirect Constituent Entity-owners under a Controlled Foreign Company Tax Regime on their share of the Controlled Foreign Company’s income are allocated to the Constituent Entity. . .2 [emphasis added].

The drafters evidently contemplated a rule based on “book conformity.” How exactly one determines the amount of US tax under Sections 951 and 951A that correlates to specific jurisdictions that generated the underlying income is not so clear. As an example, consider the following item often found in 10-Ks of US multinationals:

The significant components reflected within the tax rate reconciliation labeled “Tax differential on foreign income” include the effects of foreign subsidiaries’ earnings taxed at rates other than the US statutory rate, US taxes on foreign income and any net impacts of intercompany transactions. These items also reflect audit settlements or changes in the amount of unrecognized tax benefits associated with each of these items.

Stated differently, “there is something going on here, but we are not telling you exactly what we mean.” The drafters of Article 4.3.2(c) of Pillar Two, and the implementing members of the OECD, may want to spend a little more time cracking the secret code in which the financial statements are drafted before committing to this formulation of a rule.

Step 5 above specifies that there is an allocation of the top-up tax as computed in the first four steps, and in the preface to Article 5 of Pillar Two, the final bullet in the preface does specify “in proportion to their GloBE income” within each jurisdiction as the method of allocation. But there is no parallel step addressing how CFC taxes are attributed across multiple jurisdictions for purposes of the ETR test. This begs the question of what an implementing jurisdiction should consider in lieu of the “financial statement income by jurisdiction” test reflected currently in Article 4.3.2(c).

Approaches to Allocation

Let’s consider the following approaches to allocating CFC taxes to specific constituent entities:

- Jurisdictional income as shown in a country-by-country report and consistent with previously proposed US legislation that would have transformed the existing GILTI calculations into a country-by-country regime. The directions for IRS Form 8975 define “applicable taxes” as:a certified audited financial statement that is accompanied by a report of an independent certified public accountant or similarly qualified independent professional that is used for purposes of reporting to shareholder, partners, or similar persons; for purposes of reporting to creditors in connection with securing or maintaining financing; or for any other substantial nontax purpose.

- Jurisdictional GloBE income as determined when applying Step 1 above, which involves financial accounting income with common book-to-tax adjustments where the adjustment is justified on policy grounds.

- Jurisdictional excess profit as determined under Step 3 above, which is likely to allocate more of the CFC taxes to countries in which there is no significant substance. As noted above, this consists of GloBE less the substance-based income exclusion. The qualified business asset investment (QBAI) rule of Section 951A(d) carves out a “partially parallel” amount from GILTI in the sense that 1) jurisdictional payroll is not considered, and 2) the percentage applied is to both the payroll and asset components are half of the amount applied in determining QBAI. Nonetheless, it seems that failure to adjust for these exclusions would allocate more of the CFC taxes to jurisdictions that generate significant QBAI, which likely consists of jurisdictions in which the extra layer of tax is least needed to hit the fifteen percent mark.

- With respect to US-headquartered multinationals, the information reported on the US tax return (i.e., Form 5471 or the Section 951A(f)(2) allocation of GILTI previously taxed income to entities). If the “constituent entities” of a US multinational consisted only of CFCs, and no CFC held any transparent units or foreign branches, this kind of information would be proof positive of how US CFC taxes were imposed. However, these predicates, almost thirty years into the check-the-box regime (adopted December 19, 1995), are not likely to be true in many cases. The thought of foreign governments studying the US view of the taxpayer’s legal structure, of which foreign governments were presumably unaware back in 1995, is reason enough to reject this approach.

Before turning to our case study, we want to point out a provision of Pillar Two, Article 4.3.3, that seems intended to haircut the CFC taxes allocable to entities with passive income. The OECD defines passive income in a way that corresponds substantially to the US definition of foreign personal holding company income (FPHCI), but with none of the many important exceptions found in Internal Revenue Code Section 954. Any items of income that are excepted from FPHCI will be taxed as GILTI for US tax purposes. Oddly, the OECD’s definition applies only in the case of income that is subject to tax under a CFC regime or as a result of ownership in a hybrid entity.

