Is Your Company’s Tax Department a De Facto Family Office?

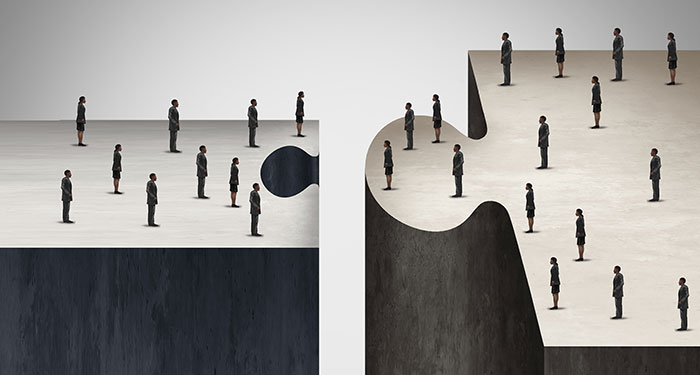

Many of today’s family offices began as the back office of a privately held company. In such companies, tax department staff members often provide services to the company’s owners and become indispensable. As a result, long after the operating business is gone, the back office lives on in the form… Read more »