President Joe Biden’s proposed tax changes include an increase to the corporate tax rate, which Congress under former President Donald Trump lowered to twenty-one percent with the passage of the Tax Cuts and Jobs Act of 2017. Any changes Biden hopes to make likely will face a long, arduous battle through Congress, so the Trump administration’s corporate-friendly rates could be here to stay for quite some time. Add to that the pressure to keep businesses afloat amid the COVID-19 pandemic—even with pandemic-triggered tax relief, decreasing unemployment, and vaccine distribution—and the prospect for a higher corporate rate gets pushed into a more distant future.

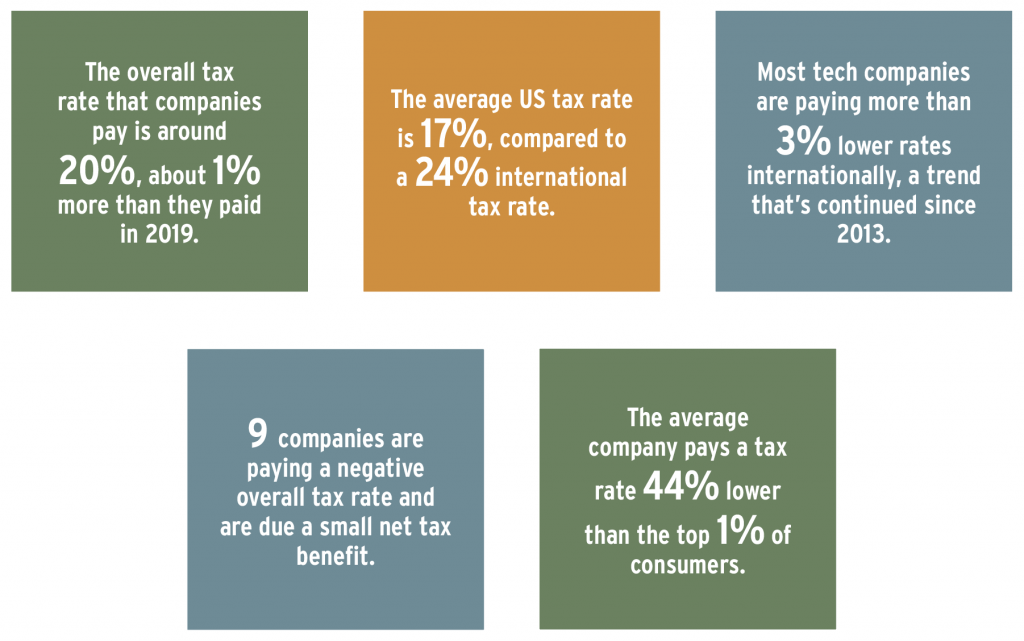

In response to the uncertain business landscape since the start of the pandemic, WalletHub analyzed annual reports for the most prominent US companies on the stock market, the S&P 100. The finance website’s goal was to determine federal, state, and international tax rates paid by these companies in 2020, which can offer insight into the overall landscape. Below are some general key findings from WalletHub’s Corporate Tax Rate Report. To explore these findings further, visit wallethub.com/edu/t/corporate-tax-rates/28330.