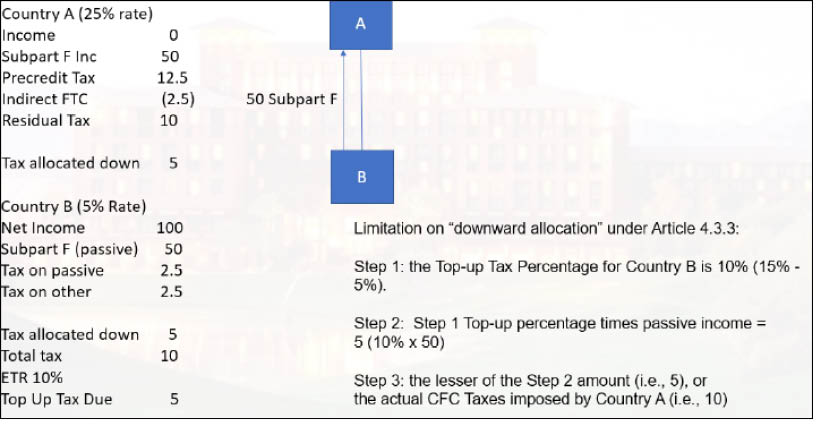

To clarify, we use “CFC regime” and “subpart F” (in the discussion of Figure 1 below) to refer to any situation in which a foreign country imposes a current period tax on income that would otherwise be deferred (or otherwise exempted) under that country’s laws. Thus, these are generic references rather than specific references to US income tax under IRC Sections 951 or 951A. (There is one later instance concerning a US parent company in which we refer to “US subpart F taxes,” and this does signify US tax imposed under those sections.)

Article 4.3.3 provides that, in determining ETR, any jurisdiction that has passive income can take account only of the lesser of two amounts: 1) the top-up percentage (fifteen percent minus the actual rate) multiplied by the CFC inclusion amount or 2) the amount of taxes paid with respect to the CFC inclusion.

Figure 1 shows our adaptation of one of the published Pillar Two examples,3 in which Company A owns Company B, and Country A has CFC rules under its domestic law. Country B imposes a 5 percent rate on 100 units of net income, half of which is subpart F income under the laws of Country A. Thus, 50 units of passive income multiplied by 10 percent yields 5 units, which is one point of comparison.

Country A has a 25 percent rate, with the result that the subpart F inclusion triggers a pre-credit tax in County A of 12.5 units. Because Country A allows an indirect credit for the Country B tax that has already been paid on the subpart F income (i.e., 2.5 units), the residual tax on the subpart F inclusion in Country A is 10 units. So 10 units is the other point of comparison, and 5 units wins out in the “lesser of” comparison above. If one allocated all of the 10 units down to Country B for purposes of testing its ETR, there would be 15 units of tax, and there would be no top-up tax. But by creating a separate category, the OECD is driving the actual ETR up to the sum of

1) 2.5 units of Country B tax on subpart F, 2) 10 units of Country A tax on subpart F, and 3) 5 units of top-up tax, for a grand total of 17.5 units. For the evident purpose of eliminating the “cross crediting” effect, the Pillar Two drafters would overlay the principles of IRC Section 904 on all the OECD member states.

What is unclear from the OECD example is exactly how the taxpayer benefits in the way of tax rates; there are still 17.5 units being paid on the 50 units of subpart F income to Countries A and B. And what the example does not say is that the “other basket” (which consists of Company B’s non-subpart F income) still needs to be topped up, has borne only 2.5 units of Country B tax, and still requires another 5 units of top-up tax to get to fifteen percent in the “other basket.”

We can hope that in implementing legislation under Pillar Two, OECD member states will see through all of this and conclude that rules intended to address base erosion have somehow been conflated with principles that the United States devised to prevent abuse of its own foreign tax credit. In the GloBE world, we submit, one should only be required to show that the requisite ETR is achieved. “Baskets of income” should not matter.

