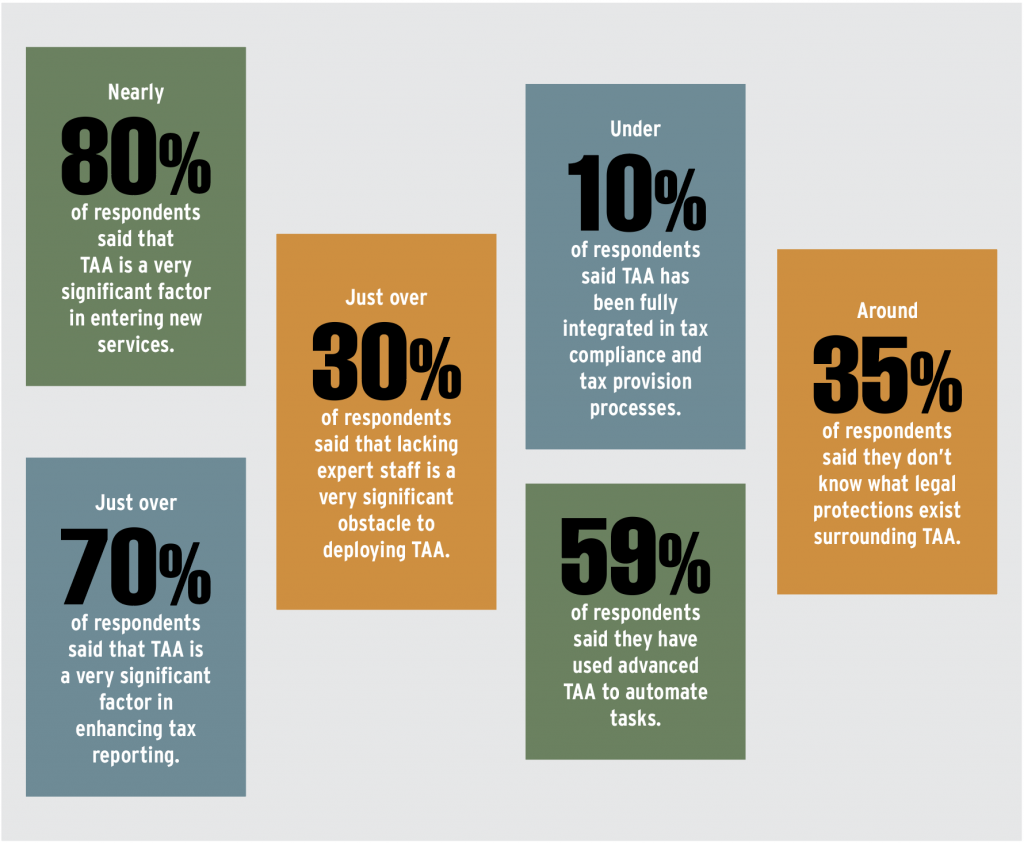

Last fall, the New York State Society of Certified Public Accountants released results from a survey about tax analytics and automation (TAA). The survey aimed to gather data about and insights into the benefits, applications, integration, obstacles, and regulatory environment surrounding TAA technologies. Although it appears that the in-house tax community is moving in the right direction when it comes to implementing TAA overall, some areas remain where progress is slow, with significant barriers to utilizing TAA technologies.

For a deeper dive into the survey’s findings and to see how your business compares, visit bit.ly/3MNt76m.

Source: New York State Society of Certified Public Accountants, “A Survey of Tax Analytics and Automation Technologies,” The CPA Journal, February 2022; www.cpajournal.com/2022/02/25/icymi-a-survey-of-tax-analytics-and-automation-technologies.