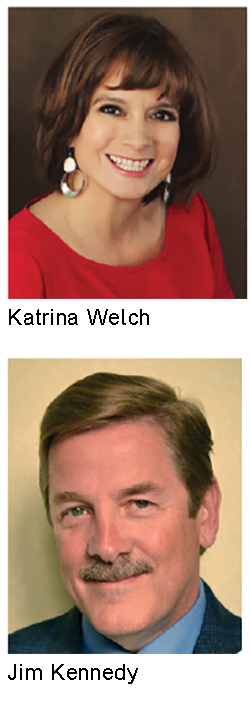

Whereas the decision to outsource key components of the tax function may have been cyclical in the past, increasingly outsourcing looks like a trend that’s not going away. But what goes into making that decision, and is there room for a hybrid model that combines insourcing and outsourcing? To find out, we convened a mini-roundtable in May that paired Katrina Welch, vice president and tax director at Texas Instruments and, starting in August, TEI’s international president, with Jim Kennedy, senior vice president and chief tax officer at Oppenheimer Funds and, starting this August, TEI’s senior vice president. Michael Levin-Epstein, Tax Executive senior editor, moderated the discussion.

Whereas the decision to outsource key components of the tax function may have been cyclical in the past, increasingly outsourcing looks like a trend that’s not going away. But what goes into making that decision, and is there room for a hybrid model that combines insourcing and outsourcing? To find out, we convened a mini-roundtable in May that paired Katrina Welch, vice president and tax director at Texas Instruments and, starting in August, TEI’s international president, with Jim Kennedy, senior vice president and chief tax officer at Oppenheimer Funds and, starting this August, TEI’s senior vice president. Michael Levin-Epstein, Tax Executive senior editor, moderated the discussion.

Michael Levin-Epstein: What are the advantages and disadvantages of insourcing versus outsourcing?

Katrina Welch: For insourcing, the natural thing for our company is that we own this information and we’re passionate about it. Historical knowledge, familiarity with the business, working closely with others internally outside of the tax function—I think these are advantages for the insourcing model. If you have a finite number of people on the team, or gaps in expertise, that’s where the outsourcing model can have an advantage.

Jim Kennedy: First of all, I agree with what Katrina said. Beyond that, I think you have to ask a threshold question before you get to whether or not the advantages and disadvantages weigh in one particular direction, and that is, “What’s the value-added proposition of an in-house function?” It’s really dependent upon the corporate culture and the view of tax. Is it a value-added shop, or is it a compliance shop? If the C-suite doesn’t perceive corporate tax as an enhancement to operations, but rather just, say, a regulatory requirement, then tax is really not a core competency, and it’s at risk of being outsourced. I think the key is the ability to demonstrate, consistent with what Katrina was saying, that the value-add that comes from having the in-house tax professionals working with the business and enhancing the execution of the strategy in operations from an after-tax perspective, that is critical. So, the understanding of how a given company operates—and could operate—coupled with the institutional memory that’s resident in the in-house tax professionals, I think makes all the difference in the world.

“To me, having robust compliance processes is our platform. That’s what keeps us going; that’s what we’re all about.”

—Katrina Welch

Welch: I’d like to add on to something that Jim said. I happen to agree with what he shared, as well. To me, having robust compliance processes is our platform. That’s what keeps us going; that’s what we’re all about. As Jim mentioned, I believe that having robust compliance processes, supported by management, makes all the difference.

Levin-Epstein: Do you think, if there is a decision to outsource rather than keep it in-house, that there is a burden to show that the outsourcing is, in the end, going to be more productive than doing it in-house?

Kennedy: I think it depends on the given situation. There may be companies that decide to outsource that don’t necessarily go to that extent of analysis. This gets to the “short-term gain versus long-term benefit” in the analysis. Companies are looking at their core mission, their core competencies. If you don’t have a core competency or service under that rubric, then you’re in danger of having that function go elsewhere. So, that’s part of it.

Welch: I feel the same. I think, to Jim’s point, there’s a variety of circumstances that could lend themselves to a company outsourcing or exploring the outsourcing model. I think one, as we talked about, is the company culture, and as Jim alluded to earlier and described, there are a host of other factors. For example, it could be as simple as a company moving its headquarters and not having a function, and needing to outsource for a time. It’s not always the value-added or cost-benefit analysis that precedes an outsourcing.

Outsourcing: Officially a Trend?

Levin-Epstein: Is the decision to outsource one that is cyclical, or is it trending toward outsourcing right now?

Welch: I’d say both. This is not new. You can look—for a hundred years, companies have been outsourcing whole departments or different pieces of functions. But I do think now, as technology is advancing more quickly, as our processes become more automated, outsourcing is becoming more of a trend in the last few years. I think the way companies are operating could lend itself to the possibility of more tax departments outsourcing than before.

