Tax technology platforms have become vital applications for completing regulatory filings, reviewing and reconciling submissions, managing data effectively, and conducting real-time analysis, says Anli Chen, tax technology lead at True Partners Consulting. We wanted to find out more about how tax technology is evolving, including how it is being deployed during the pandemic, so senior editor Michael Levin-Epstein interviewed Chen virtually in February.

Michael Levin-Epstein: What has it been like to be a leader in this area during the global pandemic?

Anli Chen: In recent years tax technology platforms have evolved far beyond the basic provision and compliance capabilities. They have become the vital process engine to complete regulatory filings, perform reconciliation and review, manage data, deliver real-time analysis, and, most importantly, perform effective governance and control. We are also seeing—and this is really the topic of today—more advanced emerging technologies that are disrupting the tax industry. In the next three to five years these technologies will streamline, automate, and accelerate the entire end-to-end tax process. These technologies are typically agile, non-inclusive, ancillary technology platforms that will open the door for tax department transformation. You mentioned the global pandemic, and I’m sure that has shaped all types of businesses in different ways. Early last year almost all businesses—especially corporate functions—transitioned to virtual environments almost overnight. Technologies like data management and cloud solutions, which may have been on the strategic agenda for C-level and tax executives for a long time, were accelerated because of the global pandemic. It is also more important than ever to have those virtual, geographically dispersed tax resources able to access important tax information, tax technology, and tax processes anywhere, anytime. So, as a result, technology platforms such as Alteryx, Tableau Prep, PowerSuite, or other robotic process automation (RPA) solutions rose to the top of the tax department’s agenda.

Levin-Epstein: When making decisions on automating the tax function, what are the key factors that go into that decision?

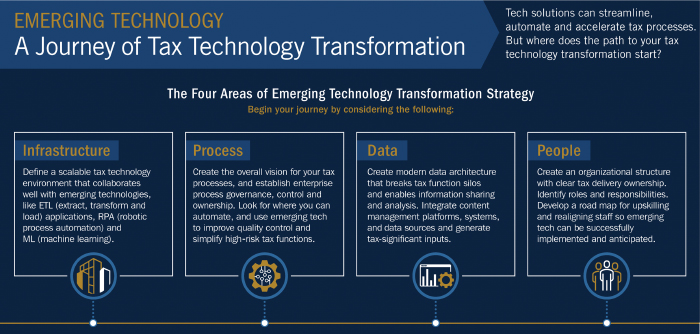

Chen: Traditionally, we see tax functions centered around tax policies and regulations and people with knowledge and expertise. By applying technologies such as Alteryx—in particular an Alteryx server—and robotic process automation, we are elevating that people-based tribal knowledge to a process-driven operation. That’s what we’ve illustrated in Figure 1, a tax process framework (TPF) that includes components of infrastructure, process, data, and people. It’s critical to think through all four pillars of this tax process framework together. This exercise creates the atlas for your future automation implementation and defines the key performance indicators, the KPIs, that tie to overall business success.

Return on Investment

Levin-Epstein: When you’re talking about ROI [return on investment] in tax automation, how do you measure it?

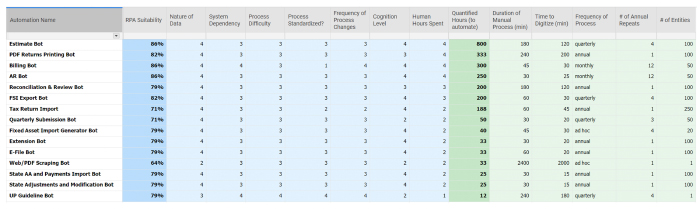

Chen: There are a series of measurable KPIs that we recommend our clients define at the beginning of a tax automation program. They are closely driven by the executive vision from each organization and are key to the success of automation programs. Take a look at Figure 2. Typically, there are measurements for automation suitability (the blue grids) and measurements for automation potential (the green grids), illustrated in the sample scorecard below. Combining both dimensions provides business leaders and technology owners a mutual view of the implementation road map and regular measurements of successes.

Examples from the blue automation suitability side in Figure 2 include measurements related to RPA suitability, nature of the data, and how difficult the process is. The other side, the green automation potential side, depicts measurements like the minutes/hours it takes to perform a manual process, how long it may take to automate, and how many entities this process may touch. Each organization may decide to customize this list by adding other KPIs important to it, but this is a pretty good framework to start with.

