The March/April issue of Tax Executive highlighted some of this year’s state-level tax changes, including six states’ reduction of their corporate income tax rates. This issue, Tax Executive is looking to the Tax Foundation once again for insight into how states stack up against one another. Its State Business Tax Climate Index is “designed to show how well states structure their tax systems and provides a road map for improvement.” According to the index, a common factor in many of what it deems the top states is the absence of a major tax, such as a corporate income tax, individual income tax, or sales tax. The commonalities among the bottom states tend to be higher corporate income tax rates, high individual tax rates, and complex codes.

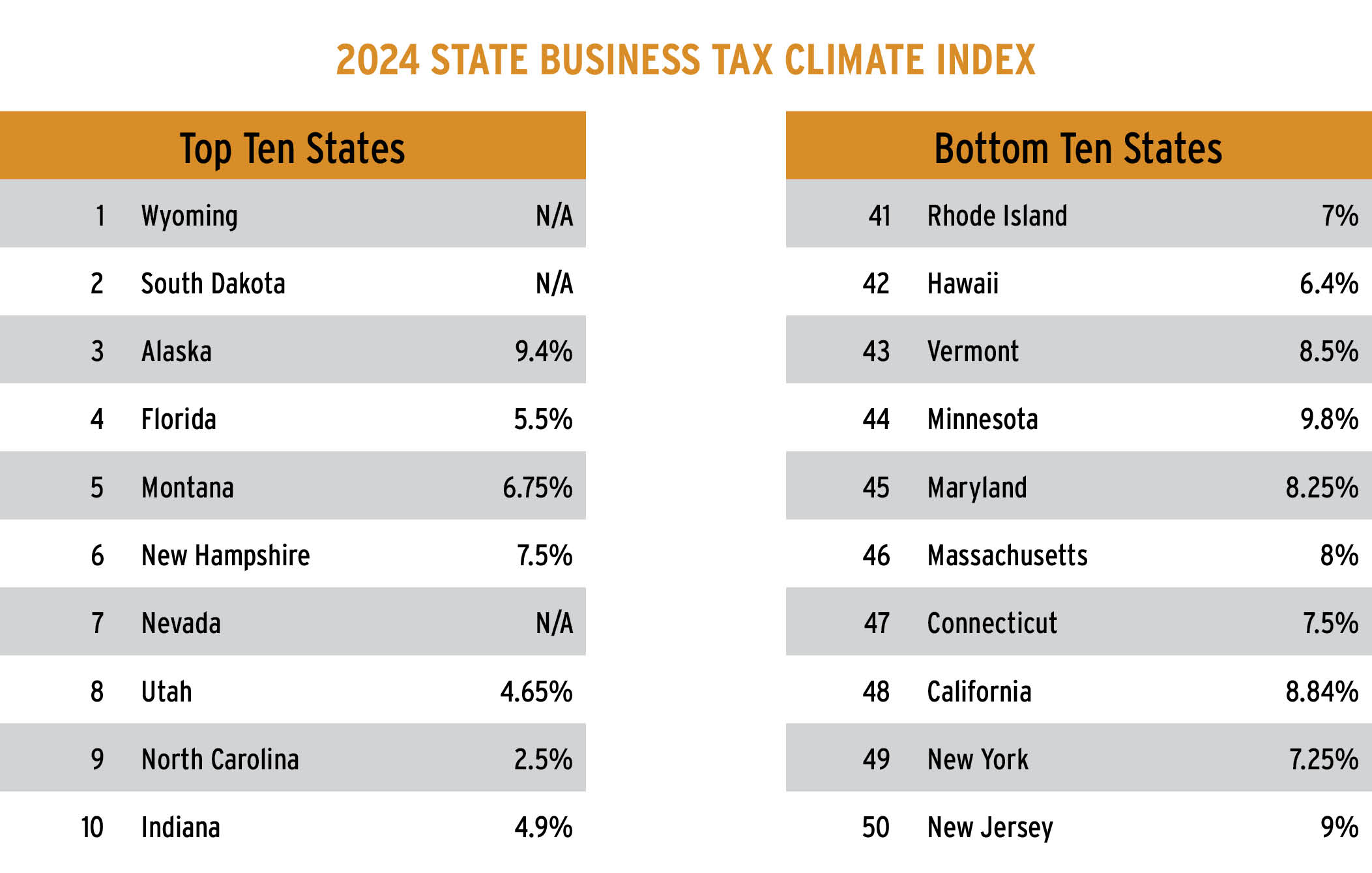

Below are the top ten and bottom ten states, according to the 2024 index, paired with their corporate income tax rates. For further analysis of the 2024 State Business Tax Climate Index, visit www.taxfoundation.org/research/all/state/2024-state-business-tax-climate-index.

Source: Jared Walczak, Andrey Yushkov, and Katherine Loughead, “2024 State Business Tax Climate Index,” Tax Foundation, October 24, 2023, https://taxfoundation.org/research/all/state/2024-state-business-tax-climate-index.