Case Study for Allocating CFC Taxes

Pillar Two contemplates that CFC taxes are included in measuring the blended ETR at the level of each country of operation, thus multinational enterprises need an approach for modeling the integration of Pillar Two and GILTI.

To illustrate such an approach, we offer the following case study fact pattern with hypothetical jurisdictional tax rates. Note that actual GloBE jurisdictional tax rates may differ as a result of required adjustments.

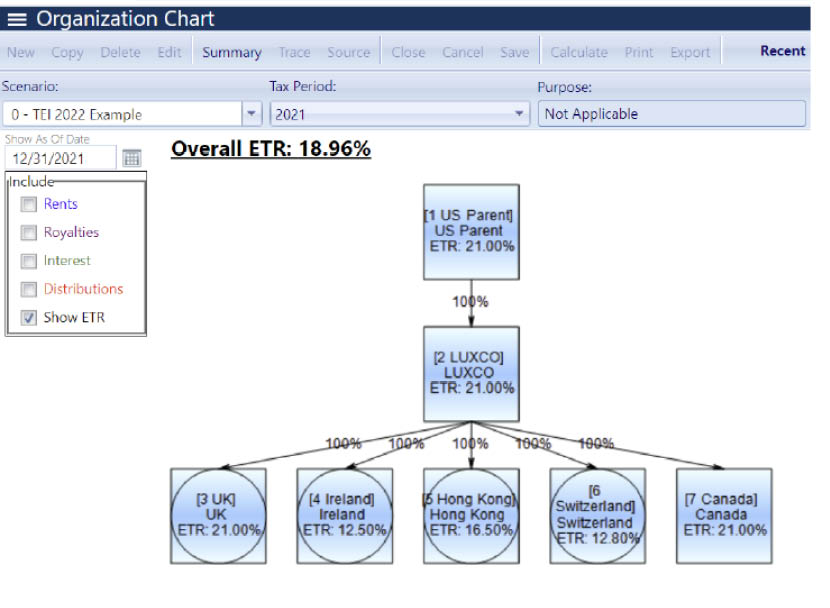

Figure 2 shows a US parent company that owns a Luxembourg company, which in turn owns five other international companies. Based on the assumption that the United States has not yet implemented Pillar Two legislation, and that Luxembourg has, the task falls to the Luxembourg entity to test the rates of the five constituent entities it owns in the United Kingdom, Ireland, Hong Kong, Switzerland, and Canada. Let us further assume that Luxembourg has chosen to base the allocation of US subpart F taxes on the income amounts shown in the country-by-country reports.