Kennedy: To your point, Michael, it has been cyclical in the past, but it is definitely a trend now, and it’s one that I think is here to stay.

Levin-Epstein: What are the implications of the recent developments involving GE, Berkshire Hathaway, and Duke Energy?

Kennedy: Each one of those companies may have had distinct business or industry issues for considering this, but it relates to what I was saying earlier about core competencies. What’s happening is service providers are stepping up to take over previously insourced functions. Similar to prior business cycles, in which outsourcing gained favor—and there are pluses and minuses in doing this—those companies are just at the forefront of what’s happening here. For at least the short term, those companies that you mentioned may achieve some cost savings through paying less for outsourcing than maintaining the status quo or the internal resource. What our perspective is [is that], over time, any such advantage is likely diminished by the opportunity cost that gets associated with not having that internal resource. And that’s what’s going to be interesting about those companies as well as others that look in this direction.

Welch: I would agree, especially on Jim’s last point. You may look at an outsourcing versus insourcing model initially and think, “OK, they’re not my full-time employees, I don’t have to pay rent for them, perhaps, not directly, anyway. I’m not covering their benefits,” that type of thing. But to Jim’s point, opportunity costs, potential opportunity could be lost. With insourcing, teams may be able to see things differently, see potential planning opportunities, and may be better positioned to do that than someone from the outside. Then, the institutional knowledge—perhaps this comes up on audit, or perhaps there’s a different type of controversy associated, and trying to defend what has been done before—I think that’s where the outsourcing team would be at a disadvantage.

“This gets to the ‘short-term gain versus long-term benefit’ in the analysis. Companies are looking at their core mission, their core competencies. If you don’t have a core competency or service under that rubric, then you’re in danger of having that function go elsewhere.”

—Jim Kennedy

Impact of Tax Reform

Levin-Epstein: After the massive tax reform legislation was enacted recently, do you think the instinctive reaction of most companies was “We can’t outsource this function at all at this time,” or was it just the opposite?

Welch: I’ll be interested in Jim’s reaction, too, but I don’t know that there was one single reaction by companies. If you think about the tax community in general, I don’t think the in-house community differs from the service firms, in that this was a major tax reform—the biggest reform we’ve seen in thirty years—and it was passed so quickly, with little to no guidance, that no one knew all the ins and outs. There were a lot of existing provisions still in effect, so these new rules were layered on; the big challenge has been to understand how the new rules interrelate with each other as well as with the prior law that stayed in effect. I don’t know that the external firms were in any better position to know how these rules worked, especially how they applied to each company. I think individuals have sometimes said, “Wow. This is so new and overwhelming, I’m so excited,” while others said, “This is so new and overwhelming, I’m not going to do this anymore.” I think you had a variety of reactions from individuals.

Kennedy: I agree with Katrina completely. There’s no one size that fits all here, Michael, particularly with respect to reaction to tax reform. It really depends on an individual company’s circumstances, their tax DNA, their tax footprint, what issues mattered, and how that fits into their overall picture of profitability and corporate strategy.

Five Years From Now

Levin-Epstein: Where do you think we’ll be on this issue five years from now?

Kennedy: I think the trend will continue. As I mentioned earlier, I think it’s here to stay. I think at the same time, though, when you crystal-ball it out five years, I think we’re going to start to see by that point in time some reconsideration of this by individual companies. And it won’t necessarily be just large companies, small companies—it’s just going to depend on their individual circumstances and strategies. You mentioned a hybrid approach. That’s an important point, Michael, because this isn’t really a pure state play when you’re dealing with outsourcing or insourcing. There are varieties. There are hybrid approaches that companies are taking. Do they outsource compliance and keep planning? There are pros and cons. There’s a benefit in planning long-term. You’re going to end up not training those compliance people to go into the planning and the value-add that is there, and then the company suffers in the long term. Then, there are also ways of taking a hybrid approach with partial outsourcing, a lot of things going to service providers in India or, say, some corporate tax functions staying or going versus specialty tax functions staying or going. This is going to continue to evolve, but I think, when you look out a few years, while the trend will continue, hopefully there will start to be some reconsideration.

Welch: I’m with Jim on this one. I think it will be less in favor, and maybe it has peaked, with people having curiosity and wanting to explore that currently. Hopefully, we won’t still be talking about aspects of TCJA as having little or no guidance at that time. But I think the trend will continue. With the continuous automation and ramping up on technology, as companies embrace that more and more, there could be pieces of it that will still be outsourced, more on a selective basis.