Latin America: Many Trading Partners, Diverse Tax Implications

Newest TEI Chapter Has Big Plans for 2015

In 2015, the vast majority of U.S. international companies have many markets to choose from, including China, India, Japan, Western Europe, Eastern Europe, Africa, and Canada. Increasingly, however, global firms are looking to market their products, invest in economies, engage in trade, or simply do business with countries in Latin America.…

Procedural State Tax Issues: Part I

Finding the Best Forum

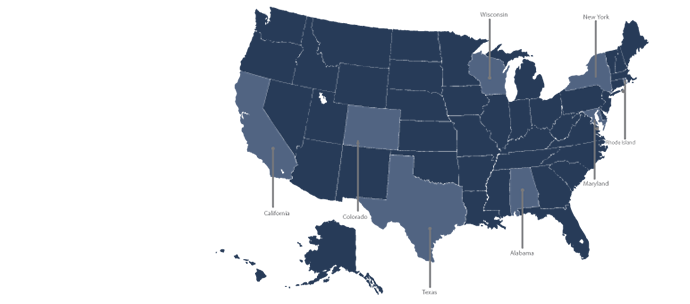

Managing state and local tax controversies is not an easy task. In addition to understanding the differences between the substantive laws applied in each jurisdiction, multistate taxpayers also need to understand the differences in procedural rules governing those disputes. In this two-part article, we address the most common issues that…

Enjoying the 65th Midyear Conference

Members and nonmembers attended more than thirty education sessions—and several enjoyable receptions—at TEI’s 65th Midyear Conference at the Grand Hyatt in Washington, D.C., March 22–25. If you missed this opportunity, mark your calendar now for the 70th Annual Conference, October 18–21, in Dallas, Texas.

Determining Taxability in the Ever-Evolving World of e-Commerce

In a world of rapidly evolving technology, e-commerce transactions have become the norm. While the term e-commerce initially referred to Internet-based sales of physical items, recent years have given rise to a new breed of purely electronic transactions including cloud computing, digital downloads, streaming entertainment, and information services, which have further… Read more »

TEI Roundtable No. 3:

The Changing Role of the Chief Tax Officer

The dizzying speed of technology, as software enables you to do your job not only quicker but more effectively. The expanding expectations of millennials, with their stated desire to better balance work and family. The burgeoning maze of regulations, with increasing government oversight. The globalization of the economy, as evidenced…

FASB’S

Revenue Recognition Standard Takes Center Stage

The Financial Accounting Standard Board’s (FASB) long-anticipated new standard on revenue recognition is clearly one of the most important developments in US GAAP accounting in the last several years. John Hepp, partner in Grant Thornton’s National Professional Standards Group, calls the new revenue standard, issued in May 2014, “the most…

Dallas Chapter

Nominates Michelle Raskierwicz for TEI Meritorious Chapter Service Award

Michelle Raskierwicz of the Dallas Chapter was honored with the nomination for TEI’s Meritorious Chapter Service Award for her efforts toward chapter development. Michelle has been a TEI member since 2007 and has served in many roles since, acting as chapter committee chair, treasurer, secretary, and finally in her current…

Thank You For a Successful 65th Midyear Conference!

More than 450 attendees gathered at the Grand Hyatt in Washington, D.C., from March 22–25 for TEI’s 65th Midyear Conference. Members and nonmembers alike had access to more than thirty educational sessions covering a wide range of topics, including “Effectively Managing Flexible Work Arrangements: Measures for Success,” “Building and Maintaining… Read more »

Intercompany Transactions: Current State Tax Developments

Nexus and documentation are key issues in understanding the current intercompany transaction legal landscape

Intercompany transactions can be used to shift income from entities with a physical nexus in many states to a related member with a limited nexus in favorable taxing jurisdictions. In moving to combat the benefits received from such intercompany transactions, states tend to employ one or more of the following…

LB&I Audits: Old Lessons, New Approach

Transparency, Collaboration, Fair and Efficient Resolution: No Argument with Goals, but the Devil Is in the Implementation Details

Managing Canadian Tax Risk The global tax environment has seen fundamental changes in recent…

Transfer Pricing in Transition Although states experienced significant tax revenue growth during the COVID-19…

The One Big Beautiful Bill Act In July 4, President Donald Trump signed into law the…

Automation in Action: Key Takeaways From the TEI Automation Competition In February, tax professionals from across the country gathered in…

Beyond Automation: Why Having a Human in the Loop Is Critical for Sales Tax Compliance The allure of sales tax automation is undeniable. Many companies,…

TEI Holds Third International Tax Student Case Competition TEI held its third International Tax Student Case Competition at…