Tax functions have pursued automation and efficiency for a long time. Enterprise financial and management reporting systems are not designed to produce tax outputs such as tax provisions, tax returns, and other key tax deliverables, but instead provide the source financial data required to prepare the tax calculations—and that is at best. This leaves a lot for the tax function to do in terms of data processing, data blending, calculations, and producing deliverables. The current pace of legislative and business change is adding to the level of effort required and highlights the need for dynamic and flexible models.

Tax functions need automation now more than ever—and fast. The flow of new legislation and regulations and the increasing level of reporting obligations have been the primary contributing factors, but there are others:

- impending global tax reform;

- finance teams pushing for a quicker close cycle;

- desire to trim costs and be more fit for purpose;

- C-suites demanding more real-time transparency;

- demand on tax leaders to support faster decision-making;

- talent shortages making new hiring challenging and expensive; and

- more time required to meet extraordinary demands and assessments of special projects.

Legacy approaches to automating tax processes have often included efforts to optimize enterprise resource planning (ERP) projects, buying (and implementing) third-party tax software, building custom applications, and using spreadsheets to fill in the gaps. These efforts have been categorized as “slow to start, slow to move,” and have often struggled to keep up with changing needs and environments. More important, these solutions are clunky to maintain, requiring deep understanding of the technology in addition to tax technical knowledge.

But transformation is happening in this space for good. Many tax functions are investing significantly in citizen tools to complement and optimize ERP systems as well as other enterprise-wide tools, since these solutions are easier to build and maintain while at the same time reducing reliance and overhead on technology subject-matter experts. The ability to quickly stand up powerful and dynamic automation models using new and emerging citizen technologies has brought much-needed change in the approach and provided immediate relief. The days of experimenting are gone, and automation is no longer at the bleeding edge, since many companies have already gone down this path. But to launch, sustain, and scale a program successfully using these tools is where leaders differentiate themselves.

For example, PwC has been working with many of the leading companies to build the tax function of the future, providing cutting-edge and practical approaches to automation. Throughout this article, we will share key tips and variables to effectively launch and maintain successful programs.

The Evolving Technology Tool Kit

Organizations leading the way in adopting automation increasingly build programs that include a combination of complementary tools—and apply governance models that identify the right tool (or tools) for each business problem rather than looking for problems to solve with each tool. These tools are not intended to replace traditional enterprise systems and business applications, but rather to close the gap created by system limitations in the most cost-effective and efficient way possible. By bridging information gaps and connecting disparate systems, business functions can leverage these tools to automate the process of entering data into and accessing data out of core systems and cleansing, blending, and using that data for downstream calculations, applications, reporting, and analytics. These tool categories can introduce rapid innovation with minor investment while informing long-term system upgrades and enhancements.

The four key categories that make up a typical automation technology tool kit are data automation tools, business intelligence and visualization tools, robotic process automation (RPA), and broader advanced automation technology.

Kick-Start Your Automation Program

As you begin or continue your tax automation journey, consider the methods used to ensure long-term success and sustainability of solutions. It is critical to think beyond “What can be automated?” to “How do I automate successfully?” The selection of technology solutions, automation design, governance model, and well-defined maintenance of the solution can have an incredible impact on your tax operations and return on investment (ROI).

Consider the following keys to a successful automation program:

- Align on target outcomes and identify automation opportunities. Review your current tax process and identify pressure points where integrating automation may alleviate manual efforts, reduce financial risk due to human error, and increase bandwidth for tax team members to perform more high-value tasks. Align with broader organizational goals and tailor key performance indicators (KPIs) to each functional area.

- Develop a road map with a plan to scale in advance. Automation solutions should be scalable to enable your organization to adapt to future technology and process needs. Develop a technology road map with scalability in mind. Schedule implementation of identified solutions and capture quick wins to help manage execution.

- Match your process issue with the appropriate technology solution. Explore all technology solutions available and understand their capabilities. Distill the technologies into a few key tools of focus for initial rollout with the highest chance of success. Consider flexibility and ability for business users to leverage and maintain the automation solutions.