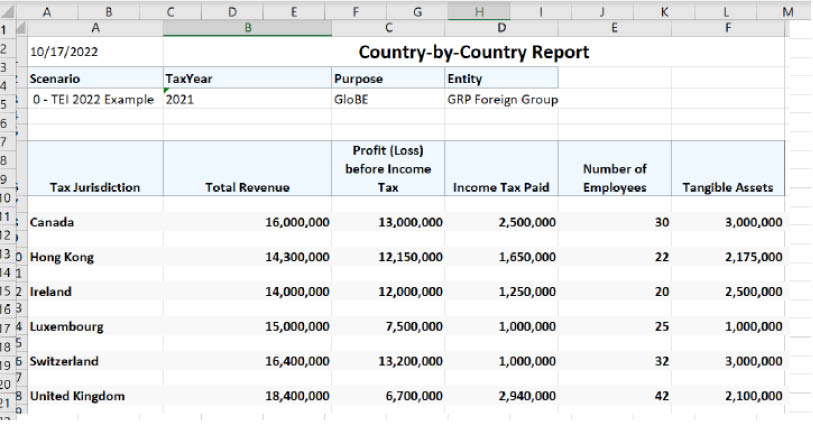

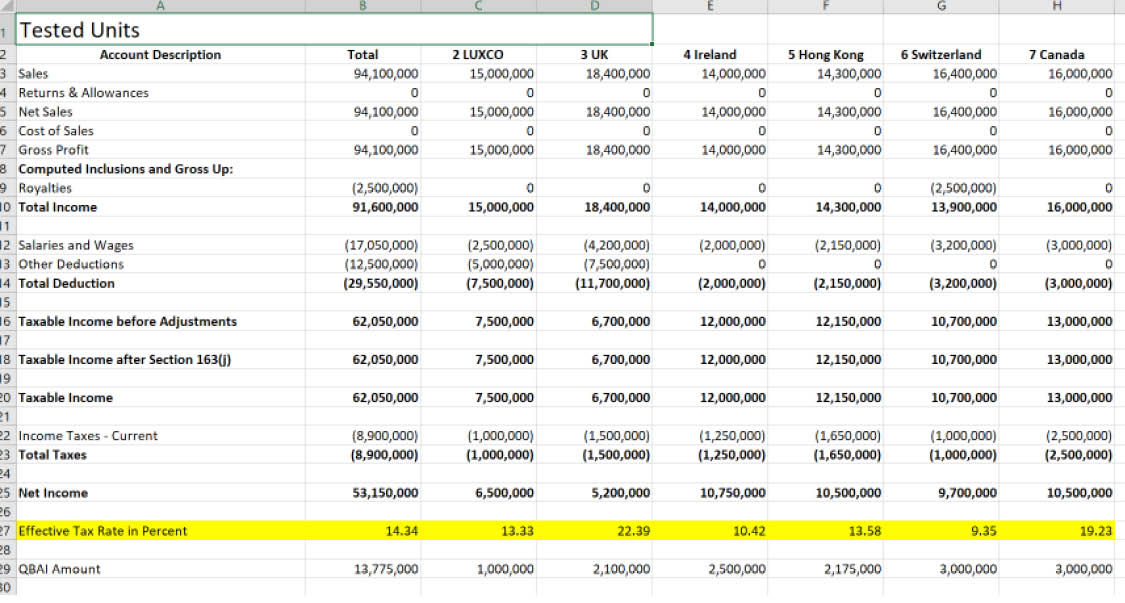

Figure 3 shows the relevant details for the five foreign country entities owned by the Luxembourg entity. Because its own attributes are relevant to the calculation, this is therefore a six-party allocation.

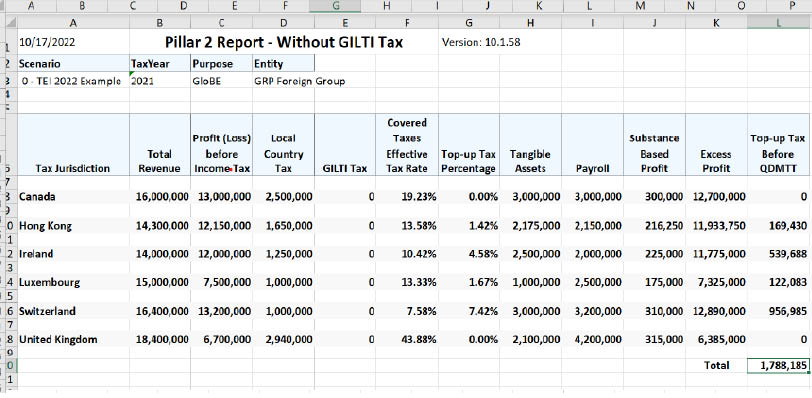

By substituting each constituent entity’s number of employees with its actual in-country payroll costs, it is possible to compute the substance-based income exclusion that converts GloBE into jurisdictional excess profits, as shown in Figure 4.

Note that the GILTI tax shown in Figure 4 is zero, which we have provided solely for the purpose of comparing the overall results with and without GILTI. As shown, there is an aggregate top-up tax of about 1.8 million units. Note that we are ignoring any qualified domestic minimum top-up taxes (QDMTT).

To show the impact of GILTI, in Figure 5 we have computed the liability based on the following amounts. For this purpose, we equated GILTI tested units as defined in Treasury Regulations Section 1.951A-7 with the OECD’s definition of constituent entities.

