A Major Development in Corporate Income Tax

What’s New Hampshire v. Massachusetts got to do with it?

The pandemic has caused drastic shifts in employment and business arrangements. Major tax implications have surfaced, and taxpayers have been eager for state guidance or federal legislation to address pandemic-related issues. But with limited state guidance, and with federal legislation completely stalled, one development has become the focus of our…

The Pandemic’s Effect on Sales Tax Post-Wayfair

Expect even more uncertainty going forward

The COVID-19 pandemic has wrought disruption and change in practically every area in which we operate, and its effects on the sales tax environment are no different. What is particularly interesting about the operation of the sales tax is that states and businesses are still grappling with the groundbreaking developments…

Going Virtual, Going Well

Since the onset of the COVID-19 pandemic, organizations have been forced to go virtual with their events, and TEI was—and still is—one of them. Surely, moving to an all-digital format comes with complications, but if event organizers did their homework, they proved they could pivot and put on successful shows… Read more »

State Tax Updates in 2021

After 2020 brought about fewer tax changes due to shortened legislative sessions amid the COVID-19 pandemic, several states implemented significant updates to their tax codes this year. As highlighted in the Tax Foundation’s article, “State Tax Changes Effective January 1, 2021,” many of those changes were born out of laws… Read more »

TEI Roundtable No. 33: Leveraging IT for State Tax Departments During the Pandemic

It’s difficult enough to manage state tax departments in “normal” times. But imagine if you had to do it in a pandemic. No imagination necessary anymore, of course. It’s as real as it gets, and we wanted to find out what this “new normal” has really been like, so, not… Read more »

Top State Tax Policies You Can Expect to Deal With in 2021

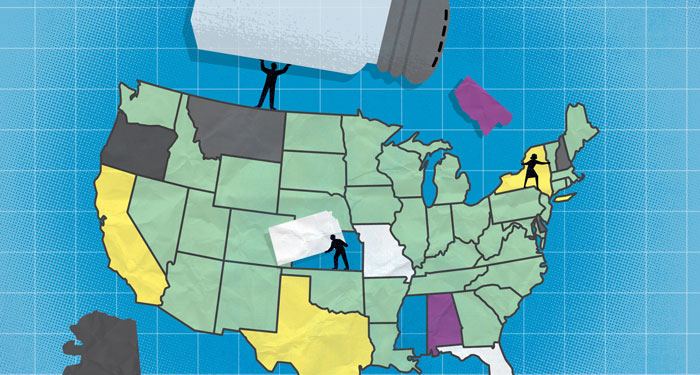

Fiscal fallout from the pandemic takes hold

When states began their 2021 fiscal year budget processes in early 2020, just about every state anticipated revenue growth consistent with what it had seen in recent years. Most states had robust rainy-day funds, and some were looking at options to lower taxes. As we fast-forward to early 2021, few…

Advocacy Work Continues on US Federal, State and Local, Canadian, and International Tax Issues

TEI’s standing committees continue their excellent advocacy work across the globe. Copies of TEI’s submissions can be found at www.tei.org/advocacy. To get involved in TEI’s advocacy efforts, please reach out to our committee chairs or any member of TEI’s legal staff. Canadian Tax Liaison Meetings With Canada Revenue Agency and… Read more »

Beth Sosidka

When Beth Sosidka was working in public accounting, she saw firsthand how a team of tax professionals could help people and companies navigate complex laws. When she worked on strategic planning opportunities for many types of state taxes, she was hooked. “I love learning about the laws—how and why they… Read more »

TEI Extends Policy of No In-Person Meetings

In mid-July, in the face of the widespread health and safety dangers posed by COVID-19, TEI announced an Institute-wide policy barring in-person meetings of any sort and at any level within TEI through the end of calendar year 2020. The Institute acknowledged that policy statements are extremely rare and are… Read more »

TEI Staff News

After fifteen years, TEI’s executive director, Eli Dicker, concluded his service to the Institute in January. Eli will join Crowe LLP, one of TEI’s platinum sponsors, as managing director of national markets. Eli played a critical role leading TEI’s staff, and we are grateful for his many contributions. The Executive… Read more »

Optimizing Your Tax and IT Stack Tax leaders, tax technologists, chief financial officers (CFOs), and chief…

An Overview of the EU Public Country-by-Country Reporting Rules The European Union (EU) has long been at the forefront…

Optimizing Tax Through Structured Data Storage and Data Pipelines In today’s fast-paced digital business environment, tax departments are under…

Renewable Energy Tax Credits After the Inflation Reduction Act Following the the 2024 US general election, with Donald Trump’s…

TEI Roundtable No. 49: A Look at the TCJA in 2025 Editor’s note. This conversation was recorded in August, prior to…

Inequitable Barriers to Equitable Apportionment Every state that imposes a corporate income tax requires multistate…