- Unlock the value of citizen-led innovation through upskilling. Adopting a “citizen-led” approach, particularly for digital acumen, can empower tax staff not only to grow as professionals but also to help carry out the future vision for tax. Provide significant upskilling opportunities and hands-on experience from the onset to equip your people with the proper knowledge to embrace new ways of working.

- Prioritize proper governance to help manage success. Establish governance guardrails and best practice standards on the front end. Engage key stakeholders early on and hold them accountable for success. Adopting protocols early in the automation process can enhance your ability to pivot seamlessly and manage risk during times of change.

Tax executives should consider what goals define success for their specific tax function. It’s important to recognize the dual goals potentially at play. CFOs and senior executives will focus on cost, risk (financial and reputational), head count, standardization, and better support for C-suite initiatives. Tax professionals, on the other hand, will be more focused on making their process easier, saving time, and reducing their manual efforts.

When weighing priorities, tax should be aligned with the broader business while also considering the sustainability and scalability of solutions.

Sustain Momentum and Scale Automation Solutions

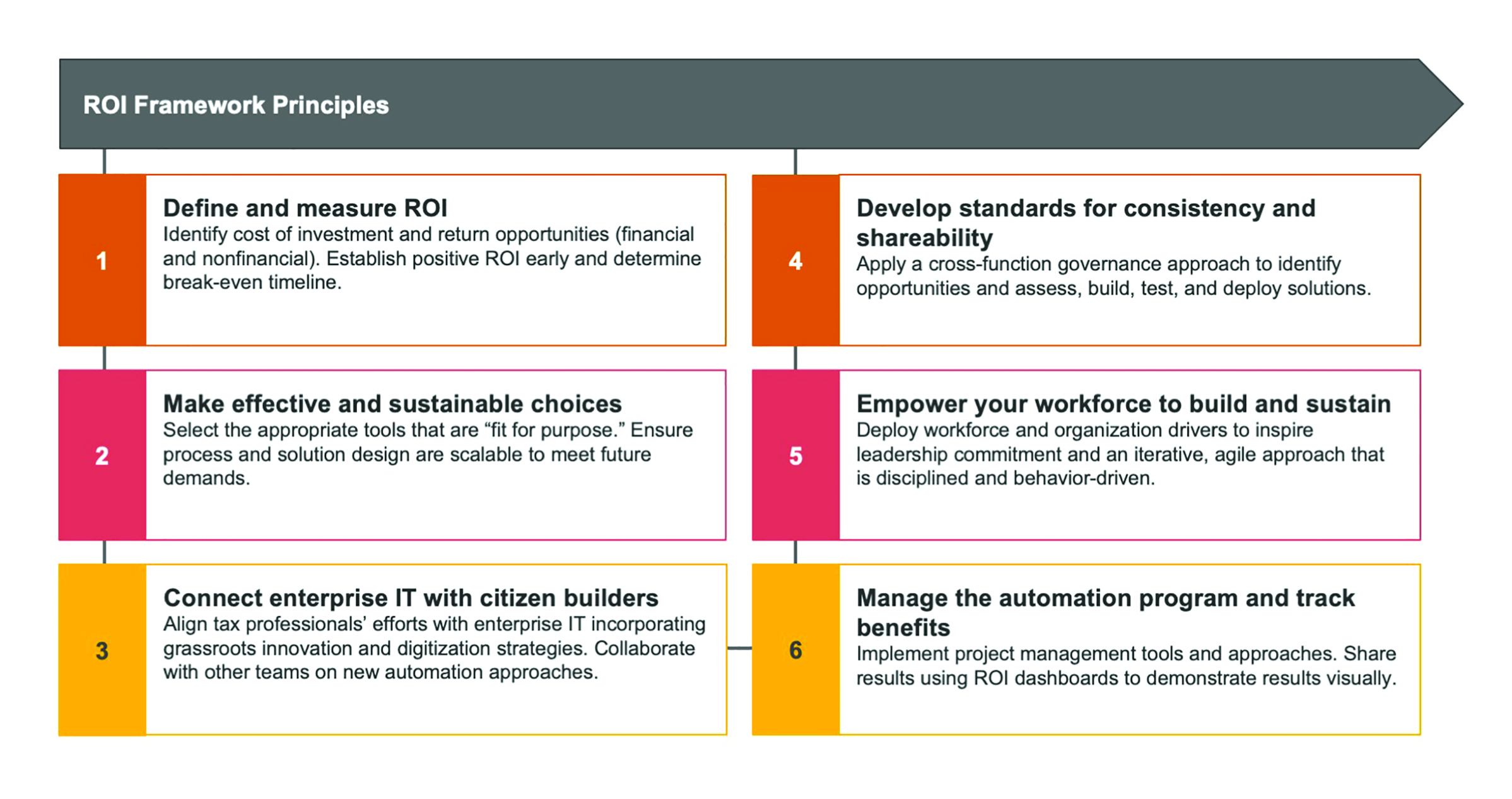

Achieving and sustaining ROI is critical to successful automation no matter where you fall along the tax automation journey, whether you’re new to automation or executing a well-defined automation strategy. Leveraging a framework for capturing ROI can help you sustain momentum and scale automation solutions for long-term success. Figure 1 demonstrates six key ROI-relevant points in successful automation.

All of the levers shown in Figure 1 are essential to capturing ROI. Let’s dive a little deeper into a couple.

Empower Your Workforce to Drive Sustainability of Automation

Automation solutions are valuable tools that can drive efficiency and effectiveness within the tax function. But without user acceptance, the potential ROI from a developed automation can be lost. Here are two crucial steps to gaining user acceptance:

- engage your leaders and workforce in the new strategy for lasting impact and better transition by establishing a strategy board or a steering committee (or both) to ensure that voices are heard and the workforce is properly represented; and

- allow your workforce to develop ways of working and to execute citizen-led automations with the proper governance procedures in place to help drive sustainability of the automated processes.

Manage Your Automation Program and Track Benefits (Including ROI)

Develop a mechanism to capture use cases in an ongoing manner and an ROI dashboard to track savings and benefits and to evaluate results. More important, create a process that is more continuous and real-time to ensure that you can be agile in your strategy and tweak the support models for your teams. Doing so can provide the ability to dedicate or divert resources to higher-impact and higher-priority models quickly. Implement project management tools and approaches to maintain control over automation projects and to keep a very strong focus on capturing and reporting to stakeholders the benefits realized.

Balance Enterprise-Led and Citizen-Led Innovation

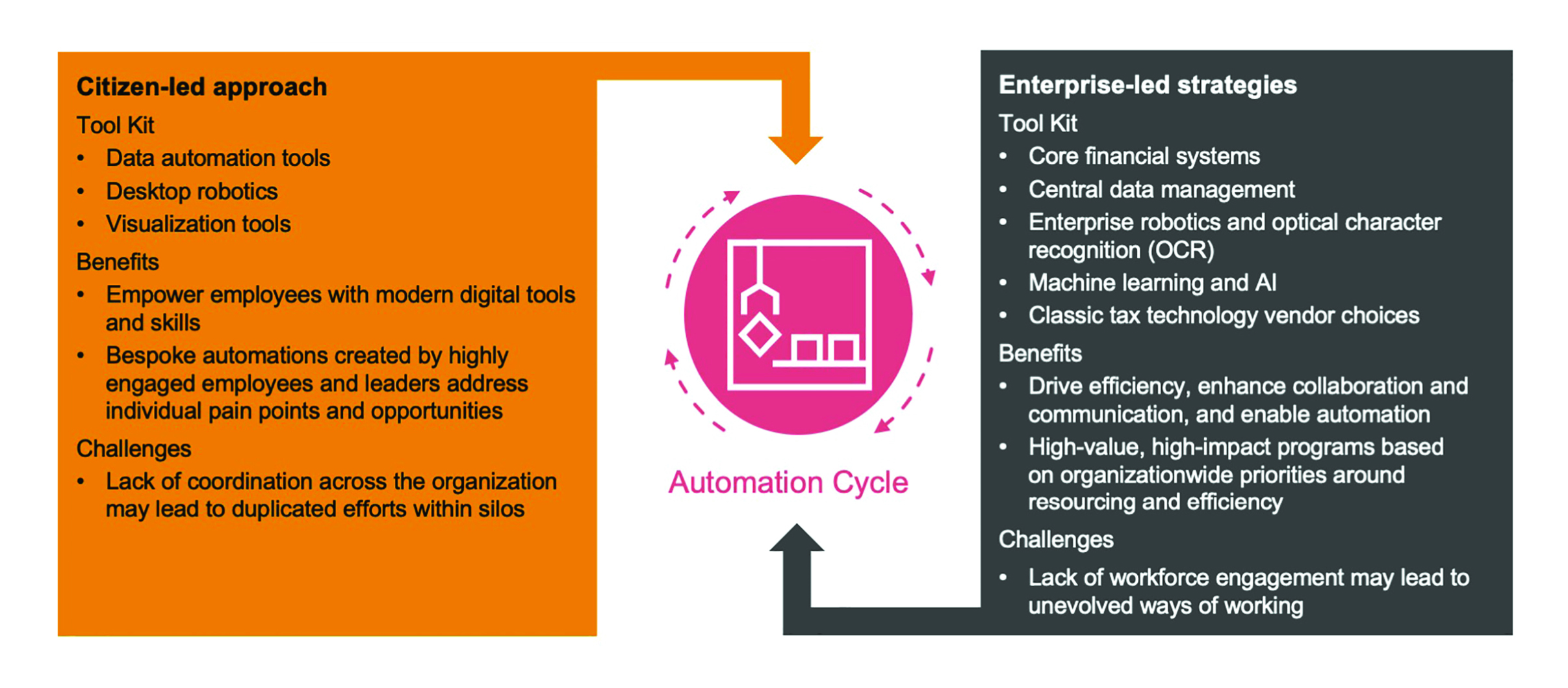

Traditionally, companies have focused on enterprise-led innovation as they execute digital transformation initiatives and often miss out on citizen engagement. Either citizen-led automation (through digital upskilling) or enterprise-led automation (through cloud computing and other enterprise-wide system implementations) offers an array of benefits, but combining these two approaches can unlock synergistic value at scale. Figure 2 shows the benefits and challenges of both.

Developing a Citizen Automation Program

Citizen automation programs have proven very effective for getting people to think about the art of the possible. This type of program provides interactive training that enables your people to put fingers to the keyboard and see firsthand the capabilities and power of the tool or tools. To get started, lay a foundation for your automation program (as laid out in the “Kick-Start Your Automation Program” section above) and help your workforce, including leaders, to understand your automation strategy. The initial wave of a program may look like this:

- Provide training. Offer “getting started” training to introduce the tool and help participants understand its capabilities and how it can enhance their day-to-day work. This awareness training should help demystify the what and the why, but let’s be realistic—no one will walk away from training as an expert. The reality is that only a select few individuals, depending on the size of your team or organization, will actually build solutions.

- Sprint to automation build. Shortly after training, identify a select group to attend an automation build workshop to learn how to get started building small automations that leverage the skills they learned in training and to work one-on-one with a tool subject-matter expert. Initial assessment workshops are necessary for use cases to be vetted to ensure that the right use cases are being lined up.

- Offer automation build support. Establish a group to provide support to the automation builders through a dedicated help desk, weekly training sessions, etc. This is where your automation builder can get custom guidance on how to develop effective practices for building the automation.

- Share results. Run a leadership workshop to share the outcomes and evaluate program feedback before starting future waves of the automation.

Wrapping Up: What Actions Should Your Function Take Next?

Now is the time to start, scale, or correct your course. Here is a basic outline:

- Practice your “why” statement—and ask if your current efforts are achieving results. If not, consider pivoting your strategy. Ask if the right opportunities are being identified and how you are tracking and measuring benefits.

- Focus on early adopters who experience success—scale what works and what will fit within your organization’s culture and strategy.

- Evaluate your people’s skill sets to align with automation strategy—determine how to train them for skills needed now and in the future for an increasingly digital work environment.

- Plan for a three-month citizen-led sprint—select priority processes or components of larger processes to get started. Capture lessons learned and iterate for the next sprint.

- Augment the citizen-led sprint with a center-led build—accelerate the completion of complex and high-priority models with more experienced support, critical to showcase scalability and buy-in from leadership.

Justin Femmer is a partner, tax reporting and strategy, Elizabeth Robles is a director, tax reporting and strategy, and Balaji Ganapathi is a director, automation, all at PwC.