Using Your Capital Investment Budget to Maximize Value From Economic Development Incentives

The Experts: Wes Bowen and Rudy Watkins

Every year, companies invest billions of dollars into property, plant, and equipment for new and existing facilities. Such capital investments are made to meet changing market demands, improve operational efficiencies, enable expansion, and maintain the integrity of existing assets. Federal, state, and local governments offer various economic development incentives to…

Emerging Leader: Susanna Yoo

For Susanna Yoo, tax law isn’t just what’s written in the Internal Revenue Code or the implementing regulations. Tax law can also be dynamic in its application and interpretation. “The same black and white words in the tax law may apply differently, depending on the facts and circumstance of the… Read more »

Elevating Our Profile, Communicating Our Value

For many or perhaps even most of TEI’s membership, the legislative process that resulted in the Tax Reform Act of 1986 (TRA ’86) is a distant memory. Indeed, by the time I first became a head of global tax (it seems like yesterday, but it very much isn’t), the provisions… Read more »

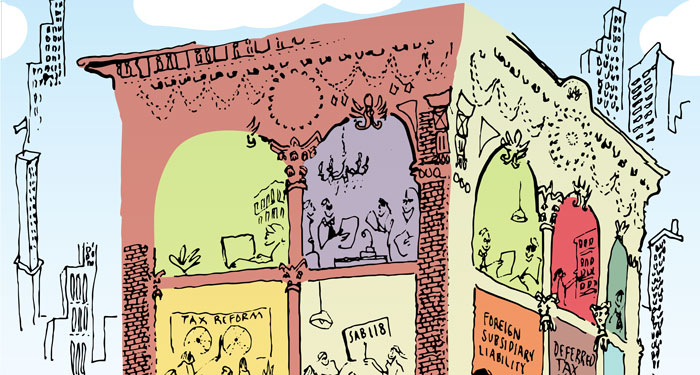

Financial Reporting Implications of the Tax Cuts and Jobs Act

Taxpayers need to deal with new realities quickly

U.S. tax reform became a reality on December 22, 2017, when President Donald Trump signed the 2017 tax reform reconciliation act (the Act) into law. The Act represents a fundamental and dramatic shift in U.S. corporate taxation, particularly concerning the taxation of foreign earnings. Since late December, companies have focused…

Emerging Leader: Cheria Coram

Cheria Coram started out college pursuing a double major in chemistry and biology but quickly became disenchanted with becoming a doctor or lab researcher and switched to business school. After two accounting classes, she found her fit and declared accounting her major. She applied for internships facing the “tax or… Read more »

Diversity in Tax Employment

In December 2017, Tax Talent released its 2018 Diversity in Tax Report, which highlights diversity trends and, specifically, pinpoints racial and gender shifts in tax employment in 2017. Using Tax Talent’s database of corporate in-house tax professionals, combined with data from the U.S. Bureau of Labor Statistics, the American Institute… Read more »

Welcome, TEI Nevada!

In mid-May, TEI’s international president, Robert Howren, presided at a ceremony to confer a charter to the members of the Institute’s newest chapter, its fifty-seventh, in Nevada. In welcoming the new chapter to the TEI family, Howren noted that “every new chapter represents a renewal and a reaffirmation of the… Read more »

The Tax and Other Costs of Paying Executives the Big Bucks

The Experts: Sheryl VanderBaan and Julie Collins

Tax reform legislation expanded the one-million-dollar annual deduction limitation applied to certain compensation paid to top executives of publicly held companies. The result? More disallowed compensation deductions for more companies and on more employees, a higher financial statement cost of compensation, and more work to account properly for the new…

Tax Reform Is in the Books

Another interim reporting period is rounding the corner, which means it is time to update the feature story in many of today’s Notes to the Financial Statements—the income tax footnote and the effects of the Tax Cuts and Jobs Act (TCJA). Believe it or not, the Financial Accounting Standards Board’s… Read more »

Tax Internal Controls in an Era of Transparency and Disclosure

SOX404, ASC 740, and PCAOB may seem easily managed but pose significant risks if not closely monitored

To meet the demands of the Public Company Accounting Oversight Board, audit firms continue to increase activity related to internal controls. So, what’s the big deal? Let’s look at some numbers: tax accounting was the second leading cause of 2016 financial restatements; in 2016, ninety-eight percent of financial restatements were…

Are Tax Insurance Proceeds Taxable? Tax insurance has emerged as a cornerstone of corporate tax…

OBBBA Modifications to US Taxation of International Income The One Big Beautiful Bill Act (OBBBA), which was signed…

How Does Conformity Impact State Revenues After the OBBBA? State conformity with the Internal Revenue Code (IRC) refers to…

Are Research Credit Interviews and Write-Ups Obsolete? Upon joining a Big Four firm in Washington, D.C.—then known…

Janelle Gabbianelli According to Janelle Gabbianelli, her first job was the catalyst…

Why Co-Sourcing Tax Technology Is Your Best Bet In today’s complex regulatory landscape, tax departments are being pushed…