To simplify we have further assumed that none of this income is what Pillar Two defines as passive income, therefore the special limitation provided by Article 4.3.3 would not apply.

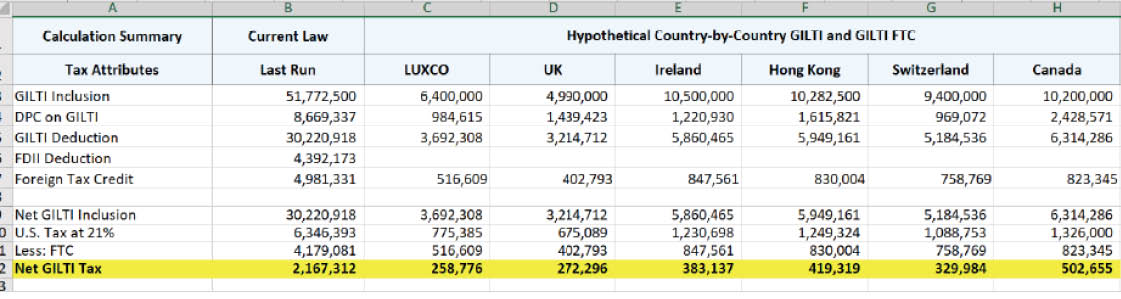

Figure 6 shows the computation of GILTI, the GILTI deduction, and the impact of FTCs, with the last row showing the amount of GILTI tax that would be allocated to each jurisdiction prior to calculating the jurisdictional ETR for that jurisdiction. The separate hypothetical country-by-country GILTI calculations are based on our interpretation of previously proposed US legislation.

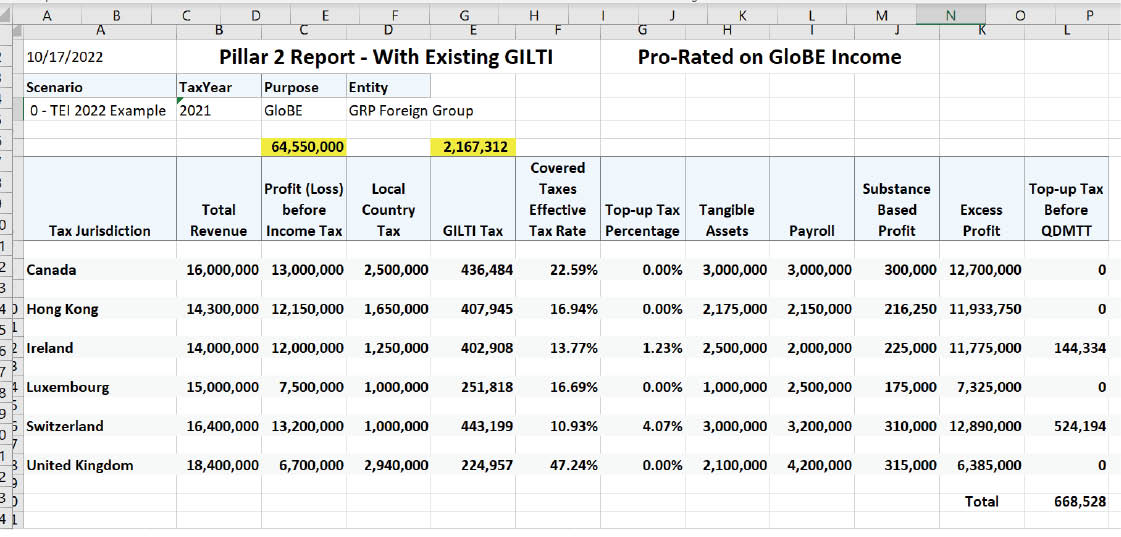

Having made this allocation, we can now calculate the top-up tax for the two jurisdictions that fall short of the fifteen percent test—Ireland and Switzerland—as shown in the “covered taxes effective tax rate” column in Figure 7.

Thus, the with and without GILTI comparison shows that the impact of pushing down the GILTI tax is more than one million of the hypothetical units. The total amount of top-up tax in this situation is $668,528.

