TEI Roundtable No. 31: Research and Experimentation Credits

Unraveling research, risk, documentation, and litigation

After COVID-19 forced the cancellation of TEI’s 70th Midyear Conference in March, we explored different ways to deliver content to our members and meet their continuing professional education (CPE) needs. With the support of several dedicated TEI sponsors, we launched our first-ever virtual midyear conference—a series of free CPE webinars…

The Year That Left Us SALT-y: Key State and Local Tax Developments in 2020

Yeah, there’s the ripple effect from 𝘞𝘢𝘺𝘧𝘢𝘪𝘳 and, that’s right, a pandemic

This year has been unusually eventful for just about everyone, not least of all payers of state and local tax. In this article, we provide highlights of some of the most important SALT developments of 2020, including: The Pandemic Playbook: key COVID-19 developments, including the CARES Act, tax issues created…

Acknowledgments

Acknowledgments TEI gratefully acknowledges the support of the following firms that sponsored TEI’s Virtual Annual Conference. Their financial support enables TEI to maintain a rich program of value-added education, networking, and advocacy activities for the in-house tax community. EXCLUSIVE AFFINITY PARTNER Thomson Reuters PLATINUM ADP Andersen Baker McKenzie Bloomberg Tax… Read more »

Statutory Corporate Tax Around the World: The Past 20 Years

In its Corporate Tax Statistics: Second Edition, the Organization for Economic Co-operation and Development (OECD) recently looked at the tax landscape beyond its own member countries, evaluating adjustments in statutory corporate income tax since 2000. Generally, the OECD found that statutory corporate income tax rates have generally decreased on average… Read more »

Under the Radar: Employee Benefit Developments in 2020

And, believe it or not, they’re 𝘯𝘰𝘵 COVID-related

The story of the year has been the coronavirus. COVID-19 has dominated news headlines, social media, and virtually every aspect of our lives. The virus has likewise dominated legal and tax news. Lawmakers and agencies have enacted multiple pieces of legislation and other guidance to help employers navigate the changes…

