The valuation of entities and assets is under greater scrutiny by tax authorities. Although valuation standards for tax purposes have generally lagged behind those for book purposes, new global standards require increased data, analysis, and support. This article will briefly review the developing and changing landscape and provide some practical considerations for implementation.

Higher Standards for Tax

Before recent conceptual developments and guidelines, the movement of assets and entities among different tax jurisdictions employed a relatively simple concept: value the asset or entity as it exists. Although simple in execution, this process lacked transparency, provided tax jurisdictions with minimal information, and isolated the asset or entity under review. As a result, a multinational enterprise (MNE) could be scrutinized or audited on a standalone basis, but without contextualization of value across a larger MNE group.

However, tax authorities began to capitalize on the increased levels of analysis and scrutiny required for financial reporting. As a result, tax requests for quantitative and qualitative bridges, and support for differences in intragroup charges and royalty rates, became commonplace.

Valuation engagements have therefore moved toward understanding the differences between tax and book accounting and reconciling these values. This process often involves the top-down approach of valuing the MNE group (which owns the MNE) or the MNE (which owns the assets) and reconciling values, from group to entity to asset. However, challenges remain in the absence of reliable financial information or forecasts (such as with nonintegrated entities). In these scenarios, a wide range of value conclusions invites scrutiny.

Overall, increased analysis within financial reporting has (intentionally or not) increased the levels of analysis required for tax reporting. This is particularly clear now that the Organisation for Economic Co-operation and Development’s (OECD’s) base erosion and profit-shifting project (BEPS) is underway.

BEPS Project

The (in-process) BEPS project has introduced major changes to global taxation and transfer pricing, with requirements for more detail and information-sharing around economic and legal ownership and asset characteristics. As a result, practitioners and tax authorities have posed several new questions, such as:

- Is there a difference between an asset’s economic and legal ownership?

- What parties developed the asset, and in what location(s)?

- What is the substance of a transferred asset, and are the economics consistent with the legal substance?

- Where and how does the asset fit within the value chain of the overall entity?

The OECD’s BEPS project has had a significant impact on valuations for tax purposes, because its goal is to limit tax avoidance by MNEs and MNE groups by eliminating double taxation, stopping the facilitation of double non-taxation, and aligning profit and value creation with location. To facilitate this effort, most jurisdictions have taken the BEPS project’s recommendation on increased disclosure, implementing country-by-country reporting requirements, with the ultimate intention of sharing the reporting among tax authorities. The BEPS project is still in process, since numerous challenges remain in the task of balancing the alignment of global taxation with the maintenance of national sovereignty.

BEPS invites additional scrutiny into and higher standards for the valuation of assets, intangibles, and other entities within transfer pricing studies, royalty assessments, and other analyses. In general, the methodologies covered under BEPS utilize in-depth qualitative and quantitative analyses to link valuation outcomes with supportable and documentable entity-wide value creation.

Transfer Pricing Considerations

Particularly within transfer pricing, numerous complexities in transactions between associated entities make it imperative to be able to reference a recent pricing study to justify charges. Establishing transfer prices—defined as the prices at which an enterprise transfers physical goods, intangible property, or services to associated enterprises—first requires determining the substance of intragroup relationships. This substance is ascertained through a functional analysis, supported by legal and valuation analyses. However, accurately determining market prices and market values can be quite difficult, especially in the absence of market forces or within intragroup transactions that independent enterprises would not otherwise undertake.

Although numerous challenges arise within transfer pricing considerations under OECD guidelines, the arm’s-length principle remains the valuation standard on which to build theoretical considerations. This standard views entities within MNE groups as operationally and taxably distinct from each other (for intragroup transactions). Given that this standard could potentially embolden tax authorities with reasons for local income-level adjustments for economic arrangements arising from special (non-arm’s-length) conditions within intragroup transactions, valuation professionals must frame their analyses on this standalone and distinct entity basis.

In a valuation analysis, the application of the arm’s-length principle, the substance of actions, and comparability of transactions are key. Delineating the commercial and financial relationships between associated enterprises, determining the economic relevance of transactions, and finding independent (or uncontrolled) transactions require an understanding of the economic setting, the industry, and other conditions in which the MNE operates. These determinations are often at the intersection of various specialties, including legal, corporate tax, and consulting. As an example, substance under transfer pricing guidelines may prioritize actual transactions, arising from conduct, which may differ from legal or contractually specified conduct. However, verifying a contract relative to operational conduct compliance often reaches well beyond the scope of any single discipline, especially valuation.

The Role of Valuation

A functional analysis supports the valuation process by identifying economically significant entity functions, assets employed (e.g., working capital fixed assets and intangible assets), the conditions of the assets employed, and risks assumed (operational, asset-based, and legal, such as property rights). Specific to the analysis of intangible assets, the OECD has tried to steer the focus to the DEMPE (development, enhancement, maintenance, protection, and exploitation) functions within an organization. However, the valuation analysis itself is distinct, in that it arises after the functional analysis is complete, to support and determine profit and value with respect to the functions and components of the asset (or MNE) within the larger MNE (or MNE group).

