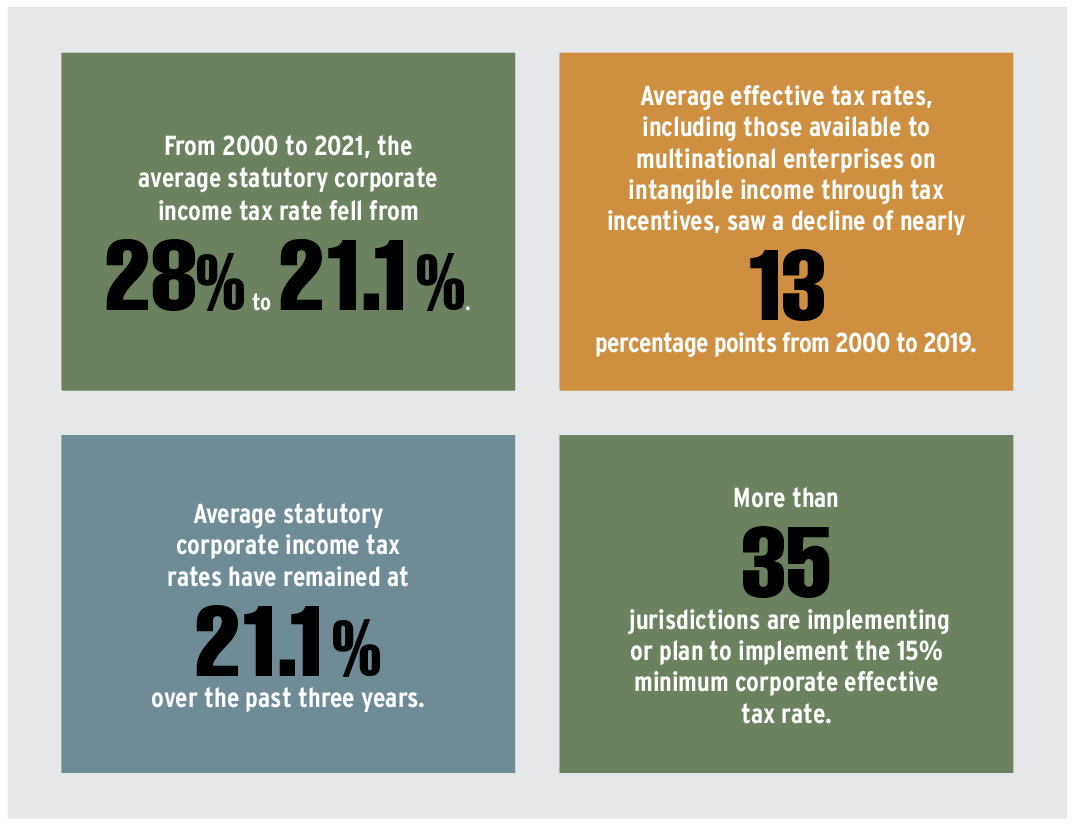

According to a recent report and accompanying press release from the Organisation for Economic Co-operation and Development (OECD), statutory corporate tax rates are stabilizing across the globe following a steady period of declining rates. In the OECD’s 2024 edition of Corporate Tax Statistics released in mid-July, average statutory corporate tax rates are now staying generally unchanged after having consistently fallen since 2000. According to the report, anticipation of the new global minimum tax could be a key contributor to the stabilization. (That global minimum tax has been agreed upon by 140 members of the inclusive framework on base erosion and profit sharing.) In addition, the report points to a stabilization of certain tax incentives designed to attract mobile intangible assets and their related income, among several other findings.

Below are a handful of findings from the report. To access the OECD’s full 2024 Corporate Tax Statistics report, visit www.oecd.org/en/publications/corporate-tax-statistics-2024_9c27d6e8-en.html.

Source: OECD, Corporate Tax Statistics 2024, www.oecd.org/en/publications/corporate-tax-statistics-2024_9c27d6e8-en.html.