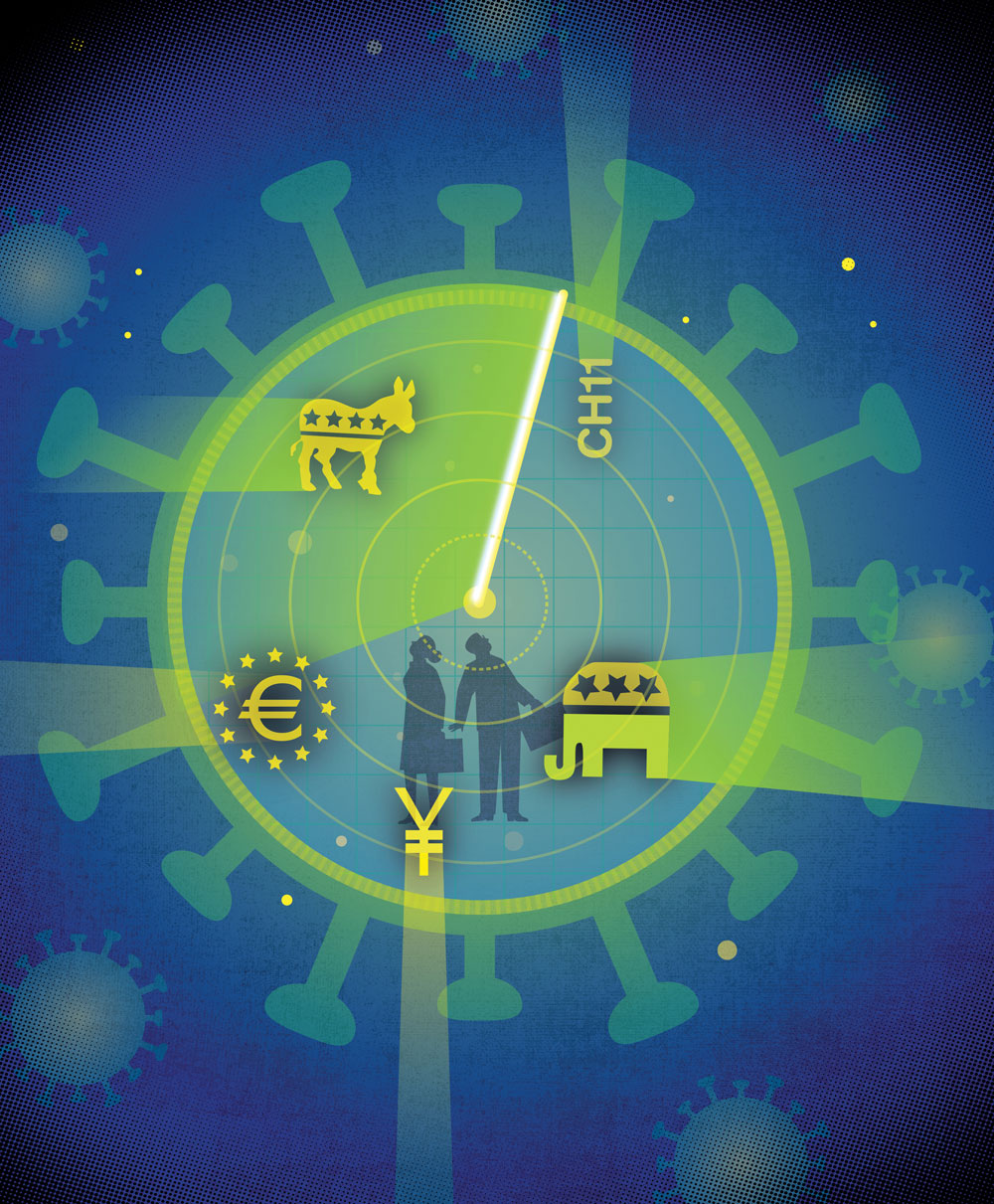

Chapter 11 Corporate Bankruptcy Reorganizations and Tax Controversy: A Primer

The considerations: preparation of tax liability schedules, objections to IRS claims, expedited audits, IRS Appeals, potential tax liens, and choosing a forum for potential litigation

In direct response to the financial pressures caused by the coronavirus, many companies, including Gold’s Gym, Neiman Marcus, J.C. Penney, and Hertz, have filed voluntary Chapter 11 bankruptcy petitions in 2020.1 Others are contemplating doing the same. For entities saddled with debt, Chapter 11 of the Bankruptcy Code can offer…

More Transparency in the EU: Questions & Answers on DAC 6

Are you up to date on cross-border arrangements?

The European Union (EU) passed a sixth version of its Directive on Administrative Cooperation in the Field of Taxation, known as DAC 6 (EU Council Directive 2018/822), on May 25, 2018. DAC 6 introduces reporting requirements for professional intermediaries (and, under certain circumstances, taxpayers) relating to their involvement in a…

Excise Taxes

The Expert: Debbie Gordon

Often to their detriment, many businesses are not focused on excise taxes and in fact may be unaware of them entirely. The truth is, excise taxes may have serious financial impacts on companies. In some cases, excise tax exposure may be material to a business. In the current uncertain economy,…

TEI Hosts 75th Annual Conference Virtually

For the first time in its history, TEI hosted the 75th Annual Conference completely virtually. With fifty sessions, fifty-seven sponsors (including ten new or returning firms), and 200 speakers, the conference offered attendees a full range of tax technical and networking opportunities. Topics covered included a presidential election preview, Brexit,… Read more »

Tax, Tech, and Talent

Digital transformation of the corporate tax department promises significant return on investment—cost reduction, risk mitigation, and data-driven insights that grow revenue and profitability. In our 2020 Corporate Tax Departments Survey, Acritas, a Thomson Reuters company, and the Thomson Reuters Institute interviewed leaders of tax departments at twenty-three large US-based companies… Read more »

Optimizing Your Tax and IT Stack Tax leaders, tax technologists, chief financial officers (CFOs), and chief…

An Overview of the EU Public Country-by-Country Reporting Rules The European Union (EU) has long been at the forefront…

Optimizing Tax Through Structured Data Storage and Data Pipelines In today’s fast-paced digital business environment, tax departments are under…

Renewable Energy Tax Credits After the Inflation Reduction Act Following the the 2024 US general election, with Donald Trump’s…

TEI Roundtable No. 49: A Look at the TCJA in 2025 Editor’s note. This conversation was recorded in August, prior to…

Inequitable Barriers to Equitable Apportionment Every state that imposes a corporate income tax requires multistate…