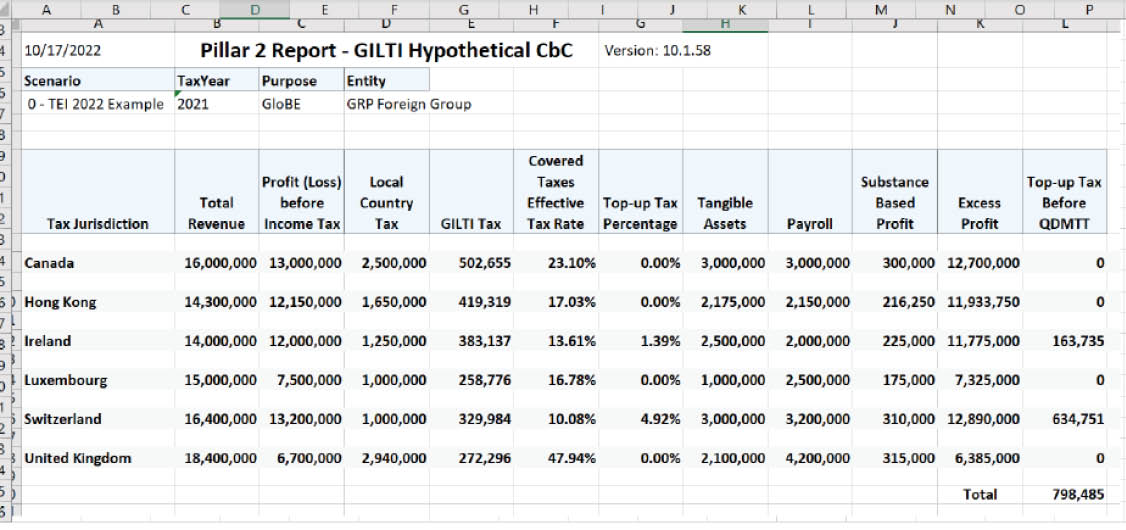

Figure 8 illustrates the impact of an allocation rule based on country-by-country reporting, which was proposed in prior US legislation. The total top-up tax under this method of allocation is $798,485, roughly $130,000 more than shown in Figure 7.

When we have discussed these rules, and the possible approaches that governments might take to the issue of allocation, the question has been posed about how it will work from an administrative perspective. For example, if a taxpayer has not completed its US tax return for a year, how can it prepare the foreign tax return on which GILTI will be claimed to establish the rate deficiency, if any, in ETR? Our answer has been that one must rely on estimates and amend as necessary to true things up when the final numbers are known. When foreign tax systems specifically take account of amounts shown on a US tax return, or when a foreign tax adjustment results in changes to the US foreign tax credit on the GILTI inclusion, the knock-on effects of such changes are going to register in multiple countries.

An extremely challenging future lies ahead for US-based multinationals.

Mark C. Gasbarra, CPA, is the national managing director and David Merrick, JD, is of counsel at Forte International Tax LLC.

Circular 230 disclaimer: Any tax advice included in this communication is not intended or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer.

Endnotes

- Organisation for Economic Co-operation and Development, Tax Challenges Arising From the Digitalisation of the Economy—Global Anti-Base Erosion Model Rules (Pillar Two): Inclusive Framework on BEPS (2021), www.oecd.org/tax/beps/tax-challenges-arising-from-the-digitalisation-of-the-economy-global-anti-base-erosion-model-rules-pillar-two.htm.

- Organisation for Economic Co-operation and Development, Tax Challenges Arising From the Digitalisation of the Economy—Global Anti-Base Erosion Model Rules (Pillar Two) (2021).

- Organisation for Economic Co-operation and Development,Tax Challenges Arising from the Digitalisation of the Economy—Global Anti-Base Erosion Model Rules (Pillar Two) Examples (2022), www.oecd.org/tax/beps/tax-challenges-arising-from-the-digitalisation-of-the-economy-global-anti-base-erosion-model-rules-pillar-two-examples.pdf.