In this new era of tax risk and controversy that emerged after a pause in enforcement during the COVID-19 pandemic, multinational businesses will need to stand firm with strong and effective tax governance. That’s the sentiment conveyed in EY’s latest report, Why Tax Governance Is Key in an Era of More Tax Risk and Controversy, based on results of its 2023 EY Tax Risk and Controversy Survey. In the report’s introduction, EY’s Luis Coronado, global tax controversy leader, explains why. “This is partly because tax authorities around the world are using the absence or presence of good governance principles in tax as a way to segment taxpayers into different risk categories,” he says. “It’s also because tax functions are recognizing that a good tax governance framework offers them many opportunities to help their organizations build long-term value for stakeholders, including in the important [e]nvironmental, [s]ocial, and [g]overnance (ESG) space.”

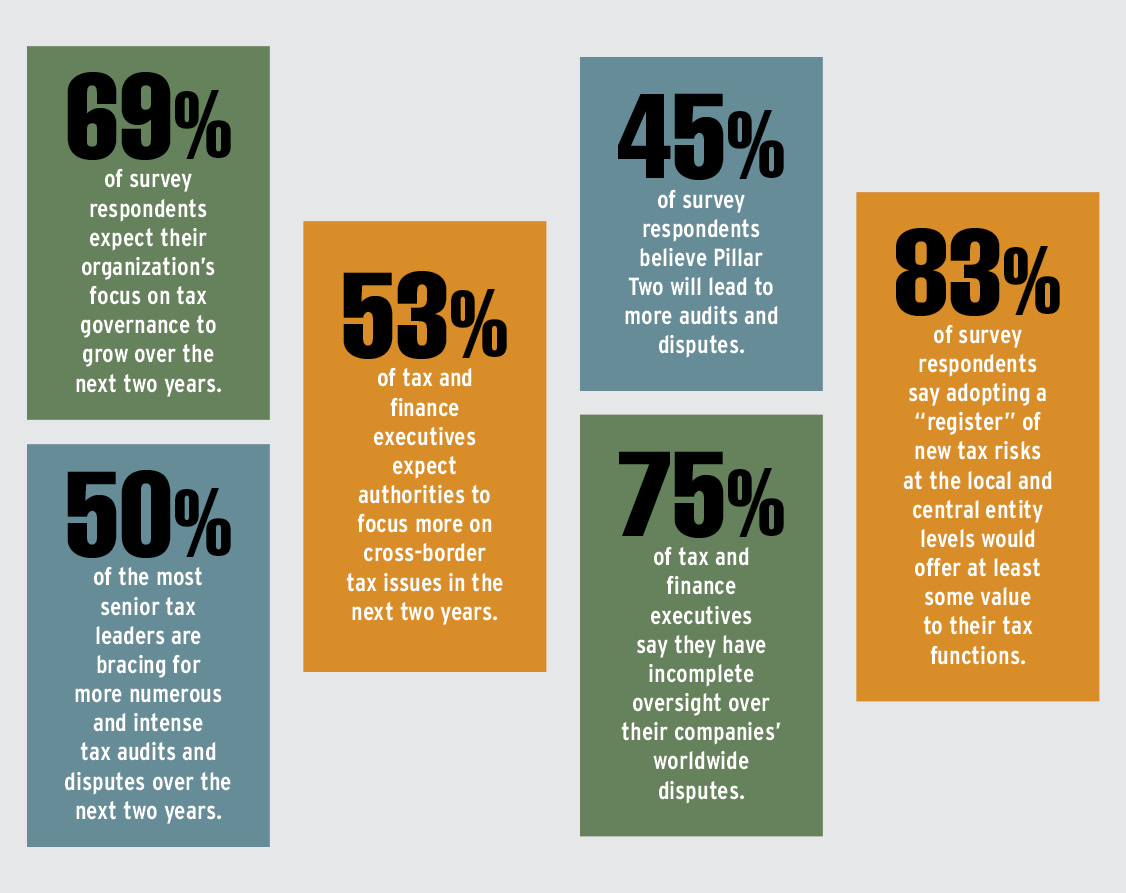

Below are a handful of findings that bolster that viewpoint. To dive deeper into the report, visit www.ey.com/en_gl/insights/tax/why-tax-governance-is-key-in-an-era-of-more-tax-risk-and-controversy.

Source: Why Tax Governance Is Key in an Era of More Tax Risk and Controversy, EY, March 28, 2023, www.ey.com/en_gl/insights/tax/why-tax-governance-is-key-in-an-era-of-more-tax-risk-and-controversy.