A valuation analysis depends on the professional’s expertise in numerous disciplines, including economics, accounting, statistics, and finance. The knowledgeable application of actionable market data in accordance with these specialties contextualizes the asset- and entity-specific economic considerations. An experienced specialist considers the employment of assets within entity functions, which together support entity profitability and functional value creation.

While certain contributory assets have observable routine returns, intangibles continue to pose challenging considerations, especially for nonexperts. The OECD has addressed intangible considerations in the BEPS project and has shifted acceptable methodologies toward more relevant and forward-looking methodologies (although valuation specialists have used these methodologies in other scenarios for decades). An example includes the discounted cash flow method (DCF), especially when market-based comparable uncontrolled price and profit-split methods are inadequate. Although the OECD considers the DCF method to be appropriate in certain circumstances, the organization provides limited guidance about what valuation parameters are appropriate for determining an arm’s-length price under its guidelines and no practical examples.

The OECD also reviews hard-to-value intangibles (HTVI) in the BEPS project. HTVI refers to intangibles (or rights within intangibles) for which either no reliable comparable exists or for which future cash flows/income or assumptions used in valuation are highly uncertain. For HTVI, supportable valuations are strongly encouraged to be performed ex ante, because tax administrations can reasonably consider ex post outcomes as presumptive evidence about the appropriateness of the pricing arrangements.

Practical Considerations for Implementation

With the complexities outlined above, valuation professionals face the challenge of bridging broad OECD guidance with the unique attributes of an asset or entity. In many cases, myriad overlapping valuation considerations exist. In the following case studies, we review several practical challenges within real-world valuations, exemplifying how delineating functions and assets may provide unique challenges in a valuation context.

Case Study #1: Different Functions, Different Jurisdictions

In this first case study, an MNE group domiciled manufacturing operations in a higher tax jurisdiction and research and development (R&D) operations in a lower tax jurisdiction. Valuation Research Corporation (VRC) was engaged to determine relative entity valuations through a margin analysis incorporating market data. This analysis was critical, because asset characteristics drive functions, and functions drive margins.

Tangible assets were the first class of assets reviewed. Although working capital and fixed assets typically generate observable routine returns, determining whether manufacturing assets always should align with contract manufacturer returns (five percent to ten percent) was critical. Next, returns on intangible assets (i.e., intellectual property [IP] and assets, such as trademarks, technology, and customer relationships) were reviewed. Although there is often complexity in estimating intangible returns (including intellectual assets and IP, such as trademarks, technology, and customer relationships), qualitative factors used in conjunction with market data can narrow down asset returns and margins to a reasonable range.

In this instance, VRC reviewed market data to determine a reasonable spread of tangible and intangible asset returns on high-value manufacturing operations. The data indicated that high-value manufacturing returns on tangible assets reasonably trends toward the higher end of the range.

Based on this analysis of margins and functions, VRC concluded that the elevated margins that R&D investment supported benefited the entire value chain, reasonably increasing the margin and returns across both entities’ functions and assets.

Case Study #2: Existing Contracts,Dated Margins

An MNE group engaged VRC to determine the value of IP being moved from one jurisdiction to a separate foreign jurisdiction, in association with tax planning for an exit charge assessment.

In this assignment, VRC first reviewed the entity’s prevailing licensing agreements, which contracted for royalties at five percent of revenue on intragroup IP utilization. However, after further review, there was reason to believe that the contract was no longer at arm’s length. Specifically, for some years after contract execution, the entity consistently invested in R&D efforts and was able to develop more valuable IP supportive of a higher margin and returns. In fact, the entity’s operating margin steadily increased from ten percent at contract execution to twenty percent a number of years later, primarily as a result of these efforts.

Based on an analysis of business trends, reinvestment rates, and financial performance, VRC determined that the preexisting intragroup IP royalty rate was below market, in that it understated the existing economics of the IP asset. VRC reviewed market royalty data, current performance, and the entity’s outlook and was able to support a materially higher royalty rate in the analysis.

Case Study #3: Different Entities, Joint Ownership

In this final practical case study, VRC was engaged by an MNE group that required valuations of over forty entities and their assets as part of a tax restructuring undertaken concurrently with a take-private acquisition. For accounting purposes, there were twenty entities identified; however, over 200 entities existed in various global jurisdictions for tax purposes.

In this process, VRC worked with the entity’s legal counsel and other consultants to break down the functions and operations into limited risk distributors (LRDs), value-added distributors (VADs), IP holding companies (IP holdcos), and several fully integrated entrepreneurial entities (i.e., owning and employing their own IP and other assets, with customer base).

