Early this year, TEI sent out a survey to all its members worldwide regarding the implementation of base erosion and profit sharing (BEPS) 2.0 and Pillar Two. The survey asked participants to rate their preparedness, level of difficulty, and technology and staffing concerns in applying the rules/guidance.

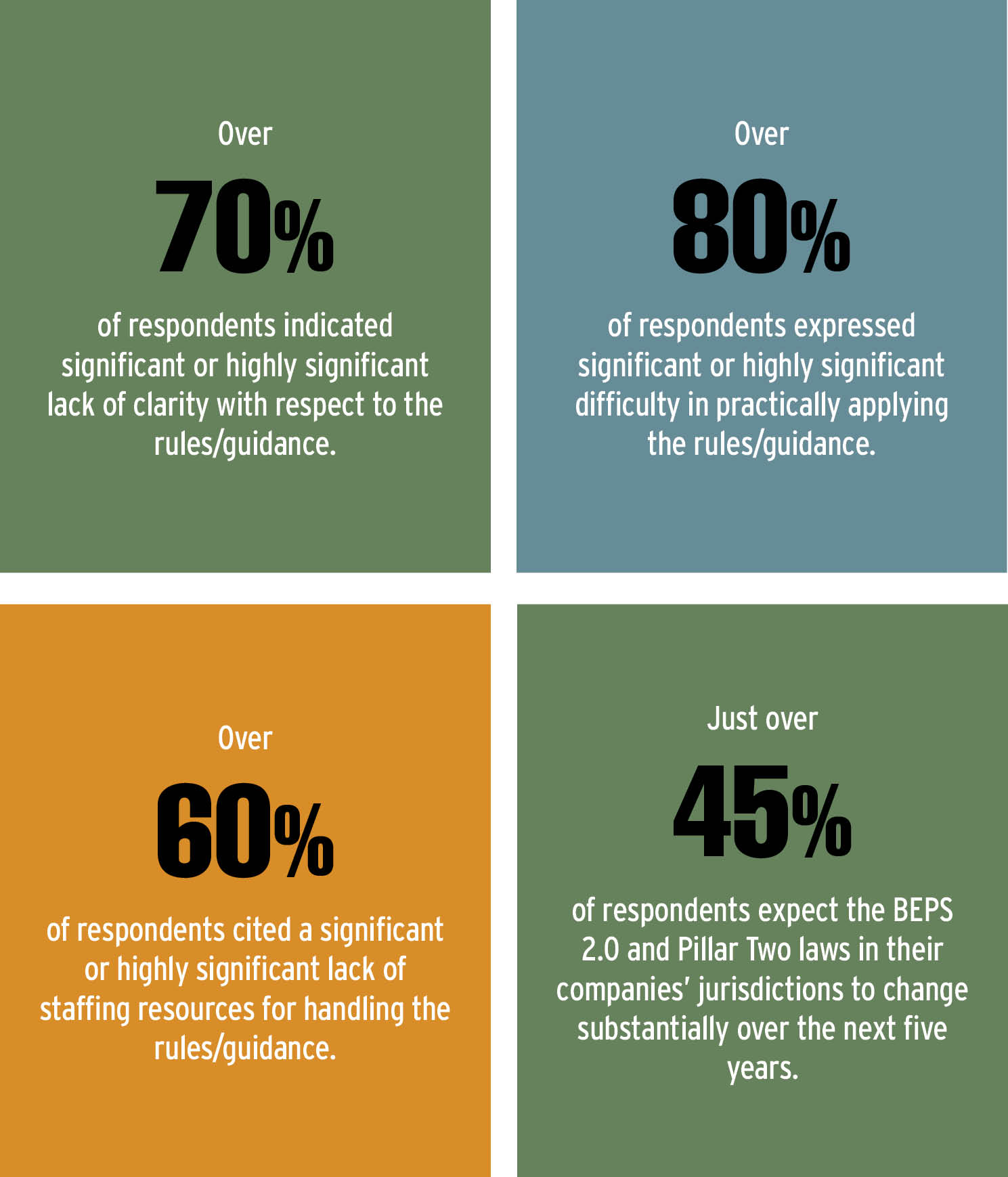

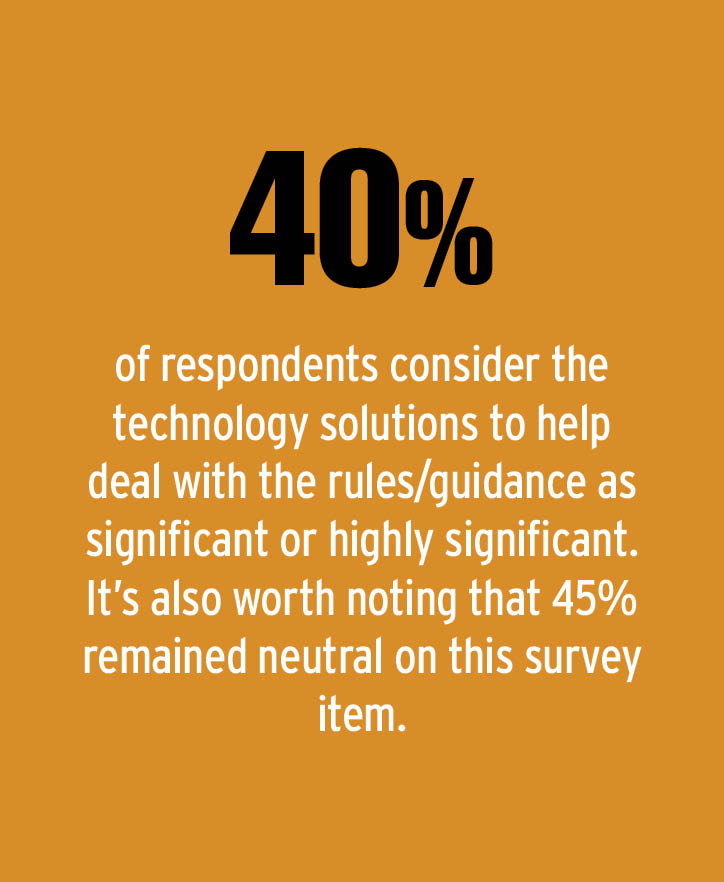

Although most respondents—just under seventy percent—noted they are either slightly prepared or well prepared to deal with the implications of the rules/guidance, responses to other survey items tell a more nuanced story. Here are some additional results:

One Canadian respondent may sum up the general sentiment among in-house taxpayers: “It is clear that Pillar Two creates a significant compliance burden without significant results. The tax is going to jurisdictions that really do not want/need the tax dollars due to the [qualified domestic minimum top-up taxes] and the impact on taxes in countries such as Canada or the US have been negligible—as could and should have been predicted/understood from the outset.”

For more on this survey and to further discuss BEPS 2.0 and Pillar Two issues with your fellow tax professionals, visit teiengage.tradewing.com.