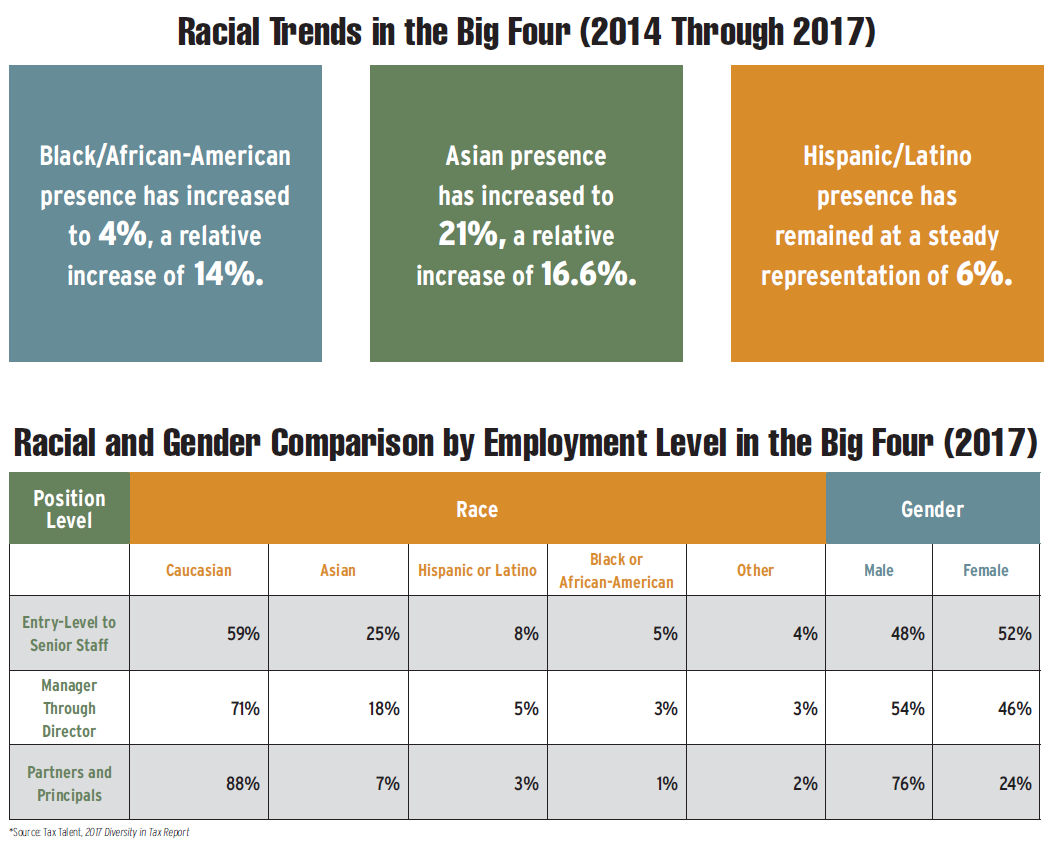

In December 2017, Tax Talent released its 2018 Diversity in Tax Report, which highlights diversity trends and, specifically, pinpoints racial and gender shifts in tax employment in 2017. Using Tax Talent’s database of corporate in-house tax professionals, combined with data from the U.S. Bureau of Labor Statistics, the American Institute of Certified Public Accountants’ 2017 Trends Report, and the Big Four public accounting firms—Ernst & Young, Deloitte, PricewaterhouseCoopers (PwC), and KPMG—the report indicates a gradual expansion in diversity overall, but not in more senior-, partner-, or principal-level roles. As Baby Boomers, who, in this industry, are generally represented by white males, retire and make way for the future, more diverse workforce, the overall trends will, it is hoped, become more prevalent in those higher-level positions. But let’s look at some current findings to see where we stand in 2018.

Managing Canadian Tax Risk The global tax environment has seen fundamental changes in recent…

Transfer Pricing in Transition Although states experienced significant tax revenue growth during the COVID-19…

The One Big Beautiful Bill Act In July 4, President Donald Trump signed into law the…

Beyond Automation: Why Having a Human in the Loop Is Critical for Sales Tax Compliance The allure of sales tax automation is undeniable. Many companies,…

TEI Holds Third International Tax Student Case Competition TEI held its third International Tax Student Case Competition at…

Natalie Friedman In recounting her education, Natalie Friedman points out that she…