One key challenge of this analysis was in the allocation of IP value between the IP holdco and certain VADs, which held joint economic ownership of certain IP assets. The allocation of IP value among these entities required quantitative and qualitative analyses of facts and circumstances underlying the specific entities. Within these analyses, VRC researched the IP attributes, reinvestments, and modifications undertaken by the VAD, enhancement costs borne by each party, and the perceived and real economic value of the modifications and enhancements.

Over time, VRC has revalued these entities. The valuation approaches continue to be refined and expanded upon, as intragroup functions have become more delineated, with clearer legal and economic boundaries between entities. For example, in a subsequent tax restructuring, with more thorough and supportable transfer pricing policies in place, VRC was able to perform a bottom-up analysis, valuing the IP holdco based on intragroup arm’s-length royalties paid by the VADs and LRDs. With a reconciliation of bottom-up and a more traditional top-down analysis (i.e., from asset to entity to group, and vice versa), additional support was available for review by third parties, including tax authorities.

Other Practical Considerations

The above case studies illustrate that valuation analyses should consider the existing structures and economics of MNEs. Without a knowledgeable team of valuation professionals or supportable transfer pricing in place, fact patterns like routine returns, preexisting contractual terms, or joint ownership can distort forward-looking drivers of value creation. MNE structures, IP holdcos, LRDs, and VADs, which own different rights with respect to IP, customer contracts, and inventory, have a substantial impact on the margin and risk profiles of entities.

When MNE groups have clear functional analyses with arm’s-length pricing in place, stronger valuation bridges are built among MNE groups, MNEs, and their underlying assets. This not only reduces an entity’s exposure to scrutiny by tax authorities but also provides a logical chain of supportable value creation usable internally and externally.

Global Developments & Diverse Perspectives

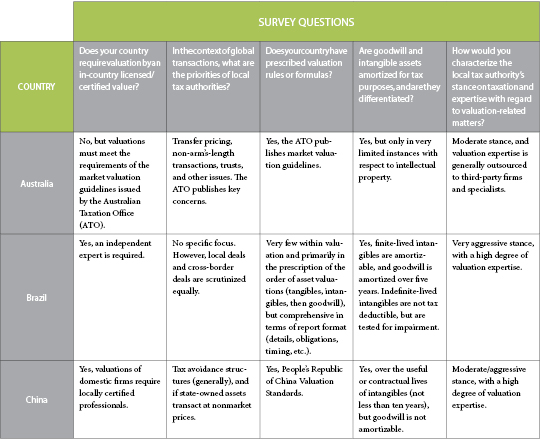

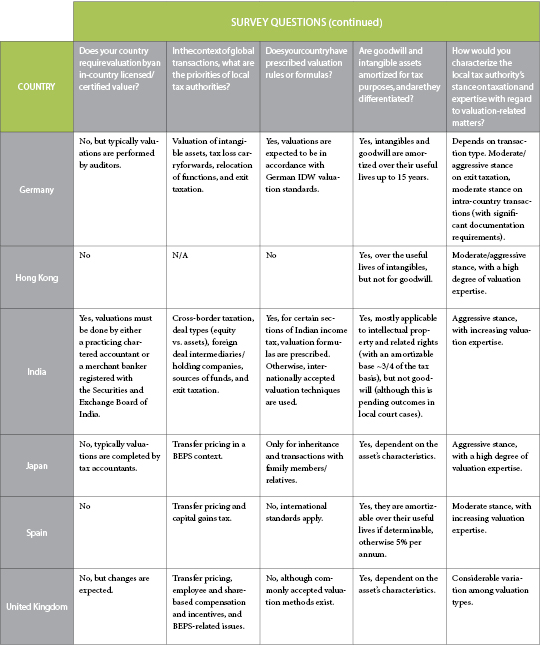

With the BEPS project underway, the global tax landscape continues to change. In light of this, VRC surveyed its global partners to determine local tax requirements, specialist certifications or licenses required for parties performing valuations, general tax rules, general stances on taxation, and the valuation expertise of local tax authorities. Table 1 summarizes, by local jurisdiction and survey question, the findings in several countries and Hong Kong.

Overall, the findings in Table 1 are consistent with the goals of the BEPS project. The global tax landscape is changing, with increased scrutiny from tax authorities, which look for substance, values, and structures that are objective and consistent with operations. In the pursuit of these goals, the level of substantiation is increasing, with analytics that bridge the gaps between financial reporting and tax standards. For these reasons, it is increasingly important to understand entity functions and assemble appropriate legal, consulting, and valuation teams as early as possible to anticipate the numerous complexities that arise with global tax transactions.

Table 1. The Global Tax Landscape, Based on Surveys of VRC’s Global Partners

PJ Patel, CFA, is co-CEO and senior managing director of Valuation Research Corporation (VRC). Anthony Pumphrey, CFA, is senior vice president of VRC.

Editor’s note: This article has been prepared for general information purposes, does not address the full complexities of specific provisions, and does not constitute valuation, legal, accounting, tax, or financial consulting advice. Those interested in specific legal, tax, or accounting guidance should seek professional advice. Inquiries to discuss specific valuation matters are welcome.