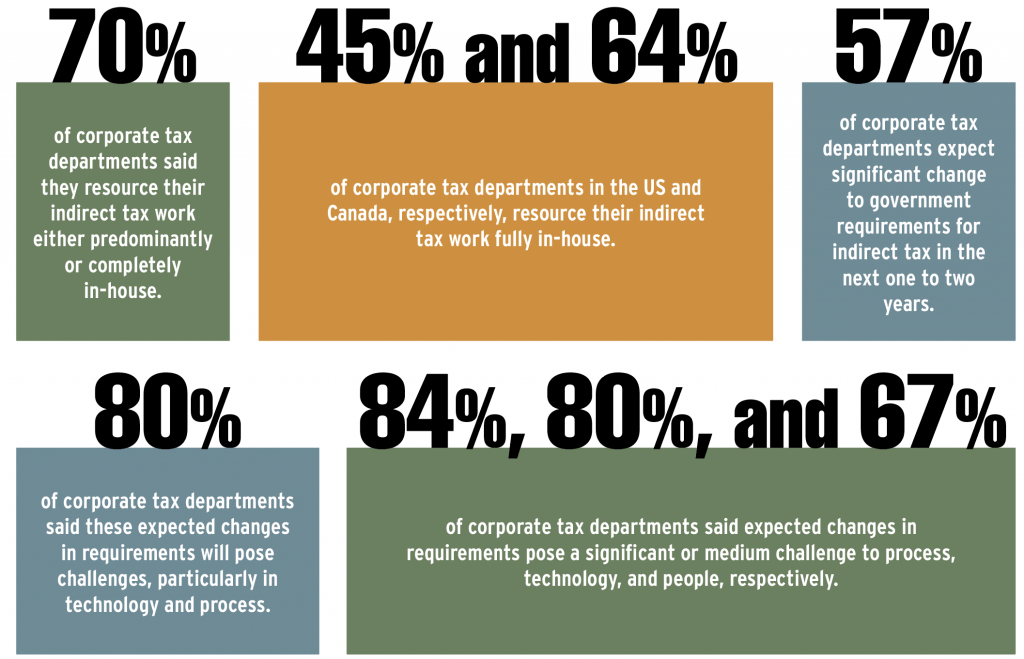

Around half of Thomson Reuters’ survey sample for its March 2021 Corporate Tax Department Report were tax departments with responsibility for indirect tax. Overall, according to the report, these departments indicated a belief that significant change is on the horizon, particularly pertaining to technology, processes, and human capital. In a follow-up survey, which was the basis of Thomson Reuters’ November 2021 Indirect Tax Report, tax managers from large companies around the world identified challenges within those expected changes and how companies can best address them. According to the Indirect Tax Report, the direction of indirect tax is clear: For businesses that operate internationally and offer multiple products and e-commerce channels, the indirect tax burden will rise.

Below are a handful of figures from the initial report that reflect the evolving state of indirect tax. To read more of Thomson Reuters’ findings in the 2021 Corporate Tax Department Report, visit tax.thomsonreuters.com/en/corporation-solutions/c/state-of-corporate-tax-2021-report. For a deeper dive into the state of indirect tax heading into a busy 2022 as well as advice on handling the myriad challenges afoot, visit tax.thomsonreuters.com/en/corporation-solutions/c/indirect-tax-report/form.

Source: Thomson Reuters Tax & Accounting, 2021 Corporate Tax Department Report and 2021 Indirect Tax Report, tax.thomsonreuters.com/en/corporation-solutions/c/state-of-corporate-tax-2021-report; https://tax.thomsonreuters.com/en/corporation-solutions/c/indirect-tax-report.