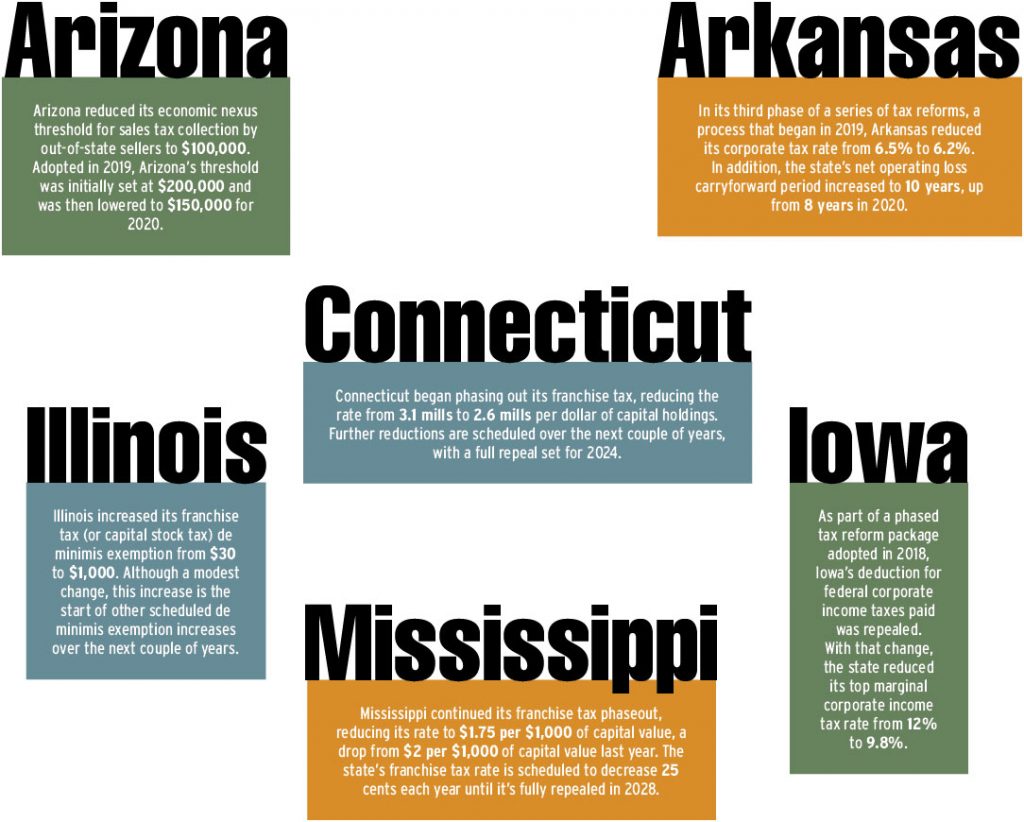

After 2020 brought about fewer tax changes due to shortened legislative sessions amid the COVID-19 pandemic, several states implemented significant updates to their tax codes this year. As highlighted in the Tax Foundation’s article, “State Tax Changes Effective January 1, 2021,” many of those changes were born out of laws that were adopted before 2020 but have January 2021 effective dates. Below are some figures tied to the notable corporate tax-related adjustments now in effect this year.

To see the Tax Foundation’s thorough breakdown of state tax changes in 2021, including a handful of retroactive changes prompted in 2020, visit www.taxfoundation.org/2021-state-tax-changes.