Levin-Epstein: What are costs attendant to the tax automation initiative? Could you give us a little sense of that, the cost structure?

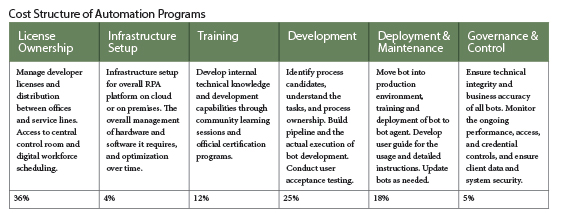

Chen: This is always one of the first questions from tax executives, and rightfully so! “What does it cost?” On the investment side, it’s tempting to simplify the cost structure to the expenses of annual license ownership. The technology providers today have created highly customizable licensing packages to fit businesses of any size. Depending on the business requirements and components to purchase, RPA licenses range from starter packages of $50,000 to $100,000 to scaled-up enterprise packages into the seven figures. ETL platform licenses range from a few thousand dollars for individual licenses up to over $100,000 with enterprise data and an analytics server. From our past experience of tax automation programs, license ownership on average consists of thirty to thirty-six percent of overall investment. You almost need to triple the actual license expense to get the true cost of ownership for tax automation platforms.

You can see in Figure 3 the main components of cost: license ownership and the critical components of infrastructure setup, training, deployment, and, most importantly, the governance and control. All of these are ongoing investments that executives need to consider for a tax automation program.

Timeliness

Levin-Epstein: Could you talk a little bit about timeliness and also how this program fits in

with compliance?

Chen: Absolutely. We talked about the monetary investment in training, but we should also discuss the time investment. “How long?” is the question that we are asked: “How long will it take for us to implement these robotic solutions? How long does it take to train our folks with these technologies?” While the cost structure may seem daunting or complex, the development time and time to see results is actually quite fast. Using Alteryx implementation as an example, the implementation of this automation solution is much faster than traditional enterprise-level technology implementation. Putting in a few successful proof-of-concepts within the first couple of months of purchase is considered typical. You will usually see the power users or star developers in your tax or finance functions emerge quickly during the data acceleration phase. After some onboarding training and self-paced learning, the power users are able to replicate the success of initial pilots and start to apply the tool in other related functions. In two to six months, we usually see the culture of data automation formed and more and more demands of data automation emerge across various functions. Within two years of initial implementation, the streamlined and accelerated tax processes would become your business as usual.

Similarly, whether you implement cloud RPA as a service or RPA technology on premises, the RPA ROI should be measured in weeks or months, never in years. The typical payback timeframe of an RPA solution is between six and nine months. For instance, our TPC tax automation team takes six weeks to create an RPA bot for data reconciliation between ERP [enterprise resource planning] and other custom sources and six weeks of testing and parallel runs in the immediate provision cycle, and the client is able to realize efficiencies with full capacities the following quarter. According to a recent study by Automation Anywhere, organizations, on average, reached the break-even point in slightly under fourteen months and achieved a 250% ROI on their initial RPA investments.1

Levin-Epstein: Talk a little bit about the training that’s necessary to get a person proficient with this technology.

Chen: In general, technology is improving our quality of life and job satisfaction. It brings better experiences for our clients, more comprehensive skills for our staff, and more competitive advantages in the marketplace. With technology you are presented with something beyond your capabilities, which allows us to rethink how we’ve always done things, thus moving us from simple doers to complex thinkers.

So, in that spirit, start with the question, “When would be a good time?” Maybe in between our busy seasons, or between other internal obligations. Because of the seasonality of tax and the regulatory requirements, there’s naturally a cycle of training, development, testing, and deployment that follows the tax season.

These technology providers have also acquired capabilities to lower the implementation complexity and the needs of extensive programming expertise.

Levin-Epstein: That’s a good way to end it. Thank you very much.

Endnotes

- “Future-Proof Your RPA Strategy With What’s Working Now and Where to Go Next,” Automation Anywhere, accessed March 28, 2021, www.automationanywhere.com/lp/now-and